Intrusion Detection System Market Size 2024-2028

The intrusion detection system market size is forecast to increase by USD 4.65 billion at a CAGR of 14% between 2023 and 2028.

- The market is witnessing significant growth due to the escalating number of cyberattacks and the need to secure IT service infrastructure, particularly in the banking and financial services industry (BFSI). IDS solutions employ two primary identification techniques: signature-based and anomaly detection. Signature-based identification relies on known attack patterns, while anomaly detection identifies deviations from normal behavior.

- Additionally, with the rise in digital transactions, there is a growing emphasis on securing security architecture through traffic monitoring and intrusion detection. The market is driven by the increasing demand for BFSI applications and the subsequent need to protect against cyber threats. However, the high cost of maintaining IDS solutions remains a challenge. In conclusion, the IDS market is expected to continue growing as organizations prioritize securing their IT infrastructure against cyber threats.

What will be the Size of the Market During the Forecast Period?

- The Intrusion Detection System (IDS) market is a significant segment of the cybersecurity industry, playing a crucial role in safeguarding IT infrastructure against various cyber threats. IDS solutions help identify and prevent unauthorized access, malicious activities, and potential security breaches. These systems can be categorized into Network Intrusion Detection Systems (NIDS) and Host-based Intrusion Detection Systems (HIDS). IDS and Intrusion Prevention Systems (IPS) are essential components of an organization's cybersecurity strategy. IPS goes beyond simple identification and provides real-time prevention of attacks. Both IDS and IPS are instrumental in mitigating risks from phishing incidents, cyberattacks, and other malicious threats.

- Additionally, cybersecurity is a major concern for various sectors, including BFSI applications, telecom, defense, and cloud computing. With the increasing reliance on IT infrastructure and work from home arrangements, cybersecurity expenditure has seen a significant rise. IDS and IPS solutions are integral to securing data and maintaining information security. Cybercrimes are on the rise, with malicious threat actors constantly evolving their tactics. Traditional signature-based identification methods may not be sufficient to detect advanced threats. Anomaly detection, a key feature of modern IDS and IPS solutions, can help identify unusual patterns and potential threats. IDS and IPS solutions are not limited to protecting traditional IT infrastructure.

- Simultaneously, they also play a vital role in securing cloud computing environments. IDS and IPS as part of IDP (Intrusion Detection and Prevention) systems offer advanced threat detection and prevention capabilities, ensuring comprehensive protection against cyberattacks. Ransomware attacks have emerged as a major concern, with their disruptive impact on business operations. IDS and IPS solutions can help prevent ransomware attacks by identifying and blocking malicious traffic before it can cause damage. In conclusion, IDS and IPS solutions are essential components of an effective cybersecurity strategy. They help organizations protect their IT infrastructure, data security, and information security against various cyber threats, including phishing incidents, cyberattacks, and malicious threat actors. The market for IDS and IPS solutions is expected to grow as organizations continue to invest in advanced cybersecurity solutions to mitigate risks and maintain business continuity.

How is this market segmented and which is the largest segment?

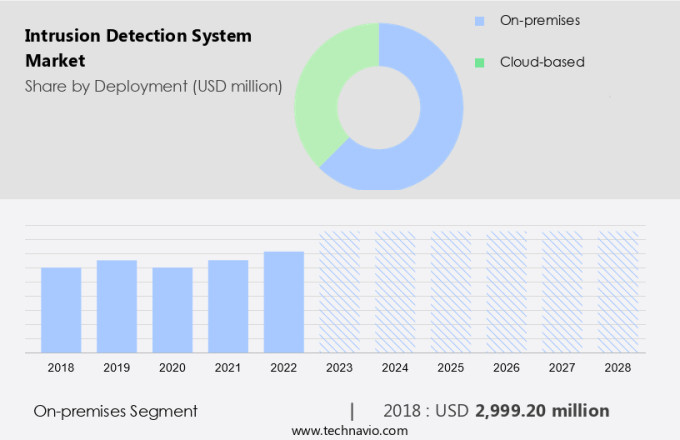

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- On-premises

- Cloud-based

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- North America

By Deployment Insights

- The on-premises segment is estimated to witness significant growth during the forecast period.

The on-premises segment is projected to dominate the market in the US, with substantial growth in terms of revenue. Large enterprises, particularly those with a global footprint, are the primary consumers of on-premises intrusion detection systems. The primary reason for this preference is the control it offers over managing software assets, including data generated and stored within business applications. This deployment model enables organizations to ensure compliance with licensing agreements and automate tasks, making it an attractive choice for many businesses. Remote work and work from home trends have led to an increased focus on IT security solutions, including intrusion detection systems.

Additionally, the need to secure networks and systems from malicious activities has become more critical than ever. On-premises intrusion detection systems provide organizations with the ability to maintain system integrity and protect against unauthorized access, ensuring business continuity. Intrusion detection systems play a crucial role in securing networks and systems against cyber threats. The market for these security technologies is expected to grow significantly in the coming years, driven by the increasing number of false alarms generated by advanced security tools and the need to mitigate the risks associated with remote work environments. According to recent reports, the US market is expected to reach significant revenue growth during the forecast period.

Get a glance at the market report of share of various segments Request Free Sample

The on-premises segment was valued at USD 3 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Intrusion Detection Systems (IDS) play a crucial role in safeguarding Information Technology (IT) infrastructure in various sectors, including Healthcare and Retail and eCommerce. Skilled security professionals are in high demand to implement and manage these systems, which utilize both hardware and software solutions. IDS solutions monitor networks for suspicious activity and alert administrators to potential threats, enhancing cybersecurity.

According to recent studies, the market for IDS is projected to grow significantly due to the increasing number of cyber-attacks and the need for advanced security measures. Key players in this market include companies such as Cisco Systems, IBM, and Symantec. To stay competitive, businesses must invest in IT security and hire cybersecurity professionals with the necessary skills to effectively utilize IDS solutions. This investment not only protects against potential threats but also ensures regulatory compliance and maintains customer trust.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Intrusion Detection System Market?

Increasing demand for banking and financial services is the key driver of the market.

- Intrusion Detection Systems (IDs) play a crucial role in safeguarding critical sectors such as Media and Entertainment and Transportation and Logistics from cyber threats. IDS solutions monitor network activities for suspicious patterns indicative of potential data breaches. These systems are essential for financial institutions to secure their digital assets against unauthorized access. For instance, Trend Micro Inc. Offers comprehensive security solutions tailored to the banking industry. Their offerings encompass protecting employees, customers, assets, and banking operations from various cyber threats. IDS is a significant component of these security systems, ensuring the detection and prevention of unauthorized network intrusions. Moreover, IDS solutions integrate seamlessly with various security applications and devices, functioning as a unified security management system.

- Additionally, this integration allows for centralized control and monitoring of security systems, enhancing operational efficiency and reducing complexity. The Media and Entertainment and Transportation and Logistics industries are increasingly relying on advanced IDS solutions to fortify their cybersecurity posture. As the digital landscape evolves, IDS remains a vital tool in maintaining strong security and protecting against potential data breaches. IDS solutions offer numerous benefits, including real-time threat detection, automated response, and comprehensive reporting capabilities. By implementing IDS, organizations can significantly reduce their risk exposure and ensure the confidentiality, integrity, and availability of their digital assets.

- In conclusion, Intrusion Detection Systems are an essential component of an effective cybersecurity strategy for industries such as Media and Entertainment and Transportation and Logistics. These solutions provide real-time threat detection, automated response, and centralized control, enabling organizations to fortify their digital defenses and protect against potential data breaches.

What are the market trends shaping the Intrusion Detection System Market?

An increase in spending on retail security systems is the upcoming trend in the market.

- Intrusion Detection Systems (IDS) play a crucial role in securing IT infrastructure and digital transactions for businesses, particularly in the BFSI sector, against cyberattacks. IDS employ two primary methods: signature-based identification and anomaly detection. Signature-based identification uses known attack patterns to detect threats, while anomaly detection identifies unusual behavior that may indicate an attack. Retailers, including Walmart, Tesco, Target, and Home Depot, invest substantially in IDS to minimize retail shrinkage and ensure a safer shopping environment. Smaller retailers, too, are following suit, recognizing the importance of securing their stores against theft. IDS enables real-time traffic monitoring, providing early warning systems for potential threats.

- By implementing IDS, businesses can strengthen their security architecture, safeguarding their assets and maintaining customer trust. In conclusion, IDS is an essential component of modern security systems, providing businesses with an effective solution to combat cyberattacks and retail shrinkage. The adoption of IDS is on the rise, driven by the increasing number of digital transactions and the need to secure larger IT infrastructures. By integrating IDS into their security architecture, businesses can enhance their operational efficiency and ensure a safer environment for their customers.

What challenges does Intrusion Detection System Market face during the growth?

The high cost of maintenance is a key challenge affecting the market growth.

- Intrusion Detection Systems (IDS) and Intrusion Prevention Systems (IPS) play a crucial role in safeguarding cybersecurity for businesses in the US. IDS and IPS solutions offer advanced encryption and monitoring capabilities to prevent unauthorized access and data theft in real-time. However, the implementation cost of these network security systems can be prohibitive for some enterprises, making their adoption a challenge. Moreover, the maintenance and monitoring of IPS solutions require specialized expertise, which adds to the overall cost. The shortage of professionals with the necessary skills further increases the expense. The maintenance cost of IPS solutions is typically higher than that of other security measures.

- However, enterprises in the US can consider various network security options, including firewalls, to secure their networks. Firewalls offer functionalities such as Virtual Private Networks (VPN), IDS, IPS, and inline antivirus scanning. While firewalls are essential for enterprise-level security, their cost and maintenance requirements must be carefully weighed against the potential risks of cyber attacks, such as phishing incidents. In conclusion, while IDS and IPS solutions offer strong protection against network intrusions, their implementation and maintenance costs can be significant barriers to adoption for some businesses. Firewalls, with their diverse functionalities, can be a viable alternative for enterprises seeking to strengthen their cybersecurity posture. However, the choice of network security solution ultimately depends on the specific needs and resources of each organization.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alert Logic Inc.

- AT and T Inc.

- Broadcom Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems Inc.

- Corero Network Security Plc

- Darktrace Holdings Ltd.

- Extreme Networks Inc.

- FireEye Security Holdings US LLC

- Fortinet Inc.

- Hewlett Packard Enterprise Co.

- Honeywell International Inc.

- International Business Machines Corp.

- Johnson Controls International Plc.

- Juniper Networks Inc.

- McAfee LLC

- NSFOCUS Inc.

- Palo Alto Networks Inc.

- Trend Micro Inc.

- Trustwave Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Intrusion Detection Systems (IDS) and Intrusion Prevention Systems (IPS) are essential components of modern cybersecurity architecture, safeguarding IT infrastructure from various cyberattacks. IDS and IPS solutions employ signature-based identification and anomaly detection techniques to identify and mitigate phishing incidents, cybercrimes, ransomware attacks, and other malicious activities. Cybersecurity expenditure continues to rise as businesses increasingly rely on digital transactions and cloud computing. IDS and IPS solutions are critical for BFSI applications, telecom, defense, healthcare, retail and ecommerce, media and entertainment, transportation and logistics, and other sectors, protecting system integrity against malicious threat actors.

In summary, IDS solutions monitor network traffic for suspicious activities, while HIDs (Host-based Intrusion Detection Systems) focus on individual hosts. NIDs (Network Intrusion Detection Systems) and HIDs work together to provide comprehensive protection. IPS solutions go a step further by preventing attacks before they occur. IDS and IPS solutions are vital for IT security solutions in the remote work era, mitigating false alarms and securing remote access. Skilled security professionals are in high demand to manage these systems and address the increasing complexity of cybersecurity threats. IDS, IPS, and other security technologies play a crucial role in securing IT infrastructure against cyberattacks, ensuring data security and maintaining business continuity.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

137 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14% |

|

Market growth 2024-2028 |

USD 4.65 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.7 |

|

Key countries |

US, China, UK, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch