Machine Learning Chips Market Size 2024-2028

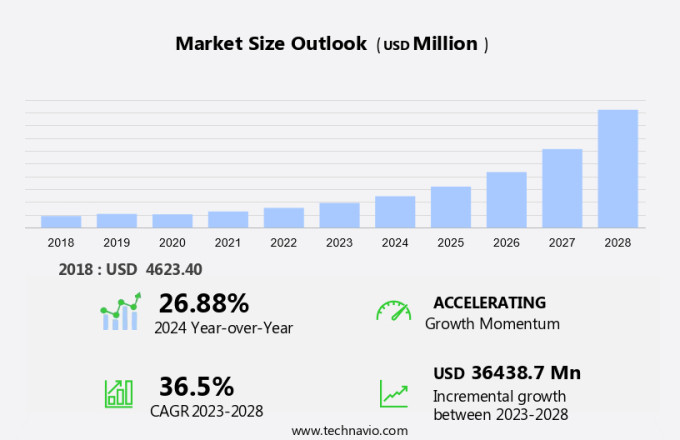

The machine learning chips market size is forecast to increase by USD 36.44 billion at a CAGR of 36.5% between 2023 and 2028. The market is experiencing significant growth due to the increasing integration of machine learning models in various industries. Key drivers include the rising demand for advanced data processing capabilities in data centers and the surge in research and development activities at institutions focusing on natural language processing, computer vision, network security, and other machine learning applications. Additionally, industry verticals such as media and advertising, and the proliferation of smart gadgets are fueling the market's expansion. However, the global chip shortage poses a challenge to market growth. Semiconductor manufacturers are investing heavily to address this issue and meet the increasing demand for machine learning chips. This report provides an in-depth analysis of market trends and growth factors, offering valuable insights for stakeholders in this dynamic and evolving market.

What will be the Size of the Market During the Forecast Period?

The machine learning chips market is experiencing significant growth, driven by the increasing demand for advanced computing solutions in various industries. Machine learning algorithms, algorithmic calculations, and neural network architectures require specialized hardware to optimize performance and energy efficiency. The market for machine learning chips comprises several types of chips, including Application-Specific Integrated Circuits (ASICs), Field-Programmable Gate Arrays (FPGAs), General Purpose Processors (GPPs), and System on Chips (SoCs). Each type of chip offers unique advantages for specific machine learning tasks. ASICs are custom-designed chips optimized for specific machine learning algorithms and neural network architectures.

Furthermore, they offer high performance and energy efficiency but require significant upfront investment for design and manufacturing. FPGAs are programmable chips that can be reconfigured to perform various tasks, including machine learning. They offer flexibility but may not achieve the same level of performance as ASICs. GPPs, such as CPUs and GPUs, are general-purpose processors that can be used for a wide range of applications, including machine learning. GPUs are particularly well-suited for machine learning tasks due to their high parallel processing capabilities. SoCs integrate multiple components, such as processors, memory, and input/output interfaces, into a single chip. They offer system-level integration and power efficiency but may not offer the same level of performance as specialized machine learning chips.

Additionally, the market for machine learning chips is driven by the increasing adoption of machine learning in various industries, including media and advertising, IT and telecom, quantum computing, smart cities, smart homes, artificial intelligence technology, autonomous vehicles, medical images, and x-rays. Machine learning is used for a wide range of tasks, including image and speech recognition, natural language processing, predictive analytics, and algorithmic calculations. Memory structures play a crucial role in machine learning performance. High-bandwidth memory (HBM) and other advanced memory technologies are essential for providing the required data bandwidth for machine learning workloads. The integration of advanced memory technologies into machine learning chips is a key trend in the market.

Moreover, the market is expected to grow at a steady pace due to the increasing demand for advanced computing solutions in various industries. The market is expected to be driven by the increasing adoption of machine learning in applications such as autonomous vehicles, medical imaging, and quantum computing. The development of new neural network architectures and the integration of advanced memory technologies into machine learning chips are also expected to drive market growth. To stay competitive in the market, chip manufacturers must focus on developing chips that offer high performance, energy efficiency, and flexibility. They must also invest in research and development to stay abreast of the latest machine learning algorithms and neural network architectures.

In conclusion, the market is experiencing significant growth due to the increasing demand for advanced computing solutions in various industries. The market comprises several types of chips, including ASICs, FPGAs, GPPs, and SoCs, each with unique advantages for specific machine learning tasks. The market is expected to be driven by the increasing adoption of machine learning in applications such as autonomous vehicles, medical imaging, and quantum computing. Chip manufacturers must focus on developing chips that offer high performance, energy efficiency, and flexibility to stay competitive in the market.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- BFSI

- IT and telecom

- Media and advertising

- Others

- Technology

- System-on-chip (SoC)

- System-in-package

- Multi-chip module

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By End-user Insights

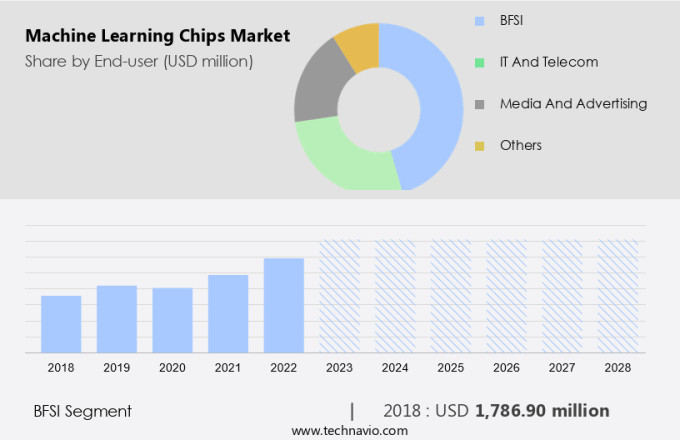

The BFSI segment is estimated to witness significant growth during the forecast period. Machine learning chips have significantly transformed various industries, including healthcare, automotive, and transportation, by enabling advanced computing capabilities. In healthcare, these chips are utilized for storing and processing large amounts of patient data, powering medical imaging systems, and facilitating the implementation of Artificial Intelligence (AI) and Deep learning algorithms. The automotive and transportation sectors are leveraging machine learning chips for real-time data processing, predictive maintenance, and advanced driver assistance systems. In the realm of computing, components, networking, and storage, machine learning chips have been instrumental in enhancing performance and efficiency. AI technologies, such as neural networks and natural language processing, rely heavily on these chips for their computational demands.

However, the increasing adoption of machine learning and AI comes with potential cybersecurity risks. As businesses continue to invest in these technologies, it is crucial to prioritize cybersecurity measures to protect sensitive data. The marketing industry has also been significantly impacted by machine learning chips, with AI being integrated into various marketing technologies like Data Management Platforms (DMPs) and Customer Data Platforms (CDPs). These platforms use machine learning algorithms to analyze user data, enabling businesses to deliver personalized and targeted marketing messages. Cookies are used to track user activity online, allowing for more effective targeting and engagement. The marketing landscape has been fundamentally changed by the integration of machine learning and AI, providing businesses with new opportunities to increase revenue and engage customers across multiple touchpoints.

Get a glance at the market share of various segments Request Free Sample

The BFSI segment was valued at USD 1.79 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

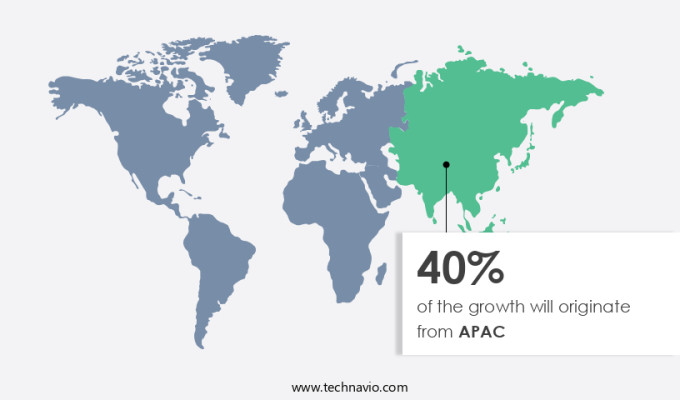

APAC is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market is experiencing significant growth due to escalating investments in the autonomous vehicle industry. Autonomous vehicles incorporate sophisticated systems, including advanced driver assistance systems (ADAS), heads-up displays (HUD), LiDAR, and RADAR, which generate and process vast amounts of real-time data. To address this data processing challenge, chip manufacturers are investing heavily in research and development of machine learning chips tailored for autonomous vehicles. Notable automotive original equipment manufacturers (OEMs) are actively working towards commercializing self-driving cars, creating lucrative opportunities for machine learning chip manufacturers to capitalize on the burgeoning market. The gaming industry is another significant contributor to the market's expansion, as integrated circuits optimized for AI tasks, algorithmic calculations, and neural network architectures are increasingly being integrated into gaming consoles and PCs to enhance user experience.

Furthermore, machine learning chips are gaining traction in various sectors, including medical imaging, where they facilitate faster and more accurate diagnosis and treatment plans. Machine learning chips are also being integrated into memory structures and general-purpose processors to improve overall system performance and efficiency. As the adoption of machine learning technology continues to expand across industries, the demand for specialized machine learning chips is expected to surge.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing adoption of machine learning chips in data centers is the key driver of the market. In today's tech-driven business landscape, data centers play a pivotal role in powering various online services. These data centers house numerous servers, each requiring a central processing unit (CPU) to function. However, with the increasing adoption of artificial intelligence (AI), such as deep neural networks, in sectors like healthcare with X-rays, MRIs, and CT scans, language translation, financial services with algorithmic trading and fraud detection, and consumer electronics like smart speakers, the demand for more powerful processors has surged.

Additionally, neural networks necessitate greater power than CPUs can provide. Consequently, companies are integrating specialized chips to augment CPUs, enhancing data center efficiency and reducing power consumption. By improving uptime and operational costs, these advancements enable businesses to deliver superior services and stay competitive in their respective industries.

Market Trends

Increasing investments in semiconductors is the upcoming trend in the market. The market is poised for significant expansion due to escalating investments in the semiconductor sector by industry players. One such instance is Intel Corporation's announcement in January 2022, committing over USD20 billion towards constructing two new chip manufacturing facilities in the United States. This investment, under Intel IDM 2.0 strategy, aims to enhance production capabilities and cater to the burgeoning demand for sophisticated semiconductors.

Moreover, these advanced chips are instrumental in powering cutting-edge technologies such as quantum computers and autonomous robotics, thereby fueling innovation in high-tech products. This investment underscores Intel's commitment to staying at the forefront of technological advancements and meeting the needs of its customers. The semiconductor industry's growth trajectory is expected to continue, driving the expansion of the market during the forecast period.

Market Challenge

Global chip shortage is a key challenge affecting market growth. The global semiconductor industry has been significantly impacted by the ongoing chip shortage since 2020, causing challenges for various sectors, including data centers, industry verticals, media and advertising, network security, natural language processing, computer vision, and smart gadgets.

However, this predicament has resulted in extended lead times for chip orders, with many businesses facing wait times exceeding 28 weeks for nearly every type of chip. To mitigate the risk of stock shortages, companies have been placing larger orders than necessary, straining manufacturing capacity and escalating costs. Research institutions and chip manufacturers are also experiencing sourcing issues, indirectly contributing to the industry's instability. The semiconductor industry's ripple effect is felt across the electronics landscape, affecting the production of cars, consumer goods, and other essential technologies.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Advanced Micro Devices Inc.- The company offers machine learning chips such as AMD Instinct. This segment focuses on offering CPUs, APUs, and chipsets for desktop and notebook personal computers.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alphabet Inc.

- Baidu Inc.

- Broadcom Inc.

- Cerebras

- Fujitsu Ltd.

- Graphcore Ltd.

- Huawei Technologies Co. Ltd.

- Intel Corp.

- International Business Machines Corp.

- MediaTek Inc.

- Microchip Technology Inc.

- NVIDIA Corp.

- NXP Semiconductors NV

- Qualcomm Inc.

- SambaNova Systems Inc.

- Samsung Electronics Co. Ltd.

- SenseTime Group Inc.

- Taiwan Semiconductor Manufacturing Co. Ltd.

- Tesla Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for advanced computing solutions in various industry verticals. Machine learning algorithms require high computational power for algorithmic calculations and neural network architectures, leading to the adoption of specialized chips such as ASICs (Application-Specific Integrated Circuits), GPUs (Graphics Processing Units), FPGAs (Field-Programmable Gate Arrays), and SoCs (Systems on Chips). These components are essential for AI tasks, including deep learning algorithms, cybersecurity, big data analytics, cloud computing, and quantum computing. The IT and telecom industry, healthcare, automotive and transportation, storage, computing, media and advertising, and financial services are some of the major industry verticals driving the growth of the market.

In summary, the information technology industry and telecommunication industry are investing heavily in digitalization, leading to an increased demand for high-performance chips. The gaming industry also contributes to the growth of the market due to the need for powerful GPUs for rendering graphics. Moreover, the rise of smart cities, smart homes, robotics, and high-tech products is fueling the demand for machine learning models and algorithms. The skilled AI workforce and the availability of structured data are also crucial factors driving the market's growth. The market is expected to continue its upward trajectory due to the increasing need for advanced computing solutions in various applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

190 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 36.5% |

|

Market growth 2024-2028 |

USD 36.44 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

26.88 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 40% |

|

Key countries |

US, China, UK, Germany, and Taiwan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Advanced Micro Devices Inc., Alphabet Inc., Baidu Inc., Broadcom Inc., Cerebras, Fujitsu Ltd., Graphcore Ltd., Huawei Technologies Co. Ltd., Intel Corp., International Business Machines Corp., MediaTek Inc., Microchip Technology Inc., NVIDIA Corp., NXP Semiconductors NV, Qualcomm Inc., SambaNova Systems Inc., Samsung Electronics Co. Ltd., SenseTime Group Inc., Taiwan Semiconductor Manufacturing Co. Ltd., and Tesla Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch