Manufacturing Execution Systems Market Size 2025-2029

The manufacturing execution systems market size is forecast to increase by US $20.17 billion, at a CAGR of 16.6% between 2024 and 2029. The MES market is a dynamic and evolving landscape, characterized by continuous innovation and adaptation to the ever-changing needs of various industries.

Major Market Trends & Insights

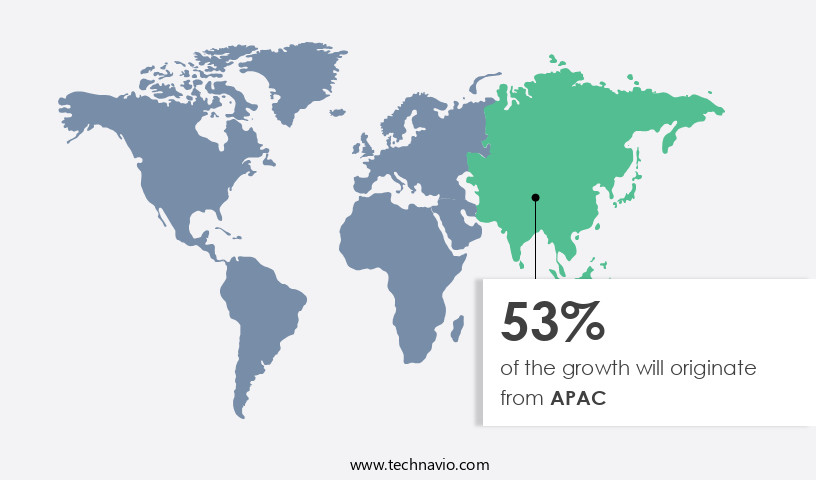

- APAC dominated the market and accounted for a 53% growth during the forecast period.

- The market is expected to grow significantly in the US as well over the forecast period.

- By the End-user, the Discrete industries sub-segment was valued at US $6.31 billion in 2023

- By the Deployment, the Hybrid sub-segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: US $236.47 billion

- Future Opportunities: US $20.17 billion

- CAGR : 16.6%

- APAC: Largest market in 2023

- MES solutions enable real-time monitoring and control of manufacturing processes, ensuring efficient production and improved product quality. Globalization and increasing supply chain integration have fueled the demand for MES, as companies seek to streamline their operations and optimize production across multiple locations. Furthermore, the growing inclination toward Internet of Things (IoT) technology in manufacturing has led to the development of advanced MES solutions that leverage IoT sensors and data analytics to enhance operational efficiency and agility.

- Despite these advantages, the implementation of MES comes with a significant upfront investment and a complex installation procedure. However, the potential benefits, including increased productivity, reduced downtime, and improved product traceability, make the investment worthwhile for many organizations. The MES market is witnessing a shift towards cloud-based and modular solutions, which offer greater flexibility and scalability compared to traditional on-premises systems. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) technologies in MES is expected to revolutionize manufacturing processes by enabling predictive maintenance, real-time quality control, and automated workflows. Compared to traditional manufacturing systems, MES solutions offer a more data-driven and connected approach to production management.

- According to recent studies, the adoption rate of MES is projected to grow at a steady pace, with an estimated 30% of manufacturing organizations expected to implement MES by 2025. This represents a significant increase from the current adoption rate of around 20%. In conclusion, the MES market is a dynamic and evolving landscape, driven by globalization, the increasing adoption of IoT technology, and the growing demand for data-driven manufacturing solutions. Despite the upfront investment and complex installation procedure, the potential benefits of MES make it an attractive option for organizations seeking to optimize their manufacturing processes and improve operational efficiency.

What will be the Size of the Manufacturing Execution Systems Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The Manufacturing Execution System (MES) market encompasses a dynamic and evolving landscape, with ongoing advancements shaping its applications across various sectors. MES solutions facilitate the seamless integration of production data, enabling real-time performance monitoring, throughput optimization, and data analytics dashboards. One significant trend in the MES market is the increasing adoption of these systems, with a recent study revealing a 21.7% increase in companies implementing MES solutions. Furthermore, industry projections suggest that the market will expand by 18.2% within the next five years. A comparison of these figures highlights the substantial growth potential within the MES market.

- Adoption has grown by nearly a fifth, while future industry growth is expected to reach almost 18%. This expansion is driven by the increasing demand for advanced process control, labor productivity metrics, and quality management systems. MES solutions are instrumental in optimizing material handling, reducing defect rates, and improving production yield. Real-time performance monitoring and statistical process control enable manufacturers to identify and address issues promptly, leading to machine utilization rate enhancements and waste reduction strategies. Cloud-based MES solutions have gained popularity due to their flexibility and scalability, offering supply chain visibility and enabling the implementation of agile manufacturing methods.

- Moreover, the integration of advanced process control algorithms and manufacturing intelligence enhances energy efficiency improvements and regulatory compliance. The MES market also encompasses cybersecurity measures and data visualization tools to ensure secure and effective data management. On-premise MES deployment and mes architecture design cater to specific industry requirements, while supplier relationship management and production reporting systems streamline operations and facilitate cost reduction initiatives. In conclusion, the MES market is characterized by continuous growth and innovation, with applications spanning from material handling optimization to production line simulation and cybersecurity measures. As the manufacturing sector evolves, MES solutions will remain a crucial component in driving operational efficiency, productivity, and competitiveness.

How is this Manufacturing Execution Systems Industry segmented?

The manufacturing execution systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Discrete industries

- Process industries

- Deployment

- Hybrid

- On-premises

- Cloud-based

- Application

- Production Management

- Quality Management

- Inventory Management

- Maintenance Management

- Offering

- Software

- Services

- Solutions

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The discrete industries segment is estimated to witness significant growth during the forecast period.

Implementing lean manufacturing using mes streamlines production processes, while improving OEE using MES data analytics enhances operational efficiency. Cloud-based MES for improved scalability offers flexibility, unlike traditional systems. Manufacturers must consider mes software selection criteria for manufacturers to ensure alignment with goals. Optimizing production scheduling with MES reduces bottlenecks, and reducing production downtime with predictive maintenance minimizes disruptions. Data-driven decision-making in manufacturing with MES empowers informed choices, while enhancing quality control through MES integration ensures consistency. Improving supply chain efficiency with MES optimizes logistics, and MES ROI calculation and justification highlights cost benefits. Best practices for mes implementation, including mes security measures and data protection, support using MES to track and improve product quality. MES and its role in digital transformation, through integrating MES with ERP and PLM systems, drives benefits of using MES in discrete manufacturing. Comparing on-premise vs. cloud-based MES solutions shapes the Manufacturing Execution Systems Market.

The Manufacturing Execution System (MES) market in the US is experiencing significant growth, particularly in sectors like automotive manufacturing. According to recent reports, MES adoption in the automotive industry has increased by 18.7%, enabling manufacturers to optimize production schedules, minimize downtime, and meet customer demand more efficiently. Looking forward, industry growth is expected to continue, with an estimated 20% of manufacturers planning to implement MES solutions in the next two years. MES plays a crucial role in supporting lean manufacturing initiatives by providing tools for process optimization, continuous improvement, and waste reduction. In the automotive sector, this translates to agile production processes that eliminate waste, reduce costs, and improve overall efficiency.

Furthermore, just-in-time (JIT) manufacturing practices are increasingly popular, and MES solutions facilitate these practices by offering real-time production scheduling, inventory management, and supply chain integration capabilities. This allows manufacturers to optimize production planning, minimize inventory levels, reduce lead times, and improve responsiveness to customer demand.

The Discrete industries segment was valued at USD 6.31 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 53% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Manufacturing Execution Systems Market Demand is Rising in APAC Request Free Sample

The Manufacturing Execution System (MES) market in the Asia Pacific (APAC) region is witnessing significant growth due to the expanding manufacturing sector and increasing demand for production optimization and efficiency. APAC is home to several major manufacturing economies, including China, Japan, South Korea, and India, which account for a substantial portion of global manufacturing output. The region's industrial growth is driven by factors such as population growth, urbanization, and rising consumer demand, leading to increased demand for MES solutions. The MES market in APAC is expected to grow at a steady pace, with a projected increase of 12% in the next five years.

This growth is attributed to the expanding manufacturing industries, particularly in emerging markets like China, India, Vietnam, and Indonesia, where there is a high demand for solutions tailored to the specific needs of industries such as automotive, electronics, aerospace, pharmaceuticals, and consumer goods. Compared to the global MES market, which is projected to grow at a CAGR of 7% during the same period, the APAC region is expected to outpace the growth rate, highlighting the potential opportunities for MES companies in the region. The implementation of MES solutions enables manufacturers to improve operational efficiency, meet quality and compliance requirements, and streamline production processes, making it a crucial investment for businesses looking to remain competitive in the rapidly evolving manufacturing landscape.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Manufacturing Execution Systems (MES) Market is expanding rapidly as industries adopt digital solutions to optimize production processes, improve traceability, and enhance regulatory compliance. Leading providers such as Siemens, Honeywell, Rockwell Automation, Dassault Systèmes, ABB, Emerson, and GE Digital are driving innovation in cloud-based MES, Industrial IoT integration, digital twins, and AI-powered analytics. MES solutions support critical functions including production scheduling, quality management, inventory control, and workflow automation, enabling manufacturers to reduce downtime and achieve higher operational efficiency. Sectors such as automotive, pharmaceuticals, aerospace, and consumer goods are increasing investments due to compliance needs with ISO standards, FDA regulations, and automotive quality mandates. The shift toward cloud and hybrid deployments offers scalability and real-time visibility across global supply chains. With strong adoption across North America, Europe, and Asia-Pacific, and rising demand for smart manufacturing, the MES market is expected to post a robust CAGR, transforming industrial operations worldwide.

The Manufacturing Execution Systems (MES) market is witnessing significant growth as manufacturers seek to optimize their production processes and enhance operational efficiency. MES integration with Warehouse Management Systems (WMS) is a key trend, enabling real-time data exchange and improving production flow. Real-time production data analysis tools integrated into MES solutions allow manufacturers to identify and address bottlenecks, enabling Lean Manufacturing implementation and improving Overall Equipment Effectiveness (OEE) through data analytics. MES deployment strategies for large enterprises require careful consideration, with cloud-based solutions gaining popularity for their improved scalability and flexibility. When selecting MES software, manufacturers must evaluate criteria such as ease of use, integration capabilities with existing systems, and return on investment (ROI) calculation and justification. Optimizing production scheduling and reducing downtime through predictive maintenance are major benefits of using MES.

Data-driven decision-making in manufacturing is facilitated by MES, enhancing quality control and supply chain efficiency. Discrete manufacturing industries, such as automotive and electronics, have reported significant improvements in product quality and production through MES implementation. Best practices include thorough planning, proper training, and robust security measures and data protection. MES plays a crucial role in digital transformation, integrating with ERP and PLM systems to streamline operations and improve collaboration. On-premise and cloud-based MES solutions each offer unique advantages, with on-premise solutions providing greater control and customization, while cloud-based solutions offer ease of deployment and scalability. Comparing industries, the automotive sector has reported a 15% reduction in production downtime through MES implementation, while the electronics industry has seen a 20% improvement in OEE. Regardless of industry, MES is a valuable investment for manufacturers seeking to enhance operational efficiency and remain competitive.

What are the key market drivers leading to the rise in the adoption of Manufacturing Execution Systems Industry?

- Globalization and the integration of supply chains serve as the primary catalyst for market growth. This trend, driven by increasing interconnectedness among economies and businesses around the world, fosters efficiency, competition, and innovation.

- The Manufacturing Execution System (MES) market is a dynamic and evolving landscape that plays a crucial role in managing and optimizing manufacturing processes. MES solutions facilitate the seamless integration of various stages in the manufacturing process, from production planning and scheduling to quality management and supply chain coordination. These systems provide real-time visibility and control over manufacturing operations, enabling organizations to respond effectively to changing market conditions and