GNSS Chip Market Size 2024-2028

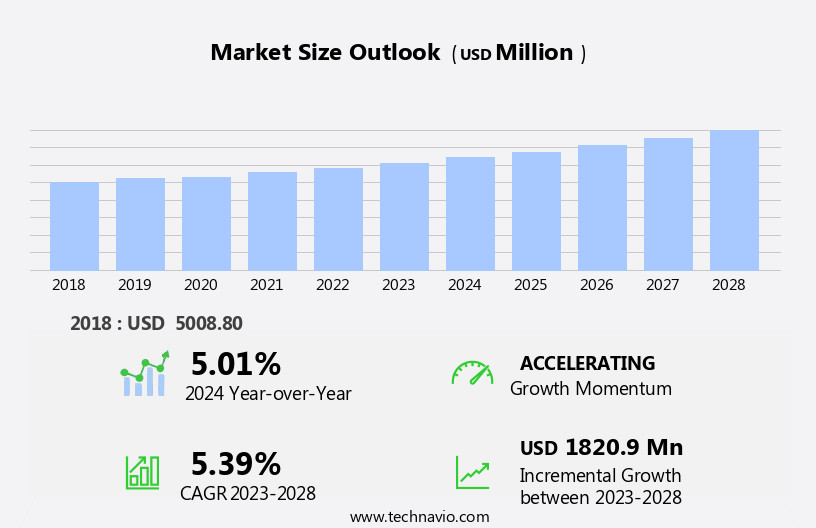

The gnss chip market size is forecast to increase by USD 1.82 billion at a CAGR of 5.39% between 2023 and 2028.

- The Global Navigation Satellite System (GNSS) chip market is experiencing significant growth, driven by government initiatives and support for the integration of GNSS technology in various sectors. These initiatives include the development of smart cities and infrastructure projects, which require precise location-based services for efficient management and operation. Furthermore, the increasing incorporation of GNSS chips with Internet of Things (IoT) technology is expanding the market's reach and applications, particularly in sectors such as transportation, logistics, and agriculture. However, the market faces challenges in overcoming the limitations of indoor positioning systems. The signal interference and multipath effects in indoor environments can hinder the accuracy and reliability of GNSS-based positioning solutions.

- To navigate these challenges, market players can explore alternative positioning technologies, such as Wi-Fi and Bluetooth, or invest in research and development to enhance the performance of GNSS chips in indoor environments. Overall, the market's strategic landscape presents both opportunities and challenges, with government initiatives and IoT technology driving growth, while indoor positioning limitations requiring innovative solutions. Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on developing advanced GNSS chips and exploring complementary technologies to enhance their product offerings.

What will be the Size of the GNSS Chip Market during the forecast period?

- The Global Navigation Satellite System (GNSS) chip market continues to evolve, driven by the expanding use cases across various sectors. Applications in unmanned aerial vehicles (UAVs), data analysis, industrial automation, and precision farming are leading the market's growth. Chipset cost remains a critical factor, with ongoing advancements in multipath mitigation and real-time kinematic technologies driving down costs. In the agricultural sector, smart farming practices rely on GNSS for positioning accuracy and data acquisition, enabling farmers to optimize crop yields. In industrial automation, GNSS is essential for supply chain management, asset tracking, and fleet management. UAVs utilize GNSS for signal acquisition and geospatial data collection, while connected devices and autonomous vehicles depend on it for location-based services and precision point positioning.

- Signal processing, noise reduction, and interference rejection are key performance metrics for GNSS chips. Multipath mitigation and low power consumption are essential for wearable technology and IoT applications. Multi-constellation support and differential correction enhance signal acquisition and improve timing accuracy. Machine learning and artificial intelligence are being integrated into GNSS systems for improved interference rejection and sensor fusion. The evolving nature of the market is further highlighted by the emergence of low earth orbit satellite constellations and the increasing use of inertial measurement units for enhanced accuracy. The market's dynamics continue to unfold, with ongoing developments in satellite signals, frequency band, and application development shaping the future of this dynamic industry.

How is this GNSS Chip Industry segmented?

The gnss chip industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Device

- Smartphones

- Tablets and wearables

- In-vehicle systems

- Personal tracking devices

- Others?

- Type

- Consumer electronics

- Automotive and transportation

- Military and defense

- Others?

- Geography

- North America

- US

- Europe

- Russia

- APAC

- China

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Device Insights

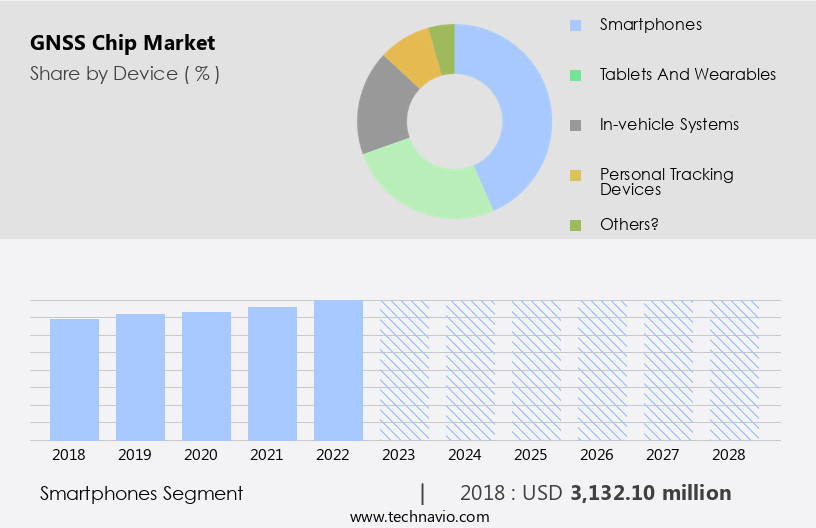

The smartphones segment is estimated to witness significant growth during the forecast period.

The Global Navigation Satellite System (GNSS) chip market is experiencing significant growth due to the increasing demand for location-based services and precision applications. GNSS chips enable time synchronization, positioning accuracy, and data acquisition for various industries, including industrial automation, precision farming, and unmanned aerial vehicles (UAVs). These chips utilize signals from multiple satellite constellations, such as GPS, GLONASS, Galileo, and BeiDou, to provide real-time kinematic (RTK) and differential correction capabilities. Moreover, the integration of GNSS chips in connected devices, such as mobile phones and wearable technology, has fueled market expansion. The development of low power consumption chipsets and multi-constellation support has also contributed to the growth of this market.

Industrial applications, such as asset tracking, fleet management, and supply chain management, rely on GNSS chips for precise location data and sensor fusion. The market is further propelled by advancements in artificial intelligence (AI) and machine learning, which enable more sophisticated signal processing, multipath mitigation, and interference rejection. The integration of GNSS chips in autonomous vehicles and the Internet of Things (IoT) is expected to drive future growth. The market's evolution is shaped by factors such as chipset cost, timing accuracy, data analysis, and geospatial data requirements. Key players in the market include Qualcomm, Broadcom, and MediaTek, among others.

The market's future potential lies in the development of low power consumption, high performance, and multi-constellation support chipsets for emerging applications, such as precision agriculture, smart cities, and autonomous drones.

The Smartphones segment was valued at USD 3.13 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

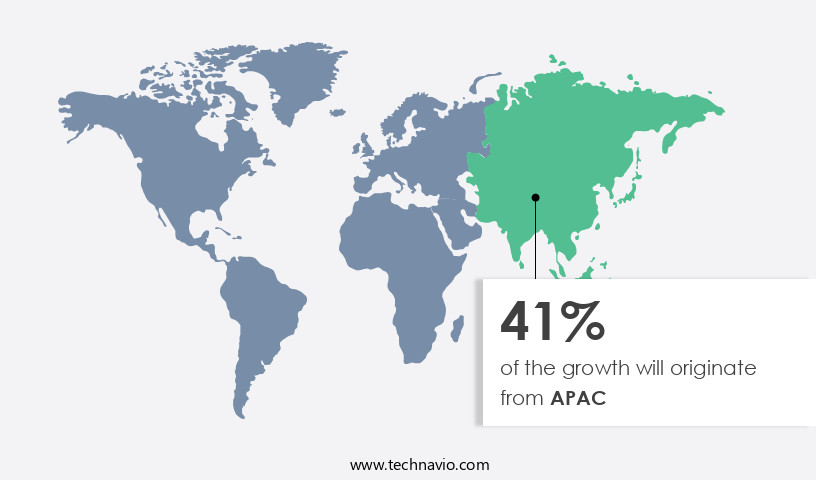

APAC is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, driven by the increasing demand for location-based services and GPS-enabled devices. In 2023, APAC held the largest market share, with South Korea, Japan, and China being the major contributors to the region's revenue. The expansion of the market is fueled by the growing adoption of GNSS chips in automotive applications, particularly in the development of autonomous vehicles for enhanced navigation and safety features. Furthermore, the proliferation of connected devices such as smartphones and wearable technology is driving demand for GNSS chips. The market is expected to continue expanding due to the rising demand for GPS technology in various sectors, including transportation, navigation, mapping, industrial automation, precision farming, and unmanned aerial vehicles.

Additionally, the integration of artificial intelligence, machine learning, and sensor fusion is leading to advanced applications, such as real-time kinematic, differential correction, and interference rejection. The market trends also include the development of multi-constellation support, low power consumption, and noise reduction technologies to enhance performance metrics. The market is further expected to be influenced by the increasing demand for geospatial data, satellite signals, and location-based services in the Internet of Things (IoT) and asset tracking industries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of GNSS Chip Industry?

- The government's initiatives and support serve as the primary catalyst for market growth.

- The Global Navigation Satellite System (GNSS) chip market is experiencing significant growth due to regulatory mandates and advancements in technology. For instance, the European Commission's rule requiring satellite and Wi-fi location services in new smartphones has led to an increase in demand for GNSS chipsets capable of connecting to the European Galileo satellite system. This system provides precise positioning and timing data, which is supported by over 95% of satellite navigation chipset-based devices, including those from Broadcom, Qualcomm, and MediaTek. The market's expansion is further driven by leading GNSS chipset suppliers producing Galileo-ready chipsets and major smartphone manufacturers integrating them into their latest models.

- Additionally, the integration of multi-constellation support, power consumption optimization, wearable technology, machine learning, differential correction, interference rejection, inertial measurement units, and satellite signals in GNSS chips is enhancing location-based services' accuracy and reliability. The market is expected to continue growing due to the increasing demand for these advanced features in various applications, including automotive, aviation, maritime, and industrial sectors.

What are the market trends shaping the GNSS Chip Industry?

- The integration of Global Navigation Satellite System (GNSS) chips into Internet of Things (IoT) technology is becoming increasingly prevalent in the current market. This emerging trend signifies the significant role of precise location data in IoT applications.

- The Global Navigation Satellite System (GNSS) chip market is experiencing significant growth due to the increasing adoption of Internet of Things (IoT) technologies. GNSS chips, which enable time synchronization, positioning accuracy, and signal processing, are integral components in various IoT devices such as self-driving cars, drones, smart sensors, and wearables. These devices offer enhanced capabilities in industries like healthcare, automotive, and navigation, where real-time data management and location tracking are essential. Precision farming, industrial automation, and jamming mitigation are some of the applications driving the demand for GNSS chips. In healthcare, GNSS chips enable real-time tracking of patients and assets, while in automotive applications, they provide accurate positioning and navigation.

- In industrial automation, GNSS chips enable precise time synchronization between devices for efficient production processes. Moreover, advancements in data transmission, artificial intelligence, and low earth orbit technologies are expected to further boost the market growth. Connected devices are increasingly being integrated with AI capabilities, enabling advanced applications such as predictive maintenance and real-time analytics. Additionally, the use of low earth orbit satellites provides more accurate and reliable signals, enhancing the overall performance of GNSS chips. In conclusion, the market is poised for substantial growth due to the increasing adoption of IoT technologies and the growing demand for precise positioning and real-time data management in various industries.

- The integration of advanced technologies like AI and low earth orbit satellites is expected to further fuel the market growth.

What challenges does the GNSS Chip Industry face during its growth?

- Indoor positioning systems' limitations, which pose a significant challenge to the industry, hinder its growth. These challenges include, but are not limited to, issues with accuracy, reliability, and scalability in large and complex environments. To overcome these obstacles, ongoing research and innovation are essential to develop more advanced and accurate indoor positioning technologies.

- The Global Navigation Satellite System (GNSS) chip market holds significant potential in various industries, particularly in the agriculture sector. GNSS technology is increasingly being utilized in precision farming applications, such as tractor guidance and automatic steering, which is expected to be a fast-growing segment. However, the initial investment for farmers to implement these technologies can be high, as they must purchase not only the farming equipment but also the GNSS-enabled devices for navigation and mapping. To fully implement a precision farming system, these devices must be integrated with the farming equipment, as well as monitoring and sensing equipment.

- Furthermore, the system must be connected to a farm management database and software for data analysis. In addition to agriculture, GNSS technology is also used in other industries, such as unmanned aerial vehicles (UAVs), asset tracking, fleet management, and real-time kinematic (RTK) applications. The demand for GNSS chips is driven by the need for accurate location data and the ability to perform data analysis in real-time. Moreover, the integration of sensor fusion technology with GNSS chips is becoming increasingly important for improving the overall performance and reliability of these systems. Sensor fusion enables the combination of data from multiple sensors to provide more accurate and comprehensive information.

- Another crucial aspect of the market is the need for effective supply chain management to ensure the timely delivery of these chips to manufacturers and end-users. This includes the ability to mitigate multipath mitigation and maintain receiver sensitivity to ensure the accuracy and reliability of the GNSS signals. In conclusion, the market is experiencing significant growth due to the increasing demand for accurate location data and the ability to perform real-time data analysis in various industries, including agriculture, UAVs, asset tracking, fleet management, and RTK applications. However, the high cost of these chips and the need for effective supply chain management remain challenges that must be addressed to ensure the continued growth of this market.

Exclusive Customer Landscape

The gnss chip market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gnss chip market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gnss chip market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accord Software and Systems Pvt. Ltd. - The company specializes in providing advanced Global Navigation Satellite System (GNSS) chip solutions. Our offerings include the MAX2771 Multiband Universal GNSS Receiver, which ensures high-precision positioning and navigation capabilities for various applications. This versatile receiver supports multiple GNSS constellations, providing robust performance in challenging environments. By utilizing state-of-the-art technology, we deliver superior accuracy and reliability, empowering customers to develop innovative solutions in diverse industries. Our commitment to continuous research and development enables US to stay at the forefront of GNSS technology, ensuring our clients remain competitive in their respective markets.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accord Software and Systems Pvt. Ltd.

- Analog Devices Inc.

- BDStar Navigation

- Broadcom Inc.

- Furuno Electric Co. Ltd.

- Futurlec

- Hexagon AB

- Hunan Bynav Technology Co. Ltd.

- Intel Corp.

- MediaTek Inc.

- Oxford Technical Solutions Ltd.

- Qualcomm Inc.

- Quectel Wireless Solutions Co. Ltd.

- Racelogic

- SkyTraq Technology Inc.

- Skyworks Solutions Inc.

- SparkFun Electronics

- STMicroelectronics International N.V.

- Trimble Inc.

- u blox AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in GNSS Chip Market

- In February 2024, Qualcomm announced the launch of its new GNSS chip, the QPM5575, which supports both satellite-based and terrestrial positioning systems, making it a versatile solution for automotive and industrial applications (Qualcomm press release). In October 2024, u-blox and Intel collaborated to integrate u-blox's GNSS chips into Intel's Mobileye self-driving car platform, expanding the reach of u-blox's technology in the automotive sector (Intel newsroom).

- In March 2025, Navtech GPSS, a leading GNSS chip manufacturer, was acquired by Trimble for USD375 million, aiming to strengthen Trimble's position in the GNSS market and expand its product offerings (Trimble press release). In June 2025, the European Union passed the European Electronic Communications Code, which mandates the deployment of Galileo, the EU's global navigation satellite system, in all new cars sold in the EU from 2024 onwards, driving demand for GNSS chips in the automotive industry (European Parliament press release).

Research Analyst Overview

The Global Navigation Satellite System (GNSS) market is experiencing significant growth, driven by the increasing demand for real-time location services and advanced navigation systems. Positioning services based on GNSS standards have become essential in various industries, from logistics and transportation to agriculture and construction. GNSS data processing plays a crucial role in delivering high-precision positioning and spatial data analysis for location-based analytics. GNSS modules, incorporating advanced algorithms and protocols, enable real-time location tracking and remote control of autonomous systems. The future of GNSS lies in the integration of sensor fusion, low-power solutions, and high-performance chipsets. GNSS system design and manufacturing continue to evolve, with a focus on certification and compliance with industry standards.

GNSS testing and network infrastructure are essential components of the GNSS ecosystem, ensuring reliable and accurate positioning data. The GNSS industry outlook is positive, with ongoing innovations in GNSS software development and the increasing adoption of GNSS technology in various applications. Remote monitoring and control systems, utilizing GNSS technology, are transforming industries by enabling efficient and effective management of assets and resources. The integration of GNSS chipsets into various systems is revolutionizing the way we navigate and collect spatial data. High-precision positioning and advanced navigation systems are becoming increasingly important in various sectors, from aviation and maritime to surveying and agriculture.

The future of GNSS is bright, with ongoing research and development in the field of GNSS technology promising even more innovative applications and use cases.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled GNSS Chip Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.39% |

|

Market growth 2024-2028 |

USD 1820.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.01 |

|

Key countries |

China, US, Russia, Japan, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this GNSS Chip Market Research and Growth Report?

- CAGR of the GNSS Chip industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gnss chip market growth of industry companies

We can help! Our analysts can customize this gnss chip market research report to meet your requirements.