Inflammatory Bowel Disease Market Size 2024-2028

The inflammatory bowel disease market size is forecast to increase by USD 7.62 billion at a CAGR of 5.48% between 2023 and 2028.

What will be the Size of the Inflammatory Bowel Disease Market During the Forecast Period?

How is this Inflammatory Bowel Disease Industry segmented and which is the largest segment?

The inflammatory bowel disease industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Crohn's disease

- Ulcerative colitis

- Geography

- North America

- Canada

- US

- Europe

- UK

- Asia

- China

- India

- Rest of World (ROW)

- North America

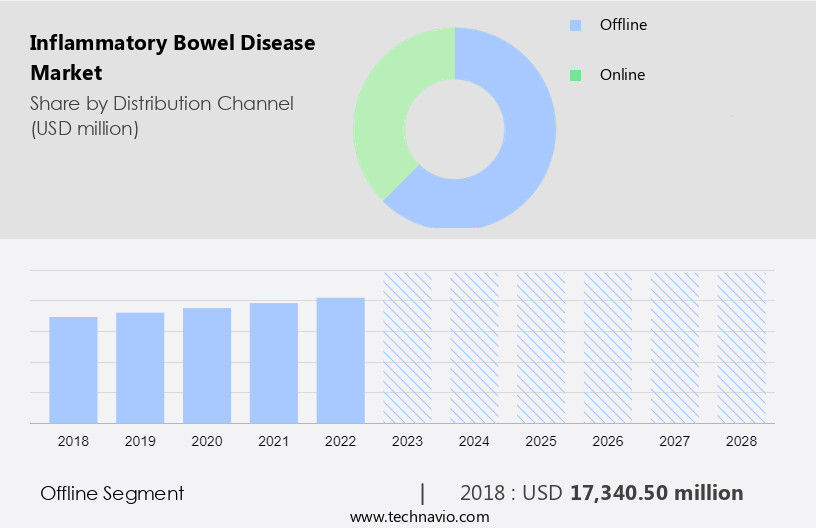

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period. The Inflammatory Bowel Disease (IBD) market encompasses various channels for the distribution of therapeutics, with the offline segment remaining a significant player. This segment includes the sale and dispensing of IBD medications through traditional pharmacies and drugstores. Despite the increasing popularity of online pharmacies, the offline channel retains its importance due to the ease of access and personal interactions it offers. Patients often prefer purchasing drugs from physical stores, ensuring immediate availability and consultations with pharmacists. This preference benefits pharmaceutical companies, enabling them to reach a broader consumer base. Key players In the IBD market, such as AbbVie, Allergan, Ferring Pharmaceuticals, Takeda, and Lilly, leverage this distribution channel to cater to the needs of IBD patients.

The offline segment also includes healthcare institutions, hospitals, and retail pharmacies, further expanding its reach. The IBD market is driven by the rising burden of the disease, increasing disease detection rates, and the availability of advanced biological drugs, including TNF inhibitors, IL inhibitors, JAK inhibitors, and toll-like receptor agonists. The disease pathophysiology, genetic predisposition, and environmental triggers contribute to the disease's complexity, necessitating the development and distribution of various therapeutic options. Reimbursement regulations and healthcare services further influence the market dynamics, with healthcare systems and hospital pharmacies playing crucial roles In the distribution of IBD medications.

Get a glance at the market report of various segments Request Free Sample

The Offline segment was valued at USD 17.34 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The IBD market in North America is experiencing growth due to the rising incidence and prevalence of chronic gastrointestinal diseases, such as ulcerative colitis and Crohn's disease. According to the Centers for Disease Control and Prevention (CDC), over 2.6 million cases of IBD were diagnosed In the US in 2022. This increasing disease burden necessitates the development of novel therapeutics for effective treatment. Pharmaceutical and biotechnology companies are focusing on research and development (R&D) to introduce new drugs, including biologicals like AbbVie's Humira, Takeda's Entyvio, and Lilly's Mirikizumab, and JAK inhibitors such as Pfizer's Xeljanz (Rinvoq) and Eli Lilly's Taltz (Jyseleca).

Healthcare systems, hospitals, and retail pharmacies are key distribution channels for these drugs. Diagnostic techniques, such as endoscopy and biopsy, are essential for disease detection, while environmental triggers and genetic predisposition play a role in disease pathophysiology. Clinical trials and reimbursement regulations are critical factors influencing market dynamics. Companies like Ferring Pharmaceuticals, CytoReason, and Allergan are also contributing to the market growth with their offerings. Telemedicine and online pharmacies are emerging trends in IBD care, offering convenience and accessibility to patients. The market is segmented by disease (Crohn's disease and ulcerative colitis) and drug class (TNF inhibitors, IL inhibitors, and toll-like receptor agonists).

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Inflammatory Bowel Disease Industry?

- Increasing incidence of IBD worldwide is the key driver of the market.Inflammatory bowel diseases (IBD), including Crohn's disease and ulcerative colitis, are chronic conditions characterized by inflammation of the gastrointestinal tract. Factors contributing to the increasing incidence of IBD include improper diets, inactive lifestyles, stress, food sensitivity, and bacterial or viral infections. The prevalence of IBD in industrialized countries is significant, with over 320,000 people in Canada living with the condition in 2023, and this number is projected to reach 470,000 by 2035. IBD can lead to various medical complications and disabilities if not diagnosed and treated promptly. Biological drugs, such as AbbVie's Humira, Janssen's Remicade, and Takeda's Entyvio, have emerged as effective treatment options for IBD.

These drugs target specific proteins In the immune system to reduce inflammation. Other treatments include injectable and oral TNF inhibitors, IL inhibitors, JAK inhibitors, and toll-like receptor agonists. Diagnostic techniques play a crucial role In the early detection and treatment of IBD. Healthcare institutes, hospitals, and retail pharmacies offer various diagnostic services, including endoscopy, biopsy, and imaging tests. Telemedicine and online pharmacies have also gained popularity in recent years, offering convenience and accessibility to patients. The disease burden of IBD is significant, and disease detection rates remain a concern. Genetic predisposition and environmental triggers are believed to contribute to the development of IBD.

Healthcare services and healthcare systems must adapt to meet the needs of IBD patients, including providing education and support, addressing reimbursement regulations, and ensuring access to the latest treatments. Pharmaceutical companies, such as AbbVie, Allergan, Lilly, and Ferring Pharmaceuticals, are investing in research and development to advance the understanding of disease pathophysiology and develop new treatments for IBD. For instance, Lilly is developing Mirikizumab, a Janus kinase inhibitor, for the treatment of Crohn's disease. CytoReason, a biotech company, is using AI to develop personalized treatments for IBD patients. Rinvoq and Skyrizi, JAK inhibitors from AbbVie and Eli Lilly, respectively, have also shown promise In the treatment of IBD.

In conclusion, the increasing incidence of IBD and the significant disease burden necessitate continued investment in research and development, as well as improved diagnostic techniques and access to effective treatments. Healthcare professionals and healthcare systems must work together to address the challenges associated with IBD and improve patient outcomes.

What are the market trends shaping the Inflammatory Bowel Disease market?

- New launches of IBD therapeutics is the upcoming market trend.The Inflammatory Bowel Disease (IBD) market is witnessing significant growth due to the increasing focus of companies on the development of innovative therapeutics. Pharmaceutical and biopharmaceutical companies are investing heavily in research and development (R&D) to bring new treatments for Crohn's disease and ulcerative colitis to market. Notable product launches include TNF inhibitors such as Humira (Adalimumab) and Cimzia, JAK inhibitors like Rinvoq and Olumiant, and IL inhibitors like Entyvio and Simponi. Additionally, AI and diagnostic techniques are being employed to improve disease detection rates and understand disease pathophysiology. companies like AbbVie, Allergan, Lilly, Takeda, and Ferring Pharmaceuticals are at the forefront of these advancements.

Reimbursement regulations and healthcare services, including hospitals, healthcare institutes, retail pharmacies, online pharmacies, and hospital pharmacies, play a crucial role In the market's growth. Environmental triggers and genetic predisposition also contribute to the disease burden. New product launches and R&D investments are expected to continue driving market growth In the coming years.

What challenges does the Inflammatory Bowel Disease Industry face during its growth?

- High cost of IBD therapeutics is a key challenge affecting the industry growth.Inflammatory bowel diseases (IBD), including Crohn's disease and ulcerative colitis, are chronic conditions requiring long-term treatment to prevent recurrence and potential complications, such as cancer. Biological drugs, including TNF inhibitors like Remicade, Humira, and Inflectra, and IL inhibitors like Cimzia and Entyvio, play a significant role in managing IBD. The cost structure for IBD treatment primarily consists of drug expenses, physician fees, and hospital visits or stays. For instance, the cost of treating ulcerative colitis ranges from USD 6,000 to USD 12,000, while Crohn's disease treatment costs between USD 30,000 and USD 32,000. JAK inhibitors, such as Rinvoq and Olumiant, and toll-like receptor agonists, like Ustekinumab, are emerging treatment options.

Diagnostic techniques and disease detection rates are crucial in early intervention and effective management of IBD. The immune system disruption in IBD is influenced by genetic predisposition, environmental triggers, and disease pathophysiology. Pharmaceutical companies like AbbVie, Allergan, Lilly, Ferring Pharmaceuticals, and Takeda are active In the IBD market. Healthcare systems, healthcare institutes, hospitals, hospital pharmacies, retail pharmacies, and online pharmacies are essential channels for IBD drug distribution. Telemedicine and reimbursement regulations significantly impact the accessibility and affordability of IBD treatments.

Exclusive Customer Landscape

The inflammatory bowel disease market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the inflammatory bowel disease market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, inflammatory bowel disease market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Abbott Laboratories - The market encompasses innovative treatments, including Cellular Therapy using Chimeric Antigen Receptor T (CAR-T) cells, which holds potential in delivering effective therapeutic solutions for patients. CAR-T therapy, a type of immunotherapy, involves engineering a patient's T cells to recognize and attack specific antigens, providing a personalized approach to treating inflammatory bowel diseases. This advanced treatment strategy offers a promising alternative to traditional therapies and may contribute significantly to the ongoing advancements In the inflammatory bowel disease treatment landscape.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- AbbVie Inc.

- AstraZeneca Plc

- Aurobindo Pharma Ltd.

- Bausch Health Companies Inc.

- Baxter International Inc.

- Bayer AG

- Biocon Ltd.

- Eli Lilly and Co.

- F. Hoffmann La Roche Ltd.

- GlaxoSmithKline Plc

- Johnson and Johnson Services Inc.

- Lupin Ltd.

- Merck and Co. Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi SA

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Inflammatory Bowel Disease (IBD) is a chronic gastrointestinal condition characterized by immune system disruption and inflammation. The disease burden of IBD is significant, with clinical manifestations including abdominal pain, diarrhea, and weight loss. IBD is classified into two main types: Crohn's disease and ulcerative colitis. The global market for IBD treatments is experiencing robust growth due to the increasing disease prevalence and the development of innovative therapeutic options. The market dynamics are driven by several factors, including the rising awareness of IBD, the expanding patient population, and the advancements in diagnostic techniques. The diagnostic techniques used for IBD detection have evolved significantly over the past few years.

These techniques include endoscopy, biopsy, imaging studies, and blood tests. The use of advanced diagnostic tools, such as genetic testing and AI-assisted analysis, is gaining popularity in healthcare institutes and hospitals. The disease pathophysiology of IBD is complex and multifactorial. It is believed that a combination of genetic predisposition, environmental triggers, and immune system dysfunction contributes to the development of IBD. The immune system disruption in IBD leads to the production of pro-inflammatory cytokines, which cause inflammation and tissue damage. The market for IBD treatments is segmented based on drug class, including TNF inhibitors, IL inhibitors, JAK inhibitors, and toll-like receptor agonists.

Biological drugs, such as Humira, Remicade, Cimzia, and Entyvio, are the most commonly used treatments for IBD. These drugs work by targeting specific proteins involved In the inflammatory response. The route of administration for IBD treatments varies, with injectable and oral options available. The choice of treatment depends on several factors, including disease severity, patient preference, and healthcare system considerations. Hospital pharmacies and retail pharmacies play a crucial role In the distribution and dispensing of IBD treatments. The reimbursement regulations for IBD treatments vary across healthcare systems. Healthcare professionals and healthcare services play a significant role In the management of IBD patients.

Telemedicine and online pharmacies are emerging as convenient options for patients, particularly in industrialized countries where access to healthcare services can be a challenge. Ferring Pharmaceuticals, AbbVie, Lilly, Takeda, and Allergan are some of the key players In the IBD market. These companies are investing heavily in R&D to develop new treatments and expand their product portfolios. For instance, Lilly is developing Mirikizumab, a JAK inhibitor for IBD, while Ferring Pharmaceuticals is focusing on Toll-like receptor agonists. The IBD market is expected to continue growing due to the increasing disease burden and the development of new treatments. The market dynamics are driven by several factors, including the rising awareness of IBD, the expanding patient population, and the advancements in diagnostic techniques and drug development.

The market is also being influenced by the changing healthcare landscape, including the increasing use of telemedicine and online pharmacies. In conclusion, the IBD market is a dynamic and growing market driven by the increasing disease burden and the development of innovative therapeutic options. The market is segmented based on drug class, route of administration, and healthcare system considerations. The market dynamics are influenced by several factors, including disease prevalence, diagnostic techniques, and reimbursement regulations. The key players In the market are investing heavily in R&D to develop new treatments and expand their product portfolios.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.48% |

|

Market growth 2024-2028 |

USD 7615.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.09 |

|

Key countries |

US, China, UK, India, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Inflammatory Bowel Disease Market Research and Growth Report?

- CAGR of the Inflammatory Bowel Disease industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the inflammatory bowel disease market growth of industry companies

We can help! Our analysts can customize this inflammatory bowel disease market research report to meet your requirements.