Ice Cream Processing Equipment Market Size 2024-2028

The Ice Cream Processing Equipment Market size is estimated to grow by USD 1.68 billion at a CAGR of 3.2% between 2023 and 2028. The ice cream industry has experienced significant growth and innovation in recent years. With the increasing number of ice cream parlors, consumers now have more options than ever before to satisfy their sweet cravings. One key trend in this sector is the extension of shelf life for food products, including ice cream, through advanced preservation techniques and packaging technologies. Another noteworthy development is the rising popularity of plant-based ice cream, catering to the growing demand for vegan and dairy-free options. This shift in consumer preferences reflects the industry's commitment to catering to diverse dietary needs and preferences while maintaining the delicious taste and texture of traditional ice cream. Overall, the ice cream industry continues to evolve, offering consumers a wider range of choices and innovations.

What will be the Size of the Market During the Forecast Period?

To learn more about this report, Download the FREE Report Sample

Key Market Customer Landscape

Our analysis of the adoption life cycle of the market indicates its movement between the innovator’s stage and the laggard’s stage. The market growth analysis report illustrates the lifecycle of the market, focusing on the adoption rates of the major countries. Technavio has included key purchase criteria, adoption rates, adoption lifecycles, and drivers of price sensitivity to help companies evaluate and develop growth strategies from 2023 to 2028.

Customer Landscape

Market Dynamics

The market is driven by rising amusement demand and the population's purchasing power, which boosts ice cream market sales. Key factors include the need for cleanliness in countertop equipment models and consistent essence in cream mixture preparation. Ice cream machines are designed for both immediate use and high-quality production of iced goods like ice cream cones and other homemade products. The food and beverage sector benefits from advancements in ice cream processing equipment, ensuring efficient and hygienic processing. Manufacturers focus on minimizing alcohol content where applicable and improving framing techniques to enhance product quality. These innovations cater to growing consumer expectations and maintain high standards in ice cream production. Our researchers studied the data for years, with 2023 as the base year and 2024 as the estimated year, and presented the key drivers, trends, and challenges for the market.

Key Market Driver

The growth of the industry is being propelled by the increasing number of ice cream parlors. The shift from traditional to organized formats has accelerated growth in various end-user industries. Consumers' busy lifestyles have made convenience and value important, leading many end-users to offer a variety of products under one roof, such as gelatos. As a result, customers are increasingly purchasing from parlors, emphasizing the importance of organized parlors. This has led to an increase in sales of ice cream processing equipment.

Moreover, Havmor Ice Cream Company Private Limited (Havmor) is expanding its market presence, particularly in Delhi, India. The company has partnered with ITC Master Chef Partners to launch 100 mobile carts selling frozen snacks, across Delhi NCR. It aims to establish direct distribution through branded freezers and increase the number of retail outlets in the coming years. These expansions are expected to drive the growth of the industry, thereby propelling the growth of the market during the forecast period.

Significant Market Trends

The market is witnessing emerging trends in the form of business strategies adopted by companies. To strengthen their market position in the vegan food industry, Companies are investing in expanding their product portfolio, including vegan food products and vegan ice cream, which will increase their sales revenue and drive market growth during the forecast period.

Moreover, Companies are pursuing diverse business strategies, such as partnerships and collaborations, with end-users and distributors to enhance their distribution channels and upgrade their product portfolios. For example, in May 2021, the Co-operative Group Ltd. partnered with Unilever plc (Unilever) to launch Europe's first smart vending machine. The vending machine features a near-field communication tag with a QR code that connects to a smartphone app, demonstrating innovative developments that are expected to drive the growth of market trends during the forecast period.

Major Market Challenge

A major challenge impeding the market is the prevailing market for second-hand ice cream processing equipment. Many end-users prefer to purchase used processing equipment, as it guarantees high-quality output and allows them to save on equipment purchase costs. Small end-users in emerging economies, who seek improved features and better quality equipment but are hesitant to spend a significant amount of money, are opting for second-hand processing equipment.

Furthermore, the online market for such equipment is expanding in developed nations, with popular online marketplaces such as eBay Inc. (eBay), Gumtree.com Limited (Gumtree), and Burkett Restaurant Equipment selling second-hand freezer equipment. The increasing preference for and purchase of used equipment is adversely affecting the sales of new equipment, which will be a significant factor restricting market growth during the forecast period.

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

BRAVO Spa - The company offers Gelato, Confectionery, Chocolate, and Ho.Re.Ca. The key offerings of the company include ice cream processing equipment.

Our market growth and forecasting report includes detailed analyses of the market’s competitive landscape and offer information on 20 market Companies, including:

- Alfa Laval Corporate AB

- Ali Group Srl

- BRAVO Spa

- CATTA 27 SRL

- Co-operative Group Ltd.

- Donper USA

- Electro Freeze

- GEA Group AG

- Goma Engineering Pvt. Ltd.

- Gram Equipment AS

- Ice Group Sp z o.o.

- ROKK Processing Ltd.

- Shenzhen Oceanpower Food Equipment Tech Co. Ltd.

- Spaceman Ice Systems Co. Ltd.

- SPX FLOW Inc.

- Taylor Freezer Sales Co.

- Technogel Spa

- Teknoice S.r.l

- Tetra Pak Group

- VOJTA Equipment s.r.o.

- Win Equipment BV

Technavio report provides an in-depth analysis of the market and its players through combined qualitative and quantitative data. The analysis classifies Companies into categories based on their business approaches, including pure-play, category-focused, industry-focused, and diversified. Companies are specially categorized into dominant, leading, strong, tentative, and weak, based on their quantitative data analysis.

Market Segmentation

By Product

The market share growth by the soft ice cream segment will be significant during the forecast period. Soft ice cream processing equipment is used for softening and decreasing the density by lowering the milk fat (3 to 6 %) and ice cream (10 to 18%) and is manufactured at a temperature of roughly 4 degrees C (25 degrees F) compared with ice cream, which is stored at 15 degrees C (5 degrees F).

Get a Customised Report as per your requirements for FREE!

The soft ice cream segment was valued at USD 7.16 billion in 2018. Air is incorporated into soft serve during the freezing process. The air content, known as overrun, can range from 0% to 60% of the total volume of the completed product. The amount of air used influences the flavor of the end product. Low-air-content products have a strong, chilly flavor and appear more yellow. Ice creams with a higher air content taste creamier, smoother, and lighter and appear whiter. The optimum quantity of air is determined by other ingredients, if any, and individual taste. Generally, the ideal air content should be between 33 and 45 percent of the volume. If more than this, the product loses taste, tends to shrink as it loses air, and melts more quickly than that with less air. With less than 33 to 45 percent, the product will not melt as quickly but will not taste good. Hence, such factors are expected to fuel the growth of the segment in the global market during the forecast period.

By Type

Under the type segment, homogenizers and mixing equipment are leading the market growth. Homogenizer and mixing equipment are equipment that is used to create a uniform and consistent mixture. It works by breaking the components and evenly distributing them throughout the solution. It provides a smooth and homogeneous distribution of particulate powder and aroma products added to the mixture. The homogenizer, which is used in the production process, improves shelf life by increasing the quality. The homogenization process offers numerous benefits. Firstly, it enhances the taste and flavor, resulting in a softer texture. Additionally, it reduces crystallization and prevents icing problems, leading to a more stable structure in the cream. Homogenization also contributes to the prolongation of the melting time and facilitates digestion, thereby improving the consistency of the ice cream. Furthermore, the process is energy-efficient and contributes to low energy consumption while providing maximum efficiency. Hence, due to the above-mentioned factors, the demand for homogenizers and mixing equipment is expected to rise in the global market during the forecast period.

By Region

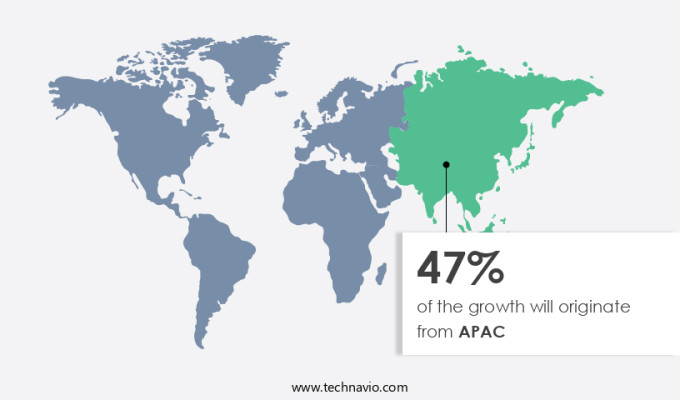

APAC is estimated to contribute 47% to the growth by 2028. Technavio’s analysts have elaborately explained the regional trends, drivers, and challenges that are expected to shape the market during the forecast period.

For more insights on the market share of various regions Request PDF Sample now!

Another region offering significant growth opportunities to vendors is North America. Due to the need to import and store frozen food products like ice creams and gelato, which require freezing, the demand for such products has been on the rise. In addition, the growing disposable incomes and increasing urban population in the region are other factors that will drive the market's growth. Companies of frozen food products are investing in expanding their production capabilities in North America to meet the rising demand from consumers, leading to an increase in demand in the region.

New flavor launches and the launch of low-fat products are significant trends emerging in this market. For instance, Oatly Group AB (Oatly) recently announced the launch of a vegan bar line in the US, which is available in four flavors, including chocolate fudge, strawberry swirl, salted caramel, and vanilla. As such, these trends are expected to propel the growth of the regional market during the forecast period.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion " for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product Outlook

- Soft

- Hard

- Type Outlook

- Homogenizers and mixing equipment

- Filling equipment

- Extrusion and molding equipment

- Freezers

- Others

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Chile

- Brazil

- Argentina

- North America

You may also interested in the below market reports

-

Dairy Processing Equipment Market: by Application, Type, and Geography - Forecast and Analysis

-

Ice Cream Market: Analysis North America, APAC, Europe, South America, Middle East and Africa - US, New Zealand, Australia, Finland, Sweden - Size and Forecast

-

Gourmet Ice Cream Market: Analysis Europe, North America, APAC, South America, Middle East and Africa - US, Germany, Belgium, UK, China - Size and Forecast

Market Analyst Overview

The market is evolving with automated ice cream processing equipment and innovative solutions to meet the growing demand for diverse frozen goods like yogurts, sorbets, and ice cream. Ice cream producers are increasingly investing in manual and semi-automatic machinery as well as automatic manufacturing systems to enhance profitability and reduce product waste. Key considerations include hygiene, contamination prevention, and clean label ingredients in organic packaging. The market addresses various top impacting factors such as installation cost, repairing, and replacing equipment. Advances in cooling, sealing, labeling, wrapping, and packing contribute to improved taste and flavors. Milk processing equipment and new design innovations cater to the hospitality sector, education industry, and travel industry. As consumer preferences shift towards healthy ice-cream packaging and innovative flavors, the market continues to grow, driven by advancements in Big Drum Engineering and enhanced varieties of iced products.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market growth 2024-2028 |

USD 1.68 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.06 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 47% |

|

Key countries |

US, China, Germany, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Alfa Laval AB, Ali Group S.r.l., BRAVO Spa, CATTA 27 SRL, Co operative Group Ltd., Donper USA, Electro Freeze, GEA Group AG, Goma Engineering Pvt. Ltd., Gram Equipment AS, Ice Group Sp z o.o., ROKK Processing Ltd., Shenzhen Oceanpower Food Equipment, Spaceman Ice Systems Co. Ltd., SPX FLOW Inc., Taylor Freezer Sales Co., Technogel Spa, Teknoice S.r.l, Tetra Pak Group, VOJTA Equipment s.r.o., and Win Equipment BV |

|

Market dynamics |

Parent market analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this report to meet your requirements. Get in touch