Hormonal Contraceptives Market Size 2024-2028

The hormonal contraceptives market size is forecast to increase by USD 4.35 billion at a CAGR of 4.2% between 2023 and 2028.

- The market is driven by several factors, including the rising number of unplanned pregnancies and the significance of family planning, particularly in developing countries. The endocrine system plays a crucial role in the effectiveness of hormonal contraceptives, which prevent ovulation through the use of synthetic hormones like progesterone and estrogen in combination or progestin-only. Hormonal contraceptives offer benefits beyond birth control, such as HIV protection and regulation of menstrual cycles. Organizations and healthcare providers continue to promote awareness and education about the various contraceptive methods available to women, enabling them to make informed decisions about their reproductive health.

- However, challenges such as lack of reimbursement and potential side effects can hinder market growth. The importance of women's health and advancements in hormonal contraceptive research continue to shape the market landscape. This analysis report provides an in-depth examination of the market trends, growth drivers, and challenges in the market. OTC contraceptives, such as emergency contraceptive pills and certain types of oral contraceptive pills, offer convenience and confidentiality for women who prefer not to obtain a prescription from a healthcare provider.

What will be the Size of the Market During the Forecast Period?

- Hormonal contraceptives are a type of birth control methods that utilize synthetic hormones, specifically progestin and estrogen, to prevent pregnancy. These hormones work by preventing ovulation, thickening cervical mucus to hinder sperm from reaching the fertilized eggs, and thinning the lining of the uterus to prevent implantation. The endocrine system plays a crucial role in the functioning of hormonal contraceptives. Progestin-only contraceptives and combination hormonal contraceptives, which include oral contraceptive pills, injectable birth control, emergency contraceptive pills, vaginal rings, patches, progestogen injectables, intrauterine devices (IUDs), implants, and over-the-counter (OTC) contraceptives, are the primary types of hormonal contraceptives available in the market.

- Moreover, the hormonal contraceptive market has witnessed significant growth due to the effectiveness of these methods in preventing unintended pregnancies. According to the Centers for Disease Control and Prevention (CDC), more than 14 million women in the United States use hormonal contraceptives. The primary mechanism of hormonal contraceptives is to prevent fertilization by preventing ovulation or preventing the fertilized egg from implanting in the uterus. Progestin-only contraceptives are effective in preventing ovulation, while combination hormonal contraceptives prevent both ovulation and thicken cervical mucus. Hormonal contraceptives offer additional benefits, including protection against certain types of cancers, such as ovarian and endometrial cancer, and relief from menstrual cramps and heavy periods.

- Similarly, some hormonal contraceptives, such as certain types of IUDs, also offer protection against HIV and other sexually transmitted infections (STIs). Long-acting contraceptives, such as IUDs and implants, have gained popularity due to their effectiveness and convenience. These methods provide continuous hormonal contraception for several years, requiring minimal user intervention. The hormonal contraceptive market is expected to continue growing due to the increasing awareness of family planning and the availability of various types of hormonal contraceptives to cater to diverse needs and preferences.

The market is also driven by the development of new and innovative hormonal contraceptive products, such as extended-cycle pills and continuous-use IUDs. In conclusion, hormonal contraceptives are an essential component of family planning and have proven to be effective in preventing unintended pregnancies. The hormonal contraceptive market is diverse and offers various types of methods to cater to the unique needs and preferences of women. The continued growth of the market is driven by the development of new and innovative products, increasing awareness of family planning, and the convenience and effectiveness of hormonal contraceptives.

How is this market segmented and which is the largest segment?

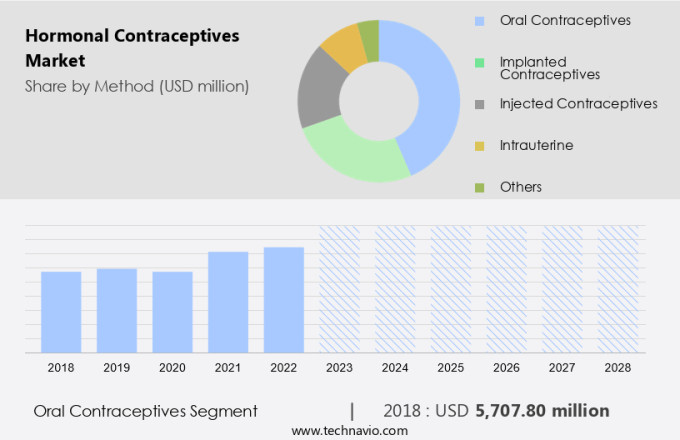

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Method

- Oral contraceptives

- Implanted contraceptives

- Injected contraceptives

- Intrauterine

- Others

- Geography

- North America

- Canada

- Mexico

- US

- Asia

- China

- India

- Thailand

- Europe

- UK

- France

- Rest of World (ROW)

- North America

By Method Insights

- The oral contraceptives segment is estimated to witness significant growth during the forecast period.

The market encompasses various contraceptive devices that inhibit pregnancy through the use of hormones. Among these, oral contraceptives, specifically those containing estrogen and progestin, represent a substantial segment. Their popularity stems from their efficacy, convenience, and availability in diverse formulations such as monophasic, biphasic, and triphasic pills. The expansion of the oral contraceptives segment is fueled by several factors. These include the growing awareness and acceptance of birth control methods, increasing disposable income levels, and enhanced healthcare accessibility, particularly in developing regions. North America dominates the market, buoyed by a strong healthcare infrastructure and high consumer consciousness. Beyond oral contraceptives, other hormonal contraceptives like progestogen injectables, intrauterine devices (IUDs), and implants are also gaining traction. These methods offer unique advantages, such as extended effectiveness and lower hormonal exposure.

Additionally, the emergence of over-the-counter (OTC) hormonal contraceptives and the ongoing efforts to integrate HIV prevention into hormonal contraceptives are expected to further bolster market growth. The market is poised for significant expansion in the coming years. This growth is driven by the aforementioned factors, as well as demographic shifts and ongoing research and development in the field. In conclusion, the market is witnessing steady growth, fueled by increasing awareness and acceptance of family planning methods, rising disposable income levels, and advancements in healthcare accessibility. North America currently leads the market, but emerging regions are expected to contribute significantly to its expansion. The market encompasses various hormonal contraceptive methods, including oral contraceptives, injectables, implants, and IUDs, each with its unique advantages. The ongoing integration of HIV prevention into hormonal contraceptives and the emergence of OTC options further underscore the market's potential for continued growth.

Get a glance at the market report of share of various segments Request Free Sample

The oral contraceptives segment was valued at USD 5.71 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 43% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is primarily driven by the US due to the presence of local market players, supportive government policies, and high consumer awareness. According to the Centers for Disease Control and Prevention (CDC), approximately half of pregnancies in the US are unplanned, leading to a significant demand for contraceptive methods. Four hormonal intrauterine devices (IUDs) are currently available in the US market: Mirena, Skyla, LILETTA, and Kyleena. Additionally, there is one copper IUD, PARAGARD. In Canada, Mirena, Jaydess, and Kyleena are also available, along with copper IUDs. The US market is further fuelled by technological innovations, such as postpartum and reusable hormonal contraceptives.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Hormonal Contraceptives Market ?

An increase in unplanned pregnancies is the key driver of the market.

- Unintended pregnancies pose significant challenges for individuals and societies, leading to unexpected population growth and financial and emotional burdens. The health of the mother and child can also be compromised if the pregnancy is not planned. The prevalence of unplanned pregnancies is a concern, particularly among the young generation who may engage in unprotected sex.

- Moreover, this trend puts additional pressure on healthcare services and negatively impacts the economic well-being of communities. Hormonal contraceptives, such as those containing progestin and estrogen, have emerged as effective solutions for pregnancy prevention. These methods work by preventing ovulation, thickening cervical mucus, and preventing fertilized eggs from implanting in the uterus. Oral contraceptive pills and injectable birth control are popular forms of hormonal contraceptives. By using these methods, women can take control of their reproductive health and reduce the risk of unplanned pregnancies.

What are the market trends shaping the Hormonal Contraceptives Market?

The importance of family planning in developing countries is the upcoming trend in the market.

- Unintended pregnancies can result from unprotected sexual activity, contraceptive malfunction, incorrect usage, or infrequent use of birth control pills, as well as instances of sexual assault. Effective contraception use can significantly reduce abortion-related and pregnancy-related complications and mortality, particularly in developing countries. The promotion of voluntary family planning has gained widespread acceptance globally, with organizations like the Asia-Pacific Council on Contraception, the European Society of Cardiology, and the International Planned Parenthood Federation leading efforts to disseminate knowledge about various contraceptive methods, including hormonal contraceptives. In developed regions, over half of all couples employ modern contraceptive techniques, such as hormonal contraceptives, to manage their family size and birth rate.

- Moreover, hormonal contraceptives, which include both progestin-only and combination hormonal methods, work by preventing ovulation or altering the endocrine system to prevent fertilization. These synthetic hormones have been extensively studied and are considered safe and effective forms of birth control. The endocrine system, which regulates various bodily functions, plays a crucial role in the mechanism of action of hormonal contraceptives. Progesterone, a naturally occurring hormone, is a key component of many hormonal contraceptives, and its synthetic counterpart, progestin, is used in progestin-only methods. Combination hormonal contraceptives, which contain both estrogen and progestin, are also widely used. HIV protection is an additional benefit of certain hormonal contraceptives, such as the combined oral contraceptive pill, which has been shown to reduce the risk of HIV transmission in women.

- In addition, the use of hormonal contraceptives is a personal decision that should be made in consultation with a healthcare provider, taking into account individual health concerns and preferences. It is essential to adhere to the recommended usage instructions to maximize the effectiveness of hormonal contraceptives and minimize potential side effects. In conclusion, hormonal contraceptives have become a popular and effective method of family planning, with over half of all couples in developed regions utilizing these methods. These contraceptives work by preventing ovulation or altering the endocrine system to prevent fertilization. Hormonal contraceptives offer various benefits, including HIV protection, and should be used in accordance with the recommended guidelines to ensure their effectiveness and safety.

What challenges does Hormonal Contraceptives Market face during the growth?

Lack of reimbursement is a key challenge affecting the market growth.

- Hormonal contraceptives, including emergency contraceptive pills, vaginal rings, and transdermal patches, are essential components of family planning and reproductive health services. The hormone segments of these contraceptives include progestin-only and combined hormonal contraceptives. However, public and private insurers do not typically cover the costs of long-acting reversible contraceptive (LARC) devices and procedures related to their insertion postpartum. This lack of coverage serves as a significant barrier to the adoption of hormonal contraceptives, particularly for pregnant women who may lose their Medicaid coverage at sixty days postpartum.

- However, most insurers pay a lump sum for all services provided during labor and delivery under a single Diagnosis Related Group (DRG) code. Unfortunately, the device and placement procedure for hormonal contraceptives, if performed postpartum in a hospital setting, are not included in the global fee for deliveries and are therefore not reimbursed. This financial hurdle can limit access to these important contraceptive options, especially during a public health emergency or in cases of unplanned pregnancies.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AbbVie Inc.

- Afaxys Pharma LLC

- Bayer AG

- Biolab Sanus Farmaceutica Ltda

- Cipla Inc.

- Facmed Pharma

- Glenmark Pharmaceuticals Ltd.

- Healing Pharma India Pvt. Ltd.

- HLL Lifecare Ltd.

- Johnson and Johnson Inc.

- Lupin Ltd.

- Mayne Pharma Group Ltd.

- Merck and Co. Inc.

- Mylan

- Organon and Co.

- Pfizer Inc.

- Pregna International

- Teva Pharmaceutical Industries Ltd.

- TherapeuticsMD

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Hormonal contraceptives are a popular method for pregnancy prevention, employing synthetic forms of hormones like progestin and estrogen to prevent ovulation, thicken cervical mucus, and prevent fertilized eggs from implanting. Progestin-only contraceptives and combined hormonal contraceptives, including oral contraceptive pills, injectable birth control, emergency contraceptive pills, vaginal rings, and transdermal patches, cater to various preferences and needs. The hormonal contraceptive market encompasses a range of hormone segments, including progestin-only and combined hormonal contraceptives. These contraceptives play a crucial role in family planning and reproductive health services, mitigating unintended pregnancies and teenage pregnancies. Synthetic hormones, such as progestin and estrogen, are integral to the functioning of these contraceptives.

Moreover, progestin prevents ovulation, thickens cervical mucus, and thwarts implantation of fertilized eggs. Estrogen, on the other hand, maintains the thickness of the uterine lining, ensuring a healthy environment for implantation in case of pregnancy. Hormonal contraceptives offer additional benefits, such as HIV protection and hormonal regulation, making them an essential component of women's health and reproductive well-being. However, contraceptive shortages and public health emergencies can disrupt access to these essential services, necessitating heightened awareness and advocacy for birth control and reproductive health. The hormonal contraceptive market comprises various contraceptive devices, including progestogen injectables, intrauterine devices (IUDs), implants, and over-the-counter (OTC) contraceptives.

In summary, long-acting contraception, such as IUDs and implants, provide extended protection, while clinical trials continue to explore new advancements in hormonal contraceptives. Despite their benefits, hormonal contraceptives carry potential health risks, necessitating careful consideration and consultation with healthcare professionals. Household accessibility, birth control awareness, and public health initiatives are essential in ensuring equitable access to these vital reproductive health services.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.2% |

|

Market growth 2024-2028 |

USD 4.35 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.9 |

|

Key countries |

Mexico, US, Dominican Republic, India, Thailand, Switzerland, China, UK, France, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Asia, Europe, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch