Gourmet Ice Cream Market Size 2025-2029

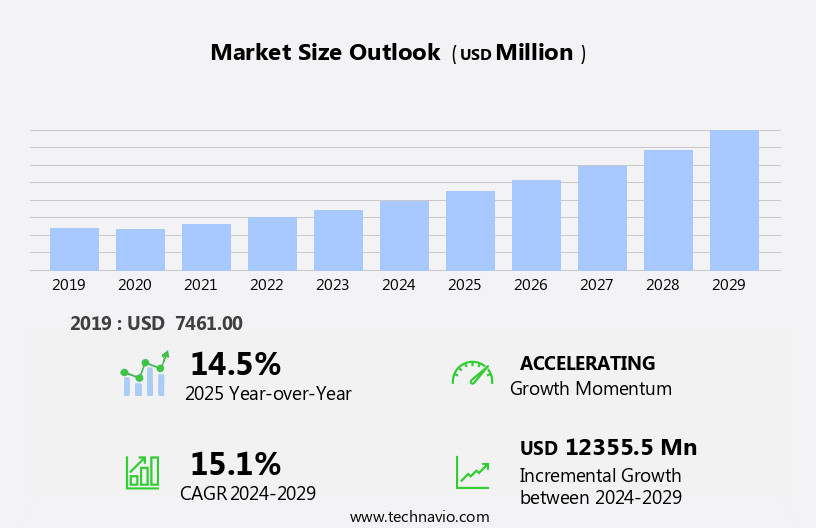

The gourmet ice cream market size is forecast to increase by USD 12.36 billion, at a CAGR of 15.1% between 2024 and 2029.

- The market is driven by the increasing health benefits associated with gelato, a key segment within the market. Consumers are increasingly drawn to the denser, richer texture and authentic Italian origins of gelato, which is perceived as a healthier alternative to traditional ice cream due to its lower fat content and use of natural ingredients. This trend is further fueled by the growing culture of socializing in gelaterias and ice cream parlors, where consumers can enjoy a premium experience and indulge in a wide variety of unique and artisanal flavors. However, the market also faces challenges in its distribution channels.

- With the increasing popularity of online sales and home delivery services, traditional brick-and-mortar stores are facing increased competition. Additionally, the perishable nature of gourmet ice cream poses logistical challenges for manufacturers and retailers, requiring careful planning and coordination to ensure timely delivery and optimal product quality. Companies seeking to capitalize on market opportunities must navigate these challenges effectively, leveraging innovative distribution strategies and supply chain management techniques to maintain a competitive edge.

What will be the Size of the Gourmet Ice Cream Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, reflecting the dynamic nature of consumer preferences and industry trends. The artisan food movement has led to a surge in small-batch production, with quality control and ethical sourcing becoming key differentiators. Plant-based and dairy-free options, including vegan ice cream, have gained popularity due to increasing demand for sustainable and ethical food choices. Food festivals and events provide a platform for brands to showcase their unique flavors and innovative recipe formulations. Premium pricing and luxury food market trends have led to the emergence of gourmet toppings and subscription services. Social media marketing and influencer collaborations have become essential strategies for brand differentiation and customer engagement.

Food safety standards and sustainable practices are increasingly important, with many brands focusing on local sourcing and fair trade ingredients. The freezing process and packaging technology have also advanced, enabling online ordering and direct-to-consumer sales. Specialty ice creams, seasonal flavors, and ice cream cakes continue to capture the imagination of consumers, offering a sensory experience that goes beyond the traditional scoop. Brand loyalty is fostered through custom flavors, loyalty programs, and a focus on the customer experience. The market is a constantly unfolding landscape, with ongoing innovation in flavor development, sensory analysis, and marketing strategies.

The dessert industry as a whole continues to adapt to changing consumer preferences and market dynamics, ensuring a rich and diverse range of options for consumers.

How is this Gourmet Ice Cream Industry segmented?

The gourmet ice cream industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Gelato

- Sorbet

- Frozen custard

- Others

- Distribution Channel

- Offline

- Online

- Product Type

- Inorganic

- Organic

- Flavor

- Vanilla

- Chocolate

- Strawberry

- Butter pecan

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

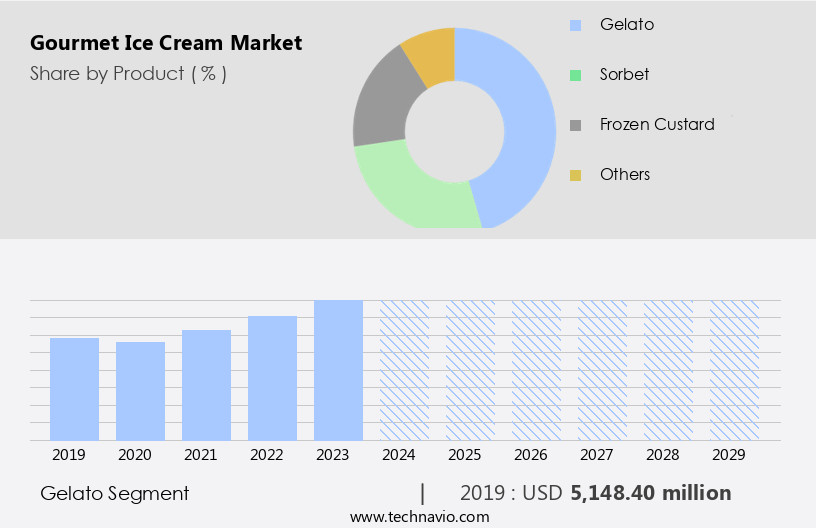

By Product Insights

The gelato segment is estimated to witness significant growth during the forecast period.

The market encompasses various offerings, including ice cream sandwiches, artisan ice cream, plant-based ice cream, and frozen yogurt. This market is a significant segment of the dessert industry, with a strong focus on quality control, ethical sourcing, and sustainable practices. The artisan food movement has fueled innovation, leading to unique flavors, custom formulations, and small-batch production. Consumer preferences for natural ingredients, organic dairy, and dairy-free options have driven the growth of this sector. Food festivals and events serve as platforms for brand differentiation and influencer marketing. Premium pricing is common, reflecting the luxury food market status of gourmet ice cream.

Food safety standards are stringently adhered to, ensuring a superior customer experience. Sensory analysis plays a crucial role in recipe formulation and flavor development. Subscription services and online ordering have streamlined distribution, while direct-to-consumer sales and wholesale distribution expand reach. Food trends, such as sustainable practices, vegan ice cream, and flavor innovation, continue to shape the market. Gourmet toppings and specialty ice creams cater to diverse consumer preferences. Loyalty programs and packaging technology further enhance the overall consumer experience. The market is characterized by a focus on local sourcing, seasonal flavors, and ice cream cakes. The freezing process is meticulously managed to preserve the texture and taste of these premium offerings.

The Gelato segment was valued at USD 5.15 billion in 2019 and showed a gradual increase during the forecast period.

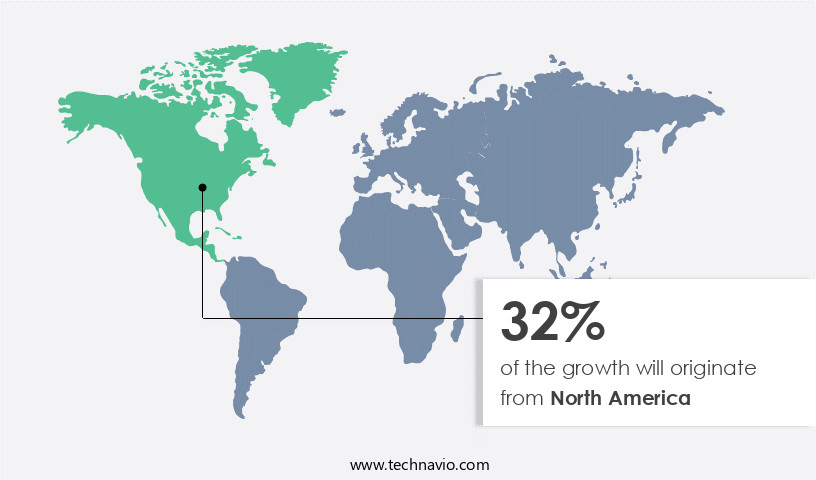

Regional Analysis

North America is estimated to contribute 32% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European the market is experiencing significant growth, driven by the increasing number of gelaterias and premium ice cream parlors across major European countries such as Italy, Germany, the UK, the Netherlands, Spain, France, Sweden, and Belgium. Consumer preferences for high-quality, ethically sourced, and natural gourmet ice cream products are on the rise, with an emphasis on small-batch production, flavor innovation, and sustainable practices. Plant-based ice cream and dairy-free options are gaining popularity in the dessert industry, catering to the growing demand for vegan and lactose-intolerant consumers. Artisan food movements and organic dairy trends are also influencing the market, with many companies focusing on local sourcing and fair trade ingredients.

Food festivals and events are providing opportunities for brands to showcase their unique flavors and customer experiences, while social media marketing and influencer collaborations help to build brand differentiation and loyalty. Premium pricing and subscription services are common strategies for companies to cater to the luxury food market. The market is subject to strict food safety standards and sensory analysis to ensure product quality and consistency. The freezing process and packaging technology are critical factors in maintaining the texture and taste of gourmet ice cream. Retail distribution, wholesale sales, and direct-to-consumer sales are common channels for reaching customers. Custom flavors and seasonal offerings are key differentiators for companies, with many offering custom ice cream cakes and specialty ice creams for various occasions.

The market is continually evolving, with a focus on sustainable practices, unique flavors, and innovative toppings to enhance the overall customer experience.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Gourmet Ice Cream Industry?

- The significant health advantages of gelato are the primary factor fueling market growth. Gelato, a popular frozen dessert, is gaining increasing recognition for its potential health benefits, which include being denser and having less air than ice cream, making it a more calorie-dense and satisfying option for consumers seeking healthier dessert choices. Additionally, gelato is often made with fresh fruits and natural ingredients, further enhancing its nutritional value and appeal to health-conscious consumers. This trend is driving the market for gelato, as both producers and consumers recognize its unique health benefits and desirability.

- The market has seen significant growth due to shifting consumer preferences towards healthier and more flavorful options. Gelato, an Italian alternative to traditional ice cream, has gained popularity for its lighter texture and rich flavors. The health benefits associated with gelato, including its use of sucrose instead of high fructose corn syrup, have attracted health-conscious consumers in leading markets such as North America and Europe. Furthermore, the frozen yogurt segment of the market has also experienced growth due to its perceived health benefits. Retail distribution channels, including supermarkets and specialty stores, have been instrumental in driving the market's expansion.

- Innovation in flavor development and sustainability practices have been key drivers in the market. Vegan ice cream options have gained traction due to increasing consumer demand for plant-based products. Event marketing and influencer partnerships have also played a role in promoting these products to a wider audience. Local sourcing of ingredients and sustainable production processes have become important considerations for consumers in the luxury food market. Overall, the market is expected to continue growing as consumers seek out unique and healthier options.

What are the market trends shaping the Gourmet Ice Cream Industry?

- The increasing preference for socializing in gelaterias and ice cream parlors represents a notable market trend. These establishments offer unique experiences, fostering community engagement and providing a relaxing atmosphere.

- The global ice cream market has witnessed a notable expansion in recent years, with an increasing number of specialty ice cream parlors emerging in countries such as the US, Italy, the UK, Germany, France, China, and India. These establishments offer unique flavors and experiences, transforming ice cream consumption into a social activity. Many ice cream manufacturers have responded by opening branded parlors to showcase their premium and gourmet ice cream varieties. In the US market, for instance, consumers can enjoy custom flavors and seasonal offerings at these parlors. Additionally, advanced packaging technology, online ordering systems, and loyalty programs have become essential components of the ice cream market, catering to the evolving preferences of consumers.

- Furthermore, the market extends beyond direct-to-consumer sales, with wholesale distribution playing a significant role in reaching a broader audience. As the ice cream industry continues to evolve, companies are focusing on innovation to stay competitive. This includes the creation of immersive and harmonious experiences, emphasizing quality and customization, and offering a wide range of ice cream cakes for various occasions. In conclusion, the ice cream market is experiencing steady growth, driven by consumer demand for unique and high-quality offerings.

What challenges does the Gourmet Ice Cream Industry face during its growth?

- The gourmet ice cream industry faces significant challenges in expanding due to the complexities and intricacies involved in optimizing distribution channels.

- In the gourmet food industry, ice cream sandwiches have emerged as a popular dessert trend. Manufacturers face unique challenges in distributing their high-quality, often artisan, products through retail stores. These challenges include pressure on pricing and profit margins due to retailers' lower profit margins, as well as demands for frequent and smaller product deliveries to minimize warehousing costs. Retailers are also seeking innovative merchandising solutions, such as movable shelves, to optimize inventory management and prevent revenue declines due to stock gaps. Additionally, consumers are increasingly demanding ethical sourcing and quality control in their gourmet food purchases, including plant-based ice cream options and organic dairy.

- Adherence to food safety standards is also crucial for both manufacturers and retailers in the competitive dessert industry. Small-batch production and food festival appearances are effective strategies for gourmet ice cream manufacturers to differentiate themselves and engage with consumers. These market dynamics reflect the evolving demands of the gourmet food market and the importance of staying attuned to food trends.

Exclusive Customer Landscape

The gourmet ice cream market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gourmet ice cream market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gourmet ice cream market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amadora Gourmet Ice creams Pvt. Ltd. - The company specializes in artisanal ice cream creations, featuring unique flavors such as Five Bean Vanilla, Caramelized White Chocolate, Dark Chocolate Sorbet, and Salted Butter Caramel. Each delectable scoop is meticulously crafted to provide an unparalleled gourmet experience. Our ice creams are made with the finest ingredients, ensuring rich, complex flavors that delight the palate. By continuously innovating and pushing the boundaries of traditional ice cream flavors, we aim to elevate the dessert experience for our discerning clientele.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amadora Gourmet Ice creams Pvt. Ltd.

- American Classic Specialities

- Amorino

- Braums Online L.L.C.

- Daves Gourmet Ice Cream

- Froneri International Ltd.

- Gelato Italia Ltd.

- General Mills Inc.

- Herrells Ice Cream

- iSwich Gourmet

- Mammino Gourmet Ice Cream

- Morellis Gelato

- Nestle SA

- Numoo

- Papacream

- Papitto Gelato

- R and R Durian

- Rons Gourmet Ice Cream

- Unilever PLC

- Vadilal Industries Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Gourmet Ice Cream Market

- In February 2024, Haagen-Dazs, a leading gourmet ice cream brand, introduced a new line of plant-based ice cream flavors, expanding its product offerings to cater to the growing demand for vegan and dairy-free options (Haagen-Dazs Press Release).

- In May 2024, Unilever, a multinational consumer goods company, announced a strategic partnership with Perfect Day, a food technology company, to produce dairy-free ice cream using precision fermentation technology. This collaboration aims to reduce the carbon footprint and improve sustainability in the production of gourmet ice cream (Unilever Press Release).

- In July 2024, Nestlé, the world's largest food and beverage company, acquired a significant stake in Ice Cream Fortuna, a leading ice cream manufacturer in Latin America. This move strengthened Nestlé's presence in the region and expanded its ice cream portfolio (Nestlé Press Release).

- In October 2025, the European Union approved new regulations for the labeling of ice cream products, requiring clearer information about the nutritional content and ingredients. This initiative aims to promote transparency and healthier choices for consumers in the market (European Commission Press Release).

Research Analyst Overview

- In the market, price sensitivity plays a significant role in consumer decision-making, as market research indicates. Online reviews and customer ratings are crucial for brand awareness and positioning, driving the importance of online marketing. Product photography and visual merchandising are essential for showcasing unique flavor pairings and textures, enhancing the in-store experience. An e-commerce platform and retail strategy are necessary for reaching a wider customer base, fostering customer loyalty through personalized experiences and incentives. Brands focus on brand storytelling and ingredient sourcing to differentiate themselves, while supplier relationships and inventory management ensure consistent flavor profiles. Product development and distribution channels rely on cold chain management to maintain quality, catering to diverse customer demographics and their varying preferences.

- Content marketing and flavor profiles are key elements of successful branding, with Cold Stone Creamery being a notable example. Customer segmentation and supplier relationships are crucial for effective inventory management and meeting demand. Ultimately, the market is dynamic, with a focus on innovation, customer satisfaction, and strategic partnerships.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Gourmet Ice Cream Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

243 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.1% |

|

Market growth 2025-2029 |

USD 12355.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

14.5 |

|

Key countries |

US, Italy, France, UK, Canada, Germany, Japan, China, Spain, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Gourmet Ice Cream Market Research and Growth Report?

- CAGR of the Gourmet Ice Cream industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gourmet ice cream market growth of industry companies

We can help! Our analysts can customize this gourmet ice cream market research report to meet your requirements.