House Wraps Market Size 2025-2029

The house wraps market size is forecast to increase by USD 2.8 billion at a CAGR of 6.8% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing focus on moisture management and energy savings. The adoption of new fire-retardant membranes in house wraps is a key trend driving market growth. However, improper installation of house wraps remains a challenge and can negatively impact the market. Moisture management is a critical factor in ensuring the longevity and effectiveness of house wraps. Energy savings are also a significant consideration, as house wraps help reduce heating and cooling costs by providing an additional insulation layer. The use of advanced materials and technologies, such as breathable house wraps and self-adhesive house wraps, is expected to further boost market growth.

- Overall, the market is poised for steady expansion, driven by these market trends and growth factors. Moisture management is a critical factor in ensuring the longevity of building structures, and it provides an effective solution by allowing moisture to escape while preventing water intrusion.

What will be the House Wraps Market Size During the Forecast Period?

- House wraps, a crucial component in the construction industry, have gained significant attention in the commercial development sector due to their ability to enhance a building's energy efficiency and aesthetic appeal. The market for house wraps is subjected to various macroeconomic and external factors that influence its dynamics. Quantitative data reveals a steady growth in the demand for house wraps, driven by increasing commercial construction activities. However, qualitative data from consumer buying behavior studies indicate a preference for cost-effective and energy-efficient solutions. Economic scenarios, such as monetary policy and inflation, play a pivotal role in shaping the market. Historical pricing data and graphical analysis reveal trends in Polypropylene, Polyethylene, and Polyvinyl chloride-based systems.

- In addition, geopolitical tensions, climate disasters, and disinflation are external factors that can impact the market's competitive position. A macroeconomic analysis of the house wraps value chain reveals the importance of intermediaries, including distributors and retailers, in the market's supply chain. Commodity prices, historical pricing data from digital archives, and insights from domain experts provide valuable information on the market's pricing analysis. Energy costs, a significant factor in the construction industry, have a direct impact on the demand for house wraps. The entry of tech firms from Silicon Valley and other innovative regions into the market is expected to intensify competition.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Commercial

- Residential

- Type

- Non-perforated house wraps

- Perforated house wraps

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Middle East and Africa

- North America

By Application Insights

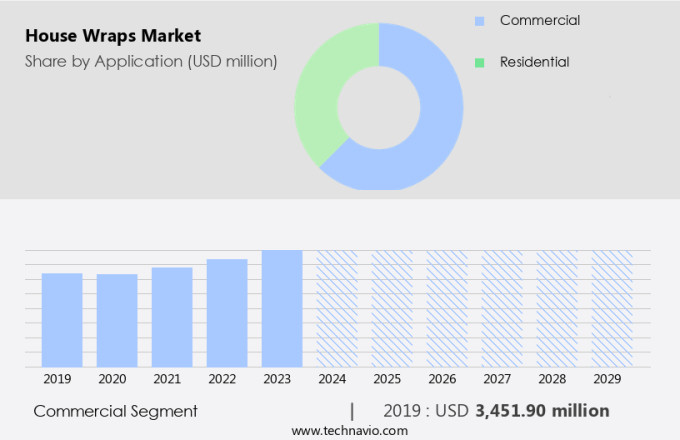

- The commercial segment is estimated to witness significant growth during the forecast period.

The market has witnessed significant growth in the commercial sector due to the increasing focus on energy efficiency and sustainability in business development. House wraps are essential components of building envelopes, providing improved air infiltration control, moisture management, and thermal performance for builders and developers. In large-scale commercial projects, such as office buildings and shopping complexes, innovative house wraps are used to ensure a comfortable internal climate, reduce heating and cooling expenses, and extend building lifespan. The market's growth is driven by the need for sustainable building practices and the benefits house wraps offer in enhancing a building's overall performance.

Get a glance at the market report of share of various segments Request Free Sample

The commercial segment was valued at USD 3.45 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 53% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market for house wraps is driven by the advanced economies of the US and Canada, which are experiencing significant infrastructure development. This growth is reflected in the construction sector, where investments are increasing, leading to a rise in demand for house wraps. For instance, in February 2022, Greater Albuquerque Housing Partnership invested USD19 million in a new project in New Mexico, US, highlighting the ongoing construction activity. The economic expansion, coupled with increasing consumer demand for energy-efficient and weather-resistant housing solutions, is expected to fuel the market in North America during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of House Wraps Market ?

Moisture management and energy-saving is the key driver of the market.

- House wraps play a crucial role in the construction industry by serving as moisture barriers and weather-resistant envelopes for both residential and commercial properties. Moisture infiltration can lead to costly repairs due to fungal growth and wood rot, as well as reduced insulation effectiveness. House wraps prevent excess air infiltration and maintain optimal heat and humidity levels, ensuring energy efficiency and cost savings. The house wrap market is influenced by various economic, political, and social scenarios. Macroeconomic analysis reveals that manufacturing costs of synthetic materials, such as Polypropylene, Polyethylene, and Polyvinyl chloride, significantly impact pricing. External factors like climate disasters, monetary policy, and geopolitical instability can also influence the market.

- In addition, the market is currently focused on innovation and sustainability, with an increasing emphasis on energy consumption and moisture barriers. Tech firms in Silicon Valley are exploring new applications for house wraps, creating opportunities for growth. However, the market faces challenges from increasing competition and changing consumer spending patterns. In summary, the house wrap market is a dynamic and complex ecosystem influenced by various economic, political, and social factors. Understanding these influences and adapting to changing market conditions is essential for success.

What are the market trends shaping the House Wraps Market?

Advent of new fire-retardant membranes in house wraps is the upcoming trend in the market.

- The market is experiencing growth due to the increasing demand for energy-efficient and flame-retardant building materials in commercial development. According to quantitative data from industry reports, the market is expected to expand at a steady rate in the coming years, driven by consumer buying trends and economic scenarios. Qualitative data indicates that external factors, such as geopolitics, monetary policy, and climate disasters, also significantly impact market dynamics. Macroeconomic analysis reveals that manufacturing costs of synthetic materials, such as Polypropylene, Polyethylene, and Polyvinyl chloride, influence pricing. Value chain analysis shows that intermediaries, including Staples, Nails, Clips, Tape, and Fasteners, play a crucial role in the distribution of house wraps.

- Furthermore, historical pricing data and graphical analysis demonstrate that economic factors, such as disinflation and inflation, impact pricing trends. Social factors, such as consumer spending and influencer engagement, also shape market demand. Political factors, such as regulations and policies, can influence the competitive position of market players. Financial statements of key industry players and strategic approaches, including strengths, weaknesses, threats, winning imperatives, current focus, and threats from competition, provide insights into market dynamics. Expert opinions from domain experts and digital archives offer valuable insights into the latest trends and developments in the market. In summary, the market in the US is influenced by various economic, political, and social scenarios. Understanding these factors through macroeconomic analysis, value chain analysis, pricing analysis, and expert opinions is crucial for making informed business decisions.

What challenges does House Wraps Market face during the growth?

Improper installation of house wraps is a key challenge affecting the market growth.

- House wraps are essential components in the construction and renovation of both residential and commercial properties. The market exhibits intricate market dynamics influenced by various economic, political, and social scenarios. Macroeconomic analysis reveals that economic factors, such as inflation and disinflation, impact the pricing analysis of house wraps. Similarly, social factors, including consumer buying trends and influencer engagement, influence the demand for house wraps. Moreover, external factors, such as geopolitics, monetary policy, and climate disasters, pose significant threats to the market. Value chain analysis reveals that intermediaries, including manufacturers, distributors, and installers, play crucial roles in the house wraps value chain.

- In addition, the use of synthetic materials, such as Polypropylene, Polyethylene, and Polyvinyl chloride, in house wraps affects manufacturing costs. Historical pricing data and graphical analysis indicate that energy costs, particularly those related to manufacturing and transportation, significantly impact house wrap pricing. Competitive positioning and winning imperatives depend on a strategic approach that addresses strengths, weaknesses, threats, and opportunities. Threats from competition, including new entrants and substitutes, require constant monitoring. Financial statements of key players in the house wraps industry provide insights into their operational and financial performance. Understanding the current focus of these players, including their product offerings and target markets, is essential for market participants.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Alpha Pro Tech Ltd: The company offers house wraps namely AlphaProTech Rex-Wrap-Plus.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Benjamin Obdyke Inc.

- Berry Global Inc.

- Builders FirstSource Inc.

- Compagnie de Saint-Gobain SA

- CS Fabric International Corp.

- DuPont de Nemours Inc.

- ENEOS Holdings Inc.

- Henry Co.

- IKO Plc

- Intertape Polymer Group Inc.

- James Hardie Industries plc

- Kimberly Clark Corp.

- Kingspan Group Plc

- MittenBP

- Owens Corning

- Protecto Wrap Co.

- R.H. Tamlyn and Sons LP

- Specialty Coating and Laminating LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market represents a significant segment within the construction industry, playing a crucial role in enhancing the energy efficiency and durability of residential and commercial properties. This analysis delves into the intricacies of the market, focusing on the key market dynamics and trends. The market encompasses a diverse range of products, primarily synthetic materials such as polypropylene, polyethylene, and polyvinyl chloride. These materials serve as moisture barriers, protecting buildings from the elements and reducing energy consumption. House wraps are installed using various fasteners like staples, nails, clips, and tape.

Furthermore, the economic factors underpinning the market's growth include the increasing demand for energy-efficient buildings, the rising construction industry, and the growing focus on renovations. Additionally, external factors such as geopolitical scenarios and monetary policy can significantly impact the market's trajectory. Consumer preferences for sustainable and eco-friendly building materials are driving the demand for house wraps. Moreover, the increasing awareness of the importance of insulation and moisture protection in reducing energy consumption and improving indoor air quality is further fueling the market's growth. The market is characterized by a diverse competitive landscape, with numerous players vying for market share.

In addition, companies focus on product innovation, pricing strategies, and strategic partnerships to gain a competitive edge. The market value chain includes raw material suppliers, manufacturers, distributors, and end-users. Each player in the value chain contributes to the overall cost structure and profitability of the market. Historical pricing trends and current market conditions are crucial factors influencing the pricing dynamics of the market. Factors such as raw material costs, manufacturing costs, and economic conditions impact the pricing strategy of market participants.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 2.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

US, China, UK, Germany, Canada, Japan, France, India, South Korea, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch