Industrial Salt Market Size 2024-2028

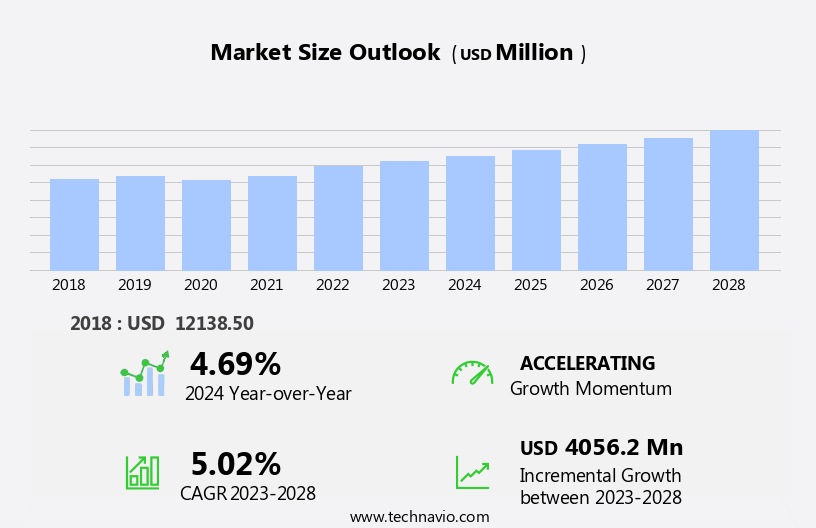

The industrial salt market size is forecast to increase by USD 4.06 billion, at a CAGR of 5.02% between 2023 and 2028.

- The market is driven by the vast array of applications in various industries, including food processing, water softening, chemical manufacturing, and others. A notable trend in the market is the increasing adoption of solar evaporation processes for salt production, particularly in the Asia Pacific region, which is witnessing a surge in output. However, this growth is not without challenges. Stringent government regulations aimed at reducing pollution pose significant obstacles for salt producers, requiring them to invest in advanced technologies and adhere to strict environmental standards. Companies seeking to capitalize on market opportunities must navigate these regulatory hurdles while also addressing the rising demand for sustainable and eco-friendly production methods.

- In summary, the market is characterized by its broad applicability and the ongoing shift towards more sustainable production methods, while facing the challenge of complying with stringent environmental regulations. Companies must stay informed of regulatory developments and invest in innovative technologies to remain competitive and meet evolving market demands.

What will be the Size of the Industrial Salt Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market is characterized by its continuous and evolving nature, with dynamic market activities and patterns unfolding across various sectors. Salt, a ubiquitous mineral, finds extensive applications in animal feed, high blood pressure management, color enhancement in glass manufacturing, salt extraction, additives, transportation, water softening, sea salt production, soap manufacturing, leather industry, and salt storage. Animal feed industries rely on salt for essential minerals and nutrients, while high blood pressure patients use it as a dietary staple. Salt's color plays a crucial role in glass manufacturing, enhancing its aesthetic appeal. Salt extraction processes yield valuable by-products, while additives improve salt's functionality in diverse industries.

Salt transportation is a critical aspect of the market, ensuring timely delivery to various sectors. Water softening applications soften hard water, improving its quality for household and industrial use. Sea salt, a premium variant, caters to the food and cosmetics industries, while soap manufacturing relies on salt for its production. The leather industry uses salt for tanning, while salt storage ensures product longevity. Salt sustainability is a growing concern, leading to innovations in solar salt production and salt crystallization. Food preservation and salt evaporation are integral to the market, with salt brine and vacuum salt processes gaining popularity.

Magnesium chloride and calcium chloride are alternative salt types used in road de-icing and industrial applications. Sodium intake concerns have led to the development of salt substitutes, such as potassium chloride and iodized salt. The market's diversity underscores its continuous evolution, with ongoing research and development in salt refining, purity, density, and crystallization.

How is this Industrial Salt Industry segmented?

The industrial salt industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Source

- Rock salt

- Natural brine

- Application

- Chemical processing

- Deicing

- Water treatment

- Others

- Manufacturing Process

- Solar Evaporation

- Vacuum Evaporation

- Conventional Mining

- Geography

- North America

- US

- Europe

- Germany

- APAC

- Australia

- China

- India

- Rest of World (ROW)

- North America

By Source Insights

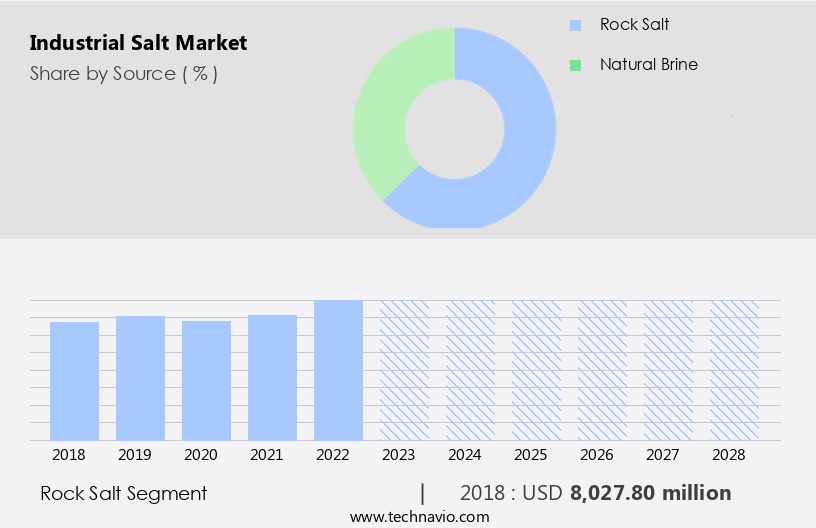

The rock salt segment is estimated to witness significant growth during the forecast period.

Rock salt, or halite, is a mineral primarily composed of sodium chloride, which is widely used as table salt. This naturally occurring crystalline mineral is found in salt deposits, often in association with sedimentary rocks and underground salt domes. The primary applications of rock salt include de-icing roads, sidewalks, and other surfaces in snowy regions, as well as water treatment applications, such as water softening and purification. The demand for water treatment chemicals is projected to boost the market for rock salt. Salt's unique properties, such as its ability to dissolve easily in water and its high moisture absorption capacity, make it an essential component in various industries.

In food production, salt's flavor enhancing qualities are indispensable. Salt's color and texture are utilized in glass manufacturing, while its moisture content is crucial in animal feed production. The salt industry also caters to the leather industry, soap manufacturing, and road de-icing, among others. Salt's sustainability is a growing concern, with an increasing focus on reducing sodium intake and exploring alternatives like solar salt, magnesium chloride, and calcium chloride. Salt's crystallization process is used to produce salt brine, which is essential in food preservation and salt refining. The salt market encompasses a diverse range of applications, from industrial uses like potassium chloride production and salt additives to consumer products like table salt and salt substitutes.

Salt's versatility and ubiquity make it an integral part of numerous industries, ensuring its continued relevance in the global market.

The Rock salt segment was valued at USD 8.03 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

