HVAC Control Systems Market Size 2025-2029

The HVAC control systems market size is forecast to increase by USD 10.91 billion at a CAGR of 7.9% between 2024 and 2029.

- The market is experiencing significant growth due to the rising demand for energy-efficient and reliable solutions. With an increasing focus on integrated building management systems, HVAC controls have become a crucial component in optimizing energy consumption and ensuring system performance. Additionally, the growing concern over environmental pollution and stringent government regulations on HVAC systems are driving market expansion. Companies are investing heavily in advanced technologies such as IoT, AI, and machine learning to develop smart systems that offer improved energy management, enhanced comfort, and reduced maintenance costs. The market is experiencing significant growth due to the integration of smart home technologies and the construction sector's focus on energy efficiency and building automation.

- However, challenges such as high implementation costs, complex installation processes, and cybersecurity concerns continue to pose challenges for market players. To capitalize on the opportunities presented by this market, companies must focus on developing cost-effective and user-friendly solutions while ensuring cybersecurity measures. By staying abreast of the latest trends and regulations, and collaborating with industry partners, companies can effectively navigate the competitive landscape and position themselves for long-term success.

What will be the Size of the HVAC Control Systems Market during the forecast period?

- The market encompasses advanced technologies that optimize heating, ventilation, and air conditioning (HVAC) systems in both residential and commercial buildings. This market is experiencing significant growth due to the increasing demand for energy efficiency and building automation. Smart homes and urban population expansion are key drivers, with systems integrating with lighting systems, occupant detection, and temperature and humidity sensing devices to reduce energy consumption and human intervention. Energy wastage is a major concern, making energy consumption reduction a priority.

- Conventional HVAC systems are being replaced with intelligent systems, enabling real-time monitoring and adjustment. Technical complexities remain a challenge in implementing HVAC systems, but the benefits of improved energy efficiency and cost savings make the investment worthwhile for both residential buyers and commercial construction projects.

How is this HVAC Control Systems Industry segmented?

The systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

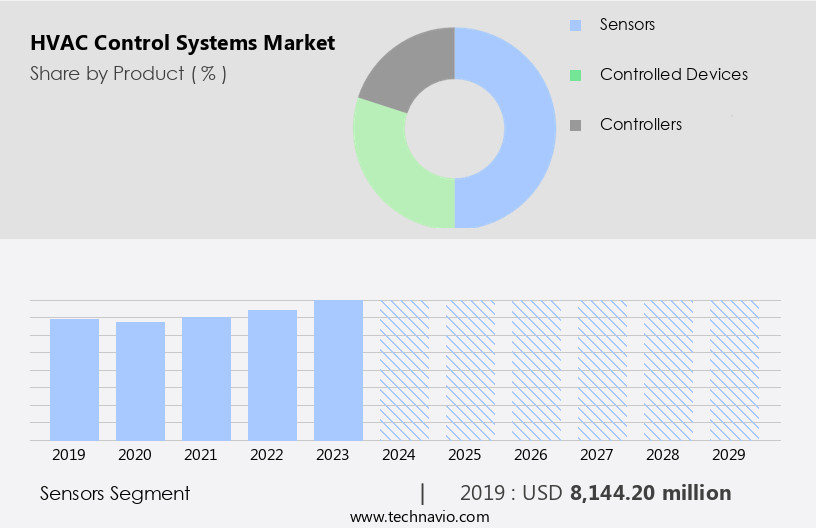

- Product

- Sensors

- Controlled devices

- Controllers

- End-user

- Automotive

- Residential

- Commercial

- Industrial

- Type

- Temperature and humidity control system

- Integrated control system

- Ventilation control system

- Geography

- APAC

- Australia

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By Product Insights

The sensors segment is estimated to witness significant growth during the forecast period. Systems enable fine tuning of temperature and humidity levels, reducing energy consumption and wastage. These systems utilize various sensors, including temperature, humidity, flow, pressure, and electric sensors, to optimize climate control and indoor air quality. Companies are investing in advanced technologies such as cloud computing, Artificial Intelligence (AI), Digital twin, and IoT integration to enhance the capabilities.

Preventative maintenance guidelines and regulations, as well as environmental requirements, are driving the adoption of systems in commercial applications, including shopping malls, educational institutions, healthcare institutions, and green buildings. Zone systems, wireless sensors, and ventilation systems are also gaining popularity. Cost savings and economic growth in the commercial sector further fuel market expansion.

Get a glance at the market report of share of various segments Request Free Sample

The sensors segment was valued at USD 8.14 billion in 2019 and showed a gradual increase during the forecast period.

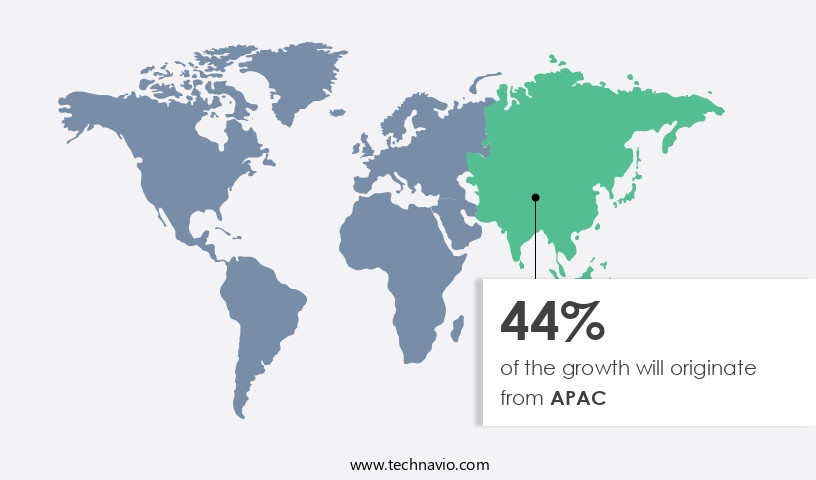

Regional Analysis

APAC is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in Asia Pacific (APAC) is experiencing significant growth due to increasing construction activities and the expansion of commercial sectors in countries like China, India, and Japan. The demand for energy-efficient systems is increasing as awareness about reducing energy wastage and improving indoor air quality grows. Western multinational companies are investing in technology and healthcare sectors in countries such as India, Singapore, Taiwan, and South Korea, driving the demand for advanced HVAC control systems. Rapid urbanization and infrastructure development are also leading to an increase in the adoption of HVAC systems, which in turn is boosting the demand for systems.

These systems enable fine tuning, preventative maintenance, and integration with smart technologies such as cloud computing, Artificial Intelligence (AI), Digital twin, and Internet of Things (IoT). The market is expected to continue growing as new construction projects prioritize energy efficiency, environmental requirements, and climate control. These systems offer cost savings through zone systems, temperature systems, occupant detection, and energy consumption reduction. Key components include temperature and humidity sensing devices, ventilation systems, humidity systems, and an integrated control system for controlled equipment.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of HVAC Control Systems Industry?

- The rising demand for efficient and fail-proof HVAC controls is the key driver of the market. The need for reliable temperature maintenance and efficient monitoring in various industries is driving the growth of HVAC control systems. This demand is particularly strong in sectors such as cold storage, data centers, food processing, healthcare, and pharmaceuticals.

- In cold storage facilities, for instance, precise temperature control is essential for preserving perishable goods like food products, dairy, and pharmaceutical drugs. Automation is also gaining popularity due to its ability to optimally manage temperature and environment. This trend is most prevalent in cold storage applications, where the benefits of automated temperature control are significant. Energy efficiency guidelines and regulations have driven the demand for these systems in both residential and commercial applications.

What are the market trends shaping the HVAC Control Systems Industry?

- The increasing focus on integrated building management systems is the upcoming market trend. The market is witnessing significant growth due to the increasing demand for energy efficiency and cost savings in both commercial and residential buildings. Approximately 60% of energy consumption in buildings is attributed to heating, ventilation, cooling, and lighting systems. Integration of these systems under a unified platform is a recent trend, enabling optimal energy usage and reducing operational and maintenance costs.

- This integration, for instance, allows for the regulation of temperature, humidity, and light within a building, leading to improved building management systems. The market dynamics are driven by the need to reduce energy consumption and enhance overall efficiency in building operations. Green buildings, which prioritize sustainable practices, are a significant market for systems. Smart homes have also contributed to the growth of systems. Residential buyers increasingly prefer homes with temperature control systems, such as smart thermostats, that can be controlled remotely. These systems enable occupant detection and adjust temperature settings accordingly, reducing energy consumption.

What challenges does the HVAC Control Systems Industry face during its growth?

- The rising environmental pollution and stringent government policies on HVAC systems is a key challenge affecting the industry growth. The market is experiencing challenges due to growing concerns over pollution, particularly air pollution. Governments and environmental organizations worldwide are enforcing stricter regulations to reduce greenhouse gas (GHG) emissions, which is hindering the adoption of HVAC systems in various regions. According to International Energy Agency (IEA) reports, global energy-related CO2 emissions increased by 1.1% in 2023, adding 410 million tonnes to the existing carbon footprint.

- HVAC systems contribute to both air and noise pollution. They release hazardous gases, such as hydrochlorofluorocarbons and chlorofluorocarbons, into the environment, which negatively impacts the environment. These environmental concerns are creating obstacles for the growth of the market. The technical complexities of implementing HVAC systems require skilled labor and custom fabrication. However, the benefits outweigh the costs, as these systems enable significant energy savings and improved climate control.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the HVAC systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, HVAC control systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Azbil Corp: The company offers ACTIVAL+ series of motorized valves and actuators, which are designed for precise control of chilled or hot water in HVAC applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Acuity Brands Inc.

- Azbil Corp.

- Computime Group Ltd.

- Delta Electronics Inc.

- Emerson Electric Co.

- Fr. Sauter AG

- Generac Power Systems Inc.

- Honeywell International Inc.

- Johnson Controls International Plc

- KMC Controls Inc.

- Lennox International Inc.

- Mass Electronics Pty Ltd.

- Mitsubishi Electric Corp.

- NanoSense

- Quest Controls Inc.

- Reliable Controls Corp.

- Schneider Electric SE

- Siemens AG

- Trane Technologies plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

HVAC control systems have gained significant traction in various sectors due to the growing emphasis on energy efficiency and building automation. These systems enable fine-tuning of heating, ventilation, and air conditioning (HVAC) systems to optimize energy consumption and reduce wastage. The integration of smart technologies, such as cloud computing and artificial intelligence (AI), has revolutionized HVAC control systems. The use of digital twins, a virtual representation of a physical system, allows for predictive maintenance and real-time monitoring of HVAC performance. This results in cost savings and improved indoor air quality. In the construction sector, HVAC control systems have become essential components of new commercial construction projects.

Zone control systems, which allow for temperature and humidity control in specific areas, have gained popularity in commercial applications. Shopping malls, educational institutions, healthcare institutions, and other large commercial buildings benefit from these systems, as they help maintain optimal indoor conditions while minimizing energy consumption. HVAC control systems have also found applications in smart cities, where they are integrated with lighting systems and other urban infrastructure. Sensing devices that monitor temperature and humidity levels enable real-time adjustments to HVAC systems, reducing energy consumption and improving indoor air quality. Ventilation control systems and humidity control systems are integral components of HVAC control systems.

These systems ensure optimal indoor conditions, which is essential for maintaining a comfortable and productive indoor environment. The economic growth of various sectors has led to increased demand for HVAC control systems. Commercial applications, such as offices, retail spaces, and industrial facilities, require controlled equipment to maintain optimal climate conditions and minimize energy consumption. In summary, HVAC control systems have become essential components of modern buildings, as they enable energy efficiency, improved indoor air quality, and climate control. The integration of smart technologies, such as cloud computing, AI, and IoT, has revolutionized these systems, making them more efficient and cost-effective. The demand for HVAC control systems is expected to continue growing, as more buildings prioritize energy efficiency and sustainable practices.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

232 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.9% |

|

Market growth 2025-2029 |

USD 10.91 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.1 |

|

Key countries |

US, China, Japan, India, Germany, Saudi Arabia, South Korea, UK, Canada, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this HVAC Control Systems Market Research and Growth Report?

- CAGR of the HVAC Control Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the HVAC control systems market growth of industry companies

We can help! Our analysts can customize this HVAC control systems market research report to meet your requirements.