Gasification Market Size 2024-2028

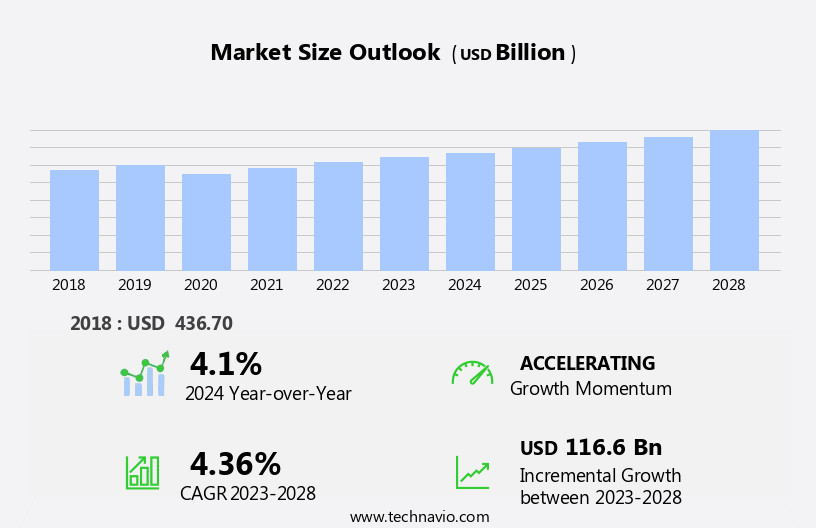

The gasification market size is forecast to increase by USD 116.6 billion at a CAGR of 4.36% between 2023 and 2028.

- The gasification market is experiencing a surge in growth, propelled by the world's insatiable and ever-increasing energy demands, which necessitate diversified and alternative energy sources. The abundant global supply of coal provides a readily available and cost-effective feedstock for gasification processes, further fueling market expansion. While high operating and maintenance costs remain a significant challenge, they simultaneously present compelling opportunities for innovation and cost reduction strategies.This process is crucial for the chemical, liquid fuel, power, and gaseous fuel segments, as it enables the production of ammonia, methanol, electricity, and hydrogen.

- Technological advancements are paramount, with improvements in efficiency and emission reduction crucial for long-term market success and sustainability. These advancements, coupled with the imperative for cost-effective and environmentally sound energy solutions, position the gasification market for continued and significant growth.

What will be the Size of the Gasification Market During the Forecast Period?

- The market encompasses various types of gasifiers, including fixed bed, entrained-flow, and fluidized-bed gasifiers, which convert carbonaceous raw materials into syngas, a mixture of hydrogen, carbon monoxide, and other gases. The coal industry, petroleum, natural gas, biomass/waste, and water are primary feedstocks for gasification. Market dynamics are influenced by industrialization and urbanization, driving the demand for alternative energy sources and reducing reliance on traditional fossil fuels.

- The BP Statistical Review indicates a growing trend towards thermochemical conversion, with gasification gaining traction as a viable solution for producing cleaner fuels and reducing greenhouse gas emissions. Carbon dioxide and water are by-products of the process, making gasification an environmentally friendly alternative to conventional fuel production methods.

How is this Gasification Industry segmented and which is the largest segment?

The gasification industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Feedstock

- Coal

- Biomass/waste

- Natural gas

- Petroleum

- Application

- Chemical

- Liquid fuel

- Gaseous fuel

- Power

- Gasifier Medium

- Air

- Oxygen

- Vapor

- Type

- Fixed Bed

- Fluidized Bed

- Entrained Flow

- Geography

- APAC

- China

- India

- Europe

- Germany

- UK

- North America

- US

- Middle East and Africa

- South America

- APAC

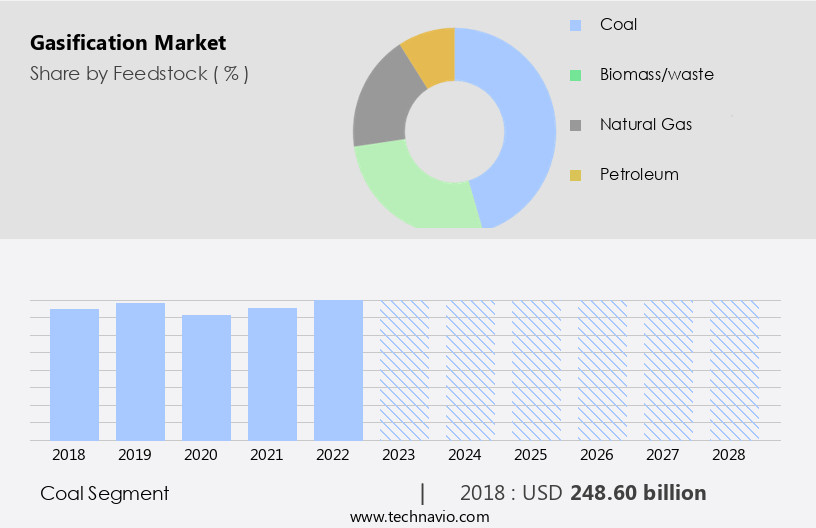

By Feedstock Insights

- The coal segment is estimated to witness significant growth during the forecast period.

Coal gasification is a critical process In the global energy sector, particularly In the context of increasing coal demand and the push towards environmental sustainability. According to the International Energy Agency (IEA), global coal demand grew by over 1.4% in 2023 due to increase economic expansion, driving industrial output and electricity consumption. However, countries are focusing on net-zero emissions to mitigate environmental concerns. Coal gasification offers a solution by transforming coal into clean chemicals, liquid and gaseous fuels, power, and blends, utilizing indigenous carbonaceous feedstocks. This approach enables nations to meet their energy security and environmental objectives while using coal.

The gasification process involves thermochemical conversion, producing syngas, which is a mixture of hydrogen, carbon monoxide, and other impurities like sulfur and particulate matter. This syngas can be further processed to generate ammonia, methanol, electricity, and hydrogen. Coal, biomass, and municipal solid waste are common feedstocks. Gasifiers include fixed bed, fluidized bed, and entrained-flow types. The chemical segment includes Dimethyl ether, synthetic natural gas, and higher alcohols, while the liquid fuel segment encompasses urea, pet coke, and ash. The power segment utilizes carbon dioxide (CO2), steam, and oxygen for power generation. Gasification's environmental benefits include reduced greenhouse gas emissions and improved waste management through carbon capture technologies.

Companies like Larsen & Toubro are investing in coal gasification plants to meet the growing demand for cleaner energy sources.

Get a glance at the Gasification Industry report of share of various segments Request Free Sample

The Coal segment was valued at USD 248.60 billion in 2018 and showed a gradual increase during the forecast period.

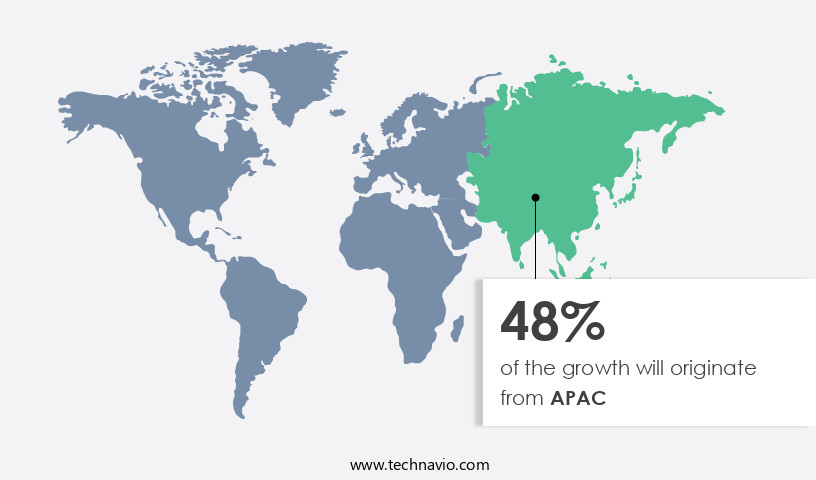

Regional Analysis

- APAC is estimated to contribute 48% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The coal industry continues to dominate energy production in APAC countries like China and India, which are the world's largest coal producers. However, the Paris Climate Agreement's emission limits have necessitated the adoption of advanced carbon capture technologies, leading to increased interest in coal gasification. This process, which can also utilize biomass as a feedstock, is gaining traction in China due to its potential to improve energy efficiency and reduce greenhouse gas emissions. Researchers propose the integration of coal and biomass energy to optimize the gasification process. In the global context, gasification is a crucial thermochemical conversion process for producing syngas (a mixture of hydrogen, carbon monoxide, and other impurities) from carbonaceous raw materials.

Syngas is further converted into various fuels and chemicals, including ammonia, methanol, electricity, and hydrogen. The power, chemical, and liquid fuel segments are the primary consumers of these gaseous fuels. Industrialization and urbanization have driven the demand for these fuels, necessitating feedstock diversification and waste management solutions. Environmental regulations, particularly those related to sulfur and particulate matter, have further fueled the growth of the market. Companies like Larsen & Toubro have invested in gasification technologies to produce urea and other chemicals, while coal, biomass, and municipal solid waste are common feedstocks. Gasifiers, including fixed bed, fluidized bed, and entrained-flow types, are used In thermal applications to produce syngas for various end-uses.

The global population's rapid growth and increasing industrialization have led to a increase in power demand and the need for sustainable energy solutions. Gasification, with its potential for energy efficiency and emission reductions, is an attractive alternative to conventional combustion technologies.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Gasification Industry?

Rise in global energy demand is the key driver of the market.

- The global energy landscape has witnessed notable growth over the last decade, driven by industrialization and urbanization, resulting in a surge in demand for fuels and chemical feedstocks. According to the BP Statistical Review, the chemical segment, including ammonia, methanol, and hydrogen, accounted for approximately 12% of global energy consumption in 2020. In the power segment, electricity demand has more than doubled over the past two decades, with the gaseous fuel segment, including syngas from gasification, experiencing significant growth. Gasification, a thermochemical conversion process, converts carbonaceous raw materials, such as coal, biomass, and municipal solid waste, into syngas, a mixture of carbon monoxide and hydrogen.

- Gasifiers, including fixed bed, fluidized bed, and entrained-flow types, are used in various industries for power generation, chemical manufacturing, and thermal applications. The coal industry continues to be a significant contributor to the global energy mix, but there is a growing emphasis on sustainability and emission reductions. Biomass and waste are increasingly being used as feedstocks in gasification processes to produce syngas for power generation, chemical feedstock, and fuels. Impurities, such as sulfur and particulate matter, must be carefully managed to meet environmental regulations. As global population growth and rapid industrialization continue, there is a need for energy efficiency and feedstock diversification in conventional combustion technologies.

- Gasification offers a solution by producing syngas from a variety of feedstocks, reducing greenhouse gas emissions, and providing a more sustainable alternative to traditional combustion technology. The market includes various sub-segments, such as the coal sub-segment, which uses coal as a feedstock, and the waste sub-segment, which uses municipal solid waste. Other sub-segments include the liquid fuel segment, which produces synthetic natural gas and higher alcohols, and the chemicals sub-segment, which produces dimethyl ether, synthetic natural gas, and plastics. Installation and operational costs, as well as capital expenditure, are important considerations In the market. Carbon capture technologies are also being explored to mitigate the environmental impact of gasification.

- Companies such as Larsen & Toubro are investing in gasification technology to produce urea and power from pet coke, reducing reliance on fossil fuels and promoting sustainability. In conclusion, the global energy market is experiencing significant growth, driven by the demand for chemical products and electricity. Gasification offers a sustainable solution by converting various feedstocks into syngas for power generation, chemical feedstock, and fuels. The market includes various sub-segments and considerations, such as feedstocks, installation and operational costs, and carbon capture technologies. As the world continues to industrialize and population grows, gasification will play an increasingly important role in meeting energy demands while reducing greenhouse gas emissions.

What are the market trends shaping the Gasification Industry?

Rise in global coal production is the upcoming market trend.

- The market encompasses various types of gasifiers, including fixed bed, fluidized bed, and entrained-flow gasifiers, which convert carbonaceous raw materials, such as coal, biomass, and municipal solid waste, into Syngas (a mixture of hydrogen, carbon monoxide, and other impurities). This process is essential for power generation, industrial processes, and the production of chemicals, including Ammonia, Methanol, Hydrogen, and Dimethyl ether. The Chemical segment and Power segment are the major consumers of Syngas, while the Liquid fuel segment uses it for the production of fuels like Urea and Pet coke. The Gaseous fuel segment utilizes Syngas for thermal applications and the production of synthetic natural gas.

- The Coal industry, with its vast reserves, dominates the market. However, the use of biomass and waste as feedstocks is increasing due to environmental awareness and sustainability concerns. The increasing global population growth, rapid industrialization, and urbanization necessitate the need for energy efficiency and feedstock diversification. The Gasification process generates impurities like sulfur and particulate matter, necessitating the use of Carbon capture technologies and stringent Environmental regulations. The installation and operational costs of gasification plants are higher than conventional combustion technologies, but the benefits of reduced emissions and increased energy efficiency make it a viable alternative. The market dynamics include factors like the availability of feedstocks, capital expenditure, and environmental regulations.

- The Coal sub-segment, which includes Coal, Petcoke, and Biomass, is a significant contributor to the market. The Air sub-segment, which includes Oxygen, Steam, and Carbon dioxide (CO2), is crucial for the gasification process. The Chemicals sub-segment, which includes chemicals like Ammonia, Methanol, and higher alcohols, and Plastics, is a significant consumer of Syngas. The Fixed bed sub-segment, which includes Fluidized bed and Entrained flow gasifiers, is essential for the efficient conversion of various feedstocks into Syngas. The market is expected to grow due to the increasing demand for electricity, industrialization, and waste management. The waste management sector, including Municipal solid waste, is a significant contributor to the market due to the need for effective waste disposal and recycling.

- The market is also expected to grow due to the increasing demand for cleaner fuels and the need for emission reductions. In conclusion, the market is a critical component of the global energy landscape, providing a cleaner and more efficient alternative to conventional combustion technologies. The market is driven by factors like the availability of feedstocks, environmental regulations, and the increasing demand for energy and chemicals. The market is expected to grow due to the increasing demand for electricity, industrialization, and waste management.

What challenges does the Gasification Industry face during its growth?

High operating and maintenance costs is a key challenge affecting the industry growth.

- The market encompasses various types of gasifiers, including fixed bed, fluidized bed, and entrained-flow, which convert carbonaceous raw materials into Syngas. This process is utilized In the Chemical segment for producing fuels like Ammonia, Methanol, and Hydrogen, as well as In the Power segment for electricity generation. The Coal industry, Petroleum, and Natural Gas sectors also leverage Gasification for fuel production and power generation. Impurities such as sulfur and particulate matter are present In the Syngas, necessitating the use of Carbon capture technologies for emission reductions. Biomass/waste, including municipal solid waste, serves as a significant feedstock in Gasification.

- The Chemicals sub-segment produces Dimethyl ether, Synthetic natural gas, and higher alcohols, while the Liquid fuel segment generates Urea and other chemicals. Thermochemical conversion of waste into Syngas offers environmental benefits, including reduced greenhouse gas emissions and improved waste management. Gasification's adoption is driven by industrialization, urbanization, and the need for energy efficiency. However, the high installation and operational costs hinder market growth. Factors like Capital expenditure, Environmental regulations, and feedstock diversification impact the market dynamics. In the Power segment, Gasification competes with conventional combustion technologies, offering advantages such as higher energy efficiency and lower pollutant emissions. The global population growth and rapid industrialization necessitate sustainable waste disposal and recycling solutions.

- The municipal sector's increasing focus on thermal applications for waste management and the development of Carbon capture technologies contribute to the market's growth. The Fossil fuels sub-segment includes Coal, Petcoke, and waste, while the Gaseous fuel segment caters to the demand for cleaner fuels. The market's key drivers include the increasing demand for industrial processes, power generation, and chemical feedstock. The market's challenges include the high installation and operational costs, environmental regulations, and the presence of impurities like sulfur and particulate matter. The market's future growth is influenced by the increasing focus on sustainability, energy efficiency, and the need for waste management solutions.

Exclusive Customer Landscape

The gasification market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gasification market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gasification market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Air Liquide SA - The company specializes in gasification technologies, including Lurgi FBDB, providing efficient and environmentally-friendly solutions for converting various feedstocks into synthesis gas for power generation and industrial applications. This process harnesses the energy potential of organic materials, enhancing energy security and reducing greenhouse gas emissions. By utilizing advanced gasification techniques, the company contributes to a sustainable energy future.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air Liquide SA

- Air Products and Chemicals Inc.

- Andritz AG

- Basin Electric Power Cooperative

- CASE GROUP

- China National Chemical Engineering Co. Ltd.

- Chiyoda Corp.

- EQTEC Plc

- General Electric Co.

- KBR Inc.

- Larsen and Toubro Ltd.

- Linde Plc

- McDermott International Ltd.

- Mitsubishi Heavy Industries Ltd.

- Oil and Natural Gas Corp. Ltd.

- Shell plc

- Siemens AG

- Synthesis Energy Systems Inc.

- ThermoChem Recovery International Inc.

- thyssenkrupp AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses various types of gasifiers, including fixed bed, fluidized bed, and entrained-flow designs, each with unique characteristics and applications. These technologies convert carbonaceous fuels, such as coal, biomass, and municipal solid waste, into syngas (a mixture of carbon monoxide, hydrogen, and other gases) through thermochemical conversion. Gasification offers several advantages over conventional combustion technologies. It enables the production of multiple useful products, such as electricity, heat, chemicals, fuels, and hydrogen, from a single feedstock. Moreover, it offers higher energy efficiency and lower emissions, making it a more sustainable option for power generation and industrial processes. The global population's rapid growth and urbanization have led to increased industrialization and power demand.

This, in turn, has fueled the need for cleaner and more efficient energy sources. Gasification plays a crucial role in this context, as it enables the conversion of various feedstocks into valuable energy products while reducing greenhouse gas emissions and pollutants. The chemical segment is a significant consumer of gasification technologies, utilizing syngas as a feedstock for the production of chemicals such as ammonia, methanol, dimethyl ether, and synthetic natural gas. The power segment also relies on gasification for power generation, providing a more efficient and cleaner alternative to conventional coal-fired power plants. The gaseous fuel segment, including hydrogen and carbon monoxide gas, is another growing application area for gasification.

Hydrogen is used as a clean fuel in various industries, including transportation and energy storage, while carbon monoxide gas is used as a reducing agent In the production of metals and other chemicals. Impurities, such as sulfur and particulate matter, are present In the syngas produced through gasification. These impurities must be removed to meet the required specifications for various applications. The removal of these impurities is typically achieved through various post-processing techniques, such as pressure swing adsorption (PSA) and membrane separation. The market for gasification technologies is driven by several factors, including the increasing demand for cleaner and more efficient energy sources, the need for feedstock diversification, and the growing importance of waste management and recycling In the municipal sector.

Environmental regulations also play a significant role In the market's growth, as they push for the adoption of cleaner technologies and the reduction of greenhouse gas emissions. The cost of installing and operating gasification plants is a critical factor In their adoption. Capital expenditure and operational costs vary depending on the type of gasifier and the feedstock used. Coal and petcoke are commonly used feedstocks In the gasification industry, but biomass and municipal solid waste are gaining popularity due to their sustainability benefits. In conclusion, the market offers a cleaner, more efficient, and more sustainable alternative to conventional combustion technologies.

It enables the production of various valuable products from a single feedstock and offers significant environmental benefits. The market's growth is driven by various factors, including population growth, industrialization, and environmental regulations. The cost of installing and operating gasification plants remains a critical factor In their adoption, but the benefits they offer make them an attractive option for various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

187 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 116.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.1 |

|

Key countries |

China, US, Germany, India, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Gasification Market Research and Growth Report?

- CAGR of the Gasification industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gasification market growth of industry companies

We can help! Our analysts can customize this gasification market research report to meet your requirements.