Food Processing Ingredient Market Size 2024-2028

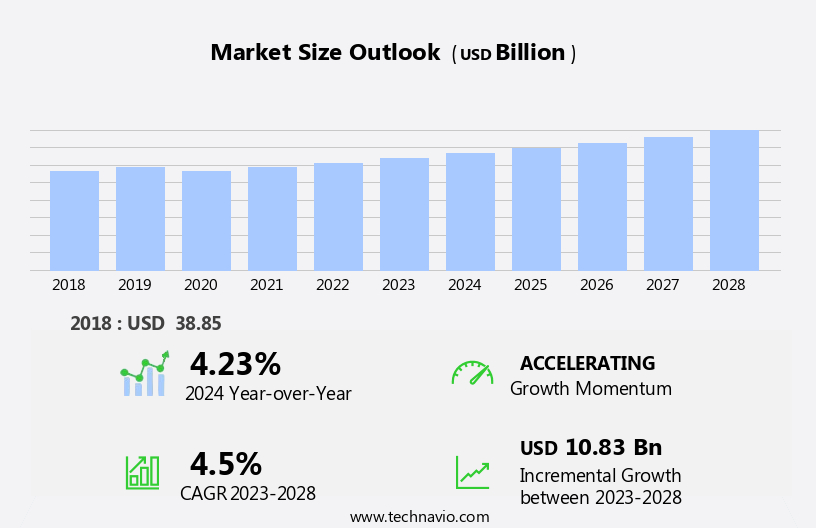

The food processing ingredient market size is forecast to increase by USD 10.83 billion at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth due to the rising demand for processed foods and ready-to-eat items. Consumers' increasingly busy lifestyles have led to a surge in demand for convenient food solutions, driving market expansion. However, challenges persist in the form of inadequate infrastructure in emerging economies. This lack of proper facilities poses a significant obstacle to market growth, particularly in regions where demand for processed foods is on the rise but the necessary infrastructure is not yet in place.

- Companies operating in this market must navigate these challenges while also capitalizing on the opportunities presented by the growing demand for processed food ingredients. Effective strategic planning and innovative solutions will be key to success in this dynamic market.

What will be the Size of the Food Processing Ingredient Market during the forecast period?

- The market continues to evolve, driven by shifting consumer preferences towards Health And Wellness, sustainable ingredients, and clean label options. Ingredient sourcing plays a crucial role in meeting these demands, with a focus on transparency and traceability. Formulation development and optimization are key areas of innovation, as companies seek to reduce costs while maintaining quality and regulatory compliance. Sustainable ingredients, such as plant-based and organic options, are gaining popularity, leading to increased demand for alternative protein sources and vegetable oils. Bakery ingredients, confectionery ingredients, and beverage ingredients are also undergoing significant changes, with a focus on allergen-free, gluten-free, and vegan options.

- Functional ingredients, including natural and synthetic options, are increasingly used to enhance product performance and extend shelf life. Manufacturing technology and supply chain management are also critical components of the ingredient market, with a focus on process control, cost reduction, and regulatory compliance. Consumer insights continue to shape market dynamics, driving product innovation and differentiation. Clean label and natural ingredients are increasingly preferred, while regulatory requirements and food safety concerns remain top priorities. The market for meat processing ingredients, dairy ingredients, and non-GMO options is also growing, as consumers seek out more sustainable and ethical options. Overall, the market is characterized by continuous change and innovation, with a focus on meeting evolving consumer demands and regulatory requirements.

- Companies that can adapt and respond to these trends will maintain a competitive advantage in this dynamic market.

How is this Food Processing Ingredient Industry segmented?

The food processing ingredient industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Source

- Natural

- Synthetic

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Source Insights

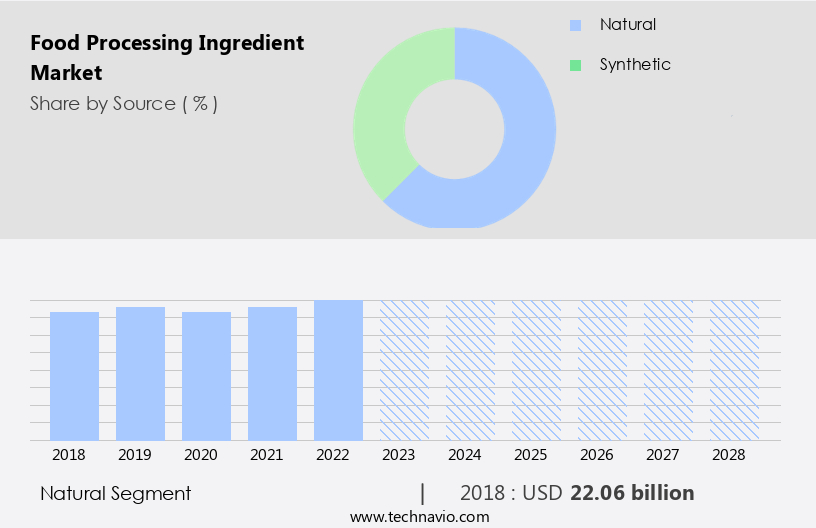

The natural segment is estimated to witness significant growth during the forecast period.

In today's market, there is a growing emphasis on health and wellness, leading to a surge in demand for sustainable ingredients in food processing. Companies are focusing on ingredient sourcing and formulation development to optimize their offerings for the clean label trend. Natural ingredients, including functional and allergen-free varieties, are increasingly preferred for their association with improved product quality and consumer trust. Bakery and confectionery ingredients, as well as beverage and meat processing ingredients, are being reformulated to cater to this demand. Manufacturing technology advances enable processing efficiency and cost reduction, while maintaining high standards of food safety.

Shelf life and regulatory compliance are critical factors in ingredient selection, with organic, non-GMO, and vegan ingredients gaining popularity due to their perceived health benefits. Consumer insights drive product innovation, with plant-based and dairy alternatives becoming increasingly common. Functional ingredients, such as vitamins, minerals, and antioxidants, are added to enhance nutritional value and extend shelf life. Ingredient cost remains a competitive advantage, with companies continually seeking to optimize their supply chain management and negotiate favorable contracts. In the realm of beverage processing, vegetable oils and dairy ingredients are essential components, while regulatory compliance and process control are crucial for ensuring product differentiation and consumer satisfaction.

The Natural segment was valued at USD 22.06 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

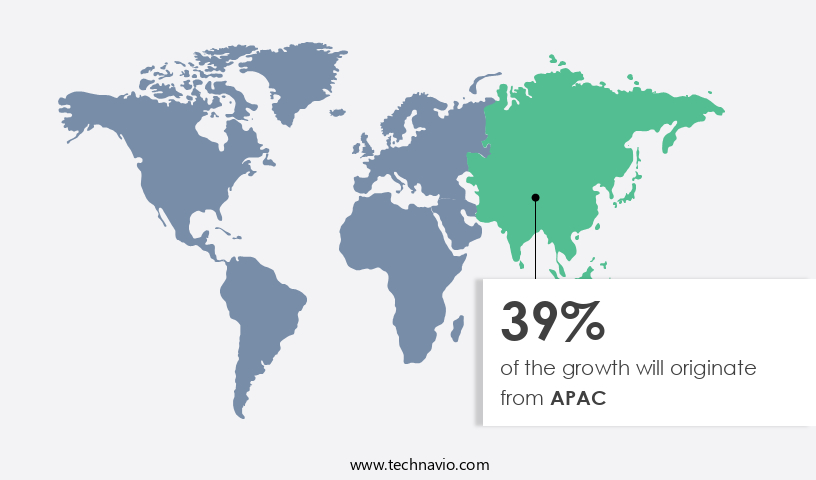

APAC is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, with Europe leading the charge in 2023. Germany and the UK are key contributors to this market, driven by the health-conscious consumer base. Consumers are increasingly focused on preventing obesity and related diseases, leading to a demand for natural preservatives in food processing. Additionally, the trend towards convenience foods, such as ready-to-eat products, is boosting market growth. Natural flavors derived from herbs and spices are gaining popularity in countries like Germany, France, and Spain. Sustainable ingredient sourcing is a priority for many companies, leading to innovation in this area. Formulation development and ingredient optimization are crucial for product differentiation and competitive advantage.

Clean label and allergen-free ingredients are essential for catering to diverse consumer needs. Bakery ingredients, beverage ingredients, and meat processing ingredients are among the key categories experiencing growth. Functional ingredients, such as vitamins and minerals, are in high demand for health-conscious consumers. Shelf life and food safety are critical factors influencing ingredient selection. Manufacturing technology plays a significant role in cost reduction and processing efficiency. Organic and non-GMO ingredients are preferred for their health benefits and consumer appeal. Regulatory compliance and process control are essential for maintaining quality and ensuring consumer safety. Plant-based and vegan ingredients are on the rise, reflecting changing consumer preferences.

Consumer insights and supply chain management are crucial for staying competitive in this dynamic market. Dairy ingredients and vegetable oils are important categories, with ongoing research and development driving innovation.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Food Processing Ingredient Industry?

- The surge in consumer preference for convenient and ready-to-eat options is the primary factor fueling the growth of the processed food market.

- The market has experienced significant growth due to the increasing demand for packaged and processed foods worldwide. Consumers' preferences for convenience and longer shelf life have driven this trend, particularly in urban areas where dietary habits have changed. Food manufacturers are responding to this demand by focusing on product differentiation and innovation. Consumer insights play a crucial role in this market, with a growing emphasis on natural and organic ingredients. Manufacturing technology advances have enabled cost reduction and increased processing efficiency. In the beverage sector, there is a similar trend towards natural and organic ingredients, as well as the use of functional ingredients to cater to health-conscious consumers.

- Supply chain management is also a critical factor in the market. Ensuring a consistent and reliable supply of high-quality ingredients is essential for manufacturers to meet demand and maintain product quality. As consumer expectations continue to evolve, food processing companies must stay agile and adapt to changing market dynamics to remain competitive.

What are the market trends shaping the Food Processing Ingredient Industry?

- The consumption of ready-to-eat food products is increasingly popular and represents an emerging market trend. This trend reflects consumers' growing demand for convenience and time-saving solutions in their daily lives.

- The market has experienced significant growth due to the increasing consumer preference for convenient and time-saving ready-to-cook and ready-to-eat food products. According to a 2020 study by Standard Process Inc., processed foods accounted for approximately 70% of the American diet. The pandemic in 2020 further accelerated this trend, with a surge in demand for ready-to-eat food products as more individuals worked from home and countries implemented lockdowns. For instance, Blinkit, an online grocery store in India, reported a 17% increase in sales in the ready-to-eat category, a 31% increase in readymade meals and mixes, and a 41% increase in Frozen Food.

- Product differentiation plays a crucial role in the market, with offerings ranging from dairy ingredients to vegetable oils, non-GMO ingredients, vegan ingredients, and more. Food safety and regulatory compliance are essential considerations, with process control being a key focus to ensure product quality and consistency. As the market continues to evolve, companies must prioritize innovation and adapt to changing consumer preferences to remain competitive.

What challenges does the Food Processing Ingredient Industry face during its growth?

- In emerging economies, the absence of adequate infrastructure represents a significant obstacle to the expansion and growth of industries.

- The market is experiencing significant growth, particularly in emerging economies, driven by increasing health consciousness, urbanization, and economic development. This trend is most prominent in the Asia Pacific region, where the expanding food processing industries further fuel the demand for ingredients such as preservatives, emulsifiers, enzymes, and others. However, the region faces challenges in providing adequate infrastructure for storing and manufacturing these sensitive ingredients. Proper handling, including maintaining specific temperatures and preventing contamination, is crucial to preserve their chemical compositions and ensure product quality.

- Ingredient sourcing, formulation development, and ingredient optimization are key focus areas for businesses in this market, with a growing emphasis on sustainable and clean label solutions. Product innovation remains a priority as companies strive to meet evolving consumer preferences and regulatory requirements. Despite the challenges, the market's potential for growth is immense, making it an exciting space for businesses in the food processing industry.

Exclusive Customer Landscape

The food processing ingredient market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the food processing ingredient market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, food processing ingredient market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agropur Dairy Cooperative - This company specializes in supplying human-grade nutrition ingredients for the food, beverage, and dietary supplement industries. Our offerings are scientifically formulated to enhance product quality and promote overall health and wellness. By leveraging advanced research and development, we provide innovative solutions that meet evolving consumer demands and regulatory requirements. Our extensive ingredient portfolio includes vitamins, minerals, amino acids, and botanical extracts, ensuring a diverse range of options for our clients. Our commitment to excellence and transparency sets US apart in the market, as we prioritize sustainability, traceability, and ethical sourcing practices.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agropur Dairy Cooperative

- Archer Daniels Midland Co.

- Arla Foods Ingredients Group PS

- Ashland Inc.

- Associated British Foods Plc

- BASF SE

- Batory Foods

- Cargill Inc.

- Chr Hansen Holding AS

- Clariant International Ltd.

- DuPont de Nemours Inc.

- EPI INGREDIENTS

- Ingredion Inc.

- Kerry Group Plc

- Koninklijke DSM NV

- Olam Group Ltd.

- PRIME Ingredients Inc.

- Puris

- Solvay SA

- Tate and Lyle PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Food Processing Ingredient Market

- In February 2024, Danisco, a leading global provider of food ingredients, launched a new line of clean-label emulsifiers, branded as "Danisco Fermentasome." These innovative emulsifiers, derived from natural sources, enable food manufacturers to produce clean-label food products with improved texture and stability, addressing the growing consumer demand for healthier and more natural food options (Danisco press release).

- In May 2025, Archer Daniels Midland Company (ADM) and Cargill, two major players in the food processing ingredients market, announced a strategic collaboration to develop and commercialize plant-based proteins. This joint venture, named "ADM-Cargill Protein Company," aims to capitalize on the growing demand for plant-based alternatives to animal protein, leveraging the combined expertise and resources of both companies (ADM and Cargill press releases).

- In October 2024, Ingredion Incorporated, a leading global provider of ingredient solutions, completed the acquisition of Penford Corporation, a specialty corn milling and food ingredient company. This strategic acquisition significantly expanded Ingredion's portfolio of specialty starches, proteins, and nutritional ingredients, enabling the company to better serve customers in the growing plant-based food and beverage market (Ingredion press release).

- In January 2025, the European Commission approved the use of microbial enzymes as food additives, paving the way for the increased adoption of enzymes in food processing. This regulatory approval is expected to drive growth in the food processing ingredients market, as enzymes offer significant benefits in terms of improving product quality, reducing production costs, and enhancing sustainability (European Commission press release).

Research Analyst Overview

The market is characterized by a dynamic interplay of various factors, including functional properties, nutritional value, and ingredient synergy. Food chemistry plays a crucial role in understanding the textural properties and flavor profile of ingredients, while ingredient sourcing strategies and sustainability certifications influence their availability and cost. Food innovation drives the demand for new ingredients with improved microbial stability and sensory properties, necessitating ingredient standardization and product lifecycle management. Allergens and ingredient interactions pose challenges, requiring stringent allergen management and ingredient declaration.

Food labeling regulations and food safety standards continue to evolve, necessitating ingredient reformulation and substitution. Ingredient cost analysis and value chain analysis are essential for optimizing supply chain efficiency and minimizing risks. Food science and food technology underpin the development of new processing parameters and ingredient interactions, ensuring the delivery of safe, high-quality, and nutritious food products.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Food Processing Ingredient Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

146 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 10.83 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, China, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Food Processing Ingredient Market Research and Growth Report?

- CAGR of the Food Processing Ingredient industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the food processing ingredient market growth of industry companies

We can help! Our analysts can customize this food processing ingredient market research report to meet your requirements.