Healthcare Fraud Detection Market Size 2025-2029

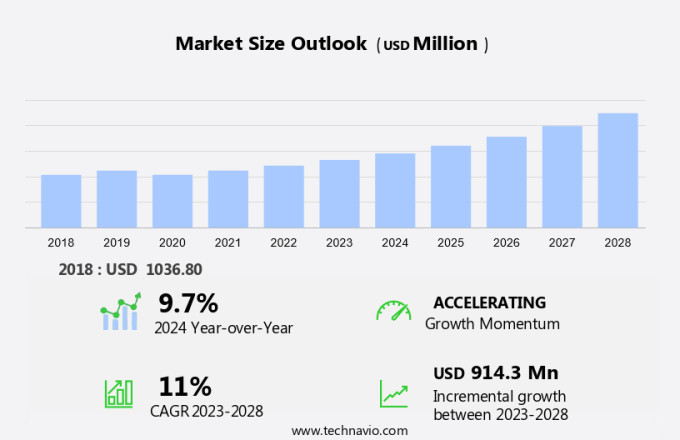

The healthcare fraud detection market size is forecast to increase by USD 1.09 billion at a CAGR of 11.8% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing number of patients seeking health insurance and the emergence of social media's influence on the healthcare industry. The rise in healthcare fraud cases, driven by the influx of insurance claims, necessitates robust fraud detection solutions. Social media's impact on healthcare extends to fraudulent activities, with fake claims and identity theft posing challenges. However, the deployment of healthcare fraud detection systems remains a time-consuming process, and the need for frequent upgrades to keep up with evolving fraud schemes adds complexity.

- Additionally, collaborating with regulatory bodies and industry associations can help stay informed of the latest fraud trends and best practices. Overall, the market presents opportunities for innovation and growth, as the demand for effective solutions to combat fraudulent activities continues to rise. Companies must navigate these challenges by investing in advanced technologies, such as machine learning and artificial intelligence, to streamline deployment and enhance fraud detection capabilities.

What will be the Size of the Healthcare Fraud Detection Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market encompasses various solutions and services designed to mitigate fraudulent activities in Medicaid services and health insurance. Data analytics plays a pivotal role in this domain, with statistical methods and data science techniques used to identify fraudulent healthcare activities. Prescriptive analytics and machine learning algorithms enable the prediction of potential fraudulent claims and billing schemes. Medical services, including pharmacy billing fraud and prescription fraud, are prime targets for offenders. Identity theft and social media are also significant contributors to healthcare fraud costs. Payment integrity is crucial for insurers to minimize financial losses, making fraud detection a priority.

On-premise and cloud-based solutions offer analytics capabilities to combat fraud. Descriptive analytics provides insights into historical data, while predictive analytics and prescriptive analytics offer proactive fraud detection. Despite the advancements in fraud detection, data limitations pose challenges. The use of artificial intelligence and machine learning in fraud detection is increasing, providing more accurate and efficient solutions. Insurance claims review is a critical component of fraud detection, with fraudulent claims costing billions annually. Fraudsters continue to evolve their tactics, necessitating the need for advanced fraud detection solutions.

How is this Healthcare Fraud Detection Industry segmented?

The healthcare fraud detection industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Descriptive analytics

- Predictive analytics

- Prescriptive analytics

- End-user

- Private insurance payers

- Third-party administrators (TPAs)

- Government agencies

- Hospitals and healthcare providers

- Delivery Mode

- Cloud-based

- On-premises

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

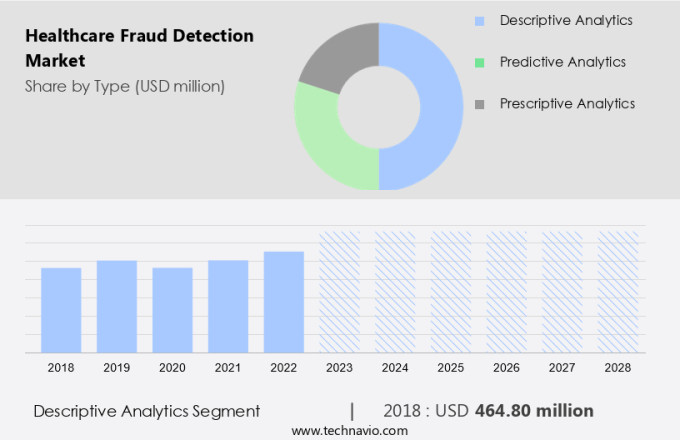

By Type Insights

The Descriptive analytics segment is estimated to witness significant growth during the forecast period. In the dynamic landscape of healthcare, Anomalies Detection and Healthcare Fraud Analytics play a pivotal role in safeguarding Financial Resources from Fraudulent Healthcare Activities. Descriptive analytics, a foundational type of analytics, forms the backbone of this industry. With its ability to aggregate and examine vast healthcare data, descriptive analytics identifies trends and operational performance insights. It is widely used in various departments, from Healthcare IT adoption to Urgent care, and supports Insurance Claims Review processes. Cloud-Based Solutions and On-Premises Solutions are two delivery models that cater to diverse organizational needs. Machine Learning and Statistical Methods are integral to advanced analytics, including Prescriptive analytics and Predictive analytics, which uncover intricate patterns and prevent Fraudulent Claims.

Social Media and Data Analytics offer valuable insights into potential Fraudulent Activities, while Real-Time Analytics ensure Payment Integrity in Healthcare Expenditure. Complex Healthcare Systems, including Medicaid Services and Healthcare Providers, are increasingly adopting Data Science and Data Analysis Techniques to enhance Payment Integrity and combat Fraudulent Billing Schemes. Pharmacy Billing Fraud, Prescription Fraud, and Identity Theft are prevalent challenges that necessitate advanced Fraud Detection Solutions. Artificial Intelligence and Machine Learning are instrumental in detecting Pharmacy Claims Fraud and Pharmacy Billing Misuse. Despite the advancements, Data Limitations pose a significant challenge, necessitating continuous improvement in Data Capturing Processes and Data Aggregation.

The market is expected to grow, driven by the increasing need for Fraud Prevention and the escalating Healthcare Spending. Healthcare fraud detection solutions employ various data analysis techniques to uncover fraudulent claims, such as anomaly detection and pattern recognition.

The Descriptive analytics segment was valued at USD 505.50 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth due to the increasing adoption of advanced analytics solutions, such as prescriptive analytics and machine learning, to identify anomalies and prevent fraudulent activities. Healthcare IT adoption, data capturing processes, and payment integrity are key drivers of this market. In North America, the largest market share is attributed to the presence of an integrated healthcare infrastructure, a high number of companies, and a high level of technology adoption, particularly in the US. However, the market growth in this region will be moderate during the forecast period due to market saturation and the need for technological disruptions to drive growth. Companies must navigate these challenges by investing in advanced technologies, such as machine learning and artificial intelligence, to streamline deployment and enhance fraud detection capabilities.

Cloud-based solutions and artificial intelligence are emerging technologies that are gaining popularity in the market for their ability to provide real-time analytics and data aggregation. Fraudulent healthcare activities, such as prescription fraud, pharmacy billing fraud, and identity theft, are significant challenges for the market. Data analysis techniques, including statistical methods and data science, are essential for detecting and preventing these fraudulent claims. The market also faces data limitations, which make it challenging to analyze comprehensive data sets. Despite these challenges, the market is expected to grow as healthcare spending continues to increase, and the need for fraud prevention and payment integrity solutions becomes more critical.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Healthcare Fraud Detection market drivers leading to the rise in the adoption of Industry?

- The significant rise in the number of patients requiring health insurance represents the primary market driver. The escalating number of health insurance claims, driven by rising enrollment, poses a significant challenge for insurers in terms of fraud prevention. According to recent industry research, approximately 84% of U.S. Health insurers have adopted artificial intelligence and machine learning (AI/ML) technologies to counteract fraudulent activities. These advanced tools enable the analysis of extensive datasets, revealing patterns indicative of fraudulent behavior. The increasing use of AI/ML technologies is a response to the growing complexity of healthcare fraud and the need for insurers to protect their financial resources. Regulatory pressures and the imperative to allocate resources efficiently further underscore the importance of robust fraud detection systems.

- Social media and data analytics are increasingly being utilized to identify potential fraud cases. For instance, analyzing patterns in healthcare communication on social media platforms and monitoring urgent care visits can help insurers detect suspicious claims. Additionally, on-premise solutions and cloud-based services are being employed to enhance fraud prevention capabilities. Healthcare providers and Medicaid services are also under scrutiny, as they are common targets for fraudulent activities. Insurers are collaborating with these entities to implement more stringent verification processes and improve overall fraud detection measures. The healthcare industry's focus on fraud prevention is intensifying, driven by the increasing volume of claims and the need to mitigate financial losses. AI/ML technologies, data analytics, social media monitoring, and collaboration with healthcare providers are key strategies insurers are employing to stay ahead of fraudsters.

What are the Healthcare Fraud Detection market trends shaping the Industry?

- The emergence of social media is a significant market trend in the healthcare industry, with profound impacts on patient engagement, information dissemination, and communication between healthcare providers and patients. (Alternatively) Social media's influence on the healthcare sector is a notable market trend, transforming patient interaction, information sharing, and provider-patient communication. The market is driven by the increasing use of data science and advanced analytics to identify billing schemes and prevent financial losses. Complex healthcare systems generate vast amounts of data from medical services, insurance claims review, and financial transactions. Data aggregation and real-time analytics enable the identification of fraudulent activities, such as identity theft and statistical anomalies.

- The financial resources allocated to healthcare expenditure necessitate the need for effective fraud detection mechanisms. Financial losses due to fraudulent activities can be significant, making it essential for organizations to invest in robust solutions to mitigate risks. Social media platforms have emerged as valuable tools in healthcare fraud detection. They facilitate two-way communication between patients, providers, and organizations, generating data that can be analyzed to identify fraudulent activities. Real-time monitoring of public sentiment and feedback on social media enables organizations to detect potential fraud patterns early, enhancing transparency and trust in the healthcare industry. Healthcare organizations employ various delivery models, including on-premises solutions and cloud-based services, to manage their data and detect fraud. Statistical methods, including machine learning algorithms and predictive modeling, are used to analyze data and identify patterns indicative of fraud.

How does Healthcare Fraud Detection market face challenges during its growth?

- The time-consuming deployment process and frequent upgrades required in the industry present a significant challenge, hindering growth through increased operational expenses and resource allocation. The market encounters considerable challenges due to the complexities involved in implementing advanced fraud detection solutions. Integration with existing healthcare systems for deployment can result in prolonged installation periods, hindering organizations from addressing fraudulent activities in a timely manner and potentially leading to substantial financial losses. Furthermore, the constant evolution of fraud schemes necessitates regular updates to detection algorithms and software to maintain effectiveness against increasingly sophisticated tactics. These updates can strain resources and budgets, especially for smaller healthcare organizations that may lack the necessary infrastructure or expertise.

- Predictive analytics, artificial intelligence, machine learning, and cloud-based solutions have emerged as effective tools to combat these issues. By analyzing patterns and trends in healthcare spending and pharmacy claims, these technologies can identify anomalies and potential fraudulent activities, enabling organizations to take swift action. Chronic care and pharmacy billing misuse are other areas where fraud detection is crucial to ensure the integrity of healthcare services and financial resources. Prescription fraud and pharmacy billing fraud are significant concerns in the healthcare industry, with offenders exploiting data limitations to commit fraud.

Exclusive Customer Landscape

The healthcare fraud detection market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the healthcare fraud detection market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, healthcare fraud detection market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

CGI Inc. - This company specializes in healthcare fraud detection, utilizing advanced analytic models to identify potential instances of fraud, waste, and abuse within healthcare claims.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- CGI Inc.

- Change Healthcare Inc.

- Codoxo

- Conduent Inc.

- Cotiviti Inc.

- ExlService Holdings Inc.

- Fair Isaac Corp.

- FraudLens

- H2O.ai Inc.

- HCL Technologies Ltd.

- Healthcare Fraud Shield

- International Business Machines Corp.

- Optum Inc.

- OSP

- Qlarant Quality Solutions Inc.

- SAS Institute Inc.

- Thomson Reuters Corp.

- Wipro Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Healthcare Fraud Detection Market

- In January 2024, IBM Watson Health announced the launch of its new AI-powered healthcare fraud detection solution, IBM Watson for Providers, designed to help healthcare organizations identify and prevent potential fraudulent claims in real-time. This solution uses machine learning algorithms to analyze historical and real-time data, reducing false positives and improving accuracy (IBM Press Release).

- In March 2024, Siemens Healthineers and Microsoft entered into a strategic partnership to integrate Microsoft Azure's advanced analytics capabilities with Siemens Healthineers' Syngo.Fraud Detection software. This collaboration aims to enhance fraud detection and enable more effective risk management in the healthcare industry (Siemens Healthineers Press Release).

- In May 2024, Cognizant announced the acquisition of TriZetto Provider Solutions, a leading provider of healthcare revenue cycle management and fraud detection services. This acquisition strengthened Cognizant's position in the healthcare IT market and expanded its offerings in the fraud detection domain (Cognizant Press Release).

- In February 2025, the Centers for Medicare & Medicaid Services (CMS) announced the expansion of its Fraud Prevention System (FPS) to include machine learning and predictive analytics. This enhancement aimed to improve the detection and prevention of healthcare fraud, waste, and abuse, ultimately saving taxpayer dollars and protecting patient care (CMS Press Release).

Research Analyst Overview

The market continues to evolve, driven by the complexities of healthcare systems and the increasing importance of payment integrity. Anomalies in healthcare data are a significant concern, with fraudulent activities posing substantial financial risks to healthcare providers, insurers, and government programs. The healthcare IT adoption and data capturing process have led to an influx of data, necessitating advanced data analysis techniques for fraudulent claims identification. Prescription fraud, billing schemes, and pharmacy billing misuse are prevalent forms of healthcare fraud. Predictive analytics, machine learning, and artificial intelligence are increasingly being employed to detect and prevent such activities.

Cloud-based solutions offer real-time analytics and data aggregation capabilities, enabling healthcare organizations to respond swiftly to fraudulent claims. Payment integrity is a critical concern in the context of healthcare spending, which continues to rise. Healthcare communication and urgent care services are essential areas where fraudulent activities can occur, necessitating robust fraud detection solutions. Identity theft and financial losses are significant consequences of healthcare fraud, making it essential to invest in advanced fraud prevention technologies. Healthcare fraud offenders employ sophisticated methods, including social media and medical services, to carry out their activities. Statistical methods and data science are essential tools in the fight against healthcare fraud.

The delivery model of fraud detection solutions is evolving, with on-premises and cloud-based options available to cater to varying financial resources and organizational needs. The ongoing unfolding of market activities reveals a dynamic and complex landscape, with continuous innovation and adaptation required to stay ahead of fraudulent activities. The use of advanced technologies such as machine learning and artificial intelligence is transforming the way fraud is detected and prevented in the healthcare sector. The challenges of data limitations and prescription fraud persist, necessitating ongoing investment in data analytics and fraud detection solutions.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Healthcare Fraud Detection Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.8% |

|

Market growth 2025-2029 |

USD 1.09 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.3 |

|

Key countries |

US, Canada, China, Germany, Mexico, India, UK, Brazil, Japan, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Healthcare Fraud Detection Market Research and Growth Report?

- CAGR of the Healthcare Fraud Detection industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Asia, Europe, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the healthcare fraud detection market growth of industry companies

We can help! Our analysts can customize this healthcare fraud detection market research report to meet your requirements.