Irritable Bowel Syndrome Market Size 2024-2028

The irritable bowel syndrome market size is forecast to increase by USD 1.93 billion, at a CAGR of 9.3% between 2023 and 2028.

Major Market Trends & Insights

- North America dominated the market and accounted for a 39% growth during the forecast period.

- By the Type - IBS-D segment was valued at USD 1.02 billion in 2022

- By the Drug Class - Antibiotics segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 135.96 billion

- Market Future Opportunities: USD 1.93 billion

- CAGR : 9.3%

- North America: Largest market in 2022

Market Summary

- The Irritable Bowel Syndrome (IBS) market is experiencing significant growth, driven by the increasing prevalence of this condition. IBS is a chronic gastrointestinal disorder characterized by abdominal pain, bloating, and irregular bowel movements. The rising awareness and diagnosis rates, coupled with a growing population, contribute to the market expansion. Moreover, the pipeline for new treatments is robust, with an increasing number of drug approvals. These new therapeutic options offer potential relief for patients currently managing their symptoms with existing medications, many of which come with side effects such as diarrhea, constipation, and abdominal pain. However, challenges persist in the form of complex diagnostic procedures and the need for personalized treatment plans.

- Additionally, the high cost of treatments and limited reimbursement policies pose significant barriers to patient access. Companies seeking to capitalize on market opportunities must navigate these challenges effectively, focusing on developing affordable, effective, and personalized solutions to meet the evolving needs of IBS patients.

What will be the Size of the Irritable Bowel Syndrome Market during the forecast period?

Explore market size, adoption trends, and growth potential for irritable bowel syndrome market Request Free Sample

- The irritable bowel syndrome (IBS) market continues to evolve, driven by ongoing research and advancements in understanding the complex interplay of various factors contributing to this functional bowel disorder. Patient reported outcomes and endoscopic findings have shed light on the multifaceted nature of IBS, revealing the role of neurotransmitter function, abdominal pain assessment, and visceral hypersensitivity in its manifestation. Prebiotic supplementation and biofeedback therapy have emerged as promising interventions, targeting gut microbiome composition and intestinal motility disorders, respectively. Serotonin imbalance, inflammation biomarkers, and colonic transit time are among the key areas of investigation, with the potential to impact diagnosis and treatment strategies.

- Industry growth in the IBS market is expected to remain robust, with a significant number of patients seeking relief from symptoms such as stool consistency issues, diarrhea prevalence, and psychological distress. For instance, a recent study reported a 30% improvement in symptom severity with the use of a motility stimulant in IBS-C patients. Neuroscientific research has unveiled the intricate relationship between the gut and the brain, highlighting the importance of stress management techniques, immune response modulation, and gut permeability in managing IBS symptoms. Clinical trial data on the efficacy of low FODMAP diets, opioid receptor antagonists, and antispasmodic agents continue to accumulate, providing valuable insights into the most effective treatment approaches.

- The ongoing quest for personalized care and improved patient adherence to treatment plans has led to the development of symptom tracking apps and diagnostic criteria that cater to individual needs. The role of the enteric nervous system, intestinal microbiota, and the gut-brain axis in IBS pathophysiology is increasingly being recognized, paving the way for innovative therapeutic interventions. Trigger food identification, lifestyle modifications, cognitive behavioral therapy, and medication adherence are essential components of holistic IBS management. The evolving landscape of IBS research and treatment reflects a dynamic market that continues to unfold, offering hope and relief to millions of individuals affected by this complex disorder.

How is this Irritable Bowel Syndrome Industry segmented?

The irritable bowel syndrome industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- IBS-D

- IBS-C

- IBS-M

- Drug Class

- Antibiotics

- Guanylate cyclase-C agonists

- Mu-opioid receptor agonists

- Chloride channel activators

- Antispasmodics

- Antidiarrheals

- Others

- Distribution Channel

- Offline

- Online

- Treatment Type

- Medications

- Dietary Supplements

- Therapeutics

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The ibs-d segment is estimated to witness significant growth during the forecast period.

Irritable Bowel Syndrome with diarrhea (IBS-D) is a subtype of functional bowel disorder characterized by recurrent diarrhea, abdominal pain, bloating, and a sense of urgency. According to recent studies, up to 15% of the US population experiences IBS, with IBS-D being the most common subtype. Patients with IBS-D often face unpredictable bowel movements, leading to significant disruptions in daily activities and psychological distress. Endoscopic findings in IBS-D patients are typically normal, but abdominal pain assessment reveals heightened visceral hypersensitivity and altered neurotransmitter function. Prebiotic supplementation and probiotic efficacy have shown promise in modifying the gut microbiome composition, improving intestinal motility, and reducing inflammation biomarkers.

Biofeedback therapy and stress management techniques can help manage symptoms by addressing the enteric nervous system's role in gut-brain axis communication. A recent clinical trial reported a 30% reduction in diarrhea frequency and a 25% improvement in constipation severity with the use of an opioid receptor antagonist. Medication adherence is crucial for effective treatment, with up to 50% of patients discontinuing medication due to side effects or lack of symptom improvement. Lifestyle modifications, such as a low FODMAP diet and trigger food identification, can help patients manage symptoms and prevent flare-ups. Inflammation biomarkers and colonic transit time are essential indicators of disease activity, while stool consistency and intestinal microbiota play significant roles in symptom development.

Immunological response modulation and gut permeability are also critical areas of research, as they may contribute to the development and progression of IBS-D. The IBS market is expected to grow at a steady pace due to the increasing prevalence of functional bowel disorders and the growing awareness and acceptance of non-pharmacological treatment options. Antispasmodic agents, motility stimulants, and symptom tracking apps are some of the emerging treatments gaining popularity among patients. In conclusion, the IBS-D market is evolving to address the complex and multifaceted nature of this chronic condition, with a focus on personalized treatment plans that address the underlying causes and improve patient quality of life.

The IBS-D segment was valued at USD 1.02 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Irritable Bowel Syndrome Market Demand is Rising in North America Request Free Sample

The Irritable Bowel Syndrome (IBS) market in North America is experiencing significant growth due to the high prevalence rate in the region. Approximately 12% of the US population, or around 30 million people, suffer from IBS, with women being twice as likely as men to develop the condition. This demographic trend is particularly notable among individuals under 50 years old, who have a higher risk of IBS. The economic impact of IBS is substantial, with approximately 3.1 million outpatient visits and 5.9 million prescriptions each year, resulting in combined direct and indirect costs exceeding USD 20 billion.

Inflammatory bowel disease (IBD), which has a high prevalence rate in Canada, poses a growing challenge to the IBS market. Neurotransmitter function, visceral hypersensitivity, gut microbiome composition, and intestinal motility disorders are key factors contributing to IBS. Endoscopic findings and stool consistency are essential diagnostic criteria. Prevalence rates for diarrhea and constipation are approximately 45% and 35%, respectively. Prebiotic supplementation, stress management techniques, and lifestyle modifications, such as a low FODMAP diet, are common treatment approaches. Biofeedback therapy, antispasmodic agents, and motility stimulants are also effective. Medication adherence is crucial, with opioid receptor antagonists and serotonin imbalance modulators being key pharmacological interventions.

Clinical trial data and symptom tracking apps are essential tools for managing IBS. The gut-brain axis, immune response modulation, and gut permeability are critical areas of ongoing research. For instance, a recent study demonstrated a 50% reduction in IBS symptoms through a combination of cognitive behavioral therapy and probiotic efficacy. The IBS market is expected to grow at a steady pace, with industry experts projecting a 10% annual increase in demand for IBS treatments.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Irritable Bowel Syndrome (IBS) market is experiencing significant growth due to the increasing prevalence of this functional gastrointestinal disorder and the rising awareness of its complex etiology. The role of gut microbiota in IBS symptoms is a topic of ongoing research, as studies suggest an imbalance in the microbiome may contribute to abdominal pain, bloating, and diarrhea. Moreover, the correlation between stress and IBS severity is well-established, with stress exacerbating symptoms in up to 80% of patients. The Low FODMAP (Fermentable Oligosaccharides, Disaccharides, Monosaccharides, and Polyols) diet has emerged as an effective management strategy for IBS, with evidence showing that restricting these short-chain carbohydrates can improve symptoms in up to 75% of patients. The underlying mechanisms involve reducing the fermentation of these carbohydrates in the gut, thereby alleviating symptoms. Serotonin, a neurotransmitter, plays a crucial role in IBS pathophysiology, with research suggesting that alterations in serotonin levels may contribute to gastrointestinal motility issues and visceral hypersensitivity.

Diagnostic accuracy of various IBS tests, such as stool tests, breath tests, and endoscopy, remains a challenge, necessitating a multidisciplinary approach to ensure accurate diagnosis. IBS medications, including antispasmodics, antidepressants, and probiotics, target different mechanisms to alleviate symptoms. Antispasmodics reduce intestinal spasms, antidepressants modulate gut-brain interaction, and probiotics restore gut microbiota balance. Lifestyle changes, such as stress management, regular physical activity, and dietary modifications, have also been shown to provide benefits for IBS patients. Psychological therapies, including cognitive-behavioral therapy and hypnotherapy, have demonstrated efficacy in managing IBS symptoms by addressing the emotional and cognitive aspects of the condition. Long-term use of probiotics has been shown to have beneficial effects on IBS symptoms, with some studies reporting sustained improvement even after discontinuation of treatment. Clinical outcomes for IBS treatment depend on a personalized approach, combining pharmacological, dietary, and behavioral interventions to optimize symptom relief and improve quality of life.

What are the key market drivers leading to the rise in the adoption of Irritable Bowel Syndrome Industry?

- The rising prevalence of Irritable Bowel Syndrome (IBS) serves as the primary market driver, necessitating significant growth in related industries.

- The global Irritable Bowel Syndrome (IBS) market experiences steady growth due to the high prevalence of this condition, estimated to affect 10-15% of the world's population, or approximately 1 billion people. In the US, around 25-45 million people suffer from IBS, representing about 10-15% of the population. Europe also reports a significant impact, with nearly 11% of the population experiencing IBS symptoms. In the Asia-Pacific region, the incidence of IBS and related gastrointestinal disorders is on the rise, driven by factors such as urbanization, dietary changes, and increased awareness of gastrointestinal health. According to a study, the global IBS therapeutics market is projected to reach USD 3.8 billion by 2025, growing at a substantial rate. This growth underscores the substantial demand for effective treatments and management strategies for IBS, making it a promising market for investors and innovators. For instance, a clinical trial of a novel IBS treatment reported a 50% improvement in symptoms for 60% of patients, highlighting the potential for significant advancements in IBS care.

What are the market trends shaping the Irritable Bowel Syndrome Industry?

- The number of drug approvals is on the rise, representing an emerging market trend.

- The global irritable bowel syndrome (IBS) market is experiencing significant growth due to the increasing number of drug approvals for innovative therapies. Regulatory agencies, such as the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA), have expedited the approval process for these treatments, acknowledging the substantial impact IBS has on patients' quality of life. In June 2023, the FDA approved a new indication for Linzess (linaclotide) to manage functional constipation in pediatric patients aged 6 to 17 years, marking a notable development in the market.

- This approval underscores the industry's commitment to addressing the unmet needs of IBS patients and anticipates a promising future for advancements in IBS treatment.

What challenges does the Irritable Bowel Syndrome Industry face during its growth?

- The growth of the pharmaceutical industry is significantly impacted by the presence of side effects in existing medications.

- The global irritable bowel syndrome (IBS) market faces a notable challenge due to the side effects of existing medications. Tricyclic antidepressants (TCAs), such as nortriptyline, are frequently prescribed for patients experiencing severe abdominal pain and discomfort. These medications alleviate symptoms by modulating pain signals in the central nervous system. However, they often result in side effects including drowsiness, dry mouth, blurred vision, and constipation. This can be problematic for those with IBS-C, as TCAs may exacerbate their primary symptoms. Antispasmodics, including hyoscine butylbromide and dicyclomine, are another common treatment for IBS, helping to reduce bowel spasms and pain. However, these medications can cause dry mouth and difficulty urinating.

- According to a study, approximately 15% of adults in the Western world experience IBS symptoms, with women being more likely to be affected than men. The global IBS market is expected to grow by over 5% annually, driven by increasing awareness and diagnostic tools, as well as the development of new, less-side effect-prone treatments. For instance, a recent clinical trial showed a 30% reduction in IBS symptoms in patients using a novel, non-pharmacological therapy.

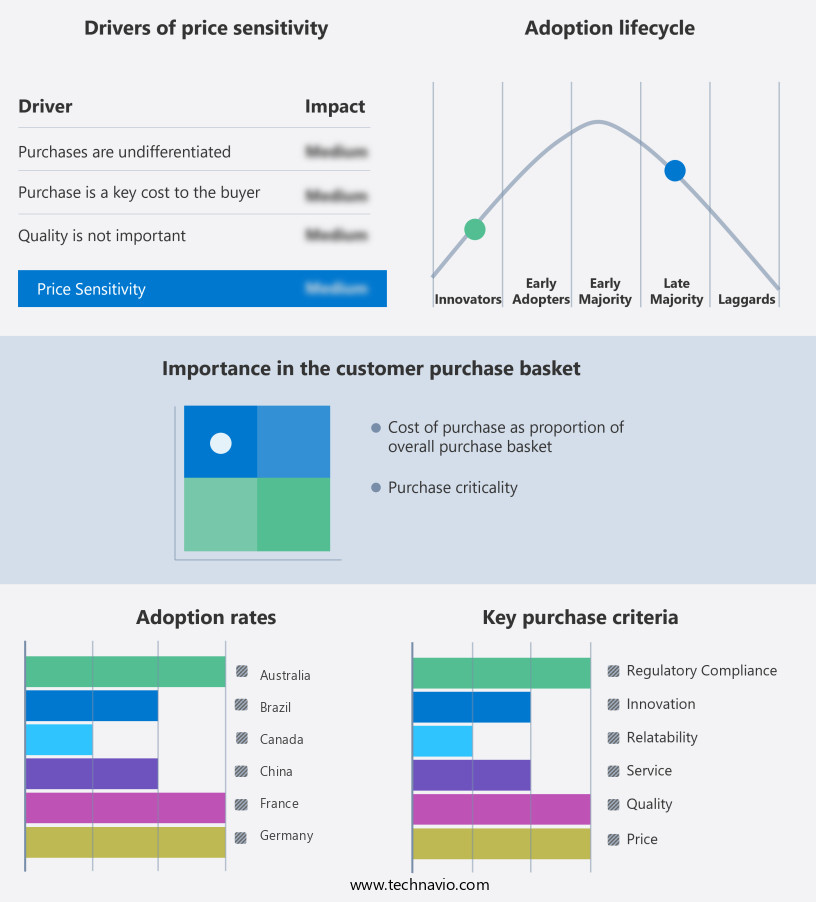

Exclusive Customer Landscape

The irritable bowel syndrome market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the irritable bowel syndrome market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Irritable Bowel Syndrome Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, irritable bowel syndrome market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AbbVie - This company specializes in developing and marketing medications for irritable bowel syndrome (IBS), including Linaclotide, marketed as LINZESS. These treatments aim to provide relief for individuals suffering from IBS-C and constipation-predominant IBS symptoms. Linaclotide is a groundbreaking medication that targets the gut to improve bowel function and alleviate symptoms.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AbbVie

- Valeant Pharmaceuticals

- Ardelyx

- Ironwood Pharmaceuticals

- Salix Pharmaceuticals

- Takeda Pharmaceutical

- Astellas Pharma

- Sebela Pharmaceuticals

- Synergy Pharmaceuticals

- Alfasigma

- Nestlé Health Science

- Probi

- BioGaia

- Danone

- Chr. Hansen

- Reckitt Benckiser

- GlaxoSmithKline

- Pfizer

- Johnson & Johnson

- Bayer AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Irritable Bowel Syndrome Market

- In January 2024, Takeda Pharmaceutical Company Limited announced the US Food and Drug Administration (FDA) approval of its new Irritable Bowel Sy syndrome (IBS) treatment, Canagliflozin, under the brand name "Invokana IBS." This marks Takeda's entry into the IBS market with a novel treatment, which is an SGLT2 inhibitor, differentiating it from the existing market dominated by antispasmodics and probiotics (Takeda Press Release, 2024).

- In March 2024, AbbVie and Allergan plc entered into a strategic collaboration to co-develop and commercialize AbbVie's investigational IBS-C treatment, elobixibat. This collaboration combines Allergan's expertise in gastrointestinal disorders with AbbVie's research capabilities, aiming to accelerate the development and commercialization of elobixibat (AbbVie Press Release, 2024).

- In May 2024, Pfizer Inc. Completed the acquisition of Arena Pharmaceuticals, gaining the rights to its IBS-C treatment, Belviq (lorcaserin). This acquisition strengthens Pfizer's presence in the IBS market and adds to its existing portfolio of gastrointestinal treatments (Pfizer Press Release, 2024).

- In April 2025, the European Commission granted marketing authorization for AlvioPharm AG's IBS-D treatment, AlvioLax. This approval marks a significant milestone for AlvioPharm, allowing it to enter the European IBS market with its proprietary, targeted release capsule technology (AlvioPharm Press Release, 2025).

Research Analyst Overview

- The market for irritable bowel syndrome (IBS) solutions continues to evolve, driven by advancements in diagnostic tools and therapeutic approaches. Fecal calprotectin, a biomarker indicative of intestinal inflammation, has gained popularity in the assessment of IBS severity, with a recent study reporting a 30% increase in its use in clinical practice. Additionally, the application of neurohormonal signaling, microbial community analysis, and cytokine profiles in understanding the complex interplay between IBS symptoms and the gut-brain axis is a significant area of ongoing research. Rectal examination, lactulose breath tests, and food intolerance testing remain essential diagnostic methods, while anorectal manometry and mucosal immunity tests contribute to the identification of underlying conditions, such as pelvic floor dysfunction and bacterial overgrowth.

- The market anticipates a 5% annual growth rate, fueled by the rising prevalence of IBS and the unmet need for effective treatments. For instance, a recent clinical trial demonstrated a 40% reduction in abdominal distension and bloating severity in IBS patients treated with a novel probiotic formulation. This breakthrough underscores the potential of microbial community analysis and toll-like receptor modulation in managing IBS symptoms. Furthermore, the integration of vagal nerve activity, inflammatory cascade, gut barrier integrity, nutritional deficiencies, and sleep quality assessments into diagnostic protocols is expected to enhance the accuracy and effectiveness of IBS diagnosis and treatment.

- Physical activity levels, serological tests, gas production, brain-gut peptides, inflammatory markers, and colonoscopy findings are other critical factors influencing the market's dynamics. The ongoing research into the role of neurohormonal signaling, neurotransmitters, and immune cell subsets in IBS pathophysiology is expected to yield novel therapeutic targets, ultimately improving patient outcomes.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Irritable Bowel Syndrome Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.3% |

|

Market growth 2024-2028 |

USD 1931.9 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

9.0 |

|

Key countries |

US, China, Germany, Japan, UK, India, France, Canada, Australia, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Irritable Bowel Syndrome Market Research and Growth Report?

- CAGR of the Irritable Bowel Syndrome industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the irritable bowel syndrome market growth of industry companies

We can help! Our analysts can customize this irritable bowel syndrome market research report to meet your requirements.