Syngas Market Size 2024-2028

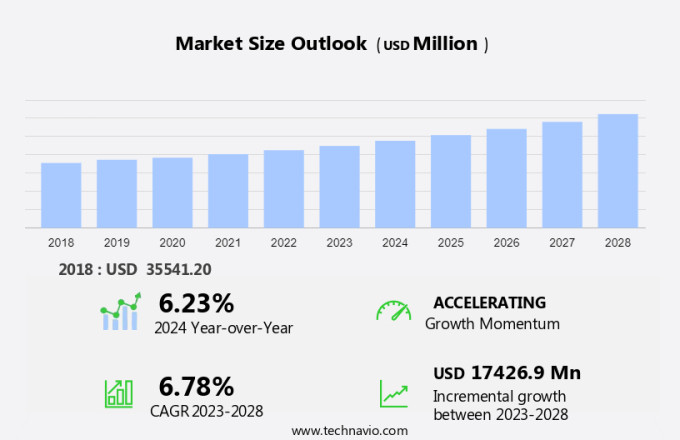

The syngas market size is forecast to increase by USD 17.43 billion at a CAGR of 6.78% between 2023 and 2028. The market is experiencing significant growth due to the increasing utilization of syngas in various applications, particularly in the production of bio-based feedstock for biofuels. Heavy crude oil and tar sand bitumen are being replaced with syngas as a cleaner and more efficient alternative. However, the production of syngas involves challenges such as the presence of water vapor and sulfur containing compounds, which require complex purification processes. Additionally, the demand for high-quality syngas, particularly for ethane and ethylene production, is driving market growth. The use of biomass-derived syngas through fermentation processes is also gaining popularity due to its environmental benefits.

The market is witnessing significant growth due to the increasing demand for alternative energy sources and the need to reduce greenhouse gas emissions. Syngas, also known as synthesis gas, is a mixture of H2, CO, CO2, and other trace gases. It is primarily produced from carbonaceous feedstocks, including biomass and waste biomasses. Biomass, such as agricultural residues, forestry waste, and energy crops, is a renewable source of carbonaceous feedstocks. The Fischer-Tropsch (FT) process is widely used for converting syngas into liquid hydrocarbons, such as methanol, diesel fuel, and jet fuel. Methanol can further be converted into hydrogen fuel cells, while diesel fuel and jet fuel can be used as transportation fuels. Landfills are another significant source of waste biomasses. The decomposition of organic waste in landfills generates methane, a potent greenhouse gas. Capturing and utilizing this methane as a feedstock for syngas production can help reduce greenhouse gas emissions and generate revenue for waste management companies. Natural gas is another common feedstock for syngas production. However, the use of biomass and waste biomasses offers several advantages, including the reduction of greenhouse gas emissions, the diversification of energy sources, and the potential for negative carbon emissions. The syngas produced from biomass and waste biomasses can also be used as feedstocks for the production of other value-added products.

Moreover, the production of syngas from biomass and waste biomasses can also generate by-products, such as ethane, ethylene, acetylene, and water vapor. These by-products can be further processed into valuable chemicals and fuels, such as polyethylene, polypropylene, and ethylene oxide. In conclusion, the market is expected to grow significantly due to the increasing demand for alternative energy sources and the need to reduce greenhouse gas emissions. Biomass and waste biomasses offer a renewable and sustainable source of carbonaceous feedstocks for syngas production. The utilization of syngas for the production of hydrogen fuel cells, methanol, diesel fuel, and other value-added products can help diversify the energy mix and reduce dependence on fossil fuels. However, careful consideration of the challenges associated with the production of syngas from biomass and waste biomasses is necessary to ensure efficient and cost-effective production.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Chemical

- Fuel

- Electricity

- Feedstock

- Coal

- Natural gas

- Petroleum byproducts

- Biomass/waste

- Others

- Geography

- APAC

- China

- India

- Europe

- Germany

- UK

- North America

- US

- Middle East and Africa

- South America

- APAC

By Application Insights

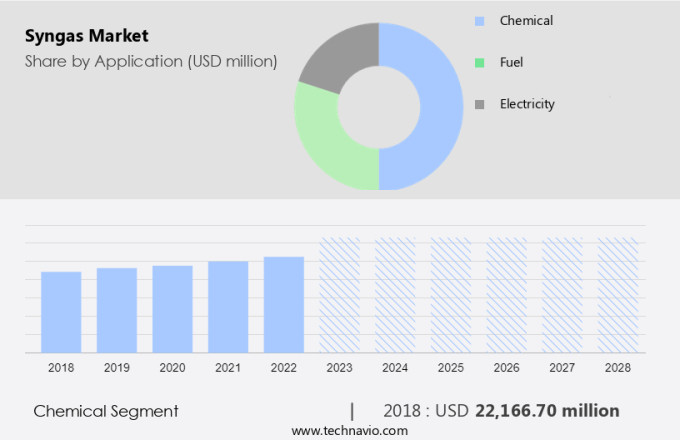

The chemical segment is estimated to witness significant growth during the forecast period. In the realm of modern industry, chemical products play a pivotal role, particularly in the production of plastics, rubber, and synthetic textiles. These chemicals enhance the functionality of various materials, including metals and timber, through protective coatings like varnishes and decorative ones like paints. The agricultural sector also heavily relies on chemicals, primarily in the form of fertilizers and agrochemicals, to sustain output levels. With the maturing fertilizer market in several regions, the demand for chemicals in this sector is dwindling. However, the burgeoning demand for plastics and other chemicals offsets this decline. Moreover, the International Energy Agency (IEA) in its Sustainable Development Scenario outlines an ambitious vision for the energy sector's evolution to meet energy-related Sustainable Development Goals.

According to this scenario, global direct carbon emissions from the chemicals sector are projected to peak in 2025. The chemicals industry's primary focus is shifting towards the production of cleaner energy sources, such as Syngas derived from biomass and waste biomasses. This shift is driving the demand for hydrogen (H2), carbon monoxide (CO), and carbon dioxide (CO2) in the production of chemicals like methanol and diesel fuel via the Fischer-Tropsch process. The use of these cleaner energy sources is expected to reduce the chemicals sector's carbon footprint significantly.

Get a glance at the market share of various segments Request Free Sample

The chemical segment accounted for USD 22.17 billion in 2018 and showed a gradual increase during the forecast period.

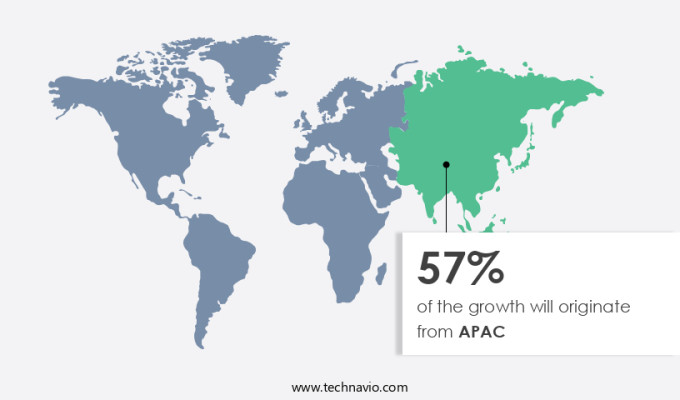

Regional Insights

APAC is estimated to contribute 57% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the global energy landscape, China and India are major consumers of coal to fulfill their energy requirements, with China being the largest coal producer since 1985. However, the 2015 Paris Climate Agreement's emission limitations have prompted China to explore advanced carbon capture technologies, particularly through coal gasification. Coal gasification can also be achieved through bioenergy gasification, as biomass alone cannot generate sufficient energy efficiently. Researchers in China have suggested the integration of coal and biomass energy to optimize energy production.

Further, hydrogen production processes, such as steam methane reforming and autothermal reforming, utilize syngas. Oxygen and air are essential components in these processes. Lignocellulosic materials, a significant component of biomass, contain lignin, which can be converted into valuable chemicals and fuels. The increasing focus on clean energy and reducing greenhouse gas emissions has led to a wave in research and development in hydrogen production and CO2 removal technologies.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The rising application of syngas is the key driver of the market. Syngas, derived from light hydrocarbons and carbonaceous feedstocks, play a significant role in various industries, including chemicals, petrochemicals, refining, and fertilizers. The primary use of syngas is in electricity generation, serving as a combustible fuel for internal combustion engines. This versatile gas can also be transformed into chemical products via the Fischer-Tropsch process. These include formaldehyde, acetic acid, methanol, ethanol, ammonia, and other essential chemical building blocks. Additionally, syngas is employed in the production of steel, synthetic natural gas (SNG), and hydrogen. SNG is an emerging fuel and a crucial element in the energy transition, enhancing the efficiency and sustainability of energy-intensive industries while reducing their carbon footprint.

Market Trends

Rising demand for bio-based feedstock is the upcoming trend in the market. The market is witnessing significant growth due to the increasing utilization of bio-based feedstocks for syngas production. Renewable syngas production is gaining traction as a sustainable alternative to traditional methods that rely on fossil fuels. Major market players are focusing on developing syngas from renewable sources, such as wood, waste wood, cellulose, lignin, and other plant-based materials. This shift towards bio-based feedstocks will help reduce carbon emissions in industries and transportation. Two common methods for producing syngas from bio-based feedstocks are fixed-bed gasifiers and fluidized-bed gasifiers. In the water-gas shift reaction, carbon monoxide in the syngas is converted into carbon dioxide and hydrogen.

