Nicotine Gum Market Size 2025-2029

The nicotine gum market size is forecast to increase by USD 1.52 billion, at a CAGR of 6.1% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing number of smokers seeking alternatives to quit smoking entirely. This trend is driven by heightened awareness of the health risks associated with tobacco use and the growing acceptance of nicotine replacement therapies as effective cessation aids. In addition, the market is witnessing an influx of new product launches, expanding the product portfolio and catering to diverse consumer preferences. However, the market faces challenges in the form of stringent regulatory requirements and potential health concerns related to nicotine consumption, particularly in the context of long-term use.

- Companies in the market must navigate these challenges while capitalizing on the growing demand for effective smoking cessation solutions. Strategic partnerships, product innovation, and regulatory compliance will be key to success in this dynamic market.

What will be the Size of the Nicotine Gum Market during the forecast period?

The market continues to evolve, driven by ongoing research and development in nicotine delivery systems and smoking cessation methods. Healthcare professionals play a crucial role in the market, advocating for behavioral therapy and prescription medications to help manage withdrawal symptoms. Product innovation remains a key focus, with nicotine nasal sprays, transdermal patches, and gum bases undergoing constant refinement. Convenience is a significant factor in market penetration, with nicotine gum and other over-the-counter products readily available in retail outlets such as Convenience Stores. Pharmaceutical-grade nicotine and various dosage forms cater to diverse consumer needs and preferences. Oral health concerns, including gum disease and tooth decay, are increasingly recognized as potential complications of nicotine use, leading to a greater emphasis on Oral Hygiene.

Marketing campaigns and patient compliance are essential for brand loyalty, with consumer education and health insurance coverage playing crucial roles in ensuring long-term effects. Regulatory approval, efficacy studies, and safety data continue to shape the market, as do pricing strategies and consumer demand for various nicotine replacement therapy options. Public health initiatives and clinical trials are ongoing efforts to address nicotine dependence and its associated health risks. Nicotine inhalers and lozenges offer alternative delivery methods, while addiction treatment programs and online pharmacies expand access to nicotine replacement therapy. The dynamic nature of the market ensures a continuous unfolding of patterns and applications across various sectors.

How is this Nicotine Gum Industry segmented?

The nicotine gum industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- 2-mg nicotine

- 4-mg nicotine

- Distribution Channel

- Offline

- Online

- Application

- Withdrawal clinics

- Medical practice

- Individual smokers

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Product Insights

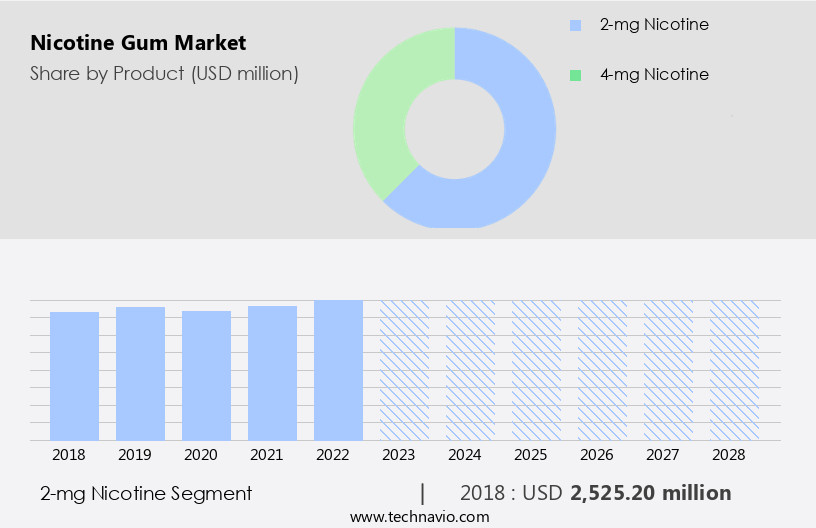

The 2-mg nicotine segment is estimated to witness significant growth during the forecast period.

The market is driven by various factors, including the role of behavioral therapy and healthcare professionals in smoking cessation. Product innovation, such as prescription medications, nicotine nasal sprays, transdermal patches, nicotine inhalers, and lozenges, provide alternative nicotine delivery systems for individuals seeking to quit smoking. Withdrawal symptoms can be alleviated through these products, increasing consumer demand. Market penetration is aided by direct-to-consumer advertising, making over-the-counter nicotine replacement therapy more accessible. Convenience stores serve as a significant retail distribution channel, ensuring easy accessibility. Oral health concerns, such as gum disease and tooth decay, further emphasize the importance of quitting smoking.

Primary care physicians often recommend nicotine gum as part of a comprehensive smoking cessation strategy. Patient compliance is crucial, with regular use of gum pieces throughout the day, as recommended by healthcare professionals. Brand loyalty is fostered through marketing campaigns and consumer education. Regulatory approval and efficacy studies ensure the safety and effectiveness of nicotine gum. Pharmaceutical grade nicotine is used in the production of these products, ensuring consistent dosage forms. Oral hygiene is a consideration, with product labeling emphasizing the importance of proper use. Long-term effects, such as nicotine dependence and potential health risks, necessitate ongoing public health initiatives and clinical trials.

Consumer demand for affordable alternatives drives the growth of generic alternatives in the market. Health insurance coverage and pricing strategies also influence consumer choice. Online pharmacies offer convenience and accessibility, further expanding the market reach. Nicotine replacement therapy continues to evolve, with ongoing research and development aimed at improving efficacy and patient experience.

The 2-mg nicotine segment was valued at USD 2.62 billion in 2019 and showed a gradual increase during the forecast period.

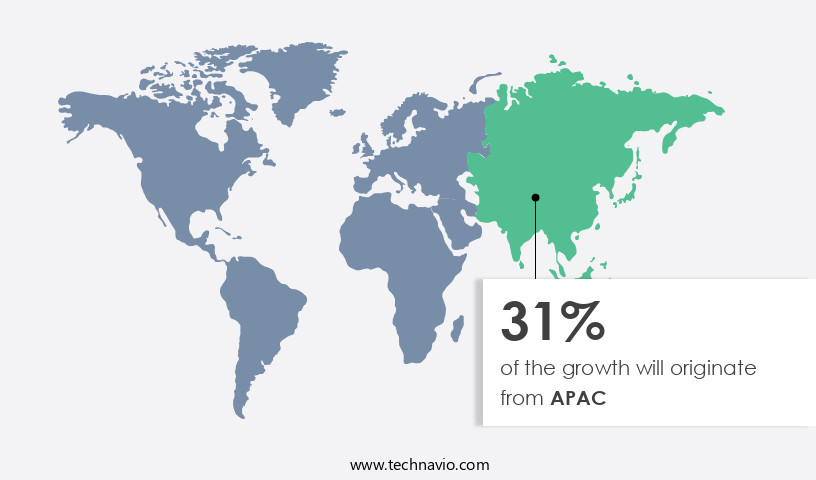

Regional Analysis

North America is estimated to contribute 29% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the increasing number of individuals seeking smoking cessation solutions. The US, Mexico, and Canada are key markets for nicotine gums, given the high prevalence of tobacco use in these countries. According to the Centers for Disease Control and Prevention, tobacco use is the leading cause of preventable death and disease in the US, with approximately 28.3 million adults and 2.8 million middle- and high-school students using tobacco products. Smoking and secondhand smoke exposure result in approximately 500,000 premature deaths annually, and 16 million people live with smoking-related illnesses.

Healthcare professionals often recommend nicotine gum as a part of behavioral therapy for smoking cessation. Product innovation, such as the development of pharmaceutical-grade nicotine and various dosage forms, has increased the market penetration of nicotine gums. Direct-to-consumer advertising and the availability of over-the-counter products have also contributed to the growth of the market. Nicotine gum is available in various forms, including transdermal patches, nasal sprays, lozenges, and inhalers. These nicotine delivery systems help manage withdrawal symptoms and cravings. Consumer demand for these products is driven by factors such as oral health concerns, including gum disease and tooth decay, and health insurance coverage.

Marketing campaigns and consumer education initiatives have played a crucial role in increasing brand loyalty and patient compliance. Regulatory approval and efficacy studies have further boosted the market's growth. However, pricing strategies and product labeling are essential considerations for market penetration and patient adherence. Long-term effects of nicotine gum use, such as nicotine dependence and potential safety concerns, are areas of ongoing research. Public health initiatives and clinical trials aim to address these issues and ensure the safety and efficacy of nicotine replacement therapy. Retail distribution and addiction treatment centers are significant channels for the sale and availability of nicotine gum products.

Online pharmacies have also emerged as a convenient and accessible option for consumers.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Nicotine Gum Industry?

- The rising prevalence of individuals endeavoring to abandon smoking is the primary catalyst fueling market growth.

- The market is experiencing significant growth due to the increasing consumer demand for smoking cessation aids. According to various studies, nicotine gum and lozenges are effective in helping individuals quit smoking. For instance, a study published in the New England Journal of Medicine found that nicotine gum was effective in helping people quit smoking, with a 2x higher quit rate compared to placebo. Consumer education and awareness campaigns, such as the World Health Organization's World No Tobacco Day, also contribute to the market's growth. Health insurance coverage for nicotine replacement therapies, including gum and lozenges, is another factor driving demand.

- Pricing strategies and dosage forms are essential considerations for manufacturers in this market. Oral hygiene is also a crucial factor, as nicotine gum can leave a residue in the mouth, necessitating proper Oral Care. Regulatory approval and efficacy studies are crucial in ensuring the safety and effectiveness of nicotine gum products. Overall, the market is expected to continue its growth trajectory due to the increasing consumer awareness and demand for smoking cessation aids.

What are the market trends shaping the Nicotine Gum Industry?

- The trend in the market involves the launch of new nicotine-related products. This growth is a significant development in the industry.

- The market continues to gain momentum due to the increasing demand for effective smoking cessation solutions. Nicotine dependence remains a significant public health concern, and nicotine replacement therapy (NRT), including nicotine gum, is a widely used treatment. Clinical trials have shown NRT to be effective in reducing nicotine cravings and helping individuals quit smoking. New product launches, such as Perrigo Company plc's nicotine-coated mint lozenges, contribute positively to the market. These products have gained traction among consumers due to their effectiveness in alleviating withdrawal symptoms. Retail sales for these lozenges have seen a substantial increase, contributing to the overall growth of the market.

- Safety data from clinical trials and real-world use supports the safety and efficacy of nicotine gum as an addiction treatment. Retail distribution channels and online pharmacies make these products easily accessible to consumers. As the market continues to evolve, it is essential to stay informed about the latest research and developments to make informed decisions regarding nicotine replacement therapy options.

What challenges does the Nicotine Gum Industry face during its growth?

- The challenge of addressing health concerns associated with the use of smoking cessation products is a significant factor impeding the growth of the industry.

- The market's expansion is influenced by several factors, including the growing need for behavioral therapy to help individuals quit smoking and the role of healthcare professionals in recommending cessation products. Product innovation, such as prescription medications, nicotine nasal sprays, and transdermal patches, also contribute to market growth. However, concerns regarding the potential health risks associated with long-term use of nicotine gums, including side effects like hair loss, skin irritation, and gastrointestinal issues, may hinder market penetration.

- Additionally, the availability of generic alternatives and direct-to-consumer advertising can impact market dynamics. Despite these challenges, the market continues to evolve, driven by ongoing research and development efforts to improve the efficacy and safety of nicotine replacement therapies.

Exclusive Customer Landscape

The nicotine gum market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the nicotine gum market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, nicotine gum market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alchem International Pvt. Ltd. - The company introduces NicSelect, a line of high-quality nicotine gums, catering to consumers seeking effective alternatives to traditional smoking. These gums employ advanced technology to deliver a consistent nicotine experience, ensuring satisfaction and convenience. The formula is scientifically formulated to help manage cravings and promote oral health. With a focus on originality and innovation, NicSelect sets itself apart in the market, enhancing search engine exposure and delivering a clear, informative message to consumers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alchem International Pvt. Ltd.

- Alkalon AS

- British American Tobacco Plc

- Cambrex Corp.

- Cipla Inc.

- Dr Reddys Laboratories Ltd.

- Enorama Pharma AB

- Fertin Pharma AS

- GlaxoSmithKline Plc

- Glenmark Pharmaceuticals Ltd.

- ITC Ltd.

- Johnson and Johnson Services Inc.

- Leeford Healthcare Ltd.

- Lil Drug Store Products Inc.

- Lucy Goods Inc.

- Major Pharmaceuticals Inc.

- Perrigo Co. Plc

- Rogue Holdings LLC

- Trumac Healthcare

- Walgreens Boots Alliance Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Nicotine Gum Market

- In February 2023, Pfizer Inc. Announced the FDA approval of its new nicotine gum product, "Benedict's Gum," aimed at helping smokers quit through a unique flavor profile and enhanced formulation. This approval marks a significant expansion to Pfizer's consumer health portfolio (Pfizer Press Release, 2023).

- In June 2024, GlaxoSmithKline (GSK) and Pfizer entered into a strategic collaboration to co-promote and co-develop Zyban (bupropion), an FDA-approved medication for smoking cessation, along with their respective nicotine replacement therapies, including nicotine gum. This partnership is expected to strengthen both companies' market presence in the nicotine gum sector (GSK Press Release, 2024).

- In November 2024, Swedish Match AB, a leading manufacturer of smokeless tobacco and nicotine products, acquired Nicotine Sciences, a UK-based research and development company specializing in nicotine gum technology. This acquisition is expected to accelerate Swedish Match's innovation pipeline and broaden its product offerings (Swedish Match AB Press Release, 2024).

- In April 2025, the European Commission approved the use of 2mg nicotine gum for the treatment of nicotine addiction in the European Union. This approval marks a significant policy change, as the previous limit was 1.5mg, and is expected to increase market demand for higher-strength nicotine gum products (European Commission Press Release, 2025).

Research Analyst Overview

- The market is driven by a growing emphasis on improving quality of life and promoting smoke-free environments in various sectors, including healthcare and public places. Pharmacokinetic and pharmacodynamic studies in clinical pharmacology continue to advance our understanding of nicotine gum's role in patient safety and health outcomes. Health communication and mass media campaigns are essential tools for tobacco control, while professional training and healthcare provider education are crucial for effective risk management. Pharmaceutical manufacturing and drug stability are critical factors in ensuring consistent drug formulation and dose response.

- Adverse effects and drug interactions necessitate ongoing research and healthcare economics analysis. Lifestyle modifications, social marketing, and community outreach are integral components of chronic disease management and patient satisfaction. Public health policy and disease management strategies continue to evolve, reflecting the dynamic nature of this market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Nicotine Gum Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.1% |

|

Market growth 2025-2029 |

USD 1524.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

US, Canada, UK, Germany, Italy, France, The Netherlands, China, India, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Nicotine Gum Market Research and Growth Report?

- CAGR of the Nicotine Gum industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the nicotine gum market growth of industry companies

We can help! Our analysts can customize this nicotine gum market research report to meet your requirements.