Offshore Drilling Market Size 2024-2028

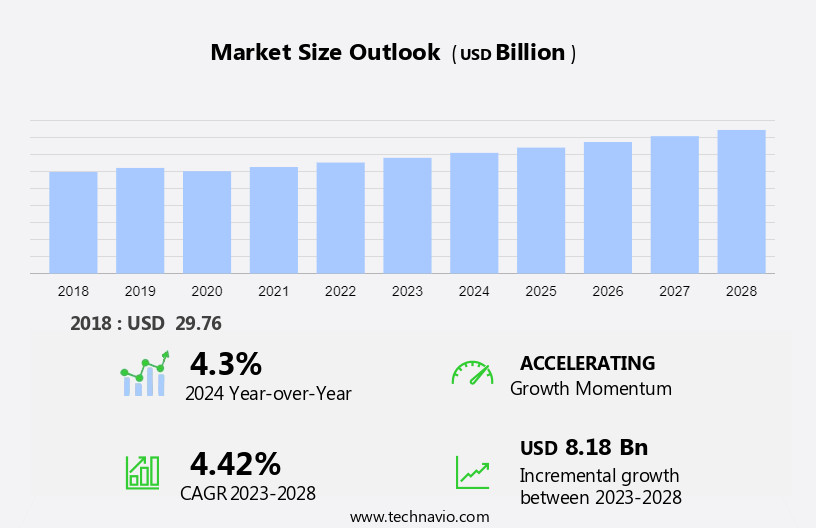

The offshore drilling market size is forecast to increase by USD 8.18 billion at a CAGR of 4.42% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing demand for oil and natural gas. Mechanical processes on the sea bed for oil and gas extraction continue to evolve, enabling exploration in deeper waters and harsher environments. However, the environmental implications of offshore E and P activities remain a challenge, with concerns over fuel consumption and greenhouse gas emissions. The market is experiencing growth, driven by the increasing use of mobile offshore drilling units and the rising demand for shale gas exploration and production. The ocean floor's fragile ecosystems and potential impacts on marine life require careful consideration. The offshore oil supply chain faces complex logistical challenges, including transportation and infrastructure development. As the industry adapts to these trends and challenges, innovation and technological advancements will play a crucial role in minimizing environmental impact and maximizing efficiency.

What will be the Size of the Offshore Drilling Market During the Forecast Period?

- The market is driven by the increasing energy demand and the need for oil production from hydrocarbon resources located in deep and shallow waters. Energy consumption is a significant factor, in the transportation sector, particularly the growing adoption of electric vehicles, shifting towards renewable energy sources. However, the transition to green energy is not expected to impact the market significantly In the short term. Drillships technology plays a crucial role in deepwater resource development, enabling exploration in areas with complex geological conditions. Automation and robotics are being increasingly adopted to enhance drilling efficiency and reduce operational costs. Petrobras and other energy companies continue to secure exploration contracts for both Deepwater And Ultra-Deepwater Drilling.

- Environmental implications are a concern for offshore drilling, with seismic blasting and oil spills posing risks to marine ecosystems. Environmental agencies are implementing stricter regulations to mitigate these risks. Controlled pressure drilling and the use of advanced technologies, such as the sea bed drilling system, are helping to minimize environmental impact. The market is expected to continue its growth, driven by energy security concerns and the need to meet global hydrocarbon demand.

How is this Offshore Drilling Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Shallow water

- Deepwater

- Ultra deepwater

- Type

- Jack up rigs

- Semisubmersibles

- Drill ships

- Others

- Geography

- North America

- US

- Middle East and Africa

- Europe

- APAC

- China

- South America

- North America

By Application Insights

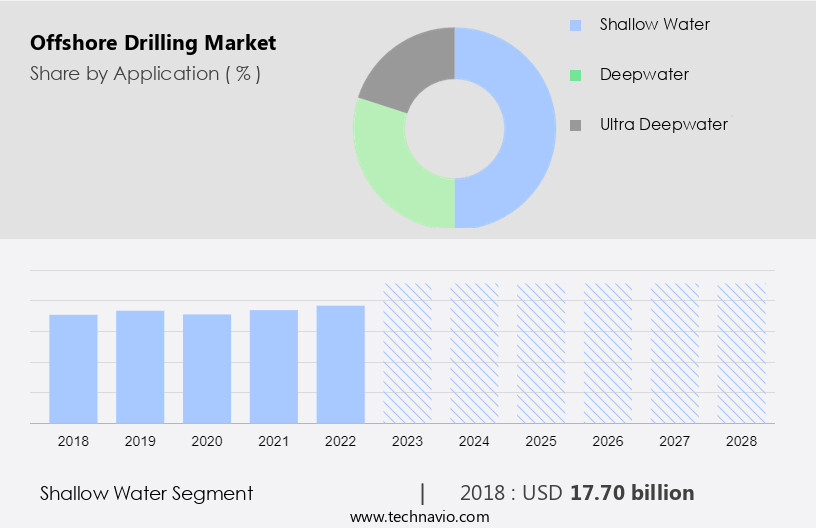

- The shallow water segment is estimated to witness significant growth during the forecast period.

The shallow water segment of the market is experiencing significant growth due to several factors. Shallow water drilling, which refers to depths of up to 500 feet, has been a long-standing practice since the mid-20th century. Compared to deepwater and ultra-deepwater drilling, shallow water drilling is considered safer as oil spills are rare and less complex, leading to improved safety and economic viability. With the increasing natural gas demand and the global energy sector's shift towards reducing carbon emissions, the role of offshore drilling in meeting energy requirements is more crucial than ever.

In shallow water, drillships and submersibles are commonly used due to the requirement for their structures to rest on the seabed. These factors are expected to drive the expansion of exploration activities in shallow water during the forecast period.

Get a glance at the Offshore Drilling Industry report of share of various segments Request Free Sample

The Shallow water segment was valued at USD 17.70 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

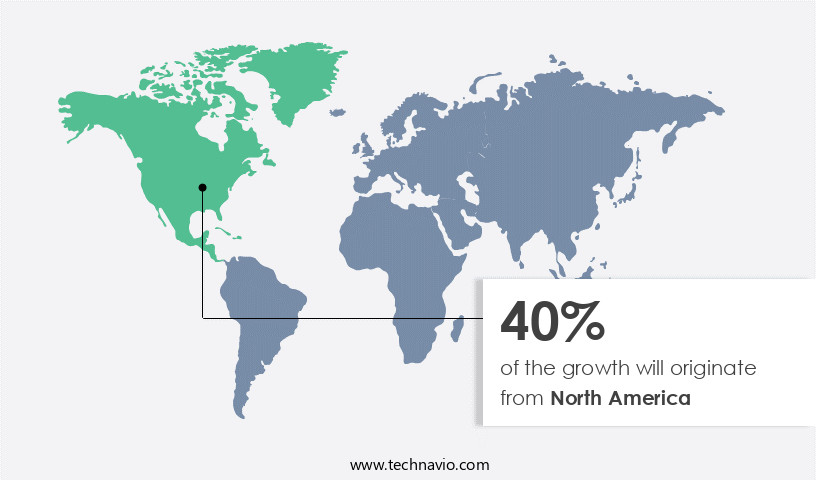

- North America is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

In the market, North America holds significant importance, with Mexico and the United States being the primary contributors in 2023. The region's market growth is anticipated to accelerate over the forecast period due to the revival of deep and ultra-deep oil and gas projects In the Gulf of Mexico (GOM). The growth of these projects is driven by the increasing demand for natural gas and the subsequent rise in crude oil prices. Moreover, the untapped potential for exploration in offshore drilling has attracted substantial investments, further fueling the market expansion. Despite the growing emphasis on renewable energy sources and concerns over carbon emissions, offshore drilling remains a crucial global energy source. The market is characterized by the deployment of advanced technologies, including drillships, for exploration in shallow water areas.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Offshore Drilling Industry?

Growth in demand for oil and natural gas is the key driver of the market.

- The global energy landscape is witnessing a significant shift towards increased energy consumption, with oil production being a key contributor. According to the US Energy Information Administration, global liquid fuel consumption is projected to reach 101.1 mbpd by the end of 2021, up from 96.94 mbpd in 2016. This growth can be attributed to the rising demand for oil and gas, as well as the depletion of existing reservoirs. To meet this demand, the market is experiencing a rise . Advanced technologies such as automation and hydrocarbon exploration are playing a crucial role In the development of deepwater drillships and the production of hard-to-reach reserves.

- Furthermore, the transition towards electric vehicles and renewable energy sources is expected to increase the demand for oil and gas In the coming years, making offshore drilling an essential component of the global energy mix.

What are the market trends shaping the Offshore Drilling Industry?

Declining costs of offshore projects is the upcoming market trend.

- Offshore drilling refers to the exploration and extraction of hydrocarbons from beneath the seabed. Due to the complexities and additional requirements for processing and transportation after extraction, offshore drilling projects incur higher costs than onshore drilling projects. The drillships used in offshore locations are more sophisticated and expensive than onshore drilling equipment. The long timeline and added risks associated with offshore drilling necessitate significant investments. However, the profitability of offshore drilling has been improving, and its demand continues to be strong due to the increasing energy consumption and the rising demand for oil and gas to meet the energy needs of various industries, including transportation via electric vehicles.

- According to the International Energy Agency (IEA), the costs of offshore oil and gas drilling projects have been decreasing over the past few years, making them more economically viable. Automation and technological advancements are also playing a crucial role in reducing the costs and risks of offshore drilling. Despite the challenges, the market is expected to grow steadily In the coming years due to the increasing energy demand and the limited availability of onshore drilling sites.

What challenges does the Offshore Drilling Industry face during its growth?

Environmental concerns associated with offshore E and P activities is a key challenge affecting the industry growth.

- The market plays a significant role in meeting the world's energy demand by producing hydrocarbons, primarily oil, which is a major source of energy consumption for transportation, heating homes, and manufacturing various products. However, the exploration and production (E&P) activities associated with offshore drilling have potential environmental implications. Oil spills, air and water pollution from toxic chemical emissions, and climate change due to methane emissions are some of the adverse effects of offshore drilling. Drilling mud, used In the drilling process to cool and lubricate the pipe and drill bit, contains toxic chemicals that can harm marine life when released into seawater.

- The offshore drilling industry is responding to these concerns through automation and the use of cleaner technologies. For instance, drillships, which are mobile offshore drilling units, are increasingly being used for deepwater drilling to minimize the environmental impact of onshore drilling. Additionally, the shift towards electric vehicles and renewable energy sources is expected to reduce the overall demand for oil and gas, potentially mitigating the environmental impact of offshore drilling In the long run.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, offshore drilling market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AP Moller Maersk AS

- Archer Ltd.

- Baker Hughes Co.

- China National Offshore Oil Corp.

- Eni SpA

- Halliburton Co.

- Hercules Offshore Inc.

- KCA Deutag Alpha Ltd.

- Loews Corp.

- Nabors Industries Ltd.

- Noble Corp. Plc

- Pacific Drilling Co.

- Parker Drilling Co.

- Saudi Arabian Oil Co.

- Schlumberger Ltd.

- Seadrill Ltd.

- Sembcorp Marine Ltd.

- Transocean Ltd.

- Valaris Ltd.

- Weatherford International Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is driven by the increasing demand for oil production from hydrocarbon exploration in both deepwater and shallow water resources. Automation and drillships technology play a significant role in reducing energy consumption and enhancing efficiency in offshore drilling operations. The market is also influenced by the exploration contracts awarded by global energy sources for hydrocarbon exploration in various regions. Deepwater resource development is a key trend In the offshore drilling industry, with drillships being used to extract oil and natural gas from the ocean floor in ultra-deepwater areas. Controlled pressure drilling, directed drilling, and robotics are some of the advanced technologies used in offshore drilling to ensure compliance with environmental regulations and minimize fuel consumption.

Financial incentives such as tax breaks, grants, and subsidies from domestic industries and governments are crucial for the growth of the market. However, the market faces challenges such as rising oil prices, environmental implications, and compliance monitoring. The increasing demand for renewable energy sources and the shift towards greenhouse gas emissions reduction may also impact the market In the future. The offshore drilling industry also has implications for the marine ecosystem, with concerns over seismic blasting and carbon emissions. The petrochemical industry and the oil supply chain are significant consumers of oil and gas produced through offshore drilling, contributing to the industry's overall impact on climate change. The use of artificial intelligence and advanced drilling technologies such as semi-submersibles is expected to further optimize offshore drilling operations.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.42% |

|

Market growth 2024-2028 |

USD 8.18 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.3 |

|

Key countries |

US, Saudi Arabia, United Arab Emirates, China, and Russia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in thisMarket Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Middle East and Africa, Europe, APAC, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.