Information Security Products And Services Market Size 2024-2028

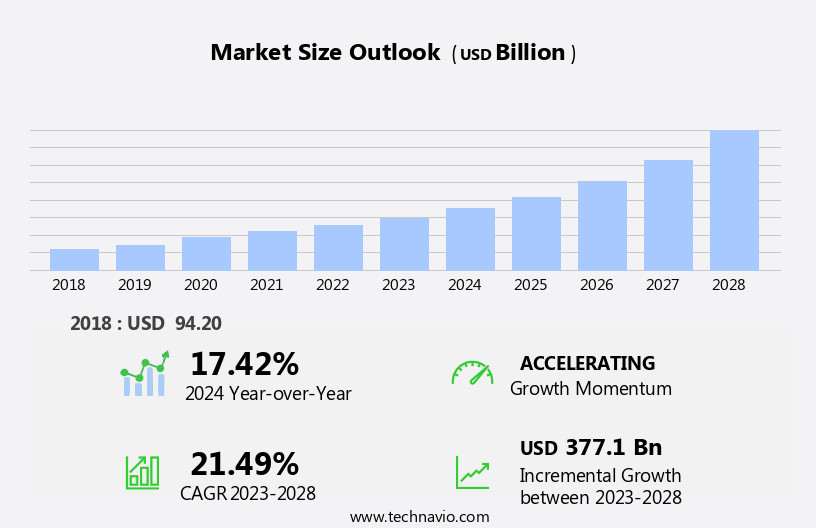

The information security products and services market size is forecast to increase by USD 377.1 billion at a CAGR of 21.49% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing threat landscape and the need for advanced security solutions. Sophisticated cyber threats, such as ransomware attacks and data breaches, continue to pose a major challenge for organizations worldwide. In response, there is a growing demand for comprehensive security solutions that can protect against these complex threats. Another key trend in the market is the emergence of a unified platform for authentication solutions. With the increasing number of devices and applications, managing multiple authentication methods can be a complex and time-consuming process. A unified platform can simplify this process and improve security by providing centralized control and management.

- However, the market is not without challenges. The complexity of network infrastructure continues to be a significant hurdle for organizations seeking to implement effective security measures. The use of cloud services, IoT devices, and remote work arrangements have added to the complexity of network security. Companies must invest in advanced technologies, such as AI and machine learning, to effectively manage and secure their networks. In summary, the market is experiencing growth, driven by the increasing threat landscape and the need for advanced security solutions. The emergence of a unified platform for authentication solutions and the use of advanced technologies to manage complex network infrastructure are key trends in the market.

- However, organizations must navigate the challenges of implementing effective security measures in the face of complex network infrastructure. Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on investing in advanced security solutions and adopting a unified approach to authentication.

What will be the Size of the Information Security Products And Services Market during the forecast period?

- The cybersecurity market is experiencing significant growth and transformation, driven by the increasing adoption of big data, edge computing, and e-commerce platforms. Artificial intelligence and machine learning are playing essential roles in enhancing cybersecurity solutions, particularly in the areas of intrusion prevention systems and detection. The cybersecurity ecosystem is expanding to include cloud workload security, hybrid strategies, and remote work solutions, as businesses seek to protect their digital assets. Large enterprises are investing heavily in cybersecurity to mitigate data breaches and safeguard sensitive information. The integration of technologies such as 5G, healthcare cybersecurity, automotive cybersecurity, and aviation cybersecurity is adding complexity to the cybersecurity landscape.

- Advanced persistent threats and cybercrime continue to pose significant risks, necessitating the development of advanced cybersecurity solutions. Cloud computing and multi-cloud strategies are becoming increasingly popular, necessitating the need for cybersecurity measures. The Internet of Things (IoT) is also expanding the attack surface, requiring new approaches to cybersecurity. Intrusion detection systems and intrusion prevention systems are critical components of the cybersecurity market, providing real-time threat detection and response capabilities. Cybersecurity transformation is a priority for businesses of all sizes, from small and medium enterprises to large corporations. The cybersecurity market is expected to continue growing as businesses seek to protect their digital assets and mitigate risks in an increasingly interconnected world.

How is this Information Security Products And Services Industry segmented?

The information security products and services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- On-premises

- Cloud

- Type

- Hardware

- Software

- Services

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

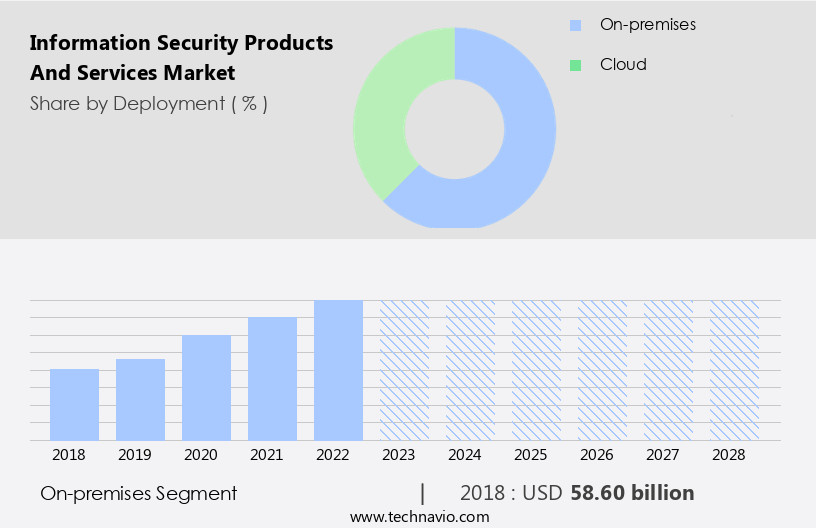

By Deployment Insights

The on-premises segment is estimated to witness significant growth during the forecast period.

In today's business landscape, large enterprises prioritize enterprise risk management, recognizing the potential consequences of data leaks for stakeholders and organizational reputation. Consequently, on-premises information security solutions continue to dominate, offering heightened security compared to cloud alternatives. However, this trend is poised to shift as advancements in cloud-based information security solutions proliferate. The integration of technologies such as machine learning, artificial intelligence, and edge computing into cloud security offerings is transforming the cybersecurity market. Multi-cloud strategies, 5G networks, and the Internet of Things expand the attack surface, necessitating advanced cybersecurity solutions. Cyber threats, including cyber espionage, cyberattacks, and advanced persistent threats, persistently target businesses, emphasizing the importance of cybersecurity.

Large enterprises grapple with a cyber talent shortage, necessitating a focus on cloud workload security, single sign-on, multi-factor authentication, intrusion detection systems, and intrusion prevention systems. Furthermore, data privacy importance transcends industries, from aviation to healthcare, necessitating cybersecurity ecosystems. The economic downturns and digital transformation accelerated by the pandemic have intensified the need for cybersecurity solutions. Cybercrime continues to evolve, with data breaches threatening e-commerce platforms and cloud applications. Amidst these challenges, next-generation firewalls and hybrid strategies offer effective countermeasures. In , the cybersecurity market is evolving rapidly, driven by the integration of technologies, the shift to cloud solutions, and the increasing importance of data privacy and security.

Large enterprises must adapt to these changes, leveraging cybersecurity solutions to mitigate risks and safeguard their digital assets.

Get a glance at the market report of share of various segments Request Free Sample

The On-premises segment was valued at USD 58.60 billion in 2018 and showed a gradual increase during the forecast period.

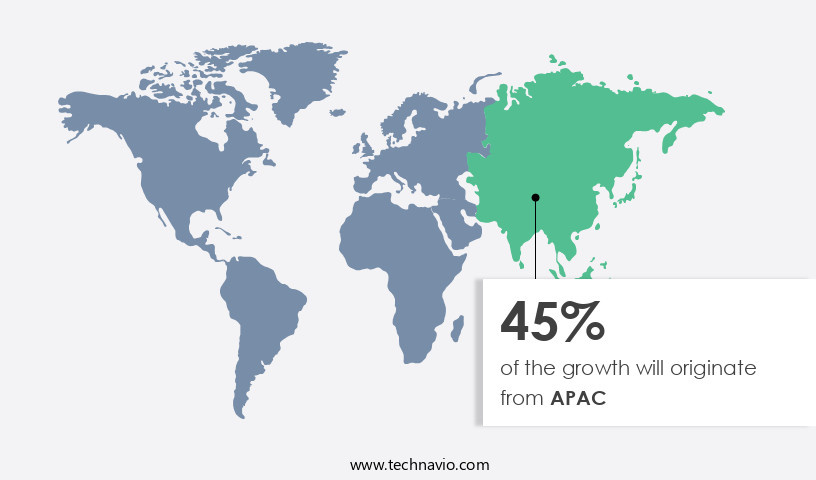

Regional Analysis

APAC is estimated to contribute 45% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

In the dynamic business landscape of the United States, the information security market is witnessing significant advancements. With the increasing adoption of technologies such as Multi-cloud strategies, Big data analytics, and the Integration of Technologies, the market is evolving at an unprecedented pace. The threat landscape is becoming increasingly complex, with Cyber Espionage, Advanced Persistent Threats, and Cyberattacks posing significant risks. Large Enterprises are prioritizing Cloud Workload Security, Single Sign-On, and Cyber Talent Shortage to mitigate these threats. The importance of Data Privacy is paramount, especially in sectors like Aviation and Healthcare Cyber Security. The deployment of NextGeneration Firewalls, Intrusion Detection Systems, and Intrusion Prevention Systems is a crucial part of the cybersecurity transformation.

The advent of 5G, Artificial Intelligence, Machine Learning, Edge Computing, and the Internet of Things is bringing about a Digital transformation. This transformation necessitates advanced Cybersecurity solutions to protect E-commerce Platforms, Cloud Applications, and fiber broadband networks from Data breaches. The Cybercrime landscape is constantly evolving, with Multi-Factor Authentication and Hybrid strategies becoming essential components of a cybersecurity ecosystem. The economic downturns have led organizations to re-evaluate their cybersecurity strategies, resulting in an increased focus on cost-effective solutions. The Cybersecurity Market is expected to continue its growth trajectory, with the integration of technologies like Artificial Intelligence and Cybersecurity solutions becoming increasingly important.

The Cybersecurity ecosystem is a complex and interconnected web of threats and countermeasures, requiring a holistic approach to ensure security.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Information Security Products And Services Industry?

- Advanced and sophisticated threats is the key driver of the market.

- The market for information security products and services is experiencing significant growth due to the increasing number of data breaches and insider fraud incidents. Advanced cyberattacks are targeting networks, people, and devices, making it essential for businesses to invest in sophisticated security solutions. With the growing dependency on web applications and websites for critical business activities, the risk of credential theft is on the rise. Industries dealing with confidential data, such as BFSI and retail, require highly advanced information security devices and software to protect their sensitive information.

- The IT infrastructure is constantly evolving, and attackers are finding new ways to bypass security measures. Therefore, businesses must stay updated with the latest security trends and technologies to safeguard their digital assets effectively.

What are the market trends shaping the Information Security Products And Services Industry?

- Emergence of a unified platform for authentication solutions is the upcoming market trend.

- Hardware One-Time Password (OTP) authentication involves the use of both software and hardware solutions for authentication purposes. While hardware solutions offer added security through the use of physical tokens, software solutions are preferred by cost-conscious industries due to their lower costs. However, the market trend is shifting towards unified platforms that provide both hardware and software authentication solutions. These platforms enable companies to reduce costs by eliminating the need to maintain separate platforms and modules, while also allowing end-users to easily switch between authentication methods.

- Large enterprises, with their traditional setups, continue to prefer hardware solutions for their added security benefits. The coexistence of hardware and software OTP authentication is expected to continue, with companies focusing on providing unified platforms to cater to the varying needs of their clients.

What challenges does the Information Security Products And Services Industry face during its growth?

- Complexity of network infrastructure is a key challenge affecting the industry growth.

- The market faces a significant challenge due to the increasing complexity of network infrastructure. companies introducing new security solutions can lead to integration issues, causing system slowdowns and customer dissatisfaction. Seamless integration with third-party solutions and previous versions is essential to prevent customer attrition. However, achieving this may increase the complexity of security products, potentially leading to operational or interface issues for end-users.

- This complexity poses a considerable challenge for companies in the global information security market.

Exclusive Customer Landscape

The information security products and services market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the information security products and services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, information security products and services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Broadcom Inc. - The company delivers information security solutions, encompassing fabric operating systems, network adapters, MACsec devices, and secure processors. These offerings ensure network protection and data confidentiality. Fabric operating systems optimize network performance and security, while network adapters safeguard data in transit. MACsec devices offer secure communication between devices, and secure processors protect against hardware-level threats. This comprehensive suite of solutions fortifies organizations' digital defenses.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Broadcom Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems Inc.

- Crowd Inc.

- Dell Technologies Inc.

- Fortinet Inc.

- Fujitsu Ltd.

- Hewlett Packard Enterprise Co.

- International Business Machines Corp.

- Juniper Networks Inc.

- LogRhythm Inc.

- McAfee LLC

- Optiv Security Inc.

- Palo Alto Networks Inc.

- RSA Security LLC

- Securonix Inc.

- SonicWall Inc.

- TIBCO Software Inc.

- Trend Micro Inc.

- VeraCore Software Solutions Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to experience significant growth as businesses increasingly prioritize cybersecurity in the face of evolving threats. One trend gaining traction is the adoption of multi-cloud strategies, which present unique challenges for securing cloud workloads. Big data analytics plays a crucial role in identifying and mitigating advanced persistent threats (APTs) and targeted attacks. The integration of technologies such as artificial intelligence (AI) and machine learning (ML) is transforming the cybersecurity landscape. These technologies enable more effective threat detection and response, particularly in the context of next-generation firewalls and intrusion prevention systems. The importance of data privacy is paramount, with large enterprises investing heavily in cybersecurity solutions to protect sensitive information.

Cybercrime continues to be a significant concern, with data breaches affecting e-commerce platforms and other digital assets. The aviation industry, healthcare sector, and automotive industry are among those that have recently faced high-profile cyberattacks. Cybersecurity solutions are essential for mitigating risks and ensuring business continuity. The cyber talent shortage poses a challenge for organizations seeking to implement effective cybersecurity strategies. Single sign-on and multifactor authentication are becoming increasingly important for addressing this issue, providing a more streamlined and secure approach to access management. The economic downturns brought about by the global pandemic have accelerated digital transformation initiatives, leading to an increased reliance on cloud computing and edge computing.

Fiber broadband networks are also playing a critical role in enabling remote work and supporting the growing demand for high-speed connectivity. The cybersecurity ecosystem is becoming more complex, with hybrid strategies and the Internet of Things (IoT) adding to the security landscape. Cybersecurity deployment is no longer a one-size-fits-all approach, with organizations requiring a comprehensive and adaptive strategy to address their unique needs. 5G networks are set to revolutionize the way businesses operate, but they also present new security challenges. Cybersecurity solutions must be able to adapt to the unique security requirements of 5G networks to ensure the protection of sensitive data and systems.

In , the market is experiencing significant growth as businesses prioritize cybersecurity in the face of evolving threats. The integration of technologies such as AI and ML, the importance of data privacy, and the growing complexity of the cybersecurity ecosystem are among the key trends shaping the market. Organizations must adopt a comprehensive and adaptive approach to cybersecurity to address their unique needs and mitigate risks.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

182 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 21.49% |

|

Market growth 2024-2028 |

USD 377.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

17.42 |

|

Key countries |

US, China, UK, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Information Security Products And Services Market Research and Growth Report?

- CAGR of the Information Security Products And Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the information security products and services market growth of industry companies

We can help! Our analysts can customize this information security products and services market research report to meet your requirements.