Biohydrogen, a type of renewable hydrogen, can also be produced through syngas. The implementation of these technologies will contribute to the expansion of The market. Major market players are continually working to make bio-based feedstock production cost-effective and sustainable. This focus on innovation and sustainability is expected to drive the growth of the market in the forecast period. Additionally, the reduction of particulate matter emissions from syngas production through the use of advanced filtration systems is a significant trend in the market. Oxides of iron, a common impurity in syngas, can be removed through these filtration systems, ensuring the production of clean syngas.

Market Challenge

Complex quality requirements for syngas is a key challenge affecting the market growth. Syngas, often referred to as synthesis gas or producer gas, is generated through the conversion of carbon-containing feedstocks. Feedstocks encompass various materials such as coal, biomass (wood gas), plastics, municipal waste, and more. The production process involves gasification or pyrolysis, where feedstocks are subjected to high temperatures with controlled oxygen levels, minimizing combustion to supply thermal energy for the reaction. Gasification can occur in engineered vessels or in situ, like in Underground Coal Gasification (UCG). The syngas composition is influenced significantly by the gasifier's input materials. Heavy crude oil and tar sand bitumen can also serve as feedstocks for syngas production.

Biomass-derived syngas can be generated through fermentation processes, contributing to the production of biofuels. During gasification, water vapor and sulfur-containing compounds are typically co-produced. Ethane and ethylene are significant components of syngas, making it a valuable resource in the chemical industry. Syngas production is a critical process in various industries, including power generation, chemicals, and refining. The flexibility of syngas as a feedstock allows for the conversion of diverse raw materials into valuable products, making it a strategic asset for businesses and economies.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Air Liquide SA: The company offers syngas such as Air Liquide Advanced Separations syngas membranes.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air Products and Chemicals Inc.

- BASF SE

- BP Plc

- Chevron Corp.

- Chiyoda Corp.

- ENERKEM Inc.

- General Electric Co.

- IHI Corp.

- John Wood Group PLC

- Linde Plc

- McDermott International Ltd.

- Methanex Corp.

- Mitsubishi Heavy Industries Ltd.

- Sasol Ltd.

- Shell plc

- Siemens AG

- Synthesis Energy Systems Inc.

- TechnipFMC plc

- thyssenkrupp AG

- Topsoes AS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the production and utilization of syngas, a mixture of hydrogen (H2), carbon monoxide (CO), and other light hydrocarbons derived from various feedstocks. Biomass and waste biomasses, such as agricultural residues, forestry waste, and landfill gas, are increasingly being used as carbonaceous feedstocks for syngas production. The Fischer-Tropsch process is a popular method for converting syngas into liquid fuels, such as diesel fuel and jet fuel, while methanol production relies on the steam-methane-reforming reaction. Hydrogen fuel cells utilize pure hydrogen gas for power generation, while methane and other light hydrocarbons can be used as feedstocks for the production of chemicals like formaldehyde, acetic acid, and ethylene. Gasification processes, including coal gasification and biomass gasification, are thermochemical methods used to convert carbonaceous feedstocks into syngas through partial oxidation. These processes generate CO, CO2, nitrogen, and water vapor as by-products.

Further, the removal of CO2 is crucial for the production of clean syngas for various applications. Syngas can also be produced from natural gas through steam methane reforming, and from heavy crude oil and tar sand bitumen through coal gasification processes. Sulfur containing compounds and particulate matter must be removed from the syngas stream before further processing. Syngas can be produced through various hydrogen production processes, including water-gas shift reaction and biomass-derived syngas fermentation. Hydrogen is used in various industries, including ammonia production and hydrocracking, as well as in fuel cells for power generation. Syngas can also be used as a feedstock for the production of biofuels, such as biodiesel and bioethanol.

Moreover, fixed-bed and fluidized-bed gasifiers are commonly used for syngas production. Oxides of iron, chromium, copper, and zinc are often used as catalysts in the gasification process. Syngas can also be produced through the steam-methane-reforming reaction, which involves the reaction of methane with steam in the presence of a catalyst to produce hydrogen and CO. In summary, the market is driven by the increasing demand for clean and renewable energy sources, as well as the need for alternative feedstocks for the production of chemicals and fuels. Syngas can be produced from various carbonaceous feedstocks through gasification processes and can be used for the production of hydrogen, methanol, and various chemicals and fuels. The removal of impurities, such as CO2 and sulfur containing compounds, is crucial for the production of clean syngas for various applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 17.43 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.23 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 57% |

|

Key countries |

China, US, India, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Air Liquide SA, Air Products and Chemicals Inc., BASF SE, BP Plc, Chevron Corp., Chiyoda Corp., ENERKEM Inc., General Electric Co., IHI Corp., John Wood Group PLC, Linde Plc, McDermott International Ltd., Methanex Corp., Mitsubishi Heavy Industries Ltd., Sasol Ltd., Shell plc, Siemens AG, Synthesis Energy Systems Inc., TechnipFMC plc, thyssenkrupp AG, and Topsoes AS |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch