Immunosuppressants Market Size 2024-2028

The immunosuppressants market size is forecast to increase by USD 4.48 billion at a CAGR of 5.19% between 2023 and 2028. The market is driven by the high dependency on these drugs for organ transplant procedures, particularly in multiple sclerosis and organ donors. Reimbursement policies for kidney transplantation are a significant growth factor, as immunosuppressants are essential for the success of these procedures. However, the market faces challenges due to the side effects of immunosuppressants, which can lead to long-term health complications. Additionally, trends in tissue engineering, implants, and developing economies offer opportunities for market expansion. Immunosuppressants are a crucial drug class in managing autoimmune diseases and ensuring the success of organ and cell transplants. In multiple sclerosis, immunosuppressants help reduce inflammation and prevent relapses. Furthermore, in organ transplantation, they prevent the rejection of the transplanted organ by suppressing the immune system. Despite their benefits, the side effects of immunosuppressants, such as increased risk of infections and malignancies, limit their widespread use. Tissue engineering and implants offer potential alternatives to organ transplantation while developing economies present new opportunities for market growth.

Market Analysis

The market is witnessing significant growth due to the increasing number of organ transplantations and the rising prevalence of autoimmune diseases. Organ transplantation requires clinical immunosuppression to prevent the immune response from rejecting the transplanted organ. Induction therapy is used during the initial stages of transplantation to suppress the immune system, while maintenance therapy is administered to prevent acute rejection responses. Immunosuppressants are also used in the treatment of various systemic autoimmune diseases such as lupus, myasthenia gravis, rheumatoid arthritis, Crohn's disease, lupus nephritis, SLE, scleroderma, psoriasis, and dermatomyositis. These diseases are characterized by an overactive immune response, leading to inflammation and damage to various organs and tissues.

Moreover, the regulatory processes for approving immunosuppressants are stringent due to their potential side effects. Some of the recent developments in the market include Glaxosmithkline's Benlysta, which is approved for the treatment of lupus nephritis, and Aurinia Pharmaceuticals' Lupkynis, which is used for the treatment of lupus nephritis in adults. These drugs have shown promising results in clinical trials and are expected to expand the market for immunosuppressants.

Market Segmentation

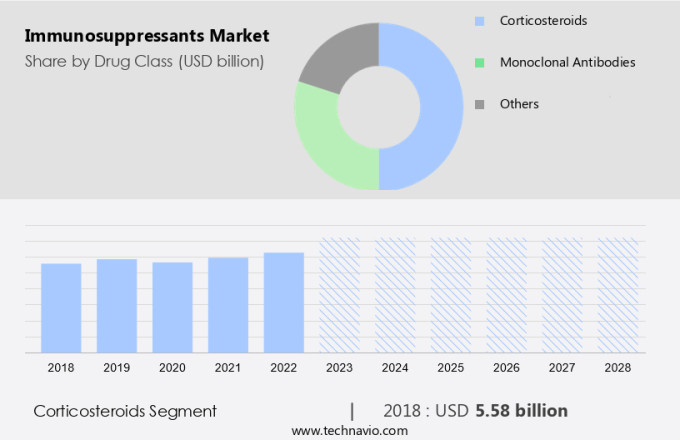

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Drug Class

- Corticosteroids

- Monoclonal antibodies

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Drug Class Insights

The corticosteroids segment is estimated to witness significant growth during the forecast period. Immunosuppressants, specifically corticosteroids such as prednisone, play a crucial role in kidney, liver, and heart transplant procedures by preventing the body's immune system from rejecting the transplanted organ. These medications are employed for both induction and maintenance therapy to suppress the immune response and reduce the production of cytokines and vasoactive substances, including interleukin (IL)â1, IL-2, IL-6, tumor necrosis factor-alpha, chemokines, prostaglandins, and proteases. Corticosteroids function primarily by acting as agonists of glucocorticoid receptors, but at higher doses, they exhibit receptor-independent effects. They also induce partial remission in the majority of patients by reducing the production of autoantibodies by B-cells and decreasing the density of Fc-gamma receptors on phagocytes in the spleen. Furthermore, in the context of clinical immunosuppression, corticosteroids are essential for managing acute rejection responses and treating autoimmune disorders.

Get a glance at the market share of various segments Request Free Sample

The corticosteroids segment accounted for USD 5.58 billion in 2018 and showed a gradual increase during the forecast period.

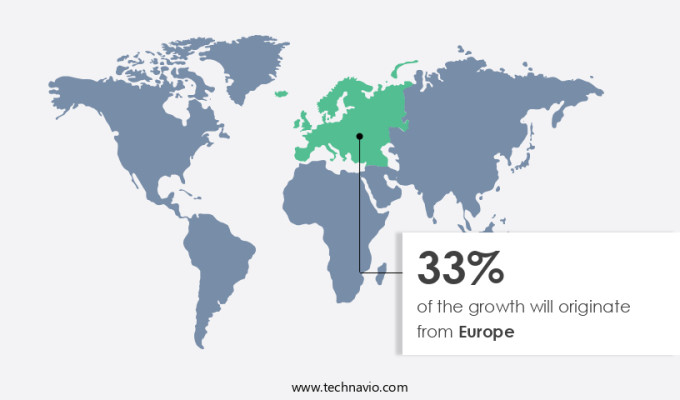

Regional Insights

Europe is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is anticipated to expand significantly during the forecast period due to the increasing number of organ transplants, particularly in kidney, liver, and heart transplant procedures. Clinical immunosuppression is essential to prevent the body from rejecting the transplanted organ. Immunosuppressants are used both in induction therapy to initiate suppression and maintenance therapy to sustain it. Technological advancements in the healthcare sector, substantial investments in research and development, and the rising prevalence of autoimmune disorders are key drivers fueling market growth. Moreover, the increasing expenditure on healthcare infrastructure and the rise in personal disposable income are indirect determinants contributing to the expansion of the market. The regional market is poised to grow substantially due to these factors.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Reimbursement policies for kidney transplantation is the key driver of the market. Immunosuppressants are essential medications used in organ transplantation to prevent the immune response from rejecting the transplanted organ. These drugs suppress the immune system, allowing the body to accept the foreign organ. Immunosuppressants are also used in the treatment of various autoimmune diseases such as myasthenia gravis, arthritis, lupus, rheumatoid arthritis, and Crohn's disease. In these conditions, the immune system mistakenly attacks the body's own tissues, leading to inflammation and damage. Chronic kidney disease (CKD), which affects over 25 million Americans, is another condition where immunosuppressants may be used. Approximately 675,000 Americans have irreversible CKD or end-stage renal disease, requiring kidney transplantation due to the high mortality rate associated with this condition.

Furthermore, organizations like the National Kidney Foundation are advocating for increased recognition and prioritization of organ transplantation to address the growing burden of CKD in the US. Immunosuppressants play a crucial role in ensuring the success of organ transplantation and the effective management of autoimmune diseases.

Market Trends

High dependency on immunosuppressants for kidney transplantation is the upcoming trend in the market. The market holds significant importance in the medical field, particularly in organ transplantation and the treatment of autoimmune diseases. Organ transplantation, such as kidney transplantation, has seen advancements in surgical techniques and ancillary healthcare methods, leading to an increase in the number of transplantations performed. However, graft rejection remains a major challenge in organ transplantation. The immune system identifies the transplanted organ as foreign and triggers an immune response, resulting in transplant rejection. There are three types of transplant rejections: hyperacute, acute, and chronic. Hyperacute rejection occurs within minutes of transplantation due to a mismatch between the donor and recipient's antigens.

In addition, autoimmune diseases, such as myasthenia gravis, arthritis, lupus, rheumatoid arthritis, and Crohn's disease, also require immunosuppressants to manage the overactive immune system. Immunosuppressants help suppress the immune response, preventing the rejection of transplanted organs and reducing the symptoms of autoimmune diseases.

Market Challenge

Side effects of immunosuppressants is a key challenge affecting the market growth. Immunosuppressants play a crucial role in organ transplantation by suppressing the immune system's response to prevent organ rejection. These drugs are essential for kidney transplantation therapeutics and have multiple approved forms for use. Immunosuppressants work by reducing the immune system's activity, making it less likely to attack the transplanted organ. However, their long-term use can lead to various side effects, including diarrhea, increased risk of infections, nausea, and vomiting. These side effects can significantly impact patients' adherence to treatment. Moreover, immunosuppressants can cause muscle damage, leading to decreased muscle function. Immunosuppressants are also used in the treatment of autoimmune diseases such as myasthenia gravis, arthritis, lupus, rheumatoid arthritis, and Crohn's disease.

Furthermore, despite their effectiveness, the long-term use of immunosuppressants requires close monitoring due to their potential side effects.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Astellas Pharma Inc. - The company offers immunosuppressants named Graceptor which maintains its efficacy and safety at similar level with the existing drug and possibly contributes to reduce physical and mental stress for patients who need to take several different medications in a long-term.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accord Healthcare Ltd.

- Bristol Myers Squibb Co.

- F. Hoffmann La Roche Ltd.

- GlaxoSmithKline Plc

- Intas Pharmaceuticals Ltd.

- Johnson and Johnson Services Inc.

- Novartis AG

- Pfizer Inc.

- RPG Life Sciences Ltd.

- Sanofi SA

- Sebela Pharmaceuticals Inc.

- Viatris Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market caters to the demand for drugs used in organ transplantation and the treatment of autoimmune diseases. These drugs work by suppressing the immune response to prevent the body from rejecting transplanted organs or attacking its own tissues in autoimmune disorders. The market includes various drug classes such as corticosteroids, monoclonal antibodies, calcineurin inhibitors, Hedgehog inhibitors, and anti-proliferative agents. Induction therapy and maintenance therapy are two types of immunosuppressive treatments used in clinical immunosuppression. Induction therapy is given before organ transplant procedures to prevent acute rejection response, while maintenance therapy is given after the transplant to prevent long-term rejection.

Moreover, Immunosuppressants are used in the treatment of various autoimmune disorders, including myasthenia gravis, arthritis, lupus, Crohn's disease, and systemic autoimmune diseases such as multiple sclerosis, alopecia areata, and systemic lupus erythematosus. They are also used in the treatment of non-autoimmune inflammatory diseases and in organ transplant procedures. The market is driven by the increasing number of organ transplant procedures, the growing number of organ donors, and the development of new drugs and therapies. The market is also expanding in developing economies due to the increasing awareness and availability of organ transplantation and immunosuppressive drugs. Immunosuppressants are available in various forms, including hospital pharmacies, retail pharmacies, and online pharmacies.

Furthermore, some of the notable drugs in the market include cyclosporine and tacrolimus. New product approvals, such as Benlysta by Glaxosmithkline for the treatment of lupus nephritis, are expected to further drive market growth. Regulatory processes and clinical trials play a crucial role in the product approval of immunosuppressants. PubMed Central and MDPI are some of the sources for the latest research and developments in the field of immunosuppressants. The market is expected to continue growing due to the increasing demand for organ transplants and the development of new drugs and therapies for autoimmune disorders.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

138 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.19% |

|

Market growth 2024-2028 |

USD 4.48 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.91 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

Europe at 33% |

|

Key countries |

US, Germany, China, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AbbVie Inc., Accord Healthcare Ltd., Astellas Pharma Inc., Bristol Myers Squibb Co., F. Hoffmann La Roche Ltd., GlaxoSmithKline Plc, Intas Pharmaceuticals Ltd., Johnson and Johnson Services Inc., Novartis AG, Pfizer Inc., RPG Life Sciences Ltd., Sanofi SA, Sebela Pharmaceuticals Inc., and Viatris Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch