High-Pressure Oil And Gas Separator Market Size 2024-2028

The high-pressure oil and gas separator market size is forecast to increase by USD 155.5 million at a CAGR of 1.2% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. The increasing exploration and production of unconventional oil and gas resources are driving market demand. Furthermore, ongoing research and development activities aiming to enhance the efficiency and performance of separators are contributing to market growth. Fluctuations in crude oil and gas prices continue to impact the market dynamics, necessitating the need for cost-effective and efficient separator solutions. These trends underscore the importance of continuous innovation and technological advancements In the market.

What will be the Size of the High-Pressure Oil And Gas Separator Market During the Forecast Period?

- The high-pressure separator market encompasses technologies designed for separating gaseous components from liquid components in high-pressure oil and gas production processes. This market caters to both onshore and offshore production, with applications in shale oil and gas fields, as well as conventional oil and gas deposits. Market dynamics are influenced by exploration and drilling activities, driven by the need to maximize crude oil and natural gas yields. Crude oil prices and shale gas reserves significantly impact market growth. Renewable energy sources and emissions regulations have led to increased focus on reducing flaring and venting, further boosting demand for advanced separator technologies.

- Hydraulic fracturing and horizontal drilling techniques have expanded the market scope. Separator technologies play a crucial role in refineries by ensuring the production of cleaner fuels and reducing greenhouse gas emissions. Artificial intelligence and advanced pressure container designs are key trends shaping the market, enabling more efficient and cost-effective separation processes. The market caters to a wide range of production fluids, including well stream gases and crude oil, ensuring energy efficiency and environmental sustainability.

How is this High-Pressure Oil And Gas Separator Industry segmented and which is the largest segment?

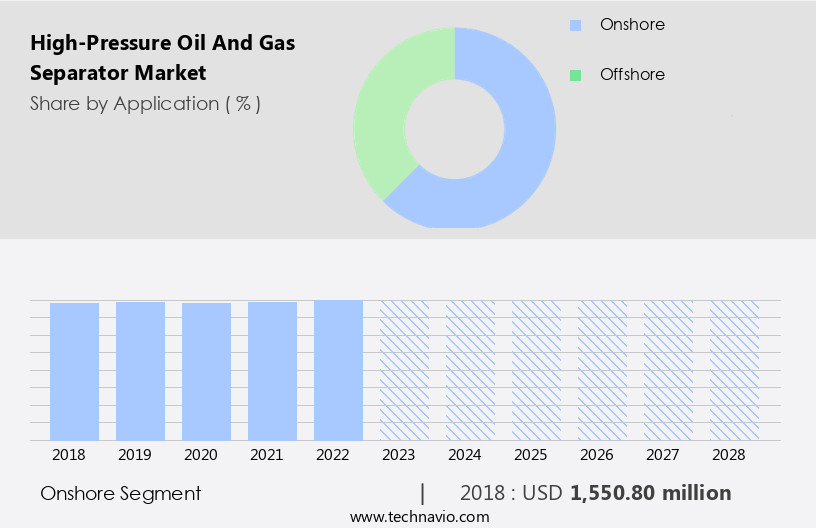

The high-pressure oil and gas separator industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Onshore

- Offshore

- Type

- Horizontal

- Vertical

- Spherical

- Geography

- Middle East and Africa

- North America

- Canada

- US

- APAC

- China

- Europe

- South America

- Middle East and Africa

By Application Insights

- The onshore segment is estimated to witness significant growth during the forecast period.

The market encompasses technologies used In the separation of produced fluids from oil and gas well streams. These separators are integral to both onshore and offshore production, particularly In the context of high-pressure environments. Shale gas reserves, onshore oil fields, and offshore exploration have witnessed significant growth due to increasing crude oil prices and exploration and drilling activities. However, the market's expansion is influenced by factors like emissions regulations, flaring and venting, and the shift towards renewable energy sources. Separator technologies include gravity separation, centrifugal technology, and hydraulic fracturing-related horizontal separators. Two-phase, three-phase, and four-phase separators cater to various production fluid compositions.

Offshore production facilities, refineries, and processing facilities utilize these separators for water separation and gas supply. The integration of advanced technologies, such as artificial intelligence, machine learning, the Internet of Things, automation, digital twins, water management, and intelligent control systems, is crucial for optimizing production, reducing environmental footprint, and ensuring energy security. Produced water treatment, modular separators, compact separators, and pressure containers are essential components of high-pressure separator systems.

Get a glance at the High-Pressure Oil And Gas Separator Industry report of share of various segments Request Free Sample

The Onshore segment was valued at USD 1550.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Middle East and Africa (MEA) region, with countries like Saudi Arabia, Iran, the UAE, and Kuwait, has been a significant contributor to global crude oil and natural gas production since the 1950s. The region's low production costs, with crude oil production in Kuwait and Saudi Arabia costing less than single digits, make it an attractive destination for drilling activities. The market in MEA is anticipated to expand moderately during the forecast period. The market growth is influenced by exploration and drilling activities in onshore and offshore oil fields and gas deposits, including shale gas reserves, oil sands, and oil shale.

Separator technologies, such as gravity separation, centrifugal technology, and hydraulic fracturing, are crucial for processing production fluids, separating gaseous and liquid components, and managing water resources. Energy security, emissions regulations, and the integration of advanced technologies like artificial intelligence (AI), machine learning (ML), the Internet of Things (IoT), automation, digital twins, intelligent control systems, and produced water treatment, are shaping the market landscape. Key trends include the installation of modular and compact separators, pressure containers, and advanced vessel configurations, such as horizontal and spherical separators, deliquilizers, scrubbers, degassers, and gravitational and centrifugal technology. The market growth is also influenced by crude oil production, condensate production, and gas supply from onshore and offshore refineries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of High-Pressure Oil And Gas Separator Industry?

Rise in unconventional oil and gas resources is the key driver of the market.

- The global high-pressure separator market In the oil and gas industry has experienced significant growth due to the increasing exploration and drilling activities in unconventional resources such as shale gas, oil sands, and oil shale. These resources have become increasingly important as crude oil prices have fluctuated and hydrocarbon reserves in traditional oil fields and gas deposits have declined. High-pressure separators are essential in processing fluids from well streams, separating gaseous components from liquid components in high-pressure and high-temperature environments. Two-phase, three-phase, and four-phase separators are commonly used In the industry, with vessel types including horizontal, spherical, and vertical.

- Offshore exploration and production have also driven the demand for high-pressure separators, particularly in deep-water oil and gas fields. The use of advanced technologies such as artificial intelligence (AI), machine learning (ML), the Internet of Things (IoT), automation, digital twins, and intelligent control systems have improved the efficiency and environmental footprint of these separators. The increasing focus on water management, energy security, and emissions regulations has led to the development of modular and compact separators, as well as pressure containers for produced water treatment. The oil sands industry, with significant reserves in Canada and other countries, has also contributed to the growth of the high-pressure separator market.

- The market is expected to continue growing as the industry adapts to new technologies and exploration and drilling activities in onshore and offshore locations. The oil and gas industry's shift towards renewable energy sources and the reduction of flaring and venting to minimize greenhouse gas emissions are also expected to impact the high-pressure separator market. The use of gravity separation, hydraulic fracturing, and horizontal drilling in shale oil and gas production has led to an increase In the demand for separator technologies. The market is expected to remain dynamic as the industry continues to evolve and adapt to new challenges and opportunities.

What are the market trends shaping the High-Pressure Oil And Gas Separator Industry?

Ongoing research and development activities is the upcoming market trend.

- High-pressure oil and gas separators play a crucial role In the production of crude oil and natural gas from both onshore and offshore oil fields and gas deposits. These separators are essential for processing production fluids, which contain gaseous and liquid components, to prepare them for transportation and further refining. The efficiency of high-pressure separators is influenced by various factors, including the nature of inlet devices and the pressure conditions of the well stream. Inlet devices, such as diverter plates, inlet vane distributors, halfpipes, inlet cyclones, tangential inlets with annular rings, slotted tee distributors, and deflector baffles, are used to separate the bulk liquid from the gas stream.

- The choice of an appropriate inlet device is crucial as it impacts the separator's efficiency and complexity. An optimal inlet device minimizes the creation of droplets, reduces inlet momentum, and ensures good vapor distribution. Moreover, the oil and gas industry is undergoing digital transformation, with companies increasingly focusing on digitizing pipelines and separators. This trend is driving the adoption of advanced technologies such as artificial intelligence (AI), machine learning (ML), the Internet of Things (IoT), automation, digital twins, intelligent control systems, and produced water treatment. These technologies enhance energy security, improve water management, and reduce the environmental footprint by optimizing separation processes, minimizing flaring and venting, and reducing greenhouse gas emissions.

- Modern high-pressure separators come in various configurations, including modular and compact designs, pressure containers, and vessel types such as horizontal, vertical, and spherical separators. They are used in various applications, including offshore exploration, oil sands, oil shale, hydrocarbon reserves, crude oil production, condensate production, and gas supply. Separator technologies, such as gravity separation, hydraulic fracturing, horizontal drilling, and shale oil production, are continuously evolving to meet the demands of the industry. In conclusion, the market is driven by the need to maximize crude oil and natural gas production while minimizing costs and reducing the environmental impact. The market is characterized by ongoing research and development efforts to improve separator efficiency and reduce equipment costs.

- The adoption of digital technologies and advanced separation processes is transforming the industry, making it more efficient, sustainable, and cost-effective.

What challenges does the High-Pressure Oil And Gas Separator Industry face during its growth?

Fluctuations in crude oil and gas prices is a key challenge affecting the industry growth.

- The High-pressure separator market plays a crucial role In the oil and gas industry, particularly during offshore and onshore production. High-pressure separators are essential for separating hydrocarbon mixtures into their respective components, including crude oil, condensate, water, and gaseous components. These separators are employed in various oil fields and gas deposits, including shale gas reserves, oil sands, and oil shale. The market dynamics of the separator market are significantly influenced by exploration and drilling activities, as well as the availability and price of crude oil and natural gas. Fluctuations in crude oil prices can impact the profitability and performance of oil and gas companies, potentially leading to the cancellation or postponement of projects.

- In recent years, the demand for oil has been affected by various factors, including the rise of renewable energy sources and emissions regulations. High-pressure separator technologies, such as gravity separation, centrifugal technology, and hydraulic fracturing, are used to process production fluids and ensure energy security. Intelligent control systems, digital twins, and automation technologies, including artificial intelligence (AI) and machine learning (ML), are increasingly being adopted to optimize separation processes, improve efficiency, and reduce the environmental footprint. Produced water treatment, modular separators, and compact separators are also gaining popularity due to their ability to reduce installation and processing costs.

- Pressure containers, such as horizontal, spherical, vertical, and vessel-type separators, are used to handle high-pressure fluids and ensure the safe and efficient separation of liquids and gases. Offshore drilling and production, as well as refineries, rely on high-pressure separators to process offshore exploration and onshore drilling fluids. These separators are also used to process gas supply streams and ensure the safe and efficient separation of gaseous components, such as CO2, methane, and nitrogen. The market for high-pressure separators is expected to grow due to the increasing demand for crude oil and natural gas, as well as the need to reduce greenhouse gas emissions and improve water management.

- The market is also expected to be driven by the adoption of advanced separation technologies, such as gravitational technology and degassers, as well as the increasing use of deliquilizers, scrubbers, and degassers to improve the efficiency and safety of oil and gas production.

Exclusive Customer Landscape

The high-pressure oil and gas separator market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the high-pressure oil and gas separator market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, high-pressure oil and gas separator market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ACS Manufacturing Inc. - High-pressure oil and gas separators are essential components In the extraction process, facilitating the separation of gas from liquid in well streams. These separators, including two-phase models, play a crucial role in optimizing production efficiency and ensuring the integrity of downstream processes. By effectively removing excess gas, these separators prevent operational issues such as equipment damage and production losses. With advancements in technology, high-pressure oil and gas separators continue to evolve, offering enhanced performance and reliability for the global energy sector.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACS Manufacturing Inc.

- Alfa Laval AB

- AMACS Process Tower Internals

- Atlas Copco AB

- BNF Engineering Pte Ltd.

- Drainstore Ltd.

- ERGIL

- GEA Group AG

- Godrej and Boyce Manufacturing Co. Ltd.

- Grand Prix Engineering Pvt. Ltd.

- Halliburton Co.

- Honeywell International Inc.

- Kapwell Ltd.

- McDermott International Ltd.

- Pentair Plc

- Schlumberger Ltd.

- Sep Pro Systems Inc.

- TechnipFMC plc

- Worthington Industries Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The high-pressure separator market encompasses a range of technologies designed to separate and process complex hydrocarbon mixtures encountered in both onshore and offshore production. These separators play a crucial role In the oil and gas industry by enabling the efficient extraction and processing of crude oil and condensate from natural gas streams. The demand for high-pressure separators is driven by the increasing exploration and production activities in various regions worldwide. The depletion of conventional oil and gas reserves has led companies to focus on unconventional resources such as shale gas and oil sands. These resources often contain significant amounts of water, impurities, and gaseous components that require effective separation before further processing or transportation.

Two primary types of high-pressure separators are two-phase and three-phase separators. Two-phase separators are designed to separate oil and water mixtures, while three-phase separators can handle oil, water, and gas. Four-phase separators are an extension of three-phase separators, capable of handling additional liquid components. Offshore exploration and production present unique challenges for separator technologies due to the high pressures and temperatures encountered. Offshore installations require large, robust separators to handle the demanding conditions. Horizontal vessel types are commonly used due to their larger capacity and ability to handle larger volumes of fluids. Onshore production also requires efficient separation technologies to maximize crude oil production and minimize emissions.

Gravity separation is a common method used in onshore production facilities to separate oil from water. However, advances in technology have led to the adoption of centrifugal separation, which can handle higher solids content and provide better separation efficiency. The increasing focus on environmental regulations and reducing the environmental footprint of the oil and gas industry has led to the development of advanced separator technologies. Intelligent control systems, digital twins, and automation are being integrated into separator designs to optimize performance, reduce emissions, and improve operational efficiency. Produced water treatment is another area where high-pressure separators play a significant role.

Separators are used to remove solids, oil, and gas from produced water before it is disposed of or reinjected into the reservoir. Modular and compact separators are gaining popularity due to their ease of installation and lower capital costs. The high-pressure separator market is expected to grow as the demand for hydrocarbon resources continues to increase. The integration of advanced technologies such as artificial intelligence, machine learning, and the Internet of Things is expected to drive innovation and improve separator performance. However, the market also faces challenges such as increasing competition, regulatory pressures, and the growing adoption of renewable energy sources.

In conclusion, the high-pressure separator market plays a critical role In the oil and gas industry by enabling the efficient separation and processing of complex hydrocarbon mixtures. The market is driven by the increasing demand for hydrocarbon resources and the need to reduce emissions and improve operational efficiency. Advanced separator technologies and the integration of digital technologies are expected to drive innovation and growth In the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 1.2% |

|

Market growth 2024-2028 |

USD 155.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

1.2 |

|

Key countries |

US, Saudi Arabia, Russia, Canada, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this High-Pressure Oil And Gas Separator Market Research and Growth Report?

- CAGR of the High-Pressure Oil And Gas Separator industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Middle East and Africa, North America, APAC, Europe, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the high-pressure oil and gas separator market growth of industry companies

We can help! Our analysts can customize this high-pressure oil and gas separator market research report to meet your requirements.