Healthcare Education Solutions Market Size 2025-2029

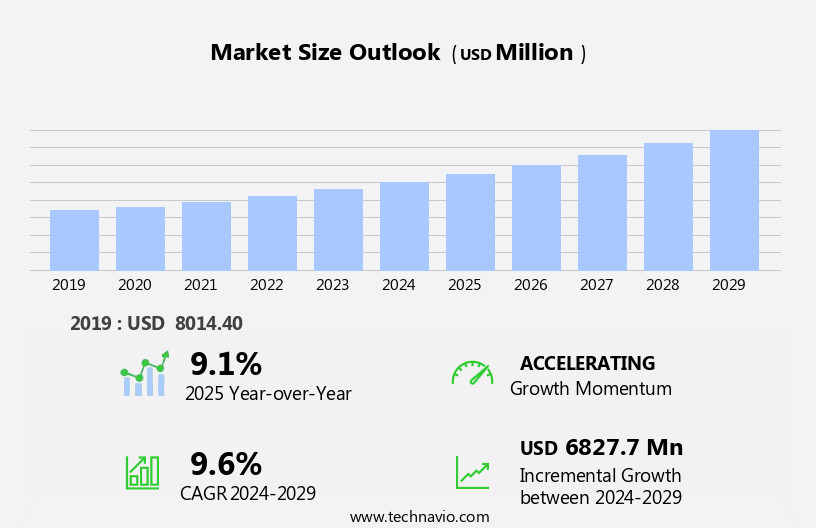

The healthcare education solutions market size is forecast to increase by USD 6.83 billion at a CAGR of 9.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of mobile learning (m-learning) in the healthcare sector and the growing popularity of Continuing Medical Education (CME) programs. M-Learning enables healthcare professionals to access educational content anytime, anywhere, making it an attractive option for busy practitioners. Furthermore, CME programs are essential for healthcare providers to maintain their certifications and stay updated with the latest medical advancements. However, a notable challenge in this market is the high costs associated with developing e-learning content.

- Creating engaging and effective educational materials requires substantial investments in technology, content development, and maintenance. Companies seeking to capitalize on market opportunities should focus on cost-effective solutions, collaborative partnerships, and leveraging technology to streamline content development processes. Effective navigation of these challenges will be crucial for success in the market.

What will be the Size of the Healthcare Education Solutions Market during the forecast period?

- The market continues to evolve, driven by advancements in technology and the ever-changing landscape of healthcare needs. Internal medicine specialists, for instance, are increasingly leveraging simulation training to enhance their skills and knowledge in managing chronic diseases like coronary heart disease and cerebrovascular disease. In the realm of radiology, educational platforms are integrating augmented reality and virtual reality technologies to provide more immersive learning experiences. E-learning solutions have gained prominence in recent times, enabling healthcare professionals to access online courses from anywhere with an internet connection. This flexibility is particularly crucial during business shutdowns and travel bans.

- The pediatrics sector too, is benefiting from these advancements, with e-learning solutions enabling interprofessional education and awareness programs for professional nurses and other healthcare workers. The importance of data quality in healthcare education cannot be overstated. Elearning Brothers, for instance, offers data analytics tools that help educational institutions assess the effectiveness of their e-learning programs. The Olympus Corporation is also investing in data quality solutions to enhance the accuracy of diagnostic tools used in clinical laboratory operations for infectious disease detection. Healthcare gaps persist in various sectors, necessitating ongoing efforts to address them. For instance, in cardiology education, there is a need for more comprehensive awareness programs on physician competency and heart failure.

- In the realm of home health services, there is a growing demand for e-learning solutions to train healthcare workers on best practices and patient care. The continuous dynamism of the market is reflected in the ongoing activities of private players. They are constantly innovating to meet the evolving needs of healthcare professionals and institutions. Research articles and awareness programs are essential tools in this endeavor, providing insights into the latest trends and best practices. Ultimately, the goal is to ensure that healthcare education keeps pace with the ever-changing healthcare landscape, enabling healthcare professionals to provide optimal patient care.

How is this Healthcare Education Solutions Industry segmented?

