Herpes Treatment Market Size 2024-2028

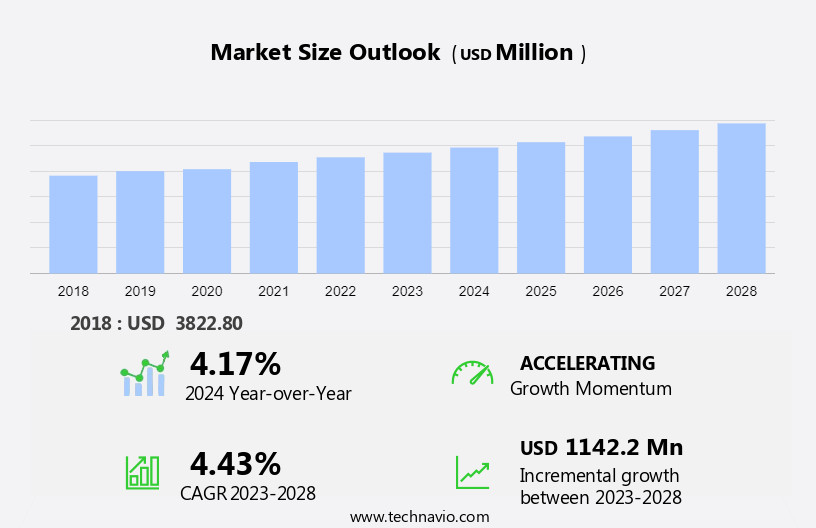

The herpes treatment market size is forecast to increase by USD 1.14 billion at a CAGR of 4.43% between 2023 and 2028.

- The herpes treatment market is experiencing significant growth due to the increasing prevalence of herpes infections and a large patient pool. The market encompasses various interventions for managing Herpes Simplex Virus (HSV) infections, including antiviral drugs and vaccines. According to the World Health Organization, approximately 3.7 billion people under the age of 50 are infected with herpes simplex type 1, and over 491 million people have herpes simplex type 2. Moreover, the older population is witnessing a rising prevalence rate of shingles, which is a complication of the varicella-zoster virus, leading to an increased demand for antiviral medications and therapies. This trend is expected to continue, making the herpes treatment market a lucrative investment opportunity for pharmaceutical companies.

What will be the Size of the Herpes Treatment Market During the Forecast Period?

- The market encompasses various interventions for managing Herpes Simplex Virus (HSV) infections, including antiviral drugs and vaccines. Genital herpes infections, caused by HSV-1 and HSV-2, are a significant health and wellness concern worldwide. Antiviral drugs, such as Acyclovir, Valacyclovir, and Famciclovir, are commonly used for treating both oral and genital herpes infections. These medications inhibit the virus from replicating, reducing the severity and duration of symptoms.

- Phase 1/2 clinical trials are ongoing for developing new therapeutic approaches, including gene therapy and mRNA therapeutics, to tackle HSV infections more effectively. HSV infections can be transmitted through saliva, vaginal secretions, and semen, making prevention and treatment crucial for the hospital population. The market for herpes treatment is driven by the increasing healthcare expenditure and the growing need for effective antiviral drugs and potential vaccines against Varicella-zoster viruses.

How is this Herpes Treatment Industry segmented and which is the largest segment?

The herpes treatment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Vaccination

- Drug therapy

- Type

- Herpes zoster

- Herpes simplex

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- Asia

- Japan

- Rest of World (ROW)

- North America

By Product Insights

- The vaccination segment is estimated to witness significant growth during the forecast period. The market encompasses various interventions, including antiviral medications like Acyclovir Oral Suspension, and the exploration of innovative approaches such as gene therapy and mRNA therapeutics. Acyclovir and its derivatives, Famciclovir and Valacyclovir, are commonly used for managing herpes simplex virus (HSV) infections caused by HSV-1 and HSV-2. These infections can manifest in different forms, including herpetic gingivostomatitis, and can lead to symptoms such as odynophagia and irritation In the saliva, vaginal secretion, and semen. Genetic retinal diseases, such as herpes simplex virus retinitis, pose a significant challenge In the field of ophthalmology. Rational Vaccines, a biotech company, is currently conducting a Phase 1/2 clinical trial for RVx-001-PSS, a live-attenuated vaccine for preventing HSV-1 and HSV-2 infections.

Get a glance at the market report of share of various segments Request Free Sample

The vaccination segment was valued at USD 2.11 billion in 2018 and showed a gradual increase during the forecast period.

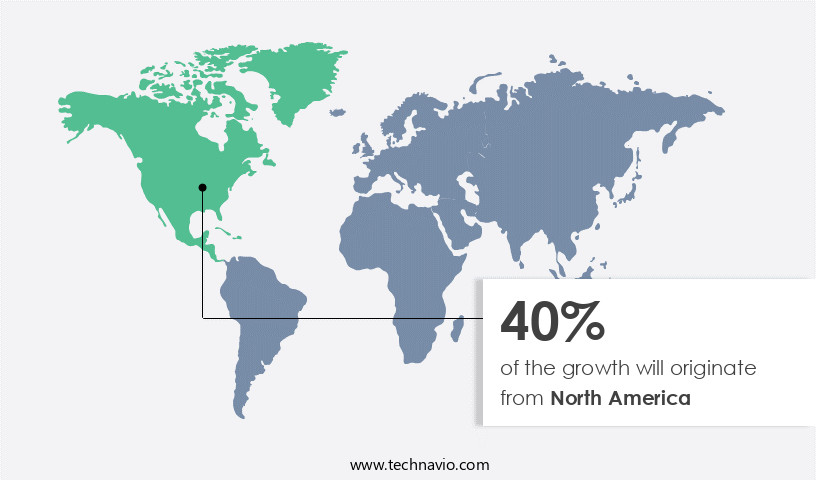

Regional Analysis

- North America is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market In the North American region is primarily driven by the demand for drugs and vaccines used In the management of Oral herpes, caused by HSV-1 infection, and Genital herpes, caused by HSV-2 infection. Acyclovir Oral Suspension is a widely used antiviral medication for the treatment of herpes. The market's growth is also fueled by the increasing prevalence of herpes among the geriatric population due to weakened immune systems. Complications such as Postherpetic Neuralgia (PHN) and fibromyalgia further necessitate effective treatment options. In the pipeline, Rational Vaccines' RVx-001-PSS is undergoing Phase 1/2 clinical trials for the prevention of HSV-1 and HSV-2 infections.

For more insights on the market size of various regions, Request Free Sample

Virios Therapeutics' IMC-1 is another potential treatment for herpes, targeting the latent form of the virus. Fibromyalgia and Irritable bowel syndrome, often co-occurring with herpes, add to the healthcare expenditure. Retail pharmacies stock Over-the-counter (OTC) products like Lidocaine and Benzocaine for symptomatic relief. Reimbursement policies and healthcare expenditure significantly impact the market. Live-attenuated vaccines, subunit vaccines, DNA vaccines, and mRNA vaccines like HSV529 from Sanofi and BNT163 are under development. Acyclovir, Famciclovir, and Valacyclovir are commonly used antiviral drugs for herpes treatment. Herpetic gingivostomatitis, a severe form of Oral herpes, requires intravenous rehydration. Saliva and vaginal secretion, as well as semen, can transmit the virus, highlighting the importance of effective prevention and treatment strategies. HSV-1 segment dominates the market due to its higher prevalence and the availability of effective treatment options.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Herpes Treatment Industry?

- Increasing prevalence of herpes infection is the key driver of the market. The market, particularly the HSV-2 segment, experiences significant growth due to the increasing prevalence of herpes, especially among individuals with weakened immune systems. Factors contributing to this vulnerability include organ transplant recipients, HIV or AIDS positive individuals, cancer patients undergoing chemotherapy, and those on long-term corticosteroid usage. Despite advancements in organ transplantation, herpesvirus infections remain a significant challenge for transplant recipients, leading to morbidity and mortality. In response, the market witnesses ongoing innovation, with companies such as Gilead Sciences and Assembly Biosciences spearheading developments. Notable advancements include the use of mRNA technology In the form of RVx-201, which holds the ILAP designation from the MHRA Innovation Passport.

- Additionally, oral antiviral treatments like Famciclovir, Valacyclovir, and Acyclovir continue to dominate the market. As the market evolves, companies focus on addressing unmet needs, such as the treatment of Hepatitis B and D coinfections, which often accompany herpes infections. Overall, the market demonstrates resilience and continuous progress, driven by the unmet medical needs and the ongoing pursuit of effective treatments.

What are the market trends shaping the Herpes Treatment Industry?

- Emergence of novel therapies is the upcoming market trend. The market, particularly the HSV-2 segment, faces a significant reliance on a restricted range of therapies. Currently, there is no cure for genital and oral herpes; treatment solely manages the symptoms. Famciclovir, Valacyclovir, and Acyclovir are major drugs used to control genital herpes outbreaks. However, they do not prevent shedding. To address this challenge, research is ongoing to develop innovative treatment options.

- For instance, Genocea's GEN-003 vaccine, under clinical trials, has shown promise in controlling both shedding and outbreaks of HSV-2 infection. In the oral segment, Gilead Sciences and Assembly Biosciences are key players. Moving forward, mRNA technology is being explored with RVx-201, assigned the ILAP designation by the MHRA, and granted an Innovation Passport. Hepatitis B and D treatment innovations from various companies are also shaping the market landscape.

What challenges does the Herpes Treatment Industry face during its growth?

- Highly genericized market is a key challenge affecting the industry growth. The market, particularly the HSV-2 segment, experiences significant competition due to the introduction of generic alternatives. With patent expiries, drugs such as Famciclovir, Valacyclovir, and Acyclovir have seen increased market penetration. This trend is supported by various organizations, both governmental and non-profit, aiming to reduce pharmaceutical costs. The affordability of these generics has intensified industry competition, impacting the revenue of branded drug companies. In Europe and several US states, generic substitution has been implemented to boost the use of generic medicines and decrease overall pharmaceutical costs. Key players In the oral segment, including Gilead Sciences and Assembly Biosciences, face this competition.

- New advancements, such as mRNA technology, represented by RVx-201, and the ILAP designation from the MHRA Innovation Passport, aim to differentiate branded drugs. However, these innovations must navigate the competitive landscape and regulatory requirements. Additionally, companies focus on addressing other viral diseases, like Hepatitis B and D, to diversify their portfolios and maintain market presence.

Exclusive Customer Landscape

The herpes treatment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the herpes treatment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, herpes treatment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AbbVie Inc.

- AiCuris Anti infective Cures AG

- Aurobindo Pharma Ltd.

- Avet Pharmaceuticals Inc.

- Bausch Health Companies Inc.

- CENTURION REMEDIES Pvt. Ltd.

- Cipla Inc.

- Eli Lilly and Co.

- Fresenius SE and Co. KGaA

- Gilead Sciences Inc.

- GlaxoSmithKline Plc

- Maruho Co. Ltd.

- Merck and Co. Inc.

- Novartis AG

- Sanofi SA

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

- Zeelab Laboratories Ltd.

- Zydus Lifesciences Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The Herpes market encompasses infectious conditions caused by the Herpes Simplex Virus (HSV). Herpes infections can manifest in various forms, including Herpes Simplex Virus Type 1 (HSV-1) and Herpes Simplex Virus Type 2 (HSV-2). The global market for Herpes treatments is significant, with a growing number of people seeking effective solutions. These treatments include antiviral drugs, vaccines, and supportive therapies. The Herpes market is driven by factors such as increasing awareness and diagnosis rates, rising prevalence of the disease, and the development of new and innovative treatments. Additionally, the market is fueled by demographic shifts, including an aging population and a rise in sexual activity.

In addition, herpes treatments are available in various forms, including oral medications, topical creams, and injectable therapies. Some of the leading companies in the Herpes market focus on research and development of new treatments, while others offer supportive therapies and educational resources. The market for Herpes treatments is expected to grow In the coming years, driven by increasing demand for effective treatments and a growing awareness of the disease. The use of advanced technologies, such as gene therapy and vaccines, is also expected to contribute to market growth. Overall, the Herpes market is a dynamic and evolving industry, with a significant impact on public health and healthcare systems around the world. The development of new and innovative treatments, coupled with increasing awareness and education, is expected to drive market growth In the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.43% |

|

Market growth 2024-2028 |

USD 1.14 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.17 |

|

Key countries |

US, Japan, Germany, France, and UK |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Herpes Treatment Market Research and Growth Report?

- CAGR of the Herpes Treatment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the herpes treatment market growth of industry companies

We can help! Our analysts can customize this herpes treatment market research report to meet your requirements.