Heat-Not-Burn Tobacco Products Market Size 2025-2029

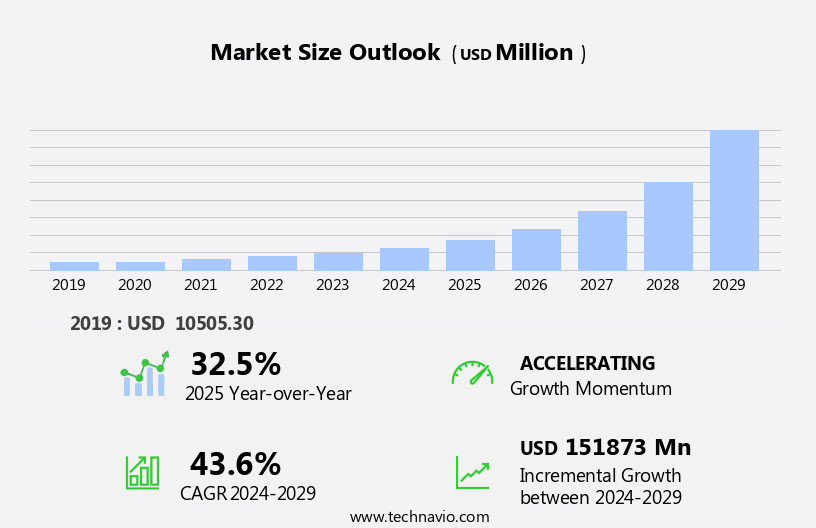

The heat-not-burn tobacco products market size is forecast to increase by USD 151.87 billion at a CAGR of 43.6% between 2024 and 2029.

- The Heat-Not-Burn (HNB) tobacco products market is experiencing significant growth, driven primarily by the cost-effectiveness of these alternatives compared to traditional cigarettes. The increasing popularity of smokeless tobacco products like hookah or vape is another key factor fueling market expansion. HNB devices offer consumers the satisfaction of smoking without the production of secondhand smoke, making them an attractive option for those seeking a less intrusive nicotine delivery system. However, the market is not without challenges. Regulatory hurdles pose a significant obstacle, with governments and health organizations continuing to scrutinize the health implications of HNB products.

- The high initial investment required for HNB devices may deter some consumers, potentially limiting market penetration. Companies looking to capitalize on market opportunities must navigate these challenges effectively, focusing on regulatory compliance and offering affordable pricing options to attract price-sensitive consumers. By addressing these challenges, HNB tobacco product manufacturers can tap into the growing demand for smokeless alternatives and solidify their position in the evolving tobacco market landscape.

What will be the Size of the Heat-Not-Burn Tobacco Products Market during the forecast period?

- The market continues to evolve, with dynamic market dynamics shaping its growth and application across various sectors. Heat-activated tobacco devices, a subset of tobacco heating systems, have gained traction among adult smokers seeking reduced risk alternatives to traditional cigarettes. These devices, which include heat-not-burn devices and heated tobacco products, operate by heating tobacco without burning it, resulting in tobacco vapor instead of smoke. Brand loyalty and consumer preferences play a significant role in market penetration, with companies focusing on product differentiation and innovative technology advancements to gain a competitive edge. Temperature regulation, heating chamber design, and aerosol generation are key areas of innovation, with some devices offering adjustable heat settings, longer battery life, and improved flavor profiles.

- Traditional smokers, dual users, and even some electronic cigarette users are exploring heat-not-burn devices as potential harm reduction tools. However, public health concerns and regulatory landscape continue to shape the market, with ongoing discussions around nicotine delivery, nicotine salts, nicotine gums and reduced risk products. Online retailers and convenience stores are important distribution channels, while vape shops and charging stations are also emerging as key players. Pricing strategies and marketing campaigns are essential components of market success, with companies leveraging consumer insights to tailor their offerings and messaging. Product innovation and technology advancements are ongoing, with heating elements, airflow control, and charging time among the areas of focus.

- The innovation pipeline is robust, with new players and product lines entering the market regularly. Despite the dynamic nature of the market, some challenges remain, including consumer education, social acceptance, and the ongoing regulatory landscape. However, the potential for harm reduction and the convenience and satisfaction offered by heat-not-burn devices make them an intriguing and evolving category in the tobacco industry.

How is this Heat-Not-Burn Tobacco Products Industry segmented?

The heat-not-burn tobacco products industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Devices

- Capsules

- Vaporizers

- Distribution Channel

- Offline

- Online

- Flavor

- Traditional tobacco

- Mint

- Fruit

- End-user

- Individuals

- Commercial

- Technology Specificity

- Electric Heating

- Carbon-Tipped

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

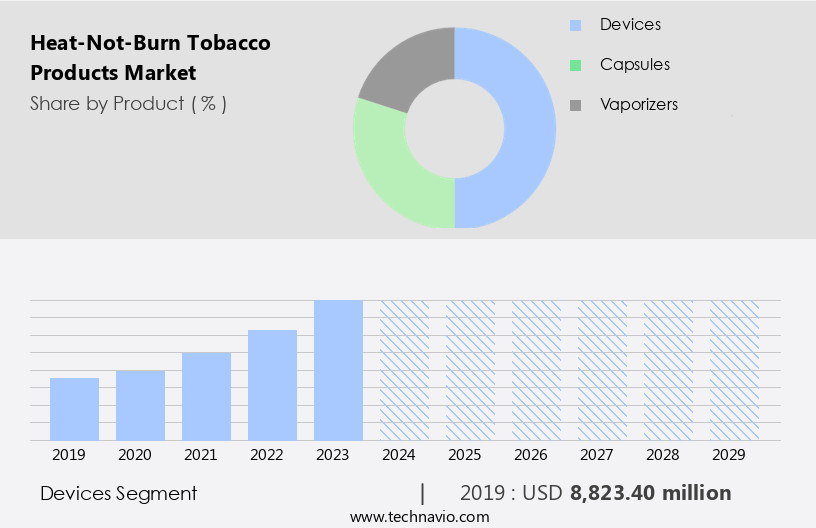

By Product Insights

The devices segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, with heat-not-burn devices being the largest product segment. These devices, which include starter kits with a charger, heating unit, and device holder, are gaining popularity due to factors such as temperature regulation, heat control, and reduced risk perception. Brands like Philip Morris International's I Quit Ordinary Smoking (IQOS) and British American Tobacco's glo and glo iFuse are leading the market. The market's concentration is attributed to a few regional and global players. Consumer preferences for convenience, online retail availability, and social acceptance are driving growth. Public health concerns and dual use with electronic cigarettes pose challenges.

Innovation in heating elements, nicotine salts, and flavor profiles is a key focus. Heating chambers, airflow control, and battery life are essential features. Pricing strategies, smoking cessation, and brand loyalty are essential marketing considerations. Temperature regulation, product differentiation, and competitive advantage are critical for companies. Despite health concerns, the market's growth is expected to continue due to harm reduction potential and adult smoker appeal. The regulatory landscape is evolving, with tobacco heating systems and heated tobacco products being researched for reduced risk profiles.

The Devices segment was valued at USD 8.82 billion in 2019 and showed a gradual increase during the forecast period.

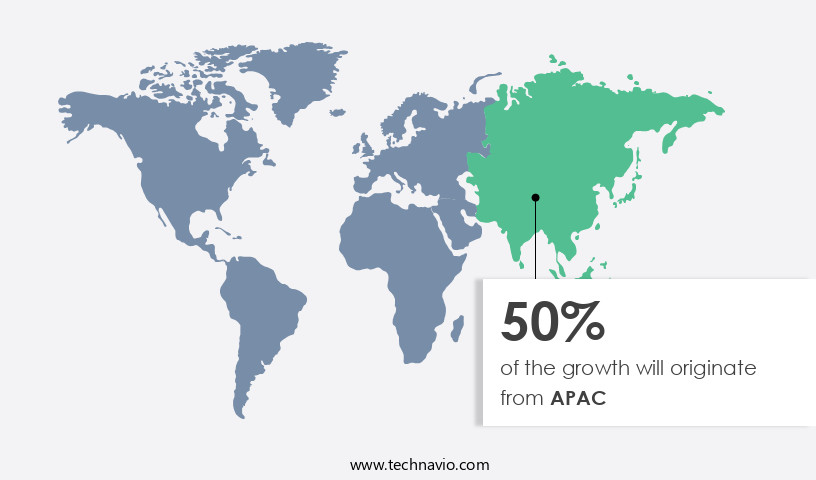

Regional Analysis

APAC is estimated to contribute 50% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the evolving tobacco industry landscape, heat-not-burn tobacco products have gained significant traction. These innovative devices, which heat tobacco instead of burning it, offer adult smokers an alternative to traditional cigarettes. The regulatory landscape for heat-not-burn tobacco products varies, with some countries embracing these reduced risk products while others remain cautious. Aerosol generation is a critical aspect of heat-not-burn technology, with precise temperature control ensuring optimal tobacco vapor production. Heat-activated tobacco and nicotine delivery systems have been instrumental in attracting consumers seeking a less harmful alternative. Consumer preferences continue to shape the market, with online retailers and vape shops increasingly stocking these products.

Public health concerns and social acceptance are ongoing debates in the market. Harm reduction is a significant selling point, as some studies suggest these products may present fewer health risks than traditional cigarettes. However, health concerns persist, with ongoing research focusing on the long-term effects of using heat-not-burn devices. The product lifecycle of heat-not-burn tobacco devices is diverse, with various heating elements, charging times, and flavor profiles catering to different consumer preferences. Brands are investing in innovation pipelines, introducing new heating chambers, temperature regulation, and airflow control features to differentiate themselves. Competitive advantage is crucial, with companies focusing on pricing strategies, marketing campaigns, and consumer insights to gain a foothold in the market.

Dual users, who use both traditional cigarettes and heat-not-burn devices, represent a significant market segment. Despite the advancements in technology and product offerings, challenges remain. Tobacco regulation, smoking cessation, and the impact on traditional smokers continue to be topics of discussion. As the market evolves, it is essential to stay informed about the latest trends and consumer preferences to capitalize on the opportunities presented by heat-not-burn tobacco products.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Heat-Not-Burn Tobacco Products Industry?

- The cost-effectiveness of heat-not-burn tobacco products serves as a significant market driver, making these innovations an increasingly popular choice for consumers seeking budget-friendly alternatives to traditional smoking methods.

- The market in the US has gained traction due to their cost-effectiveness compared to traditional tobacco products. With increasing taxes on cigarettes leading to higher prices, heat-not-burn tobacco devices and capsules offer a more affordable alternative for price-sensitive consumers. According to industry reports, the cost of a starter kit for heat-not-burn tobacco products ranges from USD30 to USD100, and the estimated cost of replacement capsules is around USD600. This is significantly less than the annual expenditure of an average heavy smoker on conventional cigarettes, which is approximately USD2,000. Social acceptance and health concerns are also influencing the market dynamics.

- While some view heat-not-burn tobacco products as a less harmful alternative to smoking, others remain skeptical due to ongoing health debates. Additionally, the dual use of heat-not-burn tobacco products and traditional cigarettes among adult smokers is a growing trend. Tobacco regulation continues to play a crucial role in the market, with pricing strategies and smoking cessation initiatives being key areas of focus. Tobacco heating systems and tobacco blends are constantly evolving to cater to consumer preferences and regulatory requirements. Despite the ongoing debate around the health implications of heat-not-burn tobacco products, their cost-effectiveness and convenience continue to drive demand among consumers.

What are the market trends shaping the Heat-Not-Burn Tobacco Products Industry?

- Companies are ramping up their promotional efforts in response to the current market trend. This increasing focus on promotional activities is a mandatory strategy for businesses seeking to remain competitive.

- The market is witnessing significant growth as manufacturers promote these alternatives as reduced risk options to traditional cigarettes. Companies are employing innovative marketing strategies to increase sales and emphasize the benefits of heat-not-burn tobacco products. For instance, Philip Morris International markets its heat-not-burn tobacco products as delivering a flavorful and satisfying nicotine experience without the need for burning or smoke. Their advertising campaigns target consumers over the age of 35, featuring testimonials from smokers aged 37-54. Heat-not-burn tobacco products use a heating element, such as a heating blade or a ceramic plate, to heat nicotine salts in a tobacco stick, releasing a nicotine-containing vapor.

- These products offer airflow control, allowing users to customize their experience. Heating time for these devices ranges from 15 to 30 seconds, making them more convenient than traditional cigarettes. Vape shops and convenience stores are stocking up on these products to cater to the growing demand. companies are investing in research and development to improve the nicotine delivery and overall user experience of their heat-not-burn tobacco products. While some may argue that these products are not entirely risk-free, they are generally considered less harmful than smoking traditional cigarettes. As the market continues to evolve, it is expected that more players will enter the market, driving competition and innovation.

What challenges does the Heat-Not-Burn Tobacco Products Industry face during its growth?

- The increasing preference for smokeless tobacco products poses a significant challenge to the expansion of the industry.

