Gifts Retailing Market Size 2025-2029

The gifts retailing market size is forecast to increase by USD 16.75 billion, at a CAGR of 3.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the rising demand for seasonal decorations and the expanding personalized gifting culture. Consumers increasingly seek specialized merchandise to express their unique tastes and preferences like e-gifts and greeting cards creating opportunities for retailers to differentiate themselves. However, this market growth is not without challenges. Intense competition among retailers puts pressure on pricing, necessitating strategic pricing strategies to remain competitive. Retailers must navigate these dynamics to capitalize on market opportunities and effectively address pricing pressures.

- To succeed, they must offer unique, high-quality merchandise while maintaining competitive pricing. By focusing on these trends and challenges, retailers can position themselves for success in the dynamic and evolving the market.

What will be the Size of the Gifts Retailing Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

In the dynamic and ever-evolving retail landscape, the gifts sector continues to adapt and innovate, integrating various elements to cater to diverse consumer needs and preferences. From sustainable practices and experiential gifts to trend forecasting and holiday gift guides, the industry remains agile in its response to market demands. Birthday gifts, inventory management, and point-of-sale systems are seamlessly integrated, enabling real-time tracking of stock levels and customer preferences. Personalized gifts, corporate gifts, and wedding gifts are customized to meet specific occasions and clientele, while customer segmentation and gift tags facilitate efficient organization and targeted marketing. Seasonal promotions, returns management, and inventory control are crucial components, ensuring a smooth shopping experience for customers.

Luxury gifts, store layout, and gift registries cater to the high-end market, while consumer behavior, product assortment, and retail analytics inform strategic decision-making. Brand loyalty, subscription boxes, and promotional gifts foster customer engagement, and e-commerce platforms, email marketing, and social media marketing expand reach and accessibility. Eco-friendly gifts, shoplifting prevention, and loss prevention measures address sustainability and security concerns.

How is this Gifts Retailing Industry segmented?

The gifts retailing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Souvenirs and novelty items

- Seasonal decorations

- Greeting cards

- Giftware

- Others

- Target Audience

- Individuals

- Corporates

- Non-Profit Organizations

- Event Planners

- Gift Basket Companies

- Type

- Traditional Gifts

- Personalized Gifts

- Experiential Gifts

- Digital Gifts

- Luxury Gifts

- Occasions

- Birthdays

- Weddings

- Holidays

- Corporate Events

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

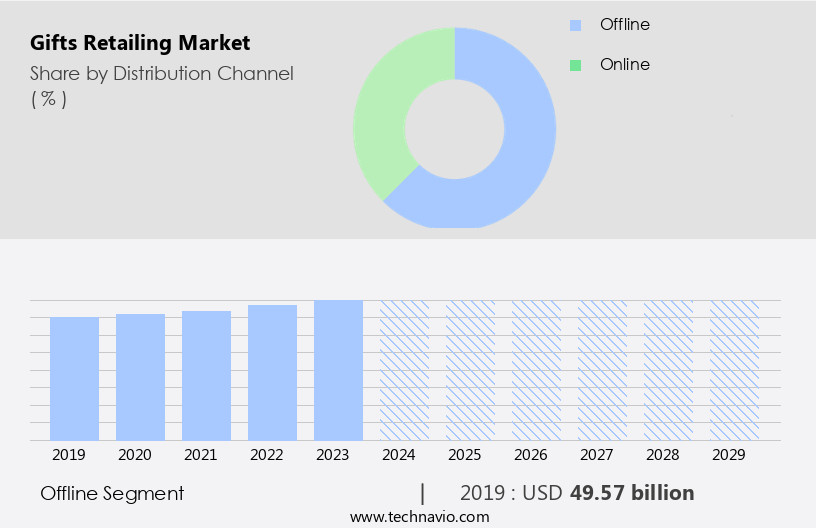

The offline segment is estimated to witness significant growth during the forecast period.

In the dynamic retail landscape, sustainable practices are increasingly shaping consumer preferences for gift purchases. Holiday gift guides highlight experiential gifts, eco-friendly options, and personalized items. Trend forecasting identifies these trends, helping retailers adapt their product assortments. Order fulfillment and inventory management are crucial for timely delivery and stock availability during the holiday season. E-gift cards offer convenience, while anniversary gifts and corporate gifts foster brand loyalty. Security systems, shoplifting prevention, and loss prevention measures ensure a safe shopping environment. Retail display fixtures and gift wrapping enhance the in-store experience. Birthday gifts, wedding gifts, and other gift-giving occasions continue to drive sales.

Customer segmentation and gift registries help retailers cater to diverse consumer needs. Inventory control, point-of-sale systems, and data analytics enable efficient retail operations. Luxury gifts and seasonal promotions cater to affluent consumers. Returns management and pricing strategies minimize shrinkage and maximize profit margins. Handmade gifts, collectible gifts, and artisan gifts offer unique product differentiation. Brand awareness and social media marketing are essential for reaching broader audiences. Sales forecasting and supply chain optimization ensure timely delivery and efficient shipping logistics. Ethical sourcing and e-commerce platforms cater to the growing demand for online shopping. Email marketing and visual merchandising engage customers and drive sales.

Retailers invest in employee training, product lifecycle management, and store layout design to optimize their businesses. Subscription boxes and promotional gifts offer recurring revenue streams. Customer service and loyalty programs retain customers and encourage repeat purchases. In the evolving retail market, retailers must adapt to changing consumer preferences and trends to remain competitive.

The Offline segment was valued at USD 49.57 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the European gifting market, there is a growing emphasis on sustainable practices and eco-friendliness. As the holiday season approaches, retailers release gift guides featuring experiential and personalized gifts, as well as eco-friendly options. companies are increasingly focusing on order fulfillment and inventory management to meet the demand for these gifts. Shoplifting and loss prevention remain crucial concerns, with employee training and retail display fixtures playing essential roles. Market research informs retailers about consumer behavior and product assortment, helping them cater to various customer segments. Gift cards, both physical and digital, continue to be popular, especially for anniversary and birthday gifts.

Inventory control and point-of-sale systems ensure efficient handling of these transactions. Brand loyalty programs and subscription boxes add value for customers. Luxury gifts, gift baskets, and in-store promotions are other significant categories. Consumer behavior analysis and retail analytics help retailers optimize their supply chain and shipping logistics. Ethical sourcing and e-commerce platforms are becoming increasingly important, with email marketing and visual merchandising used to boost sales. Profit margins are influenced by pricing strategies and shrinkage reduction. Handmade and artisan gifts, collectible items, and baby shower gifts are other popular categories. The European gifting market is dynamic, with trends shifting towards immersive and harmonious experiences.

Retailers must adapt to these changes by offering a wide product assortment, effective customer service, and efficient product lifecycle management. Overall, the market is driven by a growing awareness of consumer preferences and the need to cater to their evolving needs.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and competitive the market, merchants skillfully curate and sell a diverse range of presents to cater to various consumer preferences. From trendy tech gadgets and personalized jewelry to gourmet food baskets and artistic home decor, the industry thrives on innovation and customer satisfaction. Consumers seek out unique, high-quality gifts that reflect their relationships and personalities. Retailers leverage effective marketing strategies, such as social media campaigns and loyalty programs, to engage customers and drive sales. Sustainability and ethical sourcing are increasingly important factors, with eco-friendly and fair-trade gifts gaining popularity. The market is further shaped by seasonal trends, cultural traditions, and economic factors, making it an exciting and ever-evolving landscape.

What are the key market drivers leading to the rise in the adoption of Gifts Retailing Industry?

- The market is driven by two primary factors: the increasing demand for seasonal decorations and the thriving gifting culture.

- The market experiences significant revenue growth due to the high demand for seasonal decorative items and personalized gifts during important days and holidays. These include mugs, plates, handkerchiefs, and other similar products. Major markets such as the US, the UK, and France exhibit a strong preference for seasonal gifts. Furthermore, the demand for such products is increasing in developing markets in APAC, Central America, and South America. Holiday seasons and festivals, such as New Year, Christmas, Halloween, Easter, and Hanukkah, significantly contribute to the sales of these gifts. The market trend forecast indicates a continued emphasis on sustainable practices, experiential gifts, and eco-friendly options.

- Retailers focus on order fulfillment, e-gift cards, and anniversary gifts to cater to the evolving consumer preferences. To ensure security, retailers invest in shoplifting prevention, loss prevention, employee training, retail display fixtures, market research, gift bags, and security systems. Gift wrapping remains an essential part of the retail experience, adding to the overall value of the purchase.

What are the market trends shaping the Gifts Retailing Industry?

- The trend in the market is characterized by an increasing demand for specialized merchandise. Professionals and consumers alike are seeking out niche products to meet their unique needs.

- The market is experiencing significant growth due to the increasing demand for specialized merchandise. This market distinguishes between specialty merchandisers and mass merchandisers. Recently, there has been a notable increase in demand for gift, novelty, and souvenir retailers. Specialty stores primarily offer unique, locally crafted gifts, leading to a high degree of product differentiation. This caters to the premium customer segments, boosting demand for such merchandise. Souvenir and gift retailers often act as distributors for specialized merchandise. For instance, Disney licenses its trademarks, characters, and intellectual properties to various retailers, promoters, and publishers.

- Effective inventory management, point-of-sale systems, and consumer behavior analysis are crucial for retailers in this market. Seasonal promotions, gift tags, and gift registries are popular strategies to attract customers. Personalized gifts, corporate gifts, wedding gifts, luxury gifts, and inventory control are significant aspects of the market. Retail analytics plays a pivotal role in understanding consumer behavior and optimizing product assortment. Return management is another essential function for retailers to ensure customer satisfaction. Store layout and layout design are critical factors influencing sales. Overall, The market is dynamic, with various trends shaping its growth.

What challenges does the Gifts Retailing Industry face during its growth?

- Fierce market competition puts significant pricing pressure on the industry, posing a major challenge to its growth. The market faces significant competition from various channels, including department stores, mass merchandisers, e-retailers, and novelty stores. Major players in this sector, such as Macy's, JCPenney, Sears Holding, and House of Fraser, offer a wide range of gift products through their retail stores. However, the increasing competition puts pressure on pricing, which negatively impacts the profit margins of these market participants. E-retailers pose a significant threat to specialty gift and souvenir retailers due to the prevalence of deep Internet penetration and smart gadget usage in certain regions. To remain competitive, market companies are adopting economic pricing strategies.

- Brand loyalty plays a crucial role in the market. Subscription boxes, promotional gifts, gift baskets, and in-store promotions are effective strategies to build customer loyalty. Product lifecycle management, supply chain optimization, shipping logistics, data analytics, and ethical sourcing are essential elements of successful gift retailing businesses. E-commerce platforms, email marketing, and visual merchandising are essential tools for retailers to engage customers and increase sales. Gift giving occasions, such as birthdays, anniversaries, and holidays, provide ample opportunities for retailers to boost sales. Gift cards are also popular choices for customers. Effective customer service and product offerings are critical factors in the success of gifts retailing businesses.Market companies must focus on these areas to differentiate themselves from competitors and maintain a strong market presence.

Exclusive Customer Landscape

The gifts retailing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gifts retailing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gifts retailing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aldi Stores Ltd. - This company specializes in retailing a diverse range of toys, encompassing action figures, branded toys, dolls and dollhouses, and electric toys.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aldi Stores Ltd.

- Alibaba Group Holding Ltd.

- Amazon.com Inc.

- American Greetings Corp.

- Bed Bath and Beyond Inc.

- Card Factory Plc

- Costco Wholesale Corp.

- Enesco LLC

- Ferns N Petals Pvt. Ltd.

- Hallmark Card Inc.

- House of Fraser Ltd.

- Loop Commerce Inc.

- Macys Inc.

- My Pet Gift Box Ltd

- Penney OpCo LLC

- Shutterfly Inc.

- Spencer Gifts LLC

- The Walt Disney Co.

- Walmart Inc.

- Williams Sonoma Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Gifts Retailing Market

- In January 2024, global gourmet food and gift retailer, Dean & Deluca, announced the launch of its new subscription gift box service, "Delight Delivered," in partnership with leading e-commerce platform, Amazon (Reuters, 2024). This strategic collaboration aimed to expand Dean & Deluca's reach and enhance its digital presence.

- In March 2024, leading gift retailer, Hallmark, completed the acquisition of Shari's Berries, a specialty chocolate and fruit gift retailer, for approximately USD350 million (Bloomberg, 2024). This strategic move expanded Hallmark's product offerings and strengthened its position in the gourmet gift market.

- In May 2024, the European Union approved new regulations on online sales of gifts and gourmet food items, requiring sellers to comply with stricter labeling and import regulations (European Commission, 2024). This initiative aimed to ensure consumer safety and reduce fraudulent activities in the gifting market.

- In April 2025, leading tech company, Apple, unveiled its new "Gift Cards for Services" feature, allowing users to purchase and send digital gift cards for Apple services, such as Apple Music and Apple TV+, directly through their iPhones (Apple, 2025). This technological advancement revolutionized the gifting experience and catered to the growing demand for digital gifts.

Research Analyst Overview

- In the dynamic the market, artisan businesses thrive, offering unique handmade crafts and novelty gifts. Retail software streamlines operations, enabling price psychology strategies to boost sales conversion rates. Product reviews influence consumer decisions, while reputation management maintains a positive online presence. Mobile commerce and online gift delivery cater to convenience-driven shoppers. Local businesses benefit from digital marketing, including content marketing, affiliate marketing, and influencer marketing, to boost website traffic. Omnichannel retail, including gift exchange programs and mobile payment, enhances customer experience.

- Sales promotion through promotional calendars, marketing automation, and email open rates optimizes conversion rates. Sustainable packaging, personalized service, and customized gifts appeal to socially conscious consumers. Gift vouchers and gift receipts ensure customer satisfaction and retention. DIY gifts and charity gifts add to the market's diversity.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Gifts Retailing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.5% |

|

Market growth 2025-2029 |

USD 16.75 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.2 |

|

Key countries |

US, Germany, UK, China, Canada, India, France, Italy, Japan, South Korea, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Gifts Retailing Market Research and Growth Report?

- CAGR of the Gifts Retailing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gifts retailing market growth of industry companies

We can help! Our analysts can customize this gifts retailing market research report to meet your requirements.