Bluetooth Speaker Market Size 2025-2029

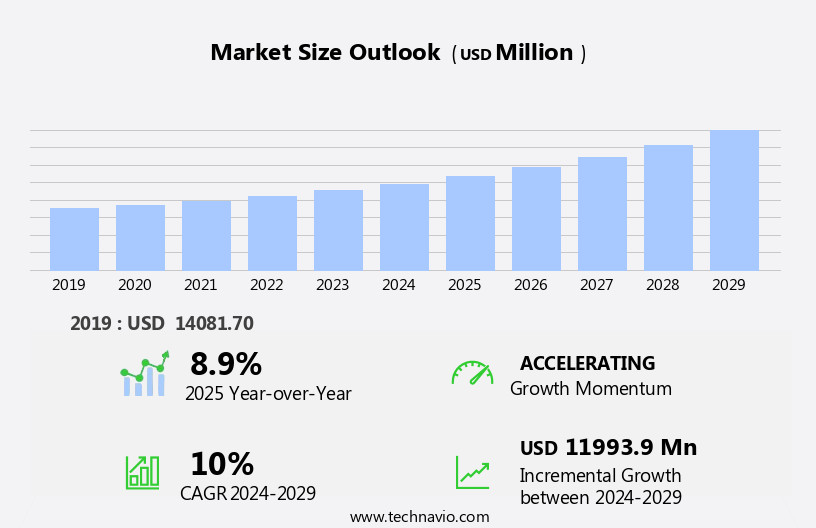

The bluetooth speaker market size is forecast to increase by USD 11.99 billion at a CAGR of 10% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of smart speakers and the popularity of voice commerce. According to recent studies, the global smart speaker market is projected to reach a value of over USD30 billion by 2024, with a compound annual growth rate (CAGR) of approximately 20%. This trend is being fueled by the integration of voice assistants into Bluetooth speakers, enabling users to control their music and access various smart home functions through voice commands. However, this market is not without challenges. The threat of cyber attacks is a major concern, as Bluetooth speakers can be vulnerable to hacking, leading to potential privacy breaches and data theft.

- Moreover, the market is becoming increasingly competitive, with numerous players vying for market share. Companies seeking to capitalize on this market's opportunities must focus on enhancing their product offerings through advanced features, such as superior sound quality, long battery life, and waterproofing. Additionally, ensuring cybersecurity measures is essential to build consumer trust and differentiate from competitors. By addressing these challenges and leveraging the growing demand for voice-activated devices, companies can effectively navigate this dynamic market and position themselves for long-term success.

What will be the Size of the Bluetooth Speaker Market during the forecast period?

- The market in the US is experiencing significant growth, driven by advancements in audio technology and consumer preferences for portable, high-performance speakers. Key features fueling this trend include deep bass, app control, power bank functionality, and customizable sound profiles. Wireless charging, audio, crystal clear highs, spatial audio, USB-C charging, RGB lighting, and LED lighting are also popular. High-end speakers often incorporate premium materials and audiophile-grade components for enhanced sound quality, while compact and stylish designs cater to on-the-go lifestyles. Extended frequency response, multi-room audio, and audiophile features such as stereo imaging, portability, and 360-degree sound further differentiate offerings. The growing popularity of adventure tourism has spurred demand for rugged, portable speakers, while integration with smart home automation systems enhances user convenience and control, making these devices a staple in modern connected living.

How is this Bluetooth Speaker Industry segmented?

The bluetooth speaker industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Portable

- Fixed

- Distribution Channel

- Offline

- Online

- Application

- Residential

- Commercial

- Others

- Connectivity

- Single bluetooth connectivity

- Multi-device pairing

- Wi-Fi and bluetooth hybrid

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- North America

By Product Insights

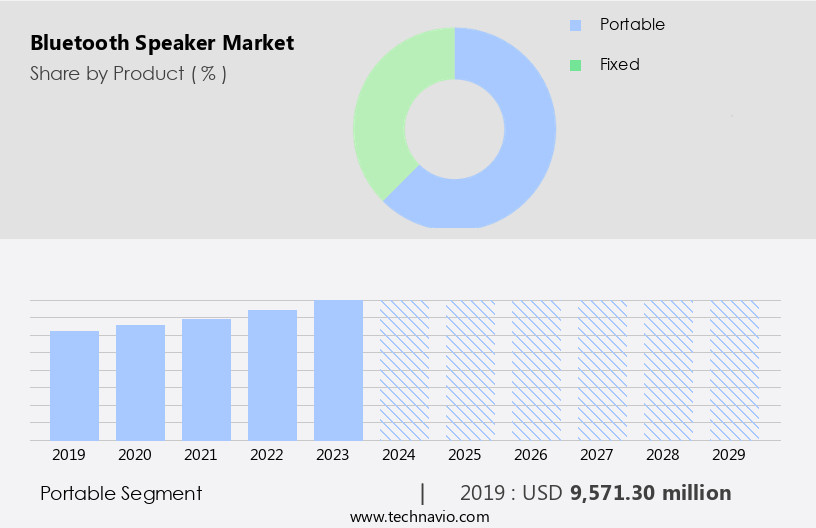

The portable segment is estimated to witness significant growth during the forecast period. The portable speaker market is experiencing substantial growth as of 2024. This expansion is driven by technological innovations, shifting consumer preferences, and increasing global demand. Younger demographics, in particular, are gravitating towards wireless and Bluetooth-enabled speakers due to their portability, convenience, and fashionable designs. The integration of voice assistants like Google Assistant, Alexa, and Siri has significantly boosted their popularity, transforming portable speakers into intelligent devices that manage home automation tasks, such as controlling lights, TVs, and appliances. These voice-activated speakers have seamlessly integrated into the modern smart home ecosystem. Improvements in battery life have addressed a previous concern for wireless speakers.

Consumers can now enjoy extended playtime without the need for frequent recharging. Additionally, advanced features such as high-resolution audio, digital signal processing, and lossless audio have become increasingly important for discerning listeners. Water resistance, dust resistance, and NFC pairing have expanded the speakers' usage beyond indoor environments, making them suitable for outdoor activities. Moreover, portable speakers cater to diverse applications, including music playback, podcast listening, gaming audio, and speakerphone functionality. They are compatible with various mobile devices, auxiliary inputs, and even microSD cards, offering versatility and convenience. With features like multi-device pairing, stereo pairing, and speakerphone functionality, portable speakers have become indispensable for both personal and professional use.

In summary, the portable speaker market is witnessing significant growth due to technological advancements, evolving consumer lifestyles, and rising global demand. The integration of voice assistants, improvements in battery life, and advanced features have made portable speakers indispensable for modern consumers, catering to their diverse needs and preferences.

The Portable segment was valued at USD 9.57 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

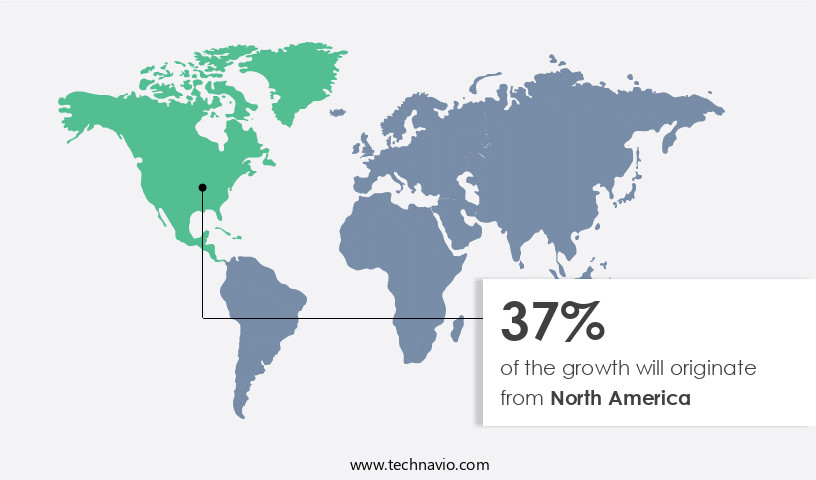

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth in 2024, fueled by the increasing popularity of wireless and portable audio devices among consumers. The United States and Canada are key contributors to this trend, with music streaming services, both free and premium, driving demand. As more North Americans subscribe to these platforms, there is a rising need for high-quality Bluetooth speakers that deliver superior sound quality. Smart home integration is another significant factor boosting market growth. Bluetooth speakers are increasingly being incorporated into living spaces, including living rooms, kitchens, and bedrooms, as part of broader home renovation and smart home upgrade projects.

Consumers value the convenience of voice assistant integration, such as Google Assistant, and the ability to pair multiple devices, ensuring seamless music playback and stereo pairing. Water resistance and dust resistance are essential features for outdoor use, making Bluetooth speakers versatile for various environments. High-resolution audio, lossless audio, and audio codecs like aptX ensure superior sound quality, catering to audiophiles and music enthusiasts. Long battery life, speakerphone functionality, and NFC pairing offer added convenience. The market also caters to diverse consumer preferences, with offerings ranging from wearable speakers for active lifestyles to party speakers for larger gatherings. Home theater systems and gaming consoles integrate Bluetooth speakers for audio experiences.

Equalizer settings, treble response, and bass response cater to individual audio preferences. Bluetooth speakers come with various connectivity options, including Bluetooth range, auxiliary input, and microSD card support, ensuring compatibility with a wide range of devices. The market continues to evolve, with innovations in wireless audio technology, digital signal processing, and sound quality enhancing the overall user experience.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Bluetooth Speaker Industry?

- The wave in the adoption of smart speakers is the primary factor fueling market growth. Smart speakers, with their advanced voice recognition technology and capability to connect to various home automation devices, have gained significant popularity among consumers, leading to an increase in demand and subsequent market expansion. Smart Bluetooth speakers have gained significant traction in the market due to their integration with voice-controlled smart assistants. These devices enable users to control multiple connected home appliances through voice commands, making them essential components of home automation and smart homes.

- Equipped with advanced features, smart Bluetooth speakers provide users with real-time updates on weather, news, meeting schedules, security alerts, and notifications related to their smart appliances. The increasing demand for convenience and connectivity has compelled market companies to develop innovative products. As a result, the adoption of smart Bluetooth speakers is on the rise, making them an indispensable part of modern households. The integration of smart assistants with these speakers has expanded their functionality, offering users a more seamless and efficient way to manage their connected devices.

What are the market trends shaping the Bluetooth Speaker Industry?

- The rising prevalence of voice commerce represents a significant market trend, signifying a notable shift in consumer behavior towards hands-free and convenient shopping experiences. Bluetooth speakers equipped with virtual assistants, such as Amazon Alexa, are revolutionizing the way consumers shop online. Voice commerce, the technology enabling this innovation, allows users to place orders and make purchases using voice commands instead of traditional input methods. This hands-free shopping experience offers several advantages, including the ability to multitask and receive fast responses and results.

- Consumers can easily search for products and complete transactions using voice commands, making the process more convenient and efficient. The popularity of voice commerce is on the rise, with more consumers preferring this method over traditional input methods. This trend is expected to continue, as the technology becomes more sophisticated and integrated into daily life. By enabling voice commerce capabilities, Bluetooth speaker companies are catering to the evolving needs and preferences of consumers, providing a more seamless and convenient shopping experience.

What challenges does the Bluetooth Speaker Industry face during its growth?

- The growth of the industry is significantly threatened by the looming danger of cyber attacks, which poses a major challenge that necessitates security measures and continuous vigilance.Bluetooth speakers, while offering convenience and wireless connectivity, pose significant cybersecurity risks. These devices are susceptible to various attacks, including denial-of-service (DoS), man-in-the-middle (MiTM), data breaches, advanced persistent threats (APTs), and ransomware.

- The mass production of identical Bluetooth speakers makes them an easy target for cybercriminals, who can exploit default or weak passwords to gain unauthorized access. Once compromised, these devices could disrupt the networks of end-users, posing a serious threat to IT infrastructure. It is essential for organizations and individuals to prioritize cybersecurity measures for their bluetooth speakers, such as regularly updating software and using strong, unique passwords. Ignoring these precautions could leave networks vulnerable to cyberattacks.

Exclusive Customer Landscape

The bluetooth speaker market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the bluetooth speaker market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, bluetooth speaker market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amazon.com Inc. - The company offers bluetooth speakers such as Amazon Echo Dot..

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Altec Lansing Inc.

- Apple Inc.

- Best IT World India Pvt. Ltd.

- Bose Corp.

- Imagine Marketing Pvt. Ltd.

- inMusic Brands Inc.

- Koninklijke Philips NV

- Kunhar Peripherals Pvt Ltd.

- Lenovo Group Ltd.

- LG Electronics Inc.

- Logitech International SA

- Onkyo Corp.

- Panasonic Holdings Corp.

- Samsung Electronics Co. Ltd.

- Sharp Corp.

- Skullcandy Inc.

- Sony Group Corp.

- SoundBot

- Zebronics India Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Bluetooth Speaker Market

- The market has witnessed significant developments in recent years, with key players introducing innovative products and forming strategic collaborations to expand their offerings and reach. Here are four noteworthy developments from 2024 and 2025, based on Technavio's market research: In Q1 2024, JBL, a leading audio equipment manufacturer, launched its PartyBox 310 portable Bluetooth speaker. This powerful speaker boasts an impressive output of 310 watts RMS and can connect up to 100 JBL PartyBox speakers for larger events. (Source: JBL Press Release) In Q3 2024, Sony and Amazon announced a technological collaboration to integrate Alexa voice assistant into Sony's SRS-XB43 and SRS-XB33 wireless speakers.

- This integration allows users to control their music playback and volume using voice commands. (Source: Sony Press Release) In Q1 2025, Harman International, a subsidiary of Samsung Electronics, acquired JBL's parent company, HARMAN, for approximately USD 3.3 billion. This acquisition is expected to strengthen Harman's position in the market and expand its product offerings. (Source: Harman International Press Release)

- In Q4 2025, Anker Innovations, a leading consumer electronics brand, announced the expansion of its Soundcore brand into Europe. This move aims to cater to the growing demand for affordable Bluetooth speakers in the region and marks Anker's entry into a new market. (Source: Anker Innovations Press Release) These developments underscore the competitive landscape of the market, with companies continually innovating to meet consumer demands and expand their reach.

Research Analyst Overview

The market continues to experience significant growth as consumers seek portable and convenient solutions for their audio needs. One of the key trends driving this market is the increasing popularity of audio streaming services, which allow users to access their music collections wirelessly. This has led to an increased demand for Bluetooth speakers that offer high-quality sound and advanced features. Another trend in the market is the development of speakers with advanced digital signal processing capabilities. These speakers use complex algorithms to optimize sound quality, providing enhanced bass response and improved treble clarity. Noise cancellation technology is also gaining traction, allowing users to enjoy their music uninterrupted in noisy environments.

Travel speakers and portable entertainment solutions are another segment of the market that is seeing strong growth. These speakers are designed to be lightweight and compact, making them ideal for use on the go. Many of these speakers also offer dust and water resistance, ensuring they can withstand the rigors of travel. The market for party speakers is also expanding, with many manufacturers releasing models that offer powerful sound and stereo pairing capabilities. These speakers are often used for outdoor events and large gatherings, providing an audio experience for guests. Wearable speakers are another emerging trend in the market.

These devices offer hands-free audio playback, making them ideal for use during workouts or other activities where users need to keep their hands free. Some wearable speakers also offer voice assistant integration, allowing users to control their music playback and other functions using voice commands. The market is also seeing increased demand from gaming consoles and other home entertainment systems. Many of these devices now offer Bluetooth connectivity, allowing users to connect wireless speakers for a gaming experience. Podcast listening is another application that is gaining popularity, with many users preferring the convenience of wireless audio playback.

Audio fidelity is a top priority for users seeking premium sound quality in modern speaker systems. High-performance speaker drivers, combined with advanced EQ settings, deliver immersive audio experiences, including surround sound, virtual surround sound, and omnidirectional sound. Products with an audiophile grade build often feature ergonomic design, compact design, and portable size to suit various lifestyles. Stylish design elements and mobile device compatibility further enhance user appeal. Key technical specs, such as IP rating, ensure durability, while microphone quality supports clear voice capture. Innovative additions like solar charging and regular firmware updates help maintain performance and extend usability in evolving environments.

The market is also seeing increased competition from wireless audio solutions using other connectivity technologies, such as Wi-Fi and NFC. However, Bluetooth remains the most widely adopted wireless audio technology due to its ease of use and widespread compatibility with devices. The market is experiencing strong growth due to the increasing popularity of audio streaming services and the demand for portable and convenient audio solutions. Advanced features such as noise cancellation, digital signal processing, and voice assistant integration are also driving demand for high-end Bluetooth speakers. The market is expected to continue growing as consumers seek out wireless audio solutions for their various audio needs.

Dive into Technavio's research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Bluetooth Speaker Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

238 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10% |

|

Market growth 2025-2029 |

USD 11.99 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.9 |

|

Key countries |

US, Canada, China, UK, Germany, India, Japan, France, The Netherlands, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Bluetooth Speaker Market Research and Growth Report?

- CAGR of the Bluetooth Speaker industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the bluetooth speaker market growth and forecasting

We can help! Our analysts can customize this bluetooth speaker market research report to meet your requirements.