Herbal Medicine Market Size 2025-2029

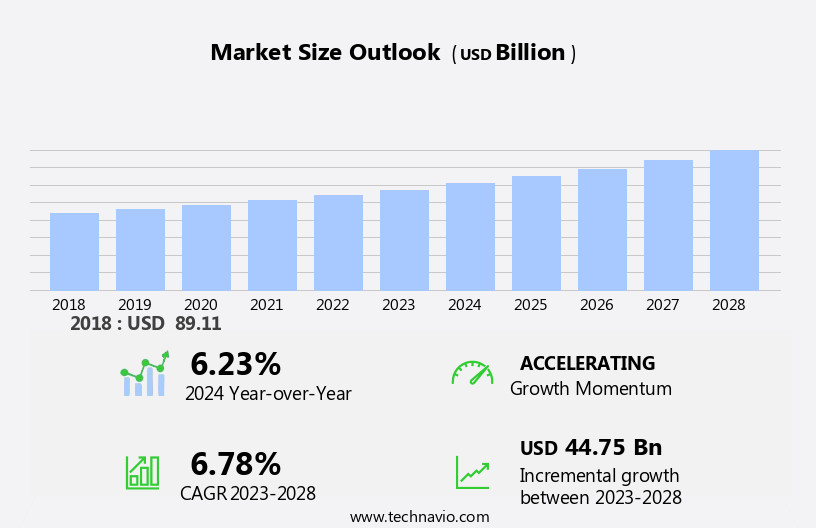

The herbal medicine market size is forecast to increase by USD 49.98 billion, at a CAGR of 7.1% between 2024 and 2029.

- The market is witnessing significant growth, driven by the increasing inclination towards natural and herbal remedies. This trend is fueled by consumers' growing awareness of the potential health benefits of herbal medicines and their preference for holistic healing approaches. Green tea, cranberries, ginger, cinnamon, garlic, flax seeds, and ginseng are among the popular herbs used in dietary supplements and herbal teas for their antioxidant properties. Moreover, technological advancements in herbal medicine research and development are enabling the discovery of new therapeutic applications and improving product efficacy. However, the market faces challenges, including inadequate knowledge and stringent regulation of herbal medicines. The lack of standardization and scientific validation of herbal medicines poses a significant hurdle for market expansion. Additionally, regulatory bodies' strict regulations on the production, distribution, and marketing of herbal medicines necessitate compliance, adding to the operational complexities for market players.

- Companies seeking to capitalize on market opportunities must invest in research and development to validate the therapeutic potential of herbal medicines and navigate regulatory requirements effectively. Embracing technological innovations and collaborating with regulatory bodies can help companies overcome these challenges and establish a strong market presence.

What will be the Size of the Herbal Medicine Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with naturopathic doctors and other healthcare professionals integrating herbal remedies into various sectors for their therapeutic benefits. Herbal medicines are gaining popularity for their safety and efficacy in addressing health concerns, such as cardiovascular health and skin care. Botanical extracts, herbal supplements, and herbal teas are increasingly being used for stress relief, mood regulation, mental clarity, and energy boost. Herbal medicine distributors play a crucial role in ensuring regulatory compliance, GMP certification, and quality control. Herbal medicine databases and research are essential for understanding the bioactive compounds and their potential applications.

Traditional practices, such as Ayurvedic medicine and Traditional Chinese Medicine, continue to influence modern herbalism. Herbal medicine manufacturers prioritize sustainable sourcing and clinical trials to ensure safety and efficacy. Herbal medicine is also available through online retailers, retail pharmacies, health food stores, and wellness centers. Topical preparations offer solutions for skin care, joint health, and sleep support. Herbal medicine journals and schools provide education and training for natural health practitioners, homeopathic practitioners, and herbalism students. Regulatory bodies, such as the FDA and EU, play a critical role in ensuring safety and efficacy through regulations and guidelines.

Herbal medicine's ongoing unfolding includes addressing drug interactions, dosage and administration, and antioxidant activity. The market's continuous dynamism offers opportunities for herbal medicine to contribute to immune boosting, cognitive function, and weight management.

How is this Herbal Medicine Industry segmented?

The herbal medicine industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Capsules and tablets

- Powders

- Extracts

- Syrups

- Others

- Distribution Channel

- Hospitals and retail pharmacies

- E-commerce

- Source

- Leaves

- Roots

- Barks

- Others

- Application

- Pharmaceutical and nutraceutical

- Food and beverages

- Personal care and beauty products

- Variant

- General wellness

- Cardiovascular health

- Cognitive health

- Gut and digestive health

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

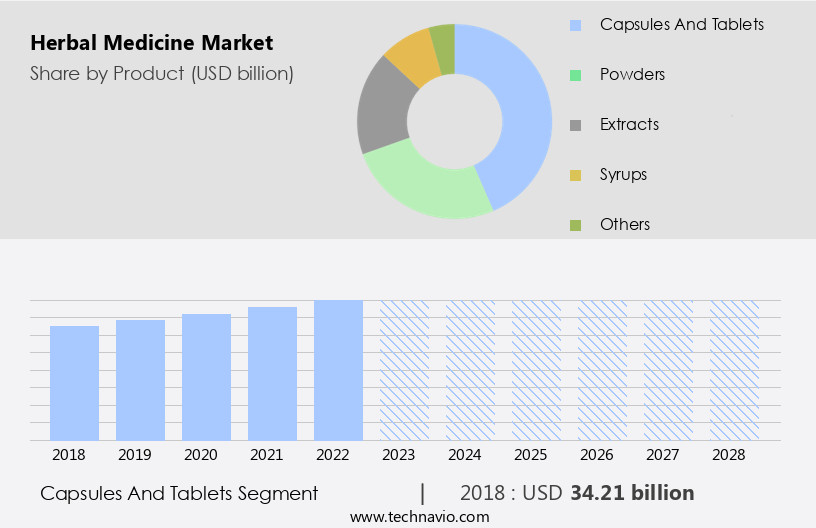

By Product Insights

The capsules and tablets segment is estimated to witness significant growth during the forecast period.

The market in the US is experiencing significant growth, driven by the increasing preference for natural remedies among consumers. Naturopathic doctors and other natural health practitioners continue to advocate for the safety and efficacy of herbal remedies, particularly in areas such as cardiovascular health and skin care. Herbal medicine distributors play a crucial role in making these remedies accessible to consumers, while manufacturers ensure GMP certification and regulatory compliance. Herbal medicine databases and research provide valuable information on the medicinal properties of various herbs, including botanical extracts with anti-inflammatory activity and mood regulation capabilities. Herbal supplements, available through online retailers, health food stores, and retail pharmacies, offer convenient solutions for stress relief, mental clarity, and joint health.

Herbal teas and topical preparations are also popular for their immune-boosting and energy-boosting properties. Herbal medicine research continues to uncover new bioactive compounds and applications, from cognitive function enhancement to sleep support and antioxidant activity. Traditional systems of medicine, such as traditional Chinese medicine and Ayurvedic medicine, are gaining recognition for their potential benefits. Herbal medicine manufacturers and schools are dedicated to advancing the field through quality control, clinical trials, and herbal pharmacognosy. Regulatory bodies, such as the FDA and EU, ensure the safety and efficacy of herbal medicines, while herbal medicine journals provide a platform for sharing research findings.

Integrative medicine practices are increasingly incorporating herbal medicine into their offerings, further expanding its reach. Despite the growing popularity of herbal medicines, it is essential to consider dosage and administration, potential drug interactions, and individual sensitivities. Sustainable sourcing and organic farming practices are also important considerations for the long-term viability of the market.

The Capsules and tablets segment was valued at USD 35.96 billion in 2019 and showed a gradual increase during the forecast period.

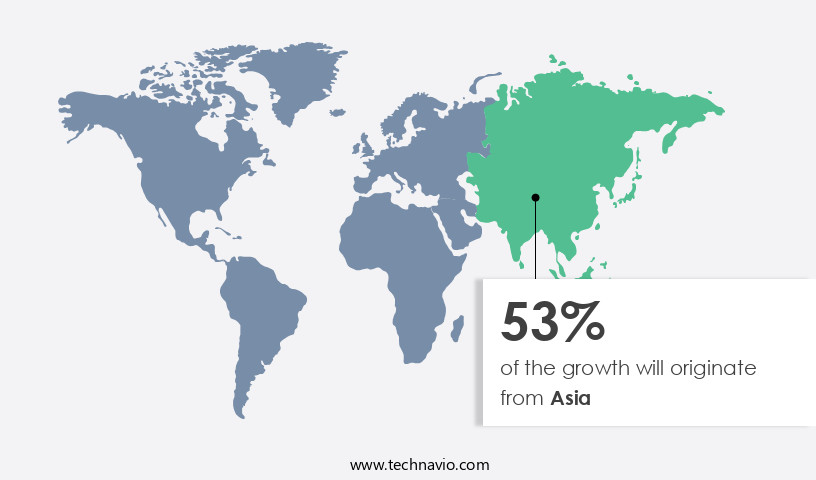

Regional Analysis

Asia is estimated to contribute 54% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia is experiencing notable growth due to increasing consumer awareness of the potential side effects of allopathic medicines and the therapeutic benefits of herbal products. This trend is particularly prominent in countries like China and India, where the number of obese individuals and those suffering from cardiovascular diseases, nutrient deficiencies, and other health concerns is on the rise. As a result, there is a heightened demand for ayurvedic and traditional Chinese medicine, including botanical extracts, herbal supplements, and personal care products. Herbal medicine distributors play a crucial role in this market, ensuring regulatory compliance and quality control through GMP certification and herbal medicine databases.

Herbal medicine manufacturers also prioritize safety and efficacy, conducting clinical trials to validate the medicinal properties of bioactive compounds. Herbal medicine research is a significant focus area, with journals and wellness centers disseminating knowledge on mental clarity, mood regulation, stress relief, and cognitive function. Integrative medicine practices, such as naturopathic doctors and homeopathic practitioners, are increasingly popular, leading to direct-to-consumer sales through online retailers and retail pharmacies. Sustainable sourcing and organic farming are also essential considerations for manufacturers and consumers alike, ensuring the market remains in line with evolving consumer preferences and regulatory requirements. The market for herbal medicine extends to various applications, including skin care, hair care, digestive health, and joint health.

Topical preparations and herbal teas are popular choices for those seeking relief from stress and inflammation, while energy boosters and immune boosting supplements cater to those with active lifestyles. The market's diversity is further underscored by the inclusion of herbal medicine in traditional practices such as Ayurveda and Traditional Chinese Medicine. Regulatory bodies, such as the FDA and EU, play a crucial role in ensuring safety and efficacy through rigorous testing and certification processes. Herbal medicine books and schools provide valuable resources for natural health practitioners and those seeking to learn more about the therapeutic properties of medicinal herbs.

In summary, the market in Asia is driven by a growing awareness of the benefits of herbal products, a rising prevalence of health concerns, and a shift towards integrative medicine practices. The market's diversity, from herbal supplements and topical preparations to traditional practices and applications, underscores its potential for continued growth and innovation.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Herbal Medicine Industry?

- The inclination towards herbal and natural remedies serves as the primary market driver, reflecting a significant trend towards holistic and chemical-free health solutions.

- Herbal medicine, rooted in ancient practices, continues to gain recognition in modern healthcare for its immune-boosting properties. Traditional Chinese medicine experts, such as Mark Frost, MSTCM, L.Ac., at the American College of Traditional Chinese Medicine, highlight the anti-pathogenic capabilities of herbs, which combat viruses, bacteria, and other harmful organisms. These immune-enhancing herbs are increasingly advocated by Western medicine practitioners for overall health benefits. Medicinal plants, revered for their healing abilities, are the focus of ongoing research. Studies explore their potential in managing viral challenges and enhancing immune function. Sustainable sourcing of these herbs is crucial to ensure regulatory compliance and maintain quality control.

- Herbalism schools and homeopathic practitioners utilize topical preparations, while research institutions investigate antioxidant activity and sleep support. Organic farming practices ensure the herbs' purity and potency. The market for herbal medicine is driven by consumer demand for natural, plant-based solutions for digestive health and overall wellness. With the increasing awareness of the benefits of herbal medicine, it is essential to adhere to FDA regulations and maintain rigorous quality control standards.

What are the market trends shaping the Herbal Medicine Industry?

- The integration of technology is becoming essential in the field of herbal medicine research and development. This trend is reflected in the market, with a growing emphasis on advanced techniques and tools for enhancing the efficacy and efficiency of herbal products.

- Herbal medicine, utilizing naturopathic doctors and botanical extracts, continues to gain traction in the health industry due to its potential benefits for various health conditions and wellness goals. Safety and efficacy are paramount in this sector, driving the need for rigorous research and development. Advanced technologies, such as Artificial Intelligence (AI) and machine learning models, are revolutionizing the identification of therapeutic properties in medicinal plants. For instance, AI tools can predict anti-inflammatory or antiviral effects, expediting the isolation of potent ingredients. Genomics and biotechnology advancements contribute to a better understanding of medicinal herbs' pharmacological mechanisms.

- On the production side, innovative technologies like spectrometry and high-performance liquid chromatography (HPLC) ensure quality control and standardization of herbal medicines. These advancements cater to diverse applications, including cardiovascular health, stress relief, skin care, hair care, and herbal supplements. Herbal medicine distributors leverage herbal medicine databases to facilitate access to accurate and up-to-date information on medicinal herbs, further enhancing their value proposition. Overall, the integration of technology and scientific research is propelling herbal medicine forward, offering promising solutions for numerous health concerns.

What challenges does the Herbal Medicine Industry face during its growth?

- The lack of sufficient knowledge regarding herbal medicines and rigid regulatory requirements poses a significant challenge to the expansion of the industry.

- Herbal medicine has gained significant popularity over the past three decades, with approximately 80% of the global population utilizing it as part of their basic healthcare. The market for herbal medicines, including those sold by online retailers, is vast and diverse, encompassing various applications from mood regulation and mental clarity to cognitive function and traditional Chinese medicine. However, the industry faces challenges due to the lack of standardization and regulatory oversight. Herbal medicine manufacturers must adhere to Good Manufacturing Practices (GMP) certification to ensure product quality and safety. Yet, many herbal treatments remain untested, and their mechanisms of action, potential side effects, contraindications, and interactions with conventional medications or functional foods are not well-documented.

- This knowledge gap poses challenges for natural health practitioners and consumers alike. A pressing concern is the limited number of clinical trials conducted on herbal medicines, which hinders a comprehensive understanding of their therapeutic potential and safety. Adverse responses or toxicities from misuse or overdosing are not well-researched, leaving practitioners and users without clear guidelines for safe dosage and administration. To address these challenges, ongoing research is essential to establish evidence-based practices and ensure the safe and effective use of herbal medicines.

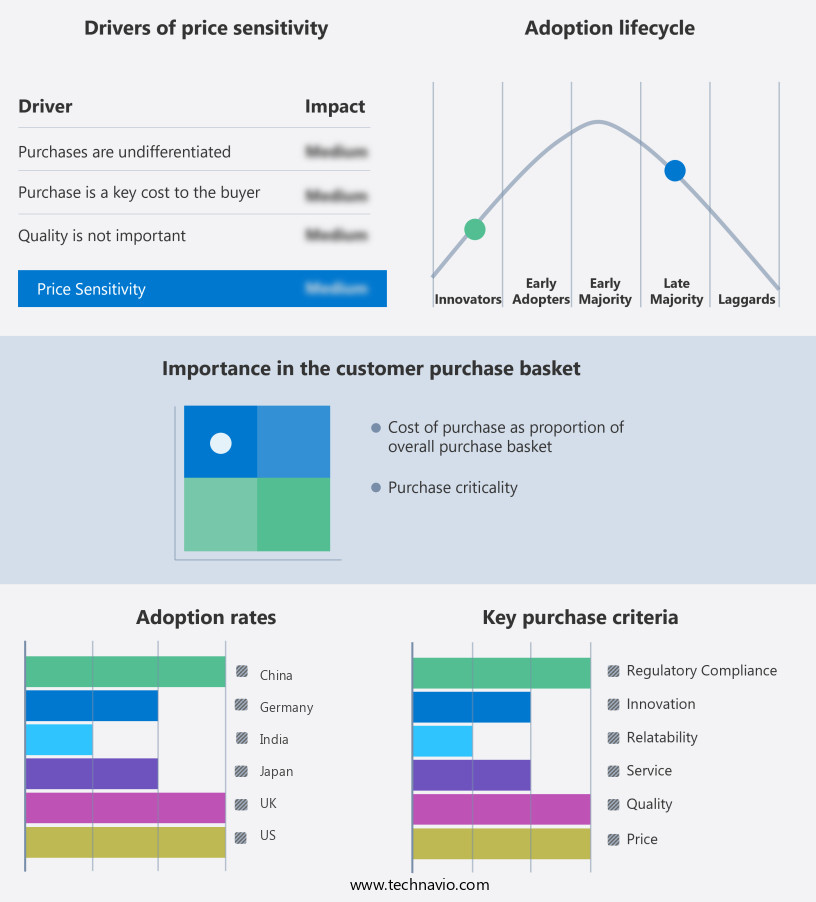

Exclusive Customer Landscape

The herbal medicine market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the herbal medicine market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, herbal medicine market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arizona Natural Products - The company specializes in herbal medicine solutions, including Arkofluides Articulations BIO.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arizona Natural Products

- Arkopharma Laboratories

- Beijing Tongrentang Co Ltd.

- Bio Botanica Inc.

- Blackmores Ltd.

- Charak Pharma Pvt. Ltd.

- Dabur India Ltd.

- Dasherb Corp.

- Dr. Willmar Schwabe GmbH and Co. KG

- Emami Ltd

- Hamdard Laboratories

- Himalaya Global Holdings Ltd.

- Hishimo Pharmaceuticals Pvt. Ltd.

- Imperial Ginseng Products Ltd.

- Ricola Group AG

- Schaper and Brummer GmbH and Co. KG

- Sido Muncul

- Tsumura and Co.

- Weleda

- ZeinPharma Germany GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Herbal Medicine Market

- In January 2024, Swiss-based pharmaceutical company, Novartis, announced the launch of Sinexia, a new business unit dedicated to herbal medicines and dietary supplements, marking a significant expansion into the market (Novartis Press Release, 2024).

- In March 2024, German herbal medicines manufacturer, Dr. Willmar Schwabe, and Indian Ayurvedic company, Dabur India, entered into a strategic partnership to co-develop and commercialize Ayurvedic and herbal products in India and Europe (Dr. Willmar Schwabe Press Release, 2024).

- In April 2024, Chinese herbal medicine company, Yunnan Baiyao Group, raised approximately USD 500 million through an initial public offering (IPO) on the Hong Kong Stock Exchange, demonstrating strong investor interest in the market (Yunnan Baiyao IPO Prospectus, 2024).

- In May 2025, the European Medicines Agency (EMA) granted a marketing authorization for Hanmi Pharmaceutical's herbal medicine, HMPL-523, for the treatment of mild to moderate Alzheimer's disease, signaling a key regulatory approval for herbal medicines in the European market (EMA Press Release, 2025).

Research Analyst Overview

- The market encompasses a diverse range of products derived from cultivated and wildcrafted herbs. Regulations governing herbal medicine are increasingly stringent, focusing on safety and standardization. Herbal toxicity and drug interactions are key concerns, necessitating clinical pharmacokinetic studies and proper labeling. Herbal medicine sustainability is a significant trend, with a push towards fair trade sourcing and certification. Innovations in herbal medicine include the development of standardized extracts and patents.

- Herbal medicine packaging must adhere to regulations, ensuring transparency regarding herbal drug interactions and adverse events. Herbal medicine conferences provide a platform for sharing research on herbal medicine education, certifications, and formulations. Herbal extracts offer consistent potency and quality, addressing concerns over herbal toxicity and variability in wildcrafted herbs.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Herbal Medicine Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

262 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 49.98 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, China, Japan, India, Canada, Germany, South Korea, UK, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Herbal Medicine Market Research and Growth Report?

- CAGR of the Herbal Medicine industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Asia, North America, Europe, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the herbal medicine market growth of industry companies

We can help! Our analysts can customize this herbal medicine market research report to meet your requirements.