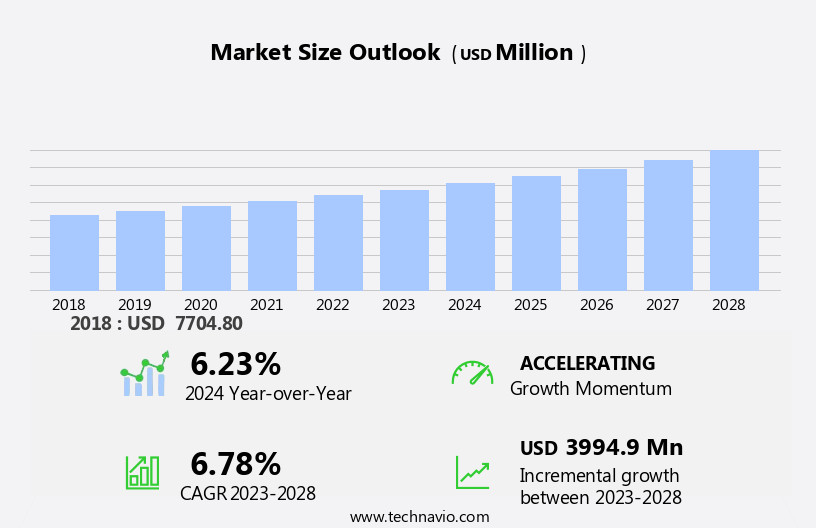

Chromatography Market Size 2024-2028

The chromatography market size is forecast to increase by USD 3.99 billion at a CAGR of 6.78% between 2023 and 2028.

- The market is experiencing significant growth driven by the increasing number of conferences and symposiums focusing on advanced separations technology. This trend reflects the growing importance of efficient and precise analytical techniques in various industries, including pharmaceuticals, food and beverage, and environmental science. Technological advances, such as the integration of automation and miniaturization, are further fueling market expansion. Stringent quality standards in healthcare and the production of monoclonal antibodies and vaccines necessitate the use of chromatography for purification. However, the market faces challenges including high costs and a shortage of skilled technicians, which may hinder its growth. Companies seeking to capitalize on market opportunities should focus on developing cost-effective solutions and investing in training programs to address the skills gap.

- Additionally, collaborations and partnerships with academic institutions and industry associations can help companies stay abreast of the latest research and developments in chromatography technology. Overall, the market presents significant opportunities for innovation and growth, particularly in areas such as point-of-care diagnostics and process analytical technology. Companies that can effectively navigate the challenges and capitalize on the trends shaping this market will be well-positioned for success.

What will be the Size of the Chromatography Market during the forecast period?

- The market encompasses various chromatographic techniques, including liquid chromatography (LC), gas chromatography (GC), and column chromatography. LC subcategories consist of high-pressure liquid chromatography (HPLC), ultra-pressure liquid chromatography (UPLC), flash chromatography, ion-exchange chromatography, partition chromatography, and size exclusion chromatography. These techniques are widely used in pharmaceutical R&D for the development of protein therapeutics, ensuring analytical performance, chromatographic efficiency, and manufacturing cost. In the food industry, chromatography plays a crucial role in ensuring food safety. Gas chromatography, particularly in GC columns, is extensively utilized in the oil & gas industry and environmental pollution analysis. Small- and medium-sized companies, academic institutions, and large corporations employ these techniques for petrochemical applications and petroleum industry processes.

- Alternative techniques, such as equilibration, wash, elution, regeneration, sanitization, and the use of antibodies, are continually being explored to enhance chromatography's capabilities. The market's growth is driven by increasing demand for high-performance analytical techniques and the need for improved manufacturing processes.

How is the Chromatography Industry segmented?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technology

- Liquid chromatography

- Gas chromatography

- Ion-exchange chromatography

- Others

- End-user

- PBC

- RFAI

- Others

- Geography

- North America

- US

- Europe

- France

- Germany

- Asia

- Rest of World (ROW)

- North America

By Technology Insights

The liquid chromatography segment is estimated to witness significant growth during the forecast period. Liquid chromatography is a prominent analytical technique in the market, accounting for the largest segment in 2023. This technique plays a crucial role in the separation, identification, and quantification of small molecules in complex mixtures. Its application is extensively used In the pharmaceutical industry for analyzing raw materials in drug development and purifying drug components, such as recombinant proteins and antibodies. High-pressure liquid chromatography (HPLC), a variant of liquid chromatography, is particularly significant for protein isolation, including insulin purification, plasma fractionation, and enzyme purification. Additionally, liquid chromatography is employed in DNA fingerprinting and bioinformatics. The adoption of these systems is driven by stringent quality standards in industries like pharmaceuticals, food, and environmental science, ensuring efficient and accurate analysis of compounds.

Key techniques within liquid chromatography include ion-exchange chromatography, partition chromatography, size exclusion chromatography, and column chromatography. These methods enable high-throughput analysis, rapid separations, and efficient sample processing. The market is expected to grow due to technological advancements, increasing automation, and the demand for compact, portable systems for point-of-care testing and on-site analysis.

Get a glance at the market report of share of various segments Request Free Sample

The Liquid chromatography segment was valued at USD 4.21 billion in 2018 and showed a gradual increase during the forecast period.

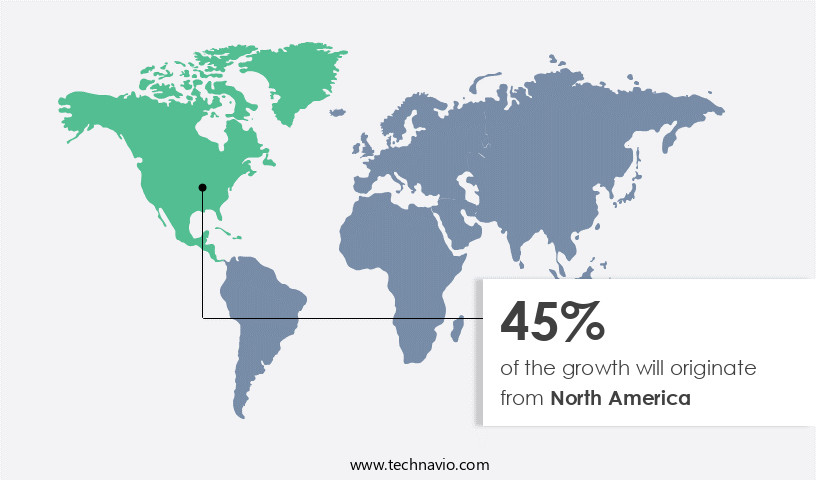

Regional Analysis

North America is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market experienced significant growth in North America, with the US leading the way in 2020, driven by the increasing focus on pharmaceutical R&D, stringent food safety concerns, and the presence of numerous companies. The demand for chromatography systems is anticipated to escalate in the US due to stringent food industry regulations. Key chromatography techniques, including liquid chromatography (LC), high-pressure liquid chromatography (HPLC), ultra-pressure liquid chromatography (UPLC), flash chromatography, ion-exchange chromatography, partition chromatography, size exclusion chromatography, and gas chromatography (GC), are employed in various industries, including pharmaceuticals, food, oil & gas, and environmental science, to ensure analytical performance, efficiency, and compliance with regulatory standards. Technological advancements in column chromatography, automation, sample handling, and miniaturization are further enhancing the capabilities of chromatography instruments.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Chromatography Industry?

- An increasing number of conferences and symposiums is the key driver of the market. Chromatography is a crucial analytical technique in the realm of scientific research, encompassing methods such as liquid chromatography, ion-exchange chromatography, and gas chromatography. Widely utilized in the biotechnology and pharmaceutical sectors, these techniques facilitate the separation and analysis of intricate molecules from complex mixtures, contributing significantly to the development of new drugs. Chromatography plays a pivotal role in the scientific community, underpinning advancements in various industries.

- Moreover, manufacturers, researchers, and scientists are continually innovating and improving chromatographic techniques to enhance analytical performance and chromatographic efficiency. Alternative techniques, such as antibody-based chromatography, are also gaining popularity due to their unique advantages. Maintaining the chromatography columns and ensuring their sanitization and sterilization is essential to prevent contamination and ensure the manufacturing cost and volume remain optimal. The advancements in chromatography techniques continue to drive the growth of this market, making it an indispensable tool for various industries.

What are the market trends shaping the Chromatography Industry?

- Technological advances is the upcoming market trend. The market experiences significant growth due to the increasing demand for advanced and automated systems. This trend is driven by the need for improved accuracy and cost reduction in various sectors, particularly in biotechnology and pharmaceuticals. The pressure to deliver quality and error-free results has led to the widespread adoption of automated chromatography systems.

- These systems streamline workflows and enhance research efficiency, making them indispensable in fields such as cancer research, drug screening, and cytotoxicity testing. Laboratories are seeking certification for automation to meet industry standards and remain competitive. The market's future looks promising as the demand for sophisticated chromatography solutions continues to grow. Environmental science also benefits from these technologies, with applications in water and air quality testing. As the demand for advanced and error-free results continues to grow, the market for chromatography systems is expected to expand further.

What challenges does the Chromatography Industry face during its growth?

- High costs and a lack of skilled technicians is a key challenges affecting the industry's growth. Chromatography is a critical technique In the analytical sciences, widely utilized in various industries such as biotechnology, pharmaceuticals, chemical, cosmetics, food and beverage, and environmental testing. This separation method isolates, purifies, and analyzes molecules from complex compounds. However, the implementation of an efficient chromatography system requires significant capital investment and skilled laboratory technicians, which can hinder smaller market entrants and pose challenges for small research laboratories in acquisition.

- Moreover, biopharmaceutical companies and research institutions heavily rely on automated sample handling, data processing, proteomics, and metabolomics for their analytical research. These advanced technologies are integrated with chromatography systems to streamline workflows and improve overall productivity. Investing in high-quality chromatography components is essential for achieving accurate and reliable results. Some of the leading market players include companies specializing in providing column accessories, autosampler accessories, flow management accessories, solvents/reagents/adsorbents, detectors, mobile phase accessories, fraction collectors, and pressure regulators. These companies ensure the production of top-tier products to cater to the evolving demands of the market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilent Technologies Inc.

- Bio Rad Laboratories Inc.

- Centurion Scientific

- Danaher Corp.

- Hamilton Co.

- Hitachi Ltd.

- Merck KGaA

- Perkin Elmer Inc.

- Regis Technologies Inc.

- Restek Corp.

- Sartorius AG

- Scientific Repair Inc.

- SCION Instruments NL BV

- Shimadzu Corp.

- Siemens AG

- Thermo Fisher Scientific Inc.

- Tosoh Corp.

- Valco Instruments Co. Inc.

- Waters Corp.

- ZirChrom Separations Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Chromatography is a widely used analytical technique in various industries, including pharmaceutical R&D, food safety, oil and gas, and environmental science. This analytical method separates compounds based on their physical or chemical properties, specifically their interaction with a stationary phase and a mobile phase. Several types of chromatography exist, each with unique applications. Liquid chromatography (LC), for instance, is a common technique that employs a liquid mobile phase. High-pressure liquid chromatography (HPLC) and ultra-pressure liquid chromatography (UPLC) are advanced LC techniques that provide high resolution and efficiency. Flash chromatography, on the other hand, is a preparative technique used for large-scale separations.

Moreover, ion-exchange chromatography and partition chromatography are other popular chromatography methods. The former separates ions based on their charge, while the latter separates compounds based on their distribution between two immiscible phases. Size exclusion chromatography separates compounds based on their size. Chromatography plays a crucial role in pharmaceutical R&D, where it is used for purification, analysis of biologics, and drug development. In the food industry, it is used for food safety concerns and quality control. In the oil and gas industry, it is used for petrochemical applications and the petroleum industry. In environmental science, it is used for environmental pollution analysis.

Furthermore, technological advancements have led to miniaturization and automation in chromatography. Compact and portable chromatography systems have emerged, enabling point-of-care testing and on-site analysis. Chromatography instruments have become more sensitive and capable, allowing for high-throughput analysis, rapid separations, and efficient sample processing. Microfluidic technologies have also revolutionized chromatography, enabling the development of compact systems for various applications, such as metabolomics studies and profiling biological samples. These systems characterize proteins, peptides, and metabolites, providing valuable information for research and development. The market is driven by the increasing demand for stringent quality standards in various industries. Biopharmaceuticals, such as monoclonal antibodies and vaccines, require high-performance chromatography systems for purification and analysis.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 3.99 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.23 |

|

Key countries |

US, Germany, China, Japan, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Chromatography Market Research and Growth Report?

- CAGR of the Chromatography industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the chromatography market growth of industry companies

We can help! Our analysts can customize this chromatography market research report to meet your requirements.