The healthcare education solutions industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Delivery

- Classroom-based

- E-learning

- End-user

- Physician

- Non-physician

- Application

- Cardiology

- Radiology

- Neurology

- Pediatrics

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- South America

- Brazil

- Rest of World (ROW)

- North America

By Delivery Insights

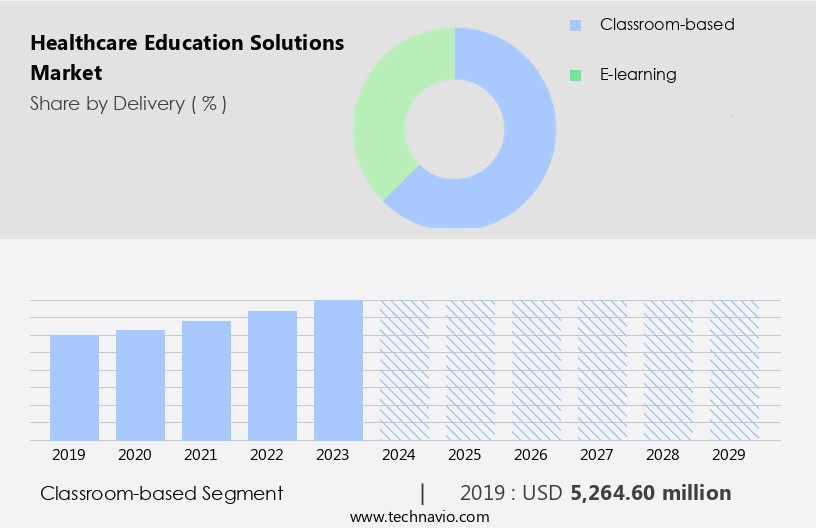

The classroom-based segment is estimated to witness significant growth during the forecast period.

The healthcare education market is experiencing significant advancements driven by technology and the increasing prevalence of chronic diseases such as coronary heart disease and cerebrovascular disease. Online courses and e-learning solutions have gained popularity, allowing healthcare professionals to access education from anywhere with an internet connection. Augmented reality and virtual reality technologies are revolutionizing medical training, providing immersive and interactive learning experiences. Private players like eLearning Brothers, Olympus Corporation, and educational platforms offer a wide range of healthcare education programs, including cardiology, radiology, and internal medicine. The importance of continuing education in healthcare is underscored by the rapid advancements in technology and the need to stay updated on the latest research and best practices.

Healthcare-associated infections (HAIs) and healthcare gaps are major concerns, necessitating awareness programs and interprofessional education. Simulation training is increasingly being used to improve physician competency and patient care, particularly in areas like cardiovascular diseases (CVD) and heart failure (HF). Clinical laboratory operations and infectious disease detection are critical areas where technology advancements are making a significant impact. For instance, data quality and analysis are crucial in ensuring accurate diagnosis and treatment. Salmonella bacteria and other infectious diseases pose a constant threat, highlighting the importance of ongoing education and training for healthcare professionals. Business shutdowns and travel bans have accelerated the adoption of e-learning solutions, enabling healthcare facilities to continue providing patient care while ensuring the safety of their staff.

Home health services are also benefiting from technology-enabled education, allowing nurses and other healthcare professionals to receive training and support remotely. In conclusion, the healthcare education market is evolving rapidly, driven by technology advancements, the growing prevalence of chronic diseases, and the need for ongoing education and training. Online courses, simulation training, and immersive technologies like augmented and virtual reality are transforming medical education, providing healthcare professionals with the knowledge and skills they need to deliver high-quality patient care.

The Classroom-based segment was valued at USD 5.26 billion in 2019 and showed a gradual increase during the forecast period.

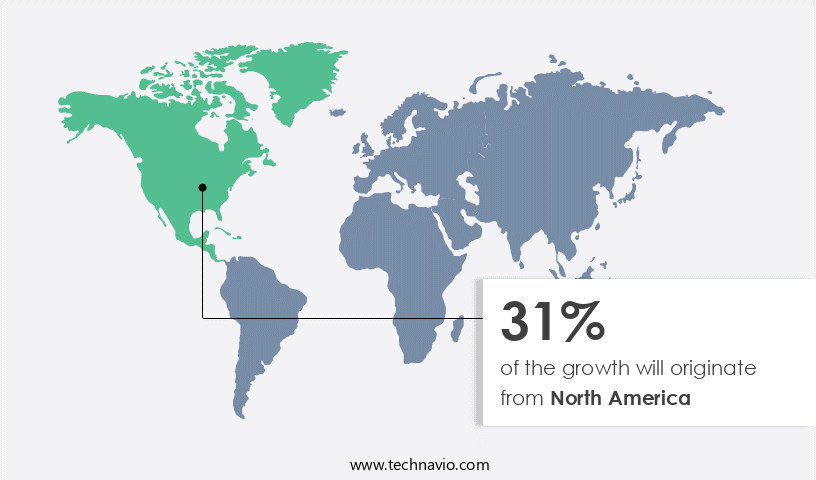

Regional Analysis

North America is estimated to contribute 31% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, driven by the advanced and mature healthcare industry, particularly in the US and Canada. Factors such as a large patient population, the need for well-trained professionals, and a high concentration of elderly individuals susceptible to chronic diseases are key drivers. The region's geriatric population has seen considerable growth over the last five years, leading to increased healthcare expenditure and the provision of advanced treatments. Technology advancements, including online courses, augmented reality, and virtual reality, are transforming medical education, enabling professionals to gain knowledge and skills in a more immersive and harmonious manner.

Continuing education is essential for healthcare professionals to stay updated on the latest research and techniques, particularly in areas such as cardiovascular diseases (CVD), healthcare-associated infections (HAIs), cerebrovascular disease, and infectious disease detection. Private players, educational platforms, and healthcare facilities are investing in e-learning solutions to address healthcare gaps and improve patient care. Simulation training, data quality, and interprofessional education are crucial components of these solutions. The market is also witnessing the integration of technology in clinical laboratory operations, radiology training, cardiology education, and internal medicine to enhance efficiency and accuracy. Home health services and awareness programs are other areas of focus to improve physician competency and patient care.

Despite business shutdowns and travel bans, the market continues to evolve, with a strong emphasis on online learning and remote training to meet the needs of healthcare professionals. Heart failure (HF) is a significant concern, with ongoing research and development in this area to improve patient outcomes.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Healthcare Education Solutions Industry?

- The surge in the implementation of m-learning in the healthcare sector serves as the primary catalyst for market growth.

- Healthcare education solutions have evolved significantly due to technological advancements, with online learning platforms becoming increasingly popular. M-learning, or mobile learning, is a key component of this trend, providing healthcare professionals with flexible and convenient continuing education opportunities. M-learning modules are presented in small, manageable lessons, reducing cognitive overload and enhancing learning effectiveness. This format is particularly useful for chronic disease management, such as coronary heart disease, where ongoing education is essential. Augmented and virtual reality technologies are also being integrated into m-learning, offering immersive and interactive educational experiences.

- Business shutdowns and social distancing measures have further accelerated the adoption of e-learning solutions in the healthcare sector. Overall, m-learning is an effective and adaptable tool for healthcare education, providing professionals with the knowledge and skills they need to deliver high-quality patient care.

What are the market trends shaping the Healthcare Education Solutions Industry?

- The increasing prevalence of Continuing Medical Education (CME) programs represents a significant market trend in the healthcare industry. Professionals are increasingly recognizing the importance of staying updated with the latest medical knowledge and advances, making CME programs an essential component of their ongoing professional development.

- Healthcare Education plays a vital role in equipping healthcare professionals (HCPs) with the latest knowledge and skills to address the ever-evolving challenges in the healthcare industry. Two significant areas of focus are the prevention and management of Cardiovascular Diseases (CVD) and Healthcare-associated infections (HAIs). CME (Continuing Medical Education) programs are essential for HCPs to maintain their competence and stay updated on the latest developments in their specialized medical fields. These programs must cater to HCPs' requirements, patients' needs, and current healthcare demands. CME content, delivered through digital platforms, optimizes training processes by providing HCPs with the most relevant content based on their needs and preferences.

- For instance, Philips offers online CME programs that cover topics such as Cerebrovascular disease, clinical laboratory operations, infectious disease detection, and pediatrics learning. The content is designed to be inclusive of both HCPs and patients to enhance its relevance and applicability. Furthermore, CME programs on infectious diseases, such as Salmonella bacteria, are crucial in addressing the ongoing challenges of infection prevention and control in healthcare settings.

What challenges does the Healthcare Education Solutions Industry face during its growth?

- The escalating expenses associated with creating e-learning content poses a significant challenge and hinders the growth of the industry.

- In the realm of healthcare education, the development of e-learning courses, particularly in specialized fields like Internal Medicine, Simulation Training for Radiology and Cardiology Education, necessitates substantial investment. On average, the creation of moderately interactive e-learning content requires between 90 and 240 hours, resulting in an approximate cost of USD10,000 per hour for medical education course developers. The complexity of the content significantly influences the cost, especially in medical fields.

- Key factors contributing to these expenses include the acquisition and adaptation of source content, integration of embedded learning elements, and the level of interaction and instructional complexity. The production of these courses involves collaboration among subject matter experts, instructional design teams, project management personnel, and technical staff specialists.

Exclusive Customer Landscape

The healthcare education solutions market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the healthcare education solutions market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, healthcare education solutions market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in providing comprehensive healthcare education solutions. Among its offerings is the 3M Health Care Academy, which encompasses a range of courses. These courses focus on essential healthcare topics, such as respiratory protection, healthcare-associated infections, prevention of surgical site infections, pressure injuries, and bloodstream infections. By delivering expert-led instruction, this academy empowers professionals to enhance their knowledge and skills, ultimately contributing to improved patient outcomes and a safer healthcare environment.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- B.Braun SE

- Becton Dickinson and Co.

- Boston Scientific Corp.

- Bruker Corp.

- Canon Inc.

- Erbe Elektromedizin GmbH

- FUJIFILM Holdings Corp.

- General Electric Co.

- Johnson and Johnson Services Inc.

- Koninklijke Philips NV

- Medtronic Plc

- Perkin Elmer Inc.

- Siemens AG

- Smith and Nephew plc

- Stryker Corp.

- Thermo Fisher Scientific Inc.

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Healthcare Education Solutions Market

- In January 2024, IBM Watson Health announced the launch of a new AI-powered virtual nursing assistant, named "Project Evergreen," designed to support clinical decision-making and improve patient outcomes in the healthcare education sector (IBM Press Release, 2024). This innovative solution utilizes natural language processing and machine learning algorithms to analyze patient data, providing personalized recommendations and insights to nursing students and educators.

- In March 2025, Merck KGaA and Siemens Healthineers entered into a strategic partnership to develop and commercialize digital education solutions for healthcare professionals. This collaboration combines Merck KGaA's expertise in healthcare education and Siemens Healthineers' advanced technology to create interactive, data-driven learning experiences for medical students and practitioners (Merck KGaA Press Release, 2025).

- In May 2024, Coursera, an online learning platform, raised a USD120 million Series F funding round led by BlackRock, bringing the company's total funding to USD310 million. This investment will be used to expand Coursera's healthcare education offerings and reach more learners worldwide (TechCrunch, 2024). The company aims to provide affordable, accessible, and high-quality education to healthcare professionals and students, addressing the growing demand for digital learning solutions in the sector.

- In October 2025, the U.S. Department of Education awarded a USD10 million grant to the University of California, San Francisco (UCSF) to develop an innovative healthcare education platform using virtual and augmented reality technologies. This initiative, named "Virtual UCSF," aims to create immersive, interactive learning experiences for medical students and healthcare professionals, enabling them to practice and hone their skills in a safe and cost-effective environment (UCSF News, 2025).

Research Analyst Overview

The market is witnessing significant activity in response to the growing burden of chronic diseases, including cerebrovascular disease and coronary heart disease. Research articles and awareness programs are essential tools for healthcare facilities to stay updated on the latest clinical practices and treatments. Private players, such as Olympus Corporation, are investing in online courses for professional nurses to enhance their skills in clinical laboratory operations and infectious disease detection. Home health services are also gaining popularity, necessitating education on best practices for managing chronic diseases like heart failure (hf) at home.

SARS-cov-2 testing and Salmonella bacteria detection are driving the need for advanced education in infectious disease detection, particularly in the context of healthcare-associated infections (HAIs). Overall, the market is dynamic, with continuous innovation and adaptation to emerging healthcare trends.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Healthcare Education Solutions Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

233 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.6% |

|

Market growth 2025-2029 |

USD 6827.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.1 |

|

Key countries |

US, UK, China, Germany, Canada, France, Italy, India, Brazil, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Healthcare Education Solutions Market Research and Growth Report?

- CAGR of the Healthcare Education Solutions industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the healthcare education solutions market growth of industry companies

We can help! Our analysts can customize this healthcare education solutions market research report to meet your requirements.