- The market is experiencing significant growth due to advancements in technology and consumer preferences for reduced harm alternatives to traditional smoking. Brands are focusing on product differentiation through superior temperature regulation, long battery life, and diverse flavor profiles to build brand loyalty. Consumers are increasingly seeking innovative tobacco vapor products that offer a more enjoyable and customizable experience. Companies are investing in marketing campaigns to reach traditional smokers and educate them about the benefits of heat-not-burn technology.

- As the market becomes more competitive, product innovation and consumer insights will continue to drive growth. With a focus on enhancing user experience, these strategies are essential for companies to gain a competitive advantage in the evolving market.

Exclusive Customer Landscape

The heat-not-burn tobacco products market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the heat-not-burn tobacco products market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, heat-not-burn tobacco products market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Philip Morris International Inc. - This company specializes in the provision of advanced tobacco solutions, introducing heat-not-burn technology through products like glo Neostiks. By utilizing this innovative method, users experience a more sophisticated and satisfying alternative to traditional smoking. Heat-not-burn technology heats tobacco without burning it, resulting in a reduced production of harmful chemicals compared to conventional methods.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Philip Morris International Inc.

- Japan Tobacco International

- British American Tobacco Plc

- Imperial Brands Plc

- KT&G Corporation

- Altria Group Inc.

- China National Tobacco Corporation

- Swedish Match AB

- Vector Group Ltd.

- Turning Point Brands Inc.

- IQOS (Philip Morris)

- Glo (BAT)

- Ploom (JTI)

- Lil (KT&G)

- Heets (Philip Morris)

- Neostiks (BAT)

- Fiit (KT&G)

- Pulze (Imperial Brands)

- Veev (Philip Morris)

- Terea (Philip Morris)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Heat-Not-Burn Tobacco Products Market

- In February 2024, British American Tobacco (BAT) unveiled the next generation of its Vuse Alto heat-not-burn (HnB) device, featuring a redesigned ergonomic shape and improved battery life. This launch marked a significant investment in product innovation within the HnB market (BAT press release).

- In June 2025, Philip Morris International (PMI) and Altria Group, Inc. Announced a strategic collaboration to jointly develop and commercialize their respective HnB products, including PMI's IQOS and Altria's MarkTen Elion, in the United States. This partnership aimed to accelerate market penetration and share growth (PMI and Altria press releases).

- In August 2024, Japan Tobacco International (JTI) secured a key regulatory approval from the U.S. Food and Drug Administration (FDA) for its Logic HS22 HnB device, marking its entry into the U.S. Market. This approval represented a significant expansion for JTI, as the U.S. Is the world's largest tobacco market (FDA press release).

- In December 2025, Imperial Brands plc showcased a breakthrough technological advancement in HnB technology by introducing its new 'Reality' device, which uses a patented 'HeatStick' design that provides a more consistent and satisfying user experience. This innovation is expected to differentiate Imperial's offerings in the competitive HnB market (Imperial Brands press release).

Research Analyst Overview

The market is experiencing significant shifts, driven by advancements in technology and marketing strategies. Digital marketing and social media platforms are increasingly utilized to reach consumers, with sensor technology and connected devices enabling targeted campaigns. Legal compliance remains a priority, ensuring customer satisfaction and product safety. Quality control and data analytics are crucial for optimizing manufacturing processes and mitigating product liability risks. Smart devices and user experience are key differentiators, with bio-based materials and aerosol chemistry shaping product design. Influencer marketing and nicotine delivery mechanisms are also influential in shaping consumer behavior. Product recalls and brand awareness are crucial considerations, with retail strategy and packaging design playing essential roles in distribution channels.

Environmental impact is a growing concern, driving innovation in manufacturing processes and supply chain management. Mobile apps and consumer behavior modeling offer opportunities for enhancing customer engagement and improving product design. Overall, the market is dynamic and complex, requiring a holistic approach to address the diverse needs of consumers and stakeholders.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Heat-Not-Burn Tobacco Products Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 43.6% |

|

Market growth 2025-2029 |

USD 151873 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

32.5 |

|

Key countries |

US, China, Canada, UK, Japan, India, Germany, Italy, France, South Korea, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Heat-Not-Burn Tobacco Products Market Research and Growth Report?

- CAGR of the Heat-Not-Burn Tobacco Products industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the heat-not-burn tobacco products market growth of industry companies

We can help! Our analysts can customize this heat-not-burn tobacco products market research report to meet your requirements.