Herbal Market Size 2025-2029

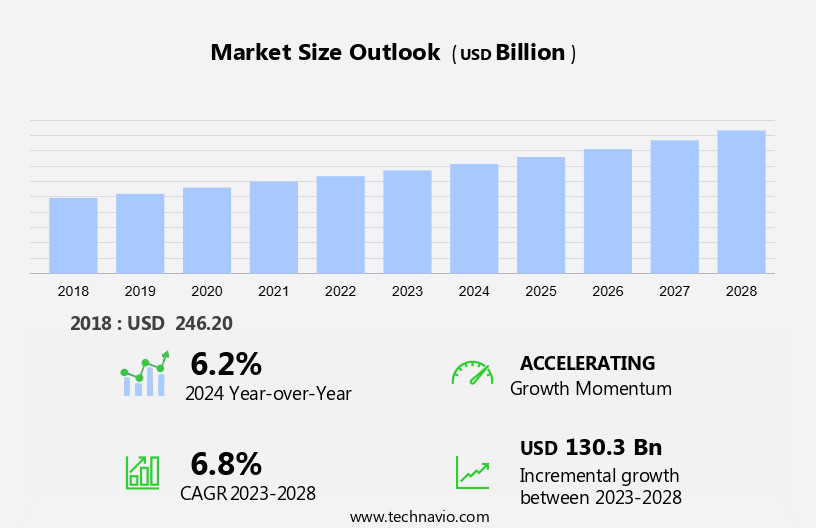

The herbal market size is forecast to increase by USD 145.3 billion at a CAGR of 7.1% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing prevalence of liver and heart diseases, driving a heightened demand for natural remedies. This trend is further fueled by the rising awareness among consumers about the advantages of herbal products over synthetic alternatives. However, the market faces challenges in the form of adverse climatic conditions that negatively impact herbal plant production. The cosmetics industry and toiletries sector also contribute significantly to the market's expansion, with skincare products being a major focus. These conditions, including extreme temperatures and unpredictable weather patterns, pose a significant threat to the sustainability and consistency of herbal supply chains.

- Additionally, adopting sustainable farming practices and exploring alternative production methods can help mitigate the risks associated with adverse climatic conditions. By staying agile and responsive to market trends and challenges, the market participants can effectively navigate the complex and dynamic landscape of this growing industry. To capitalize on the market's opportunities, companies must focus on implementing robust sourcing strategies and investing in research and development to create innovative, high-quality herbal products. As consumers continued to prioritize natural alternatives for their health and wellness needs, the market demonstrated a strong commitment to quality control and innovation.

What will be the Size of the Herbal Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market exhibits dynamic trends, with plant genetics playing a pivotal role in product innovation. Marketing campaigns highlight the benefits of herbal products, ranging from herbal baths and functional beverages to herbal compresses and infusions. Water management and weed control are crucial aspects of herbal farming, ensuring optimal growing conditions. Food safety and consumer safety are paramount, with labeling requirements strictly enforced. Customer segmentation is essential for effective brand building, as processing facilities cater to various market niches. Pricing strategies and public relations are key components of successful sales channels.

Soil analysis and harvesting equipment are vital for maintaining herbal product quality. Pest control and seed propagation are ongoing concerns for herbal farmers. Distribution networks must adapt to meet the diverse demands of the market, with an increasing focus on sustainability and transparency. E-commerce and mail order pharmacies, have gained prominence in recent years, making herbal products more accessible to consumers worldwide.

How is this Herbal Industry segmented?

The herbal industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Delivery

- Over the counter

- Prescription

- Product

- Herbal supplements and remedies

- Herbal medicine

- Herbal cosmetics

- Type

- Detoxification medicine

- Antipyretic medicine

- Aigestant medicine

- Blood circulation medicine

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- Australia

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Delivery Insights

The Over the counter segment is estimated to witness significant growth during the forecast period. In 2024, the over-the-counter (OTC) herbal supplement market experienced continued growth, fueled by increasing consumer preference for natural wellness solutions. The FDA and industry reports indicated a steady rise in retail sales, with popular ingredients such as turmeric and psyllium continuing to garner strong demand due to their perceived benefits for inflammation reduction, digestive health, and cardiovascular support. Consumers sought out OTC herbal products for preventative care and everyday wellness, favoring brands that prioritized transparency, traditional knowledge, and plant-based formulations. Companies like Himalaya, Herbalife, and Patanjali responded to this trend by expanding their product lines and distribution channels, focusing on formulations that boosted immunity, alleviated stress, and promoted metabolic health.

Herbal extracts, infusion methods, and traditional Chinese medicine gained traction as consumers explored various methods for harnessing the therapeutic properties of plants. Fair trade practices and organic farming ensured the ethical sourcing of raw materials, while packaging materials and brewing temperatures ensured product efficacy and shelf life. Pain relief, stress reduction, and sleep improvement were among the key health benefits driving demand for herbal remedies, which also found applications in functional foods, dietary supplements, cosmetics ingredients, and medicinal applications. Extraction methods, such as liquid extracts and tinctures, and drying techniques, like sun-drying and freeze-drying, were crucial in preserving the therapeutic properties of herbs.

Sustainable harvesting practices and medicinal applications further broadened the market's scope, with herbal tinctures, herbal teas, and essential oils offering versatile solutions for various health concerns. Inflammation reduction, immune system support, and natural pain relief were some of the primary therapeutic properties that attracted consumers to herbal remedies.

The Over the counter segment was valued at USD 190.40 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

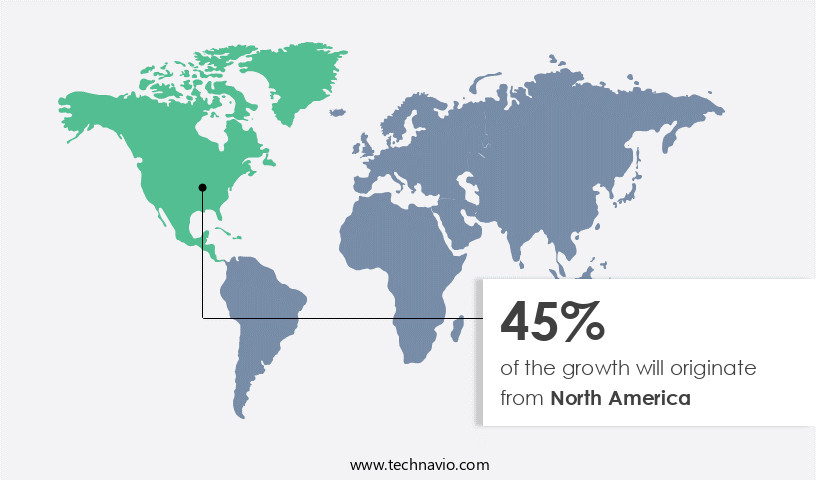

North America is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the North American market of 2024, the herbal sector experiences significant growth, fueled by consumers' growing preference for natural wellness and plant-based alternatives. Herbal products, valued for their potential health benefits and alignment with sustainability and clean-label trends, are increasingly popular. Herbal supplements, such as ashwagandha, turmeric, and elderberry, are sought after for their adaptogenic and immune-supporting properties. Herbal teas and infusions, including hibiscus, lemongrass, and rooibos, are favored for their calming and digestive benefits. The skincare and personal care sector also witnesses a rise in demand for botanical ingredients, like calendula, witch hazel, and green tea, which are known for their gentle, nature-derived formulations.

Fair trade practices are increasingly important to consumers, ensuring herbal extracts are sourced ethically and sustainably. Traditional medicinal applications continue to influence modern herbal remedies, with traditional Chinese medicine gaining popularity. Quality control measures, including organic farming and sustainable harvesting, are essential to maintain the therapeutic properties of herbal ingredients. In the realm of functional foods, herbal ingredients are incorporated into various products, such as weight management supplements and dietary supplements, to enhance their nutritional value. Herbal tinctures and liquid extracts are popular for their quick absorption and high potency. Drying techniques and brewing temperatures are crucial factors in preserving the herbal ingredients' therapeutic properties and ensuring consistent shelf life.

Pain relief and stress reduction are common reasons consumers turn to herbal remedies. Essential oils, derived from various plant sources, are used for their aromatic and therapeutic properties. Inflammation reduction is another area where herbal ingredients, such as ginger and turmeric, show promise. Herbal infusions and tinctures are used for smoking cessation, offering a natural alternative to traditional methods. The market's evolution is marked by a focus on natural, plant-based solutions for various health concerns. The market's trends reflect a growing awareness of the therapeutic properties of herbal ingredients and consumers' desire for sustainable, ethical, and clean-label alternatives.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Herbal market drivers leading to the rise in the adoption of Industry?

- The prevalence of liver and heart diseases serves as the primary driver for market growth in this sector. The market is experiencing significant growth due to increasing consumer interest in natural alternatives for pain relief, immune system support, and overall health benefits. Functional foods and dietary supplements containing herbs like Milk Thistle and Hawthorn Berry are gaining popularity, particularly for their therapeutic properties in liver and cardiovascular health. Milk Thistle, with its active compound silymarin, offers strong antioxidant and anti-inflammatory properties, promoting liver cell regeneration and shielding against oxidative stress.

- Similarly, Hawthorn Berry is recognized for its cardiovascular benefits, including reducing blood pressure and improving heart function. These herbs, as cosmetics ingredients, add value to various industries, further expanding the market's reach. Recent studies suggest its potential in reducing liver enzyme levels and alleviating symptoms in non-alcoholic fatty liver disease and hepatitis-related cirrhosis.

What are the Herbal market trends shaping the Industry?

- The increasing recognition of the benefits associated with natural remedies is shaping the latest market trend. This shift towards more natural healing methods is a significant development in the healthcare industry. The market is experiencing significant growth as consumers seek natural and holistic remedies for health and wellness. The trend towards herbal therapies is fueled by increasing awareness of the potential side effects of synthetic pharmaceuticals and a renewed trust in traditional healing systems. Anti-inflammatory herbs like turmeric, ginger, and Boswellia are popular choices for managing chronic pain and inflammation.

- Quality control is crucial in the production of herbal remedies, with organic farming, proper drying techniques, and brewing temperatures ensuring the herbs' potency and shelf life. Herbal tinctures, made by extracting the active compounds of herbs in alcohol, offer a convenient and effective way to consume these natural medicines. Herbal supplements, including echinacea and ginseng, and herbal beverages, such as chamomile and peppermint, are popular examples of this trend. Immune-supportive botanicals, such as echinacea, elderberry, and astragalus, are in high demand as people look to strengthen their natural defenses. Herbal teas, including chamomile, peppermint, and lemon balm, have become staples in daily wellness routines due to their calming and digestive benefits.

How does Herbal market faces challenges during its growth?

- The herbal plant industry faces significant challenges due to adverse climatic conditions negatively impacting production. This issue hinders industry growth and requires urgent attention and solutions to ensure continued production and expansion. The market, driven by the growing demand for smoking cessation and medicinal applications, is facing challenges due to the impact of climate change on traditional Chinese medicine production. Prolonged droughts, erratic rainfall, and extreme heat events disrupt the growth cycles of key medicinal plants, leading to reduced yields and compromised quality.

- These climatic stressors also trigger shifts in the geographic distribution of several species, forcing cultivation into new regions with suboptimal growing conditions. Sustainable harvesting practices and advanced extraction methods, such as liquid extracts and steeping times, are essential to mitigate the effects of climate change on herbal quality and consistency. The market encompasses a diverse range of natural products derived from medicinal plants and used in various industries, including pharmaceuticals, cosmetics, and toiletries. Elevated temperatures alter the phytochemical composition of herbs like ginseng, rhodiola, and echinacea, diminishing their therapeutic potency and consistency. Excessive humidity and unseasonal rains increase the prevalence of fungal infections and pest outbreaks, particularly affecting crops such as chamomile, lavender, and holy basil.

Exclusive Customer Landscape

The herbal market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the herbal market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, herbal market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Archer Daniels Midland Co. - This company specializes in herbal offerings, providing phospholipids, vitamin E capsules, plant sterols, soy isoflavones, and flaxseed oil for diverse nutritional supplements and applications, including nutrition bars, beverages, spreads, and dressings.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Archer Daniels Midland Co.

- Arizona Natural Products

- Arkopharma Laboratories

- Bellan Pharmaceuticals

- Blackmores Ltd.

- Dabur India Ltd.

- Dasherb Corp.

- Dr. Willmar Schwabe India Pvt. Ltd.

- Gaia Herbs Inc.

- Glanbia plc

- Greenstorm Foods Pty Ltd

- Herbalife International of America Inc.

- Himalaya Global Holdings Ltd.

- Hishimo Pharmaceuticals Pvt. Ltd.

- KPC Products Inc.

- Patanjali Ayurved Ltd.

- Schaper and Brummer GmbH and Co. KG

- SP Pharmaceuticals

- Tsumura and Co.

- ZeinPharma Germany GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Herbal Market

- In January 2024, industry leader Herbal Health Inc. Announced the launch of their new herbal tea line, "Revitalize," which includes six unique blends infused with adaptogens and antioxidants (Herbal Health Inc. Press release).

- In March 2024, Herbal Health Inc. Entered into a strategic partnership with organic farming cooperative, EcoFarmers, to secure a steady supply of high-quality, sustainably grown herbs for their products (Herbal Health Inc. Press release).

- In April 2025, Herbal Health Inc. Completed a USD25 million Series C funding round, led by venture capital firm GreenVest Capital, to support research and development efforts and expand their product offerings (Bloomberg).

- In May 2025, the European Commission approved Herbal Health Inc.'s application to sell their herbal supplements in the European Union, marking their entry into this significant market (European Commission press release).

Research Analyst Overview

The market continues to evolve, with dynamic market activities unfolding across various sectors. Herbal remedies, once relegated to the realm of traditional medicine, have gained mainstream recognition as effective alternatives for various health concerns. From digestive health to stress reduction and pain relief, herbal extracts find applications in diverse areas. Quality control and organic farming practices are paramount in ensuring herbal products' therapeutic properties and natural benefits. Inflammation reduction is a key area of focus, with natural remedies gaining popularity for their potential to alleviate chronic conditions. Shelf life, brewing temperatures, and drying techniques are essential considerations in the production of herbal teas and tinctures.

Essential oils and functional foods are also integral components of the market, offering health benefits and adding value to various industries. Fair trade practices and sustainable harvesting methods are increasingly important in the market, reflecting growing consumer awareness and demand for ethical sourcing. Medicinal applications of herbs extend beyond traditional uses, with ongoing research revealing new therapeutic properties. Extraction methods, such as liquid extracts and infusion methods, continue to evolve, ensuring optimal potency and bioavailability. Steeping times and packaging materials are crucial factors in maintaining the quality and efficacy of herbal products. The market's continuous dynamism is further reflected in its expanding reach, with herbal ingredients finding applications in cosmetics, dietary supplements, and smoking cessation products. The market's evolving patterns underscore its potential for innovation and growth.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Herbal Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 145.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, Australia, Canada, Germany, UK, France, Brazil, Italy, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Herbal Market Research and Growth Report?

- CAGR of the Herbal industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the herbal market growth of industry companies

We can help! Our analysts can customize this herbal market research report to meet your requirements.