Gas Chromatography (Gc) Market Size 2024-2028

The gas chromatography (gc) market size is forecast to increase by USD 1.15 billion, at a CAGR of 7.35% between 2023 and 2028.

- The market experiences robust growth, driven by expanding applications across various industries, including pharmaceuticals, food and beverage, and environmental analysis. Technological advancements in chromatography, such as improved separation efficiency, faster analysis times, and enhanced sensitivity, further fuel market expansion. However, the lack of skilled technicians poses a significant challenge, as the complex nature of GC analysis requires specialized expertise. Regulatory hurdles also impact adoption, with stringent regulations governing the use of GC in certain applications, such as pharmaceutical and food industries.

- Supply chain inconsistencies, including raw material availability and price fluctuations, temper growth potential. Companies seeking to capitalize on market opportunities must invest in training and development programs to address the skills gap and navigate regulatory requirements effectively. Strategic partnerships and collaborations with academic institutions and industry associations can also help mitigate supply chain risks and ensure a steady supply of skilled labor.

What will be the Size of the Gas Chromatography (Gc) Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the diverse applications across various sectors. Chemical analysis and quantitative measurement remain at the core of GC's significance, with clinical chemistry and data processing playing essential roles in healthcare and research. Gas chromatography systems are integral to environmental monitoring, ensuring regulatory compliance and enabling the identification of pollutants. Injection techniques and chromatogram analysis are crucial components of GC, facilitating chromatographic separation and peak identification. Thermogravimetric analysis (TGA) complements GC, providing valuable information on material decomposition and property changes. The petrochemical industry relies on GC for process monitoring and compound identification.

Packed columns, calibration curves, and carrier gases are integral to GC, with sample preparation and chromatographic software optimizing the analytical process. GC finds applications in forensic science, scientific research, and materials science, contributing to quality assurance and quality control in laboratories. Capillary columns, analytical instruments, and mass spectrometry (MS) enhance GC's capabilities, enabling validation studies and method development. The biopharmaceutical industry, polymer science, and other sectors benefit from GC's ability to analyze analytical standards and identify compounds with high detector sensitivity. The continuous unfolding of market activities and evolving patterns in the GC market reflect the dynamic nature of this field, with ongoing research and development ensuring its relevance and importance in various industries.

How is this Gas Chromatography (Gc) Industry segmented?

The gas chromatography (gc) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Consumables and accessories

- Instruments

- End-user

- Pharmaceuticals and biotechnology

- Food and beverages

- Academic and research institutes

- Others

- Instruments

- Systems

- Detectors

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Middle East and Africa

- South Africa

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

The consumables and accessories segment is estimated to witness significant growth during the forecast period.

Gas chromatography (GC) is a widely used analytical technique for separating and identifying volatile and semi-volatile compounds. This method is integral to various industries, including pharmaceuticals, clinical chemistry, environmental monitoring, and scientific research. In the realm of pharmaceuticals, GC is employed for purity and contamination analysis, component testing, and compositional analysis of crude oils. In the field of clinical chemistry, GC plays a crucial role in the detection and quantification of metabolites and biomarkers. Environmental monitoring is another domain where GC shines, with applications ranging from air and water quality analysis to the identification of volatile organic compounds.

Regulatory compliance is a significant driver for the adoption of GC, as it enables organizations to meet stringent industry standards. Gas chromatography systems consist of several components, such as injection techniques, chromatographic separation, data processing, and detector systems. Injection techniques include split, splitless, and programmed temperature vaporization. Chromatographic separation is facilitated by packed or capillary columns, while data processing involves the analysis of chromatograms using chromatographic software. Thermogravimetric analysis (TGA) is a complementary technique to GC, used for the analysis of non-volatile samples. The petrochemical industry relies heavily on GC for the analysis of complex hydrocarbon mixtures.

Sample preparation is a critical aspect of GC, with various techniques used to ensure accurate and reliable results. Calibration curves and reference materials are essential for ensuring the accuracy and precision of quantitative analysis. Qualitative analysis is another application of GC, which involves the identification of compounds based on their retention times and detector responses. Mass spectrometry (MS) is often used in conjunction with GC for compound identification and confirmation. GC is also used extensively in forensic science for the analysis of illicit substances, and in materials science for the characterization of polymers and other materials.

Detector sensitivity is a critical factor in the selection of GC systems for various applications. In the biopharmaceutical industry, GC is used for the analysis of complex mixtures, such as those found in biological samples. Validation studies and method development are essential for ensuring the accuracy and reliability of GC methods in this industry. Gas chromatography consumables and accessories are essential for the effective operation of GC systems. These include items such as carrier gases, ferrules, nuts, tubing, inlet liners, syringes, and septa. Agilent Technologies Inc., is one of the companies that offers a wide range of gas chromatography supplies and consumables.

In conclusion, the market for gas chromatography consumables and accessories is driven by the diverse applications of GC in various industries. The need for accurate and reliable analysis, regulatory compliance, and the development of new applications continue to fuel the growth of this market.

The Consumables and accessories segment was valued at USD 1.73 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

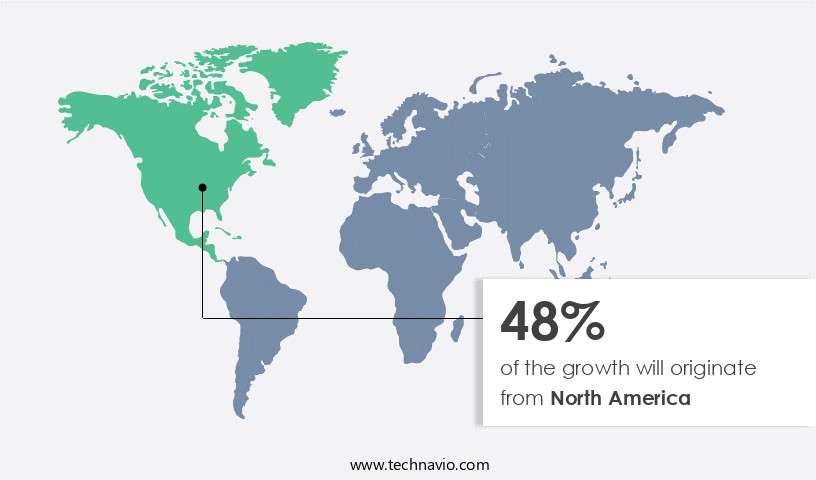

North America is estimated to contribute 48% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market for gas chromatography (GC) systems experiences significant growth, driven by the increased adoption in end-user industries such as food and the biotechnology and pharmaceutical sectors. In the US, the market is propelled by the widespread use of GC for drug discovery and quantitative analysis. Portable GC systems are gaining popularity due to their convenience and ease of use, further fueling market expansion. Canada contributes to the market's growth as well, with research laboratories and government bodies like Defence Research and Development Canada (DRDC) advancing chromatographic techniques and approaches. In the realm of clinical chemistry, GC plays a pivotal role in diagnostic analysis, ensuring regulatory compliance.

Environmental monitoring applications continue to expand, with GC systems providing accurate and reliable data processing for air, water, and soil analysis. Injection techniques and chromatographic separation techniques have evolved, enabling efficient sample preparation and precise compound identification. Capillary columns and packed columns are widely used for GC analysis, offering advantages in terms of efficiency and resolution. Calibration curves and analytical standards are essential for ensuring accurate quantitative analysis. Thermogravimetric analysis (TGA) is a complementary technique used in materials science and polymer science for compound identification and detector sensitivity enhancement. Gas chromatography systems are integral to scientific research, forensic science, and process monitoring in various industries.

Chromatographic software and mass spectrometry (MS) are frequently used in conjunction with GC for enhanced data acquisition and compound identification. Quality assurance and quality control are crucial aspects of GC applications, with laboratories relying on GC systems for ensuring product consistency and compliance with regulatory standards. In the petrochemical industry, GC is used for process monitoring and compound identification, ensuring the quality and purity of petrochemical products. Validation studies and method development are essential for maintaining the accuracy and reliability of GC systems in various applications. The biopharmaceutical industry also benefits from GC systems, with GC-MS used for the identification and quantification of biomolecules and impurities in pharmaceutical products.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Gas Chromatography market size and forecast, highlighting B2B gas chromatography solutions for pharmaceuticals and food safety. Leverage AI-powered gas chromatography systems and GC-MS for pharmaceutical testing to ensure compliance. Gas chromatography for environmental monitoring and food safety testing with GC address regulatory needs. Explore cloud-based GC data analysis and portable gas chromatography solutions for flexibility. GC market growth opportunities 2025 include gas chromatography in petrochemical analysis and forensic applications of GC. Cost-effective GC systems for SMEs and automated gas chromatography instruments enhance efficiency. Gas chromatography market challenges like high costs are offset by GC adoption trends in biotech and green chemistry in gas chromatography.

What are the key market drivers leading to the rise in the adoption of Gas Chromatography (Gc) Industry?

- The significant expansion of applications for gas chromatography is the primary driving force behind the market's growth.

- Gas chromatography (GC) is a widely used analytical technique in various industries, including the biopharmaceutical sector and materials science, for method development and compound identification. The integration of mass spectrometry (MS) with GC has significantly enhanced the capabilities of these analytical instruments. Capillary columns, a key component of GC, enable high-resolution separations and increased detector sensitivity. Validation studies are crucial in ensuring the accuracy and reliability of GC results. In the biopharmaceutical industry, GC-MS is employed for the analysis of complex mixtures, such as drug formulations and impurities. In materials science, GC is used to analyze polymers and identify their components.

- The demand for GC in the industry is driven by the need for rapid compound identification and quantification. Portable GC instruments have gained popularity due to their compact size, making them suitable for on-site analysis in various applications, including environmental monitoring and polymer science research. The increasing focus on analytical standards and the need for precise and accurate results further boosts the market growth.

What are the market trends shaping the Gas Chromatography (Gc) Industry?

- Chromatography, a field that has seen significant technological advances, is currently a prominent market trend. The ongoing innovation in this technique offers promising opportunities for industry growth.

- The market for gas chromatography (GC) systems experiences significant growth due to the increasing demand for precise and efficient chemical analysis. This technology is crucial in various industries, including clinical chemistry, environmental monitoring, and the petrochemical industry, for quantitative analysis. The need for regulatory compliance and high-quality results drives the adoption of advanced and automated GC systems. Automated injection techniques and data processing capabilities enhance workflow solutions, ensuring accuracy and reducing costs. In sectors such as biotechnology and pharmaceuticals, the adoption of automated GC systems has been rapid, improving research efficiency and enabling applications in cancer research, drug screening, and cytotoxicity testing.

- To maintain certification and meet industry standards, laboratories are increasingly turning to automation for their GC systems. Thermogravimetric analysis (TGA) is another application of GC that offers valuable insights into the thermal behavior of materials, further expanding its utility.

What challenges does the Gas Chromatography (Gc) Industry face during its growth?

- The insufficient supply of competent technicians poses a significant obstacle to the expansion and growth of the industry.

- Gas chromatography (GC) is a widely used analytical technique in scientific research and various industries, including forensic science and environmental science. In this process, packed columns are utilized to separate complex mixtures of compounds based on their affinity to a stationary phase. The separated components are then detected through various detectors, such as flame ionization detectors or mass spectrometers. Sample preparation is a crucial step in GC analysis, ensuring accurate and reliable results. Calibration curves are generated to quantify the amount of each compound in a sample based on the peak area. Chromatographic software is employed to process and analyze the data obtained from GC analysis, facilitating peak identification and quantification.

- The expertise of professionals, including gas chromatography technicians and chemists, is essential for the successful implementation of GC analysis. These professionals must possess a deep understanding of GC principles, as well as other analytical techniques like high-pressure liquid chromatography (HPLC) and titration methods. The limited pool of individuals with this knowledge restricts the market's growth potential. In summary, the application of gas chromatography in scientific research and various industries requires a skilled workforce and advanced tools to ensure accurate and reliable results. The expertise of professionals in GC analysis, coupled with the use of chromatographic software, plays a significant role in the successful implementation of this technique.

Exclusive Customer Landscape

The gas chromatography (gc) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gas chromatography (gc) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gas chromatography (gc) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agilent Technologies Inc. - The company specializes in providing advanced gas chromatography solutions, featuring the Intuvo 9000 GC system, 8890 GC system, and 990 Micro GC system. These systems deliver high-performance and accuracy in separating and analyzing complex mixtures, enhancing research and development initiatives.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilent Technologies Inc.

- Avantor Inc.

- Bruker Corp.

- Chromatec SDO JSC

- Chromtech GmbH

- DataApex Ltd.

- Ellutia Ltd.

- GERSTEL GmbH Co.KG

- GL Sciences Inc.

- LECO Corp.

- Merck KGaA

- Perkin Elmer Inc.

- Restek Corp.

- Rigaku Corp.

- SCION Instruments NL BV

- Shimadzu Corp.

- Scientific Repair Inc.

- Teledyne Technologies Inc.

- Thermo Fisher Scientific Inc.

- Waters Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Gas Chromatography (Gc) Market

- In February 2024, Agilent Technologies, a leading player in the GC market, launched the 7980B GC System, featuring a triple-axis temperature programmable autosampler and improved data processing capabilities (Agilent Technologies Press Release). This innovation aimed to enhance the efficiency and accuracy of GC analysis.

- In May 2025, Thermo Fisher Scientific and Waters Corporation, two major GC market competitors, announced a strategic collaboration to co-develop and commercialize integrated GC-MS solutions (Thermo Fisher Scientific Press Release). This partnership was expected to strengthen their combined offerings and cater to the growing demand for comprehensive analytical solutions.

- In October 2024, Shimadzu Corporation, a prominent GC market player, secured a significant investment of USD150 million from Sumitomo Chemical to expand its GC business (Sumitomo Chemical Company Limited Press Release). This funding would support the development of advanced GC technologies and broaden the company's market reach.

- In March 2025, the European Union (EU) introduced new regulations on the use of certain chemicals, increasing the demand for GC techniques to ensure regulatory compliance (European Chemicals Agency Press Release). This regulatory shift created opportunities for GC market players to provide solutions that help businesses monitor and manage their chemical inventories effectively.

Research Analyst Overview

- The market encompasses a range of technologies and services, including chromatographic method validation, various detectors, applications, sample injection systems, calibration, and reporting. Chromatography applications span diverse industries, from petrochemicals to food and beverage, necessitating rigorous validation and optimization. Gas chromatography detectors, such as flame ionization, mass spectrometry, and thermal conductivity, enable precise identification and quantification of compounds. Chromatography calibration ensures accurate results, while headspace GC caters to volatile analytes. Chromatographic data analysis, driven by software solutions, facilitates efficient interpretation of complex data. Miniaturized GC, microchip GC, pyrolysis GC, and portable GC technologies offer enhanced convenience and versatility. Principles of chromatography theory underpin analytical method development, while validation, consulting, and training services ensure optimal performance.

- Chromatographic stationary phases, columns, and automation systems further advance separation capabilities. Chromatography services, including custom analysis and method development, cater to businesses seeking specialized expertise. Software validation and optimization ensure data integrity and compliance with regulatory standards.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Gas Chromatography (Gc) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.35% |

|

Market growth 2024-2028 |

USD 1147.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.71 |

|

Key countries |

US, Germany, China, Japan, France, Sain, Canada, India, South Korea, and South Africa |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Gas Chromatography (Gc) Market Research and Growth Report?

- CAGR of the Gas Chromatography (Gc) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gas chromatography (gc) market growth of industry companies

We can help! Our analysts can customize this gas chromatography (gc) market research report to meet your requirements.