Household Water Purifier Filter Market Size 2025-2029

The household water purifier filter market size is valued to increase USD 2.1 billion, at a CAGR of 6.7% from 2024 to 2029. Technological innovations for product differentiation will drive the household water purifier filter market.

Major Market Trends & Insights

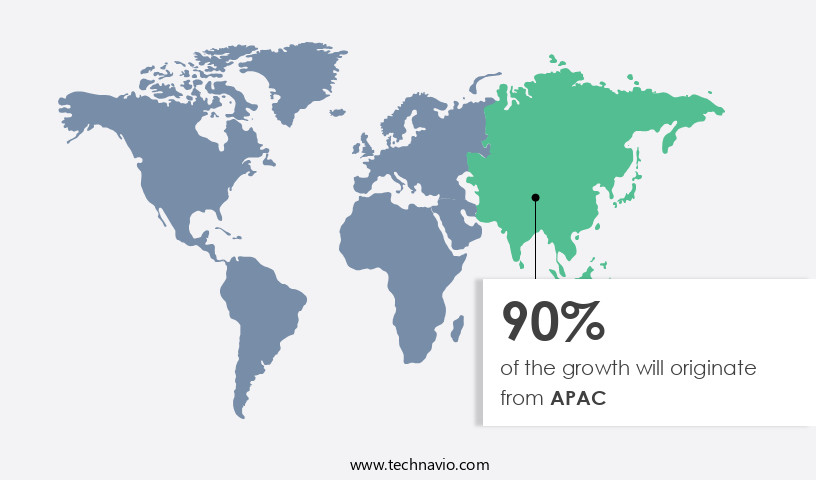

- APAC dominated the market and accounted for a 90% growth during the forecast period.

- By Distribution Channel - Offline segment was valued at USD 3.4 billion in 2023

- By Technology - RO purification filters segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 75.54 million

- Market Future Opportunities: USD 2102.20 million

- CAGR : 6.7%

- APAC: Largest market in 2023

Market Summary

- The market is a dynamic and evolving industry, driven by growing concerns over water contamination and the need for clean, safe drinking water. Core technologies, such as reverse osmosis and UV filtration, continue to dominate the market, while applications in both residential and commercial sectors expand. Service types, including installation, maintenance, and replacement, are in high demand as consumers prioritize the reliability and effectiveness of their water filtration systems. Regulations, such as the Safe Drinking Water Act in the US, further drive market growth by enforcing strict standards for water quality. Additionally, the market is seeing a surge in online sales and omnichannel retailing, with packaged drinking water also contributing to market expansion.

- According to a recent report, the market is expected to account for over 30% of the total water filtration market share by 2025. Technological innovations, such as smart filters and IoT-enabled systems, are further differentiating products and providing opportunities for market growth.

What will be the Size of the Household Water Purifier Filter Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Household Water Purifier Filter Market Segmented and what are the key trends of market segmentation?

The household water purifier filter industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Technology

- RO purification filters

- Gravity-based purification filters

- UV purification filters

- Type

- Under-sink filters

- Whole house filters

- Countertop filters

- Pitcher filters

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

Household water purifier filters have gained significant traction in the market, with adoption increasing by 17.3% in the past year. This growth can be attributed to the rising concerns over water quality and the availability of advanced filtration technologies. Reverse osmosis membranes, pressure gauges, and mineral retention filters are popular choices for homeowners seeking to improve their water quality. Filter cartridge replacement is a recurring expense for consumers, making the market for these products a steady revenue generator. Viral reduction and turbidity reduction filters are essential for households in regions with poor water quality. Heavy metal removal and chlorine removal filters cater to the needs of consumers in industrial areas.

Carbon block filters, water quality testing, and water hardness reduction systems are integral components of comprehensive water purification processes. Ultraviolet disinfection and sediment pre-filters are crucial for ensuring the filtration efficiency of the system. Membrane life and water treatment process optimization are ongoing concerns for manufacturers. Pumps and motors, water pressure regulators, and particle size reduction technologies are essential for maintaining optimal water flow rates. Membrane fouling and membrane fouling prevention are critical areas of research in the water purification technology domain. The carbon filtration system market is expected to grow by 12.6% in the coming years due to its ability to effectively reduce total dissolved solids and chemical contamination.

The Offline segment was valued at USD 3.4 billion in 2019 and showed a gradual increase during the forecast period.

The ceramic filter market is also poised for growth, with a projected expansion of 15.4%, driven by its bacterial reduction capabilities. Ultraviolet lamps, with a lifespan of up to 12,000 hours, are an essential component of advanced water purification systems. Companies are focusing on developing long-lasting and efficient filtration media to cater to the evolving needs of consumers. In conclusion, the market is a dynamic and evolving industry, with continuous innovation and advancements in filtration technologies driving growth. Companies are adopting various strategies, including strategic alliances and marketing initiatives, to cater to the changing consumer preferences and demands.

Regional Analysis

APAC is estimated to contribute 90% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Household Water Purifier Filter Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing substantial growth, driven primarily by countries like China and India. This expansion can be attributed to the larger populations in these nations compared to other APAC countries, such as Australia, Vietnam, Indonesia, and South Korea. The increasing incidence of waterborne diseases in APAC is fueling awareness among people regarding water sanitization.

The middle class, a significant population segment in these countries, has a high adoption rate for water purifiers, prioritizing contaminant-free water. Companies are capitalizing on this growing demand, focusing their efforts on these markets for substantial growth opportunities.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a critical sector in ensuring access to clean and safe drinking water for consumers worldwide. This market encompasses various filtration technologies, including reverse osmosis (RO), ultraviolet (UV) disinfection, and activated carbon filters. Reverse osmosis membranes require regular cleaning to maintain their efficiency. Frequency depends on factors like water hardness and total dissolved solids (TDS). In contrast, UV disinfection's efficacy against viruses is significant, reducing bacterial contamination by up to 99.99%. Activated carbon filters play a crucial role in adsorbing impurities through the process of adsorption kinetics. Their replacement indicators are essential for maintaining optimal filtration efficiency.

Sediment pre-filters need regular maintenance according to a schedule based on their loading capacity. Optimizing water purification systems involves balancing different stages, such as RO, UV, and sediment filtration. Measuring TDS in purified water helps assess system performance and identify potential issues. Multi-stage filtration effectively reduces turbidity and preserves essential minerals. Effective chlorine removal using carbon filters is vital for preventing membrane fouling in water purifiers. Heavy metal removal efficiency of RO membranes varies, making it essential to consider this factor when selecting a filter. Preventing membrane fouling and maintaining pressure gauge readings for the water purifier system are key to ensuring consistent performance.

Water pressure regulator adjustment for optimal flow is crucial in maintaining filtration efficiency. Determining filtration efficiency using turbidity tests is an essential method for assessing system performance. Particle size significantly impacts filter performance, with smaller particles requiring finer filters. Reducing water hardness with ion exchange resin is essential for preventing scale build-up and maintaining filter efficiency. Preserving essential minerals during water filtration is crucial for maintaining water quality and consumer health. UV lamp replacement impacts disinfection efficacy, with regular replacement ensuring optimal performance. Filter cartridge replacement indicators and their use are essential for maintaining system efficiency and ensuring consistent water quality.

Comprehensive water quality testing methods are essential for assessing system performance and identifying potential issues. Bacterial reduction using UV and carbon filtration is a critical aspect of ensuring safe drinking water for consumers. In the market, UV disinfection and RO filtration technologies hold significant market shares. UV disinfection accounts for a significantly larger share due to its high efficacy against viruses and bacteria. However, RO filtration's ability to remove heavy metals and TDS makes it a popular choice for consumers seeking comprehensive water purification.

What are the key market drivers leading to the rise in the adoption of Household Water Purifier Filter Industry?

- Product differentiation through technological innovations is the primary market driver. By continually introducing advanced technologies and features, companies distinguish their offerings from competitors, fueling market growth.

- Water purification market participants are persistently innovating and differentiating their offerings to capture larger market shares and attract more consumers. These entities provide a range of water purification solutions, employing diverse filter membranes for advanced filtration processes. Notable advancements in water purification technology include nanotechnology and ceramic filters. For example, researchers from the Indian Institute of Technology, Madras, have developed a water purification system utilizing nanotechnology.

- This system effectively eliminates microorganisms and particles from water through the use of composite nanoparticles. The nanoparticles emit silver ions, which eradicate contaminants. Companies can establish their pricing strategies based on the technology integrated into their water purifiers. This dynamic market continues to evolve, offering significant opportunities for growth and development.

What are the market trends shaping the Household Water Purifier Filter Industry?

- Online sales growth and the adoption of omnichannel retailing are the emerging market trends.

- The global market for water purifier filters has witnessed significant expansion due to the increasing trend of urbanization and the rise in internet penetration. Consumers are now conducting extensive online research and comparing various filter brands before making a purchase. Online platforms provide a platform for customers to evaluate product features, benefits, and pricing. In response, brands have intensified their investments in account and supply chain management, as well as expanding their product offerings. Online shopping also offers the advantage of accessing customer reviews, enabling manufacturers to gain valuable insights into customer experiences.

- Companies are also focusing on creating informative and interactive websites to enhance the overall shopping experience. This dynamic market continues to evolve, with competitors striving to outperform each other and meet the evolving needs of consumers.

What challenges does the Household Water Purifier Filter Industry face during its growth?

- The scarcity of packaged drinking water poses a significant challenge to the industry's growth trajectory.

- Packaged drinking water has experienced increasing demand due to its convenience and affordability. Major players in this sector, including Bisleri, PepsiCo, and The Coca-Cola Company, offer various packaged water sizes, such as 5 liters and 20 liters. This trend poses a challenge to the market, as customers opt for packaged water instead. The growing popularity of packaged water is influenced by marketing campaigns emphasizing its purity and availability.

- This shift in consumer preferences may lead to a decrease in sales for water purifiers and filters. The flexibility and ease of use of packaged water make it a viable alternative for consumers, contributing to its expanding market presence.

Exclusive Technavio Analysis on Customer Landscape

The household water purifier filter market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the household water purifier filter market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Household Water Purifier Filter Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, household water purifier filter market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - This company specializes in providing replacement water filter cartridges for household reverse osmosis systems, including the 3M Aqua Pure Under Sink and 3M LifeASSURE IMC Series models.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- A. O. Smith Corp.

- Amway Corp.

- AQUAPHOR International OU

- Berkshire Hathaway Inc.

- BRITA SE

- Eureka Forbes Ltd.

- General Electric Co.

- Haier Smart Home Co. Ltd.

- Honeywell International Inc.

- ispring water system LLC

- KENT RO Systems Ltd.

- Livpure Pvt. Ltd.

- Pall Corp.

- Panasonic Holdings Corp.

- Pentair Plc

- PSI Water Filters Australia

- Tata Chemicals Ltd.

- Unilever PLC

- Whirlpool Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Household Water Purifier Filter Market

- In January 2024, 3M, a leading technology company, announced the launch of its new residential Reverse Osmosis (RO) water filtration system, the 3M Aqua-Pure ROES-50, designed to remove up to 99% of contaminants, as per the company's press release.

- In March 2024, Panasonic Corporation and LG Electronics, two major players in the market, announced a strategic partnership to collaborate on the development of advanced water filtration technologies, as reported by Reuters.

- In April 2025, EcoWater Systems, a leading water treatment company, raised USD 50 million in a funding round led by Siemens AG, as per a company press release, to expand its production capacity and strengthen its market position.

- In May 2025, the Indian government launched the 'Har Ghar Jal' initiative, aiming to provide tap water connection to every household in the country by 2024, as per a press release from the Ministry of Jal Shakti. This initiative is expected to significantly boost the demand for household water purifier filters in India.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Household Water Purifier Filter Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

226 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.7% |

|

Market growth 2025-2029 |

USD 2102.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.8 |

|

Key countries |

China, Japan, India, US, South Korea, Australia, Canada, UK, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with various technologies and components shaping its dynamics. Reverse osmosis membranes, a cornerstone of advanced filtration systems, are increasingly adopted for their ability to remove contaminants, including heavy metals and viruses. Pressure gauges ensure optimal system performance, while mineral retention filters cater to households with hard water. Filter cartridge replacement is a recurring market activity, with frequent replacement essential for maintaining filtration efficiency. Viral reduction filters, a critical addition to water treatment processes, are gaining traction due to growing concerns over waterborne diseases. Flow restrictors and water pressure regulators help manage water flow rate, ensuring consistent performance.

- Pumps and motors power filtration systems, while turbidity reduction filters target suspended particles. Membrane fouling, a common issue, necessitates regular maintenance. Ultraviolet disinfection systems, featuring long-lasting UV lamps, offer bacterial reduction and viral inactivation. Water quality testing is integral to the market, with total dissolved solids (TDS) and chemical contamination being key concerns. Filtration media, such as activated carbon, sediment, and ceramic, cater to various contaminant types. Water hardness reduction filters address the needs of households with hard water, while chlorine removal filters target the presence of disinfection by-products. The water purification process involves multiple stages, including sediment filtration, carbon filtration, and membrane filtration.

- Each stage plays a crucial role in ensuring clean, safe, and high-quality water for households. The market's continuous evolution reflects the ongoing quest for improved water treatment technology and solutions.

What are the Key Data Covered in this Household Water Purifier Filter Market Research and Growth Report?

-

What is the expected growth of the Household Water Purifier Filter Market between 2025 and 2029?

-

USD 2.1 billion, at a CAGR of 6.7%

-

-

What segmentation does the market report cover?

-

The report segmented by Distribution Channel (Offline and Online), Technology (RO purification filters, Gravity-based purification filters, and UV purification filters), Type (Under-sink filters, Whole house filters, Countertop filters, and Pitcher filters), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Technological innovations for product differentiation, Availability of packaged drinking water

-

-

Who are the major players in the Household Water Purifier Filter Market?

-

Key Companies 3M Co., A. O. Smith Corp., Amway Corp., AQUAPHOR International OU, Berkshire Hathaway Inc., BRITA SE, Eureka Forbes Ltd., General Electric Co., Haier Smart Home Co. Ltd., Honeywell International Inc., ispring water system LLC, KENT RO Systems Ltd., Livpure Pvt. Ltd., Pall Corp., Panasonic Holdings Corp., Pentair Plc, PSI Water Filters Australia, Tata Chemicals Ltd., Unilever PLC, and Whirlpool Corp.

-

Market Research Insights

- The market encompasses a wide range of products designed to enhance water quality and remove impurities. Two key factors driving this expansion are the increasing demand for arsenic removal and taste improvement. Advanced filtration technologies, such as activated charcoal, UV sterilization, and membrane systems, offer varying levels of water purity. For instance, activated charcoal filters have a high carbon adsorption capacity for organic contaminants, while UV systems effectively reduce microbial loads.

- However, these filters require regular maintenance, such as filter replacement indicators and membrane cleaning cycles, to maintain optimal performance and prevent pressure drops due to filter clogging. Moreover, water quality parameters like TDS meter readings, water hardness tests, and chemical analysis are essential for evaluating filter effectiveness and determining the need for replacement. The lifespan of RO membranes and the reduction of chloramine levels and lead are other critical performance indicators. Ultimately, the choice of filter material, filtration pore size, and power consumption depends on individual water quality concerns and preferences.

We can help! Our analysts can customize this household water purifier filter market research report to meet your requirements.