Home Equity Lending Market Size 2025-2029

The home equity lending market size is forecast to increase by USD 48.16 billion, at a CAGR of 4.7% between 2024 and 2029.

- The market is experiencing significant growth, fueled primarily by the massive increase in home prices and the resulting rise in residential properties with substantial equity. This trend presents a lucrative opportunity for lenders, as homeowners with substantial equity can borrow against their homes to fund various expenses, from home improvements to debt consolidation. However, this market also faces challenges. Lengthy procedures and complex regulatory requirements can hinder the growth of home equity lending, making it essential for lenders to streamline their processes and ensure compliance with evolving regulations.

- Additionally, economic uncertainty and potential interest rate fluctuations may impact borrower demand, requiring lenders to adapt their strategies to remain competitive. To capitalize on market opportunities and navigate challenges effectively, lenders must focus on enhancing the borrower experience, leveraging technology to streamline processes, and maintaining a strong regulatory compliance framework.

What will be the Size of the Home Equity Lending Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, shaped by various economic and market dynamics. Fair lending practices remain a crucial aspect, with entities ensuring borrowers' creditworthiness through rigorous risk assessments. Economic conditions, employment history, and credit score are integral components of this evaluation. Mortgage insurance (PMIs) and mortgage-backed securities (MBS) are employed to mitigate risk in the event of default. Verification of income, property value, and consumer protection are also essential elements in the home equity lending process. Housing prices, Homeowners Insurance, and property value are assessed to determine the loan-to-value ratio (LTV) and interest rate risk. Prepayment penalties, closing costs, and loan term are factors that influence borrowers' financial planning and decision-making.

The regulatory environment plays a significant role in shaping market activities. Consumer confidence, financial literacy, and foreclosure prevention initiatives are key areas of focus. real estate market volatility and mortgage rates impact the demand for home equity loans, with cash-out refinancing and debt consolidation being popular applications. Amortization schedules, mortgage broker involvement, and escrow accounts are essential components of the loan origination process. Market volatility and housing market trends continue to unfold, requiring ongoing risk assessment and adaptation.

How is this Home Equity Lending Industry segmented?

The home equity lending industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Source

- Mortgage and credit union

- Commercial banks

- Others

- Distribution Channel

- Offline

- Online

- Purpose

- Home Improvement

- Debt Consolidation

- Investment

- Loan Type

- Fixed-Rate

- Variable-Rate

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Source Insights

The mortgage and credit union segment is estimated to witness significant growth during the forecast period.

In the realm of home equity lending, mortgage and credit unions emerge as trusted partners for consumers. These financial institutions offer various services beyond home loans, including deposit management, checking and savings accounts, and credit and debit cards. By choosing a mortgage or credit union for home equity lending, consumers gain access to human advisors who can guide them through the intricacies of finance. Mortgage and credit unions provide competitive rates on home equity loans, making them an attractive option. Consumer protection is a priority, with fair lending practices and rigorous risk assessment ensuring creditworthiness. Economic conditions, employment history, and credit score are all taken into account during the loan origination process.

Home equity loans can be used for various purposes, such as home improvement projects, debt consolidation, or cash-out refinancing. Consumer confidence plays a role in loan origination, with interest rates influenced by market volatility and economic conditions. Fixed-rate and adjustable-rate loans are available, each with its advantages and risks. The regulatory environment shapes the market, with mortgage lenders adhering to strict verification of income and property value requirements. Mortgage insurance, property taxes, and loan terms are also essential factors. Homeowners insurance and debt management services can help mitigate default risk. The amortization schedule, closing costs, and financial statements are crucial components of the home equity loan process.

Financial planning and mortgage rates are closely monitored to ensure optimal financial outcomes. Foreclosure prevention measures are in place to help borrowers navigate challenging economic circumstances. Mortgage brokers can facilitate the loan application process, while rate locks provide borrowers with security against interest rate fluctuations. Title insurance and loan-to-value ratio assessments protect both the borrower and the lender. In summary, mortgage and credit unions offer a comprehensive suite of financial services, including home equity lending. By focusing on consumer protection, fair lending practices, and rigorous risk assessment, these institutions provide a reliable and secure option for homeowners seeking to tap into their home equity.

The Mortgage and credit union segment was valued at USD 82.39 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

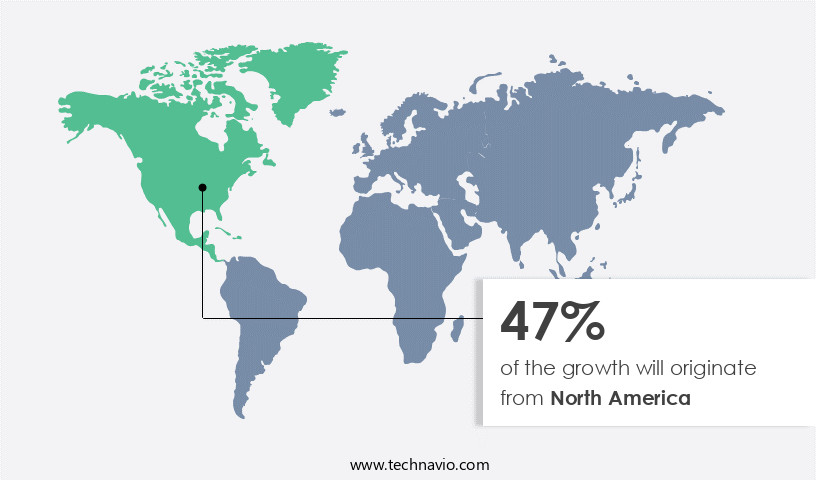

North America is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America experienced notable growth in 2024, with a significant portion attributable to the rise in home prices. Banks and credit unions capitalized on this trend, offering home equity loans and lines of credit as an attractive option for Canadians. The allure of using homes as collateral increased due to the surge in real estate values and fewer regulations. The seasonally adjusted balance of Home Equity Lines of Credit (HELOC) rose by 1% to USD 128 billion in February 2022. Household debt in Canada is predominantly composed of residential mortgages, accounting for 74%, while lines of credit and credit cards comprise 16% and 4%, respectively.

These debt categories contribute to net worth. The economic conditions, employment history, and credit score are crucial factors in the risk assessment process for mortgage lenders. Consumer confidence, financial literacy, and fair lending practices are essential in the origination of home equity loans. Homeowners also consider interest rates, loan terms, loan-to-value ratios (LTV), and prepayment penalties when making decisions. The regulatory environment, mortgage insurance (PMIs), mortgage-backed securities (MBS), and verification of income are integral components of the home equity lending process. Home improvement loans, cash-out refinancing, amortization schedules, and financial planning are other aspects that influence borrowers' decisions.

Homeowners must also consider property taxes, property values, homeowners insurance, and market volatility when evaluating their home equity options. In the event of default risk, foreclosure prevention measures and mortgage brokers can assist homeowners. The amortization schedule, mortgage rates, and closing costs are essential factors in the financial planning process. Home equity loans can be used for debt consolidation, debt management, and various other financial needs.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and evolving the market, borrowers tap into their home's value to secure funds for various financial needs. Home equity loans and lines of credit are popular options, providing access to substantial funds based on a homeowner's equity. Home appraisals and creditworthiness determine loan amounts. Borrowers can use home equity funds for debt consolidation, home improvements, education expenses, or unexpected costs. Home equity lending requires a mortgage and carries risks, including the possibility of foreclosure. Homeowners must consider their financial situation, long-term goals, and alternative financing options before making a decision. The market trends include increasing competition, flexible terms, and innovative products. Home equity lending can be a valuable financial tool, offering potential benefits for those who understand its implications.

What are the key market drivers leading to the rise in the adoption of Home Equity Lending Industry?

- The significant surge in home prices serves as the primary catalyst for market growth.

- The market has witnessed notable expansion due to the substantial rise in home values, enabling homeowners to leverage their equity for various needs. Home equity loans offer advantages such as lower interest rates than unsecured loans and potential tax deductions for interest payments, making them an attractive option for consumers. Furthermore, the emergence of online lending platforms provides convenience and competitive rates, broadening the borrower base. However, economic instability and volatile property values introduce risks for both lenders and borrowers, necessitating thorough credit risk assessments, including debt-to-income ratio (DTI) evaluations, credit counseling, and financial literacy education. Despite these challenges, the market's growth is expected to continue as homeowners seek financial solutions to fund home improvements, major purchases, and debt consolidation.

What are the market trends shaping the Home Equity Lending Industry?

- The current market trend indicates a significant increase in the number of residential properties being developed and sold. This upward trend is a reflection of the growing demand for housing solutions in both urban and suburban areas.

- The market has experienced significant growth due to various factors. The expanding population and the increasing demand for decent housing and infrastructure are driving the residential sector's expansion. The recent shift towards remote work as a result of the COVID-19 pandemic has further fueled this trend, with more homebuyers opting for larger homes. In India, for instance, there is a current shortage of 10 million housing units, and it is projected that by 2030, 25 million affordable housing units will be required to accommodate the country's growing urban population. Fair lending practices are crucial in this market, ensuring equal access to credit regardless of economic conditions, employment history, or credit score.

- Mortgage insurance (PMIs) and mortgage-backed securities (MBS) play essential roles in managing default risk. Verification of income and property value assessment are also vital components of the lending process. Consumer protection regulations safeguard borrowers from potential risks, while homeowners insurance protects their investments. The housing market's dynamics are influenced by economic conditions, employment trends, and housing prices. Property value fluctuations can significantly impact the equity borrowers can access. In conclusion, the market's growth is underpinned by various factors, including demographic trends, economic conditions, and regulatory frameworks. Understanding these dynamics is crucial for businesses seeking to capitalize on the market's potential. Recent research indicates that the market will continue to grow, driven by these factors and the ongoing demand for housing.

What challenges does the Home Equity Lending Industry face during its growth?

- The prolonged nature of industry procedures poses a significant challenge to growth, necessitating a need for streamlined processes to increase efficiency and productivity.

- Home equity lending involves the borrowing of funds using the value of a property as collateral. The process can take between two weeks and two months to complete, with several factors influencing the timeline. Lenders require consumers to provide current mortgage statements, property tax bills, and proof of income for review. Delays may occur if these documents are not readily available. Additionally, lenders assess consumers' creditworthiness by evaluating credit scores, debt-to-income ratios, and other financial details. A licensed third-party appraiser is hired to confirm the property's value, which could prolong the process if the appraiser's schedule is busy.

- In some instances, state regulations mandate the presence of an attorney during loan closings, further extending the process. Prospective borrowers undergoing financial planning should consider mortgage rates, amortization schedules, and foreclosure prevention measures when applying for a home equity loan. Mortgage brokers can facilitate the process by providing rate locks to secure favorable mortgage rates. Payment history is crucial, as lenders prefer borrowers with a solid history of on-time payments.

Exclusive Customer Landscape

The home equity lending market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the home equity lending market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, home equity lending market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bank of America Corporation - The company specializes in home equity lending solutions, including Home Equity Line of Credit (HELOC), empowering homeowners to access and utilize their home equity for various financial needs

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bank of America Corporation

- Capital One Financial Corporation

- Chase Bank (JPMorgan Chase)

- Citibank N.A.

- Discover Financial Services

- Fifth Third Bank

- Flagstar Bank

- Freedom Mortgage Corporation

- KeyBank

- LoanDepot.com LLC

- Mr. Cooper (Nationstar Mortgage)

- Navy Federal Credit Union

- PNC Financial Services Group Inc.

- Quicken Loans (Rocket Mortgage)

- TD Bank N.A.

- Truist Financial Corporation

- U.S. Bank National Association

- United Wholesale Mortgage

- Wells Fargo & Company

- Wyndham Capital Mortgage

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Home Equity Lending Market

- In January 2024, Wells Fargo & Company announced the expansion of its Home Equity Access Line, allowing borrowers to access up to USD1 million in home equity lines of credit (HELOCs) with competitive variable rates (Wells Fargo press release). This expansion aimed to cater to the growing demand for larger home equity loans.

- In March 2024, Quicken Loans, the nation's second-largest mortgage lender, partnered with J.P. Morgan Chase to offer home equity loans and lines of credit through Chase's digital platform (Bloomberg). This collaboration combined Quicken's origination expertise with Chase's extensive customer base, aiming to streamline the application process and enhance the customer experience.

- In May 2024, Bank of America secured regulatory approval for its acquisition of Ally Financial's home lending business, including its home equity lending division (Reuters). This acquisition expanded Bank of America's home lending portfolio, enabling it to offer a broader range of mortgage and home equity products to its customers.

- In February 2025, Fannie Mae introduced a new product, the HomeStyle Renovation mortgage, which allows homebuyers to finance both the purchase and renovation of a property using a single mortgage (Fannie Mae press release). This product expansion catered to the increasing trend of homebuyers seeking properties requiring renovation and aimed to simplify the homebuying process.

Research Analyst Overview

- The market is characterized by various dynamics and trends, including the presence of a secondary market for securitized loans, diverse income verification methods, and multiple repayment options. Valuation methods and pricing models play a crucial role in determining loan amounts and interest rates, while prepayment speeds and financial restructuring impact portfolio management. Default rates are influenced by macroeconomic factors, credit spreads, and yield curve shifts. Interest rate swaps and foreclosure alternatives offer hedging strategies for lenders. Subprime lending, with its unique underwriting guidelines and compliance regulations, presents distinct challenges.

- Due diligence, risk modeling, fraud prevention, and debt relief are essential components of risk management. Capital requirements and investment strategies shape the competitive landscape, with automated underwriting systems streamlining the application process. Regulatory scrutiny and compliance audits ensure market risk is mitigated, while loan modification and mortgage servicing rights enable lenders to manage delinquent loans.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Home Equity Lending Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

192 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market growth 2025-2029 |

USD 48155.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.3 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Home Equity Lending Market Research and Growth Report?

- CAGR of the Home Equity Lending industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the home equity lending market growth of industry companies

We can help! Our analysts can customize this home equity lending market research report to meet your requirements.