Injection Molding Market Size 2025-2029

The injection molding market size is forecast to increase by USD 54.4 billion, at a CAGR of 4.5% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the rising adoption of high-efficient injection molding machines in the packaging industry. This sector's expansion is a response to the increasing innovations in global packaging trends, which prioritize sustainability, functionality, and aesthetics. However, the market's dynamics are not without challenges. Government regulations and policies pose obstacles to market growth, particularly in areas such as material restrictions and safety standards. Companies must navigate these regulatory hurdles to capitalize on the opportunities presented by the evolving packaging industry and maintain a competitive edge.

- To succeed, businesses must stay informed of emerging trends, invest in research and development, and collaborate with industry partners to overcome regulatory challenges. By doing so, they can effectively address market demands, enhance their offerings, and ultimately drive growth in the market.

What will be the Size of the Injection Molding Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Injection molding, a critical process in manufacturing industries, continues to evolve with dynamic market trends and applications across various sectors. Industrial equipment manufacturers are constantly innovating to optimize resin viscosity, injection pressure, cooling time, and process efficiency. Acrylonitrile butadiene styrene (ABS) and other polymers are increasingly used in automotive parts due to their lightweight properties and durability. Moreover, the construction materials sector leverages injection molding for energy efficiency and waste reduction. Mold temperature management and carbon fiber reinforcement are key considerations in this context. Computer-aided design (CAD) and simulation software enable precise mold flow analysis and design for manufacturing.

Environmental compliance and safety standards are crucial in the injection molding industry. Flame retardants and mold maintenance practices are essential to meet safety regulations. Mold temperature and melt temperature control ensure consistent product quality. High-volume production and digital twin technology streamline manufacturing processes. Precision molding and runner system optimization minimize cycle time and manufacturing costs. Industry certifications and data analytics support quality assurance and continuous improvement. Automotive, construction, consumer products, electronics, medical devices, aerospace, and packaging industries all benefit from injection molding's versatility. Part finishing, ejector pin design, and gate location optimization further enhance product design and performance.

Mold repair, lead time optimization, and smart manufacturing practices, such as robotics and finite element analysis, ensure efficient and cost-effective production. Shrinkage rate management and part cost reduction strategies are essential for competitive pricing in the market. Injection molding's continuous evolution reflects its adaptability and relevance in modern manufacturing. From material handling and process optimization to energy efficiency and digitalization, the industry remains at the forefront of technological advancements.

How is this Injection Molding Industry segmented?

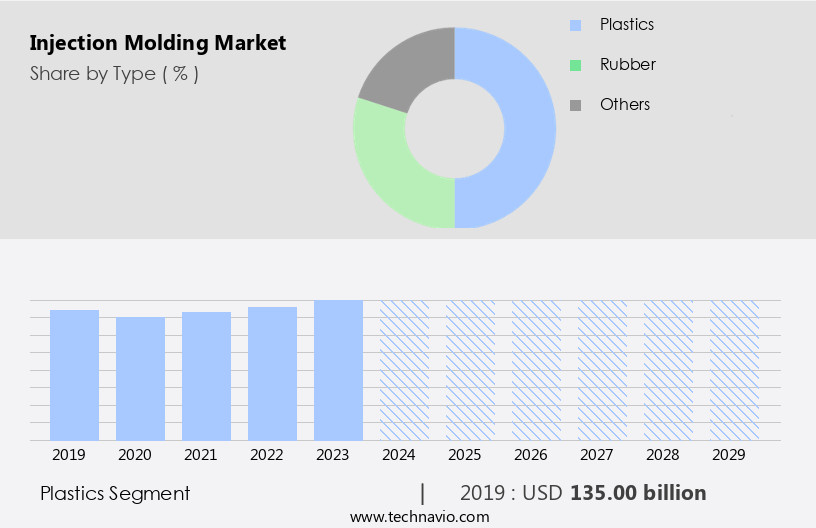

The injection molding industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Plastics

- Rubber

- Others

- Application

- Packaging

- Automotive and transportation

- Electronics

- Consumer goods

- Others

- Technology

- Standard molding

- Overmolding

- Insert molding

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The plastics segment is estimated to witness significant growth during the forecast period.

The plastic the market encompasses the production of rigid plastics through the injection molding technique. In 2024, plastic injection molding held the largest market share, driven by its extensive use in various applications, including packaging, automotive, consumer goods, and electronics. The packaging sector, particularly for food and beverage, utilizes injection molding to produce bottles and containers. Additionally, industries like pharmaceuticals, chemicals, and consumer goods rely on rigid plastics for their packaging needs. Key raw materials in plastic injection molding include polypropylene, acrylonitrile butadiene styrene, and high-density polyethylene (HDPE). Material handling and environmental compliance are crucial aspects of injection molding. Injection molding machines are designed to handle a wide range of materials, ensuring efficient production.

The use of computer-aided design (CAD) and simulation software facilitates the design process and optimizes mold temperature, melt temperature, and cycle time. Flame retardants and impact modifiers are added to enhance the material's properties for specific applications. Quality assurance is a significant focus in injection molding, with techniques like statistical process control and precision molding ensuring consistent product quality. Automated injection molding and computer-aided engineering streamline the manufacturing process, reducing lead time and manufacturing costs. Safety standards, such as holding pressure and mold maintenance, ensure the safety of operators and the longevity of the mold. Injection molding is used to produce various parts, including automotive, aerospace components, and medical devices.

Waste reduction and energy efficiency are essential considerations, with techniques like process optimization and digital twin technology improving production efficiency. The runner system and ejector pins facilitate part ejection, while part finishing and mold cleaning ensure the final product's quality. Industry certifications, such as those for medical devices and consumer products, ensure adherence to regulatory standards. Design for manufacturing principles guide the design process, reducing the need for mold repair and minimizing part cost. Injection molding is also used in industrial equipment, with resin viscosity and melt index playing a crucial role in the production process. Injection molding machines are used to produce parts with complex geometries, requiring careful consideration of gate location and cooling time.

Data analytics and process optimization techniques enable manufacturers to optimize production and improve product design. The integration of robotics and automation further enhances production efficiency and reduces labor costs. In summary, the plastic the market is driven by its extensive use in various industries, particularly packaging, automotive, and consumer goods. The use of advanced technologies, such as computer-aided design, simulation software, and automation, streamlines the manufacturing process, ensuring consistent product quality and reducing manufacturing costs. Adherence to safety standards and regulatory requirements is essential, with a focus on waste reduction, energy efficiency, and process optimization.

The Plastics segment was valued at USD 135.00 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, driven by the expanding end-user industries, particularly in Asia Pacific. In this region, countries like China, India, and Japan are poised to become major contributors due to their rapidly developing e-commerce sectors. Packaging is a crucial element in e-commerce, as products may be susceptible to damage during transportation. Injection molding machines play a vital role in producing multi-layered packaging, ensuring product safety and durability. Material handling is another sector benefiting from injection molding technology. Construction materials, such as PVC pipes and fittings, are commonly manufactured using injection molding processes. These materials require precise molding to ensure strength and durability.

Mold temperature and pressure are crucial factors in achieving the desired product properties. Carbon fibers, a popular material in the aerospace and automotive industries, are also injection molded. Computer-aided design and simulation software are essential tools in the design and manufacturing process, enabling process optimization and reducing waste. Flame retardants are added to certain materials to meet safety standards. Tooling costs and mold maintenance are significant considerations in injection molding. Quality assurance is ensured through various methods, including statistical process control and part design analysis. Precision molding, such as medical device manufacturing, requires stringent quality control measures. Injection molding is also used in the production of consumer products, including toys, household items, and electronics components.

Part finishing and mold cleaning are essential steps in the manufacturing process to ensure a high-quality final product. Energy efficiency and waste reduction are ongoing priorities in the industry. High-volume production requires automated injection molding and digital twin technology for process optimization. Automotive parts, such as dashboards and engine components, are injection molded for their durability and precision. Aerospace components, including aircraft interiors and structural parts, are also injection molded using advanced materials and manufacturing techniques. Smart manufacturing and finite element analysis are emerging trends in the injection molding industry, enabling real-time process monitoring and predictive maintenance. Injection molding machines are becoming more sophisticated, with features such as computer-aided engineering, automated ejector pins, and data analytics for process optimization.

In conclusion, the market is a dynamic and evolving industry, driven by advancements in technology and the expanding needs of various end-user industries. From packaging and construction materials to automotive and aerospace components, injection molding plays a crucial role in manufacturing high-quality, precision parts.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Injection Molding Industry?

- The packaging industry's increasing adoption of high-efficiency injection molding machines serves as the primary market driver.

- Injection molding, a critical manufacturing process, is gaining traction in various industries due to its efficiency and versatility. Automated injection molding systems, in particular, are increasingly popular for their ability to improve productivity and reduce costs. These systems utilize design for manufacturing principles, ensuring optimal product design and efficient use of materials. Safety standards are paramount in injection molding, with holding pressure and mold maintenance crucial elements. Advanced injection molding machines incorporate safety features and offer improved cycle times, enabling the production of complex parts. The injection molding industry caters to diverse sectors, including medical devices, consumer products, and packaging.

- Materials such as polyvinyl chloride, glass fibers, impact modifiers, and additives are commonly used. Mold cleaning and part finishing techniques ensure the production of high-quality parts. Industry certifications, such as ISO and FDA, guarantee adherence to stringent quality and safety standards. Data analytics plays a vital role in optimizing production processes, reducing downtime, and enhancing overall efficiency. Gate location, an essential factor in injection molding, influences part quality and cycle time. Proper gate design and location can significantly improve product performance and reduce waste. Mold maintenance is crucial for maintaining machine performance and longevity. Regular cleaning and maintenance ensure consistent part quality and reduce the risk of machine downtime.

- In conclusion, the market is dynamic and evolving, driven by factors such as energy efficiency, safety standards, and technological advancements. Operators are continuously seeking ways to reduce costs, improve sustainability, and enhance product quality.

What are the market trends shaping the Injection Molding Industry?

- The global packaging industry is witnessing a significant increase in innovations, serving as the latest market trend. Continuous advancements in packaging technologies are shaping the industry's future.

- Injection molding is a critical industrial process for manufacturing parts and products using thermoplastic resins. The market for injection molding equipment is driven by various factors, including the production of automotive parts, high-volume manufacturing, and waste reduction. The process involves injecting molten resin into a mold under high injection pressure and controlling cooling time for proper solidification. Process optimization is a key focus area in injection molding, with advancements in digital twin technology, runner system design, and precision molding enabling improved efficiency and quality control. Resin viscosity plays a crucial role in the injection molding process, and the use of energy-efficient machines and molds with extended mold life further enhances overall productivity.

- Innovations in packaging applications, such as active packaging, modified atmosphere packaging (MAP), and intelligent packaging, are expected to increase the consumption of injection-molded products. Active packaging contains smart materials that offer temperature control, moisture absorption, and oxygen scavenging capabilities, while intelligent packaging uses sensors and indicators to monitor environmental conditions and product freshness. These advancements are particularly relevant to the food and beverage, pharmaceutical, and healthcare industries. In conclusion, the market is poised for growth due to its versatility, efficiency, and ability to produce high-quality parts and products across various industries. The ongoing development of innovative technologies and applications will continue to drive demand for injection molding equipment and services.

What challenges does the Injection Molding Industry face during its growth?

- The growth of the industry is significantly influenced by government regulations and policies, posing a significant challenge that necessitates careful navigation and adherence to ensure compliance.

- The market is driven by various factors, including lead time, part design, and manufacturing costs. Robotic arms and statistical process control are essential in ensuring consistent part quality and delivery time. Mold design plays a crucial role in minimizing mold repair and maintaining a high shrinkage rate. In the electronics industry, injection molding is widely used for manufacturing components due to its ability to produce complex parts with intricate details. Aerospace components also benefit from injection molding due to its high precision and low manufacturing costs. Smart manufacturing technologies, such as finite element analysis and shot size optimization, are increasingly being adopted to improve production efficiency and reduce part costs.

- However, regulations, such as the US Environmental Protection Agency (EPA) and the European Union's Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) Regulation, impose stringent rules on the use of injection molding machines in the production of food and medical devices. Compliance with these regulations can add to the overall manufacturing costs. In conclusion, the market is influenced by various factors, including regulations, part design, manufacturing costs, and technological advancements. Robotic arms, statistical process control, and smart manufacturing technologies are essential in ensuring consistent part quality and reducing manufacturing costs. However, regulations can add to the overall manufacturing costs and impact the growth of the market.

Exclusive Customer Landscape

The injection molding market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the injection molding market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, injection molding market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

All Plastics LLC - This company specializes in injection molding services, delivering innovative solutions for various industries. Our expertise encompasses medical and clean room injection molding, prototype development, tool building, and turnkey manufacturing. By combining advanced technology with meticulous attention to detail, we ensure high-quality results for our clients. Our team of experienced professionals is dedicated to bringing your ideas to life, from concept to production. Our commitment to excellence and continuous improvement sets us apart in the injection molding industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- All Plastics LLC

- Biomerics LLC

- BORCHE NORTH AMERICA INC.

- C and J Industries Inc.

- Currier Plastics Inc.

- D and M Plastics LLC

- ENGEL AUSTRIA GmbH

- EVCO Plastics

- Formplast GmbH

- H and K Muller GmbH and Co. KG

- Hehnke GmbH and Co KG

- HTI Plastics

- Husky Technologies

- Majors Plastics Inc.

- Mold Hotrunner Solutions Inc.

- Proto Labs Inc.

- Tessy Plastics Corp.

- The Rodon Group

- TR Electronic

- Woojin Plaimm Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Injection Molding Market

- In January 2024, BASF Corporation, a leading chemical producer, announced the launch of Ultramid TG3, a new high-performance polyamide material for injection molding applications. This innovative material offers improved heat resistance and enhanced mechanical properties, making it suitable for the automotive and electrical industries (BASF press release, 2024).

- In March 2025, LG Chem and SABIC, two global chemical companies, formed a strategic partnership to develop and commercialize advanced materials for the automotive industry through injection molding technology. The collaboration aims to reduce carbon emissions and improve production efficiency (LG Chem press release, 2025).

- In May 2024, Toshiba Machine Co., Ltd. Unveiled its new HS series of high-speed injection molding machines, capable of producing parts up to 30% faster than previous models. This technological advancement significantly reduces production time and costs for manufacturers (Toshiba Machine press release, 2024).

- In July 2025, Engel Austria GmbH, a leading injection molding machinery manufacturer, announced a major expansion of its production facilities in China to cater to the growing demand for injection molding solutions in the Asian market. The investment is estimated to reach â¬100 million and will create over 500 new jobs (Engel press release, 2025).

Research Analyst Overview

- Injection molding, a key manufacturing process for producing parts with precision and consistency, encompasses various techniques such as multi-component, powder, compression, gas, electric, blow, rotational, micro, insert, transfer, reactive, and hydraulic methods. These processes cater to diverse industries and applications. Multi-component injection molding enables the production of complex parts with multiple materials in a single cycle. Mold inserts and hot runner systems streamline production and reduce material waste. Powder injection molding offers enhanced material properties through the use of powders. Compression molding, gas injection molding, and blow molding cater to large parts and components, while surface finish inspection ensures product quality.

- Manufacturing execution systems, inventory management, production planning, and supply chain optimization tools facilitate efficient workflows. Material testing, stress analysis, and dimensional measurement ensure product reliability and performance. Automation software and process control systems enhance productivity and reduce human error. Data acquisition systems provide real-time insights for continuous improvement. Mold flow software and quality control tools optimize the design and manufacturing process, while insert molding and transfer molding offer cost-effective solutions for producing intricate parts. Reactive injection molding expands the range of materials that can be processed. The market continues to evolve, driven by advancements in technology and the growing demand for high-performance, customized parts.

- Companies are investing in automation, data-driven solutions, and sustainable materials to remain competitive.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Injection Molding Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

226 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2025-2029 |

USD 54.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

US, China, Japan, Germany, India, Canada, France, South Korea, UK, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Injection Molding Market Research and Growth Report?

- CAGR of the Injection Molding industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the injection molding market growth of industry companies

We can help! Our analysts can customize this injection molding market research report to meet your requirements.