Hydrophobic Coatings Market Size 2025-2029

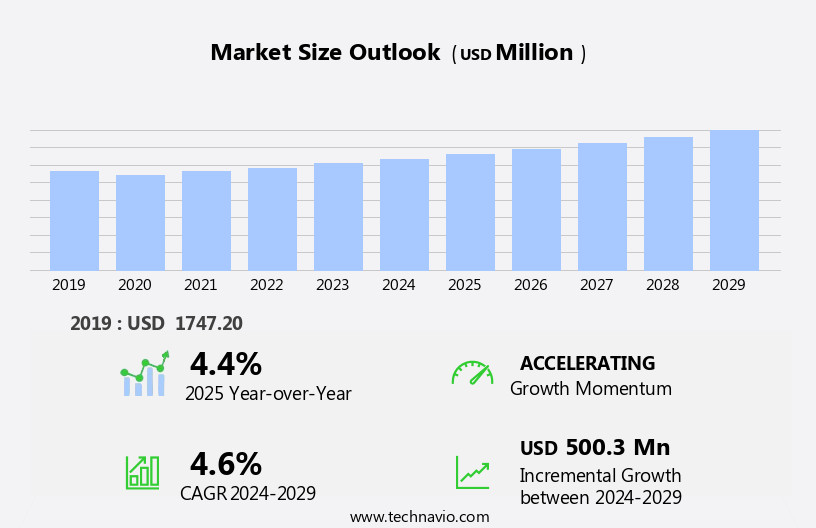

The hydrophobic coatings market size is forecast to increase by USD 500.3 million at a CAGR of 4.6% between 2024 and 2029.

- The market experiences significant growth, driven by increasing demand from the building and construction industry. This sector's expansion is attributed to the rising preference for water-resistant and durable coatings, particularly in regions with high precipitation. Another key trend is the in demand for waterborne hydrophobic coatings, which offer environmental benefits over solvent-based alternatives. However, market growth faces challenges. Regulatory hurdles impact adoption due to stringent environmental regulations, particularly in Europe and North America. Moreover, the healthcare sector is adopting hydrophobic coatings for medical devices to prevent bacterial growth and ensure longevity.

- Additionally, supply chain inconsistencies, including raw material availability and price fluctuations, temper growth potential. Companies seeking to capitalize on market opportunities must navigate these challenges effectively, focusing on innovation and sustainability to meet evolving customer demands and regulatory requirements. The oil & gas industry is also utilizing hydrophobic coatings for pipelines and offshore platforms to prevent corrosion and increase operational efficiency.

What will be the Size of the Hydrophobic Coatings Market during the forecast period?

- The market encompasses various technologies, including sol-gel coatings, plasma treatment, and the lotus effect, which offer significant benefits for thermal insulation and light reflection in both industrial and green building applications. Eco-friendly coatings, such as sustainable and bio-based options, are gaining popularity due to their cost-benefit analysis and alignment with LEED certification requirements. Hydrophilic, anti-fouling, oleophobic, and superhydrophobic coatings provide solutions for fire resistance, building code compliance, and surface modification. Coating innovations, like self-healing and smart coatings, offer enhanced health and safety features and improved return on investment. Hydrophobic coatings are applied to a substrate, such as metal, glass, polymer, ceramics, concrete, or textiles, to create a coating layer that repels water.

- Digital printing technology enables patterned coatings, adding aesthetic value to various industries. VOC emissions and life cycle analysis are crucial factors in the selection process, driving the market towards more sustainable solutions. Coating technologies continue to evolve, offering solutions for various industries while addressing environmental concerns and regulatory requirements. Polysiloxanes, fluoropolymers, fluoro-alkylsilanes, titanium dioxide, and other hydrophobic coating materials are extensively used on substrates like metal, glass, polymer, ceramics, concrete, and textiles.

How is this Hydrophobic Coatings Industry segmented?

The hydrophobic coatings industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Automotive

- Building and construction

- Aerospace

- Marine

- Others

- Technology

- Chemical vapor deposition

- Sol-gel process

- Physical vapor deposition

- Vacuum deposition

- Electrospinning

- Type

- Anti-icing or wetting

- Anti-microbial

- Anti-corrosion

- Anti-fouling

- Self-cleaning

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

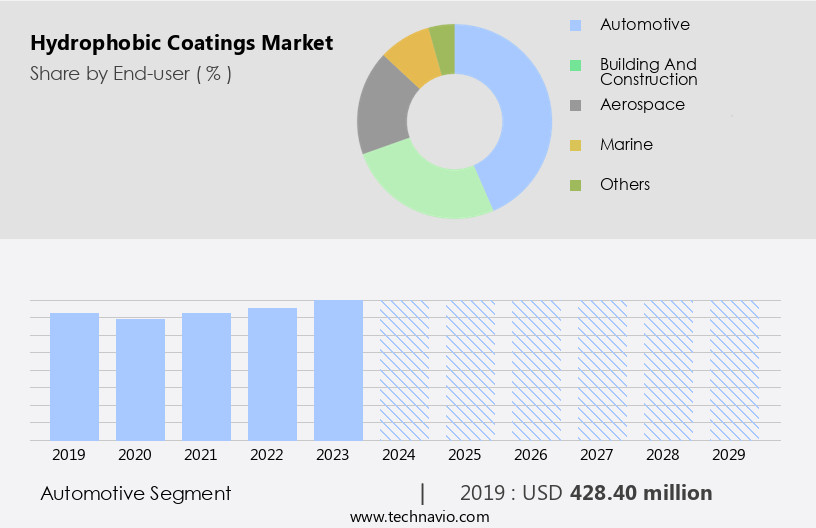

The automotive segment is estimated to witness significant growth during the forecast period. The market encompasses various industries, with the automotive segment leading the demand due to its self-cleaning property and visual appeal. These coatings, which restrict water formation and allow easy cleaning, are utilized in both new vehicle production and aftermarket applications such as repair and refinishing. Hydrophobic coatings serve dual functions in the automotive industry: protection against environmental elements and decorative enhancement. Beyond automotive, industries such as textile, industrial, and architectural also employ hydrophobic coatings for moisture control, corrosion protection, condensation control, and surface protection. The increasing demand for waterborne coatings can be attributed to the growing consumer preference for eco-friendly and less toxic alternatives. Coating types include polyurethane, epoxy, acrylic, silicone, and silane, with application methods ranging from brush and roller to spray.

The Automotive segment was valued at USD 428.40 million in 2019 and showed a gradual increase during the forecast period. Substrate compatibility is essential, with coatings designed for use on wood, metal, concrete, and glass. Performance testing ensures the desired properties, including water contact angle, coating thickness, water repellency, abrasion resistance, and UV protection. The market trends toward energy efficiency, solvent-based and water-based coatings, and longer service life and shorter curing times. Maintenance costs are a consideration, with some coatings offering superior durability and ease of maintenance. Industries such as aerospace, marine, and building facades also benefit from hydrophobic coatings for their resistance to chemicals, impact, and weather. Additionally, the anti-corrosion property of hydrophobic coatings makes them ideal for use in industrial maintenance and protective coatings applications.

Regional Analysis

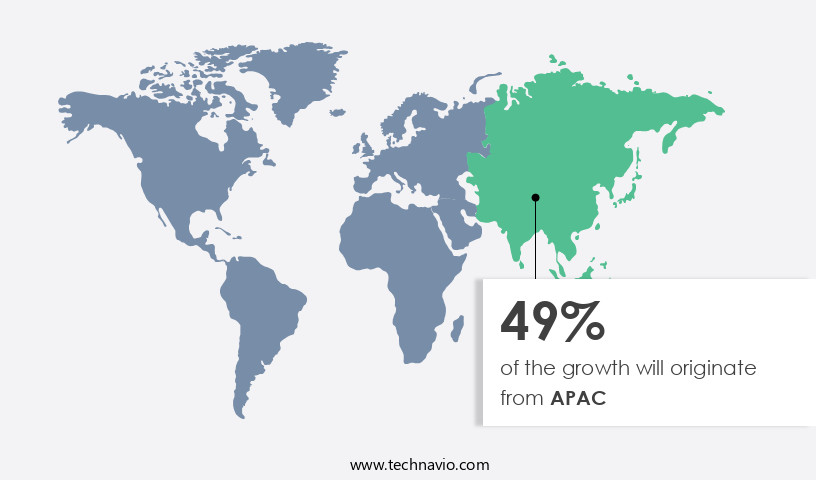

APAC is estimated to contribute 49% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Hydrophobic coatings, which offer water repellency and stain resistance, are gaining significant traction in various industries due to their unique properties. These coatings are applied using methods such as brush application and roller application, and are available in forms like polyurethane coatings, epoxy coatings, acrylic coatings, and silicone coatings. The coatings' service life and curing time vary depending on the specific type and application. Textile coatings and industrial coatings are major sectors utilizing hydrophobic coatings for moisture control, corrosion protection, and condensation control. Surface preparation is crucial before applying these coatings to ensure substrate compatibility. Fluoropolymer coatings and water-based coatings are popular choices for their chemical resistance and ease of application.

Wood coatings, metal coatings, architectural coatings, and marine coatings are other sectors benefiting from hydrophobic coatings. Building facades and aerospace coatings also use these coatings for their UV protection, energy efficiency, and weather resistance. The coatings' abrasion resistance, impact resistance, and drying time are essential factors in their selection. In the Asia Pacific region, China, Japan, and India are leading markets due to the presence of large industries and growing consumer demand. For instance, China's automotive industry, the largest in the world, drives the demand for hydrophobic coatings. Despite price-sensitive consumers, the increasing disposable income, government initiatives, and vehicle penetration are fueling the market's growth.

Application methods include spray application and solvent-based coatings, while performance testing is crucial to ensure the coatings' quality and effectiveness. Maintenance costs and glass coatings are also significant considerations in the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Hydrophobic Coatings market drivers leading to the rise in the adoption of Industry?

- The building and construction industry's expanding demand serves as the primary driver for market growth. Hydrophobic coatings have gained significant traction in the construction industry due to their moisture control and corrosion protection properties. These coatings enhance water repellency by increasing the water contact angle and reducing coating thickness. The construction sector's growth is driving the demand for hydrophobic coatings, with numerous projects underway, such as the Turkey Urban Renewal Project. The industry's expansion, particularly in emerging economies like China and India, is anticipated to boost hydrophobic coatings' consumption in buildings and infrastructure. The anti-microbial, self-cleaning, and anti-fouling properties of hydrophobic coatings are also gaining popularity in consumer goods, medical & healthcare, and logistics industries.

- Substrate compatibility is a crucial factor in the application methods of hydrophobic coatings, which include epoxy coatings. These coatings effectively protect against condensation and water damage, making them an essential component in various industries, including construction.

What are the Hydrophobic Coatings market trends shaping the Industry?

- The demand for waterborne hydrophobic coatings is experiencing significant growth, representing a notable market trend in the coatings industry. Waterborne hydrophobic coatings offer numerous advantages, including superior water resistance and eco-friendly formulations, making them an increasingly popular choice for various applications. The market is experiencing significant growth due to the increasing demand for waterborne coatings. Waterborne coatings, including acrylic, silicone, and silane coatings, offer several advantages such as superior chemical resistance, ease of application via roller application, and excellent surface protection. These coatings are less toxic and flammable due to their low Volatile Organic Compounds (VOC) and Hazardous Air Pollutants (HAP) emissions, contributing to reducing air pollution. Moreover, waterborne coatings offer good heat resistance, resistance to abrasion, and excellent adhesion. They do not require additional additives, thinners, or hardeners, reducing overall costs compared to solvent-borne coatings. The longer pot life of waterborne coatings enables their preservation for future use, making them an ideal choice in cases where solvent-borne coatings may react with the substrate.

- Additionally, the hassle-free maintenance of paint guns used for waterborne coatings, as they can be cleaned using water or water-based solutions, further adds to their appeal. The market is driven by various industries such as aerospace, automotive, marine, and metal, where the need for high-performance coatings is essential. Performance testing is crucial in ensuring the quality and reliability of these coatings, ensuring customer satisfaction and repeat business.

How does Hydrophobic Coatings market faces challenges face during its growth?

- Strict environmental regulations pose a significant challenge to the industry's growth. Adhering to these regulations adds to the operational costs and complexities for businesses in the sector, necessitating continuous investment in technology and processes to ensure compliance. Hydrophobic coatings, which include architectural coatings with properties such as abrasion resistance, UV protection, energy efficiency, and weather resistance, are gaining popularity due to their advanced features. These coatings are increasingly being used in various industries, including concrete structures, to enhance their durability and reduce maintenance costs. However, the use of solvent-based coatings, which contain volatile organic compounds (VOCs), poses environmental concerns. In response to regulatory pressures, key market players have shifted towards low- or no-VOC coatings. For instance, in the US, Southern California mandates the use of VOC-free tinting bases for architectural base colors. This regulation, while initially applied only in Southern California, was effectively implemented through industry-wide advertising and promotional efforts highlighting the benefits of VOC-free coatings.

- Moreover, the adoption of spray application methods and shorter drying times has further increased the demand for hydrophobic coatings. The energy efficiency and impact resistance offered by these coatings are additional advantages that make them a preferred choice for various applications. Overall, the market for hydrophobic coatings is expected to grow due to these factors and the increasing focus on sustainable and eco-friendly solutions.

Exclusive Customer Landscape

The hydrophobic coatings market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hydrophobic coatings market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hydrophobic coatings market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in applying advanced hydrophobic coatings, including 3M Novec and 3M Scotchgard, enhancing surfaces with exceptional water repellency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- AccuCoat Inc.

- Aculon

- Advanced Nanotech Lab

- Anhui Sinograce Chemical Co. Ltd.

- Artekya Technology

- BASF SE

- CYTONIX

- Drywired

- Lotus Leaf Coatings Inc.

- NEI Corp.

- NeverWet LLC

- Nippon Paint Holdings Co. Ltd.

- NTT Advanced Technology Corp.

- P2i Ltd.

- Pearl Global Ltd.

- PPG Industries Inc.

- Sto SEA Pte. Ltd

- Surfactis Technologies

- UltraTech International Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hydrophobic Coatings Market

- In February 2024, DuPont Water Solutions, a leading global provider of water treatment and energy management solutions, introduced a new line of hydrophobic coatings, called Tyvek DrainWrap Xtra. This innovative product offers enhanced water repellency and improved drainage capabilities, making it suitable for various applications in construction, infrastructure, and industrial markets (DuPont Press Release, 2024).

- In May 2025, PPG Industries, a leading coatings manufacturer, announced a strategic partnership with NanoGraf, a leader in advanced materials for energy storage. Together, they will develop hydrophobic coatings for lithium-ion batteries, aiming to increase battery efficiency and extend their lifespan (PPG Industries Press Release, 2025).

- In August 2024, Wacker Chemicals, a leading specialty chemicals company, completed the acquisition of the hydrophobic coatings business of 3M, significantly expanding its presence in this market. The acquisition included the transfer of production sites and technologies, enabling Wacker to offer a broader range of hydrophobic coating solutions to its customers (Wacker Chemicals Press Release, 2024).

- In December 2025, the European Union (EU) approved the use of hydrophobic coatings in food contact applications, opening up a new market segment for this technology. This approval is expected to boost the adoption of hydrophobic coatings in the food industry, particularly in the production of packaging materials (European Commission Press Release, 2025).

Research Analyst Overview

The market continues to evolve, driven by the diverse requirements of various sectors. Architectural coatings, for instance, utilize hydrophobic properties for stain resistance, enhancing the aesthetics and longevity of buildings. In industrial applications, hydrophobic coatings offer corrosion protection and moisture control for critical infrastructure. Abrasion resistance and UV protection are essential features in textile coatings, ensuring durability and longevity. Energy efficiency is a growing concern in industrial and architectural coatings, with hydrophobic coatings offering potential solutions through reduced energy consumption. Solvent-based coatings have long dominated the market, but water-based alternatives are gaining popularity due to their environmental benefits and ease of application.

Application methods, including brush, roller, and spray, continue to evolve, offering flexibility and efficiency. Substrate compatibility is a critical consideration in hydrophobic coatings, with epoxy, acrylic, silicone, and silane coatings each offering unique advantages. Performance testing is essential to ensure optimal coating thickness, water repellency, and coating durability. Hydrophobic coatings find applications in various sectors, including concrete structures, aerospace, automotive, marine, and building facades. Coating thickness and drying time are essential factors in optimizing application and reducing maintenance costs. Impact resistance, chemical resistance, and condensation control are additional benefits of hydrophobic coatings, making them indispensable in numerous industries. The ongoing research and development in this field ensure that hydrophobic coatings continue to offer innovative solutions for surface protection.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hydrophobic Coatings Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

226 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 500.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, China, Japan, Germany, Canada, South Korea, UK, India, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hydrophobic Coatings Market Research and Growth Report?

- CAGR of the Hydrophobic Coatings industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hydrophobic coatings market growth of industry companies

We can help! Our analysts can customize this hydrophobic coatings market research report to meet your requirements.