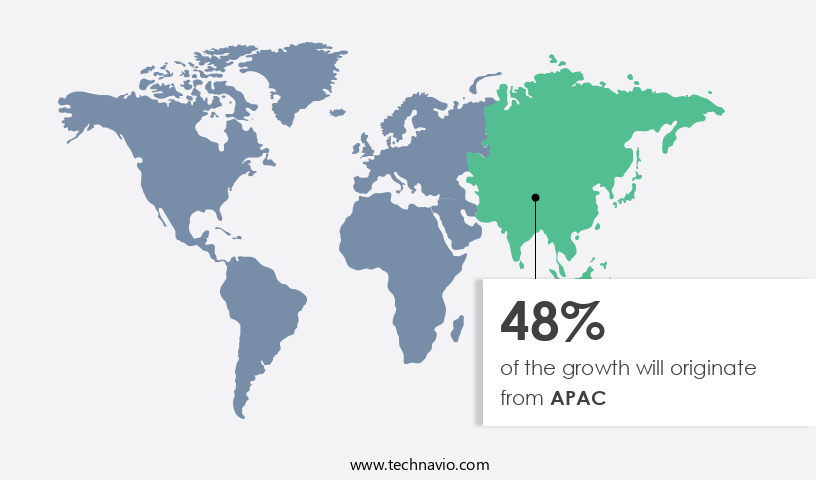

APAC is estimated to contribute 48% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific is experiencing significant growth due to the increasing demand for salt in various industries. In this region, countries like India and China, which are undergoing rapid industrialization, are driving the market's expansion. Salt is a crucial ingredient in several industries, including chemical processing, pulp and paper, and leather, and its demand is surging as a result. China is the leading producer of salt in Asia Pacific, with the chlor-alkali industry being a major contributor to the market's growth in the region. Salt's applications extend beyond industrial use. It is also essential in food preservation, animal feed, and road de-icing, among other areas.

Salt's versatility is further demonstrated by its use in glass manufacturing, soap manufacturing, and water softening. However, concerns over salt allergies and high blood pressure have led to the development of salt substitutes and iodized salt. Mining and extraction methods for salt production include rock salt mining, salt beds, and salt domes. Salt can also be produced through solar evaporation or through the refining of salt brine. Various salt types, such as sodium chloride, magnesium chloride, and calcium chloride, cater to diverse industrial requirements. Salt's texture and crystallization properties are also critical factors in its application. Salt's market dynamics are influenced by factors such as salt moisture content, salt density, and transportation logistics.

Salt packaging plays a crucial role in maintaining the quality and purity of the product during transportation and storage. Sustainability is also becoming a significant consideration in the salt industry, with a focus on reducing the environmental impact of salt mining and production. In conclusion, the market in Asia Pacific is experiencing robust growth due to the increasing demand for salt in various industries. China's chlor-alkali industry is a major driver of this growth, but other sectors, such as food processing and animal feed, also contribute significantly. Salt's versatility and essential role in various industries make it an indispensable commodity.

The market's evolution is shaped by factors such as production methods, product types, and sustainability concerns.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Industrial Salt Industry?

- The significant industrial applicability of salt, encompassing various sectors, serves as the primary market driver.

- Industrial salt plays a vital role in various industries, serving numerous applications beyond table use. The major sectors driving the demand for industrial salt include chemical processing, water treatment, and de-icing. In chemical processing, salt is indispensable as a raw material in the production of soda ash, caustic soda, and chlorine, which are integral to the manufacture of numerous industrial products such as solvents, alumina, and synthetic materials. Moreover, salt's utility extends to water treatment, where it aids in the removal of impurities and maintains desirable moisture content. In the de-icing industry, it is essential for ensuring safety on roads and runways during winter.

- Other applications of industrial salt include feedstock, metal processing, leather tanning, rubber manufacturing, oil and gas exploration, pulp and paper production, pharmaceuticals, and dyeing. The market is experiencing significant growth due to the increasing industrialization and the resulting demand for salt in diverse applications. Salt's versatility and essential role in various industries make it a crucial commodity in the industrial sector. Industrial salt is available in various forms, including rock salt, solar salt, and potassium chloride, catering to different application requirements regarding salt dissolution, flavor, packaging, moisture content, and granularity. Salt allergies pose a minimal concern in industrial applications due to the minimal human contact involved.

What are the market trends shaping the Industrial Salt Industry?

- The solar evaporation process for producing salt is gaining significant traction in the APAC market. This trend is driven by the increasing demand for sustainable and cost-effective production methods.

- The market in Asia Pacific is experiencing significant growth, particularly in countries like India and China, due to the widespread use of the solar evaporation process in salt manufacturing. Solar evaporation, an ancient method of salt production, is gaining prominence in the region because of the abundance of salty lakes and long coastlines. Favorable climatic conditions, including warm temperatures and consistent winds, contribute to the efficient production of salt through this process. In regions with warm climates, the evaporation rate surpasses the precipitation rate, enabling the crystallization of salt. This method is commonly used in the production of various salt types, including those used in animal feed, high blood pressure medication, glass manufacturing, and soap and leather industries.

- Salt additives, water softening, and sea salt are also derived from this process. The solar evaporation process is essential for salt transportation and storage as well, ensuring a steady supply of salt to various industries. Overall, the market in Asia Pacific is thriving due to the availability of natural resources and favorable climatic conditions, making it a crucial player in the global salt industry.

What challenges does the Industrial Salt Industry face during its growth?

- Strict government regulations on pollution pose a significant challenge to the expansion and growth of the industry.

- The market is subject to stringent regulations aimed at reducing environmental pollution, particularly in relation to volatile organic compounds and industrial pollutants. These regulations, driven by growing global awareness and pressure from regulatory bodies, have resulted in increased operating costs for industrial end-users of salt. For instance, under the Greenhouse Gas Reporting Program (GHGRP) and the National Emission Standards for Hazardous Air Pollutants (NESHAP) in the US, the Environmental Protection Agency (EPA) has enacted laws regulating the emission of greenhouse gases from the plastic industry, a significant end-user of salt.

- Salt's role in food preservation and road de-icing remains crucial, but its production processes must evolve to meet sustainability requirements. Techniques like vacuum salt production, magnesium chloride usage, and salt crystallization in salt brines or pans are gaining traction as more eco-friendly alternatives to traditional methods.

Exclusive Customer Landscape

The industrial salt market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the industrial salt market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, industrial salt market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Cargill Inc. - This company specializes in the development and distribution of innovative sports products.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Cargill Inc.

- CK Hutchison Holdings Ltd.

- Compass Minerals International Inc.

- Dev Salt Pvt. Ltd.

- Dominion Salt Ltd.

- Donald Brown Group

- INEOS AG

- Irish Salt Mining and Exploration Co. Ltd.

- Israel Chemicals Ltd.

- KS Aktiengesellschaft

- Mitsui and Co. Ltd.

- Nobian

- Rio Tinto Ltd.

- Salins Group

- Solvay SA

- Sudwestdeutsche Salzwerke AG

- Tata Sons Pvt. Ltd.

- Wacker Chemie AG

- Wilson Resources Ltd.

- ZOUTMAN NV

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Industrial Salt Market

- In January 2024, Solvay, a leading global chemical company, announced the expansion of its salt production capacity at its site in Europe. The â¬100 million investment aimed to increase production by 25%, strengthening Solvay's position in the market (Solvay press release).

- In March 2024, Tata Chemicals and SABIC, two major players in the industrial salt industry, entered into a strategic partnership to jointly develop and market chlor-alkali and derivatives in India and the Middle East. The collaboration was expected to create a significant impact on the regional market (Business Wire).

- In May 2024, Dow Inc. received regulatory approval from the European Commission for its merger with DuPont de Nemours. The combined entity, DowDuPont, would become a leading player in the market, with a significant presence in chlor-alkali and derivatives (Dow Inc. Press release).

- In February 2025, Cargill, a global food and agriculture company, entered the market with the acquisition of Morton Salt, a leading North American salt producer. The acquisition expanded Cargill's reach in the food, agriculture, and industrial sectors (Cargill press release).

Research Analyst Overview

- The market is characterized by a complex web of dynamics and trends, encompassing various aspects of salt production, safety, technology, and sustainability. Salt safety remains a top priority, with continuous advancements in technology ensuring the highest standards for workers and consumers. Salt waste management and sustainability are increasingly important, driving innovation in salt crystal morphology, automation, and traceability. Salt price fluctuations impact the market, necessitating robust quality control measures and supply chain optimization. Salt certification, awareness campaigns, and education are crucial for brand awareness and consumer behavior.

- Salt efficiency, standards, and regulations shape the competitive landscape, while salt leaching, recovery, and analytics offer opportunities for innovation and cost savings. The environmental impact of salt production is a growing concern, with a focus on reducing by-products and minimizing waste. Overall, the market is a dynamic and evolving landscape, requiring businesses to stay informed and adapt to emerging trends.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Industrial Salt Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.02% |

|

Market growth 2024-2028 |

USD 4056.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.69 |

|

Key countries |

China, US, India, Germany, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Industrial Salt Market Research and Growth Report?

- CAGR of the Industrial Salt industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the industrial salt market growth of industry companies

We can help! Our analysts can customize this industrial salt market research report to meet your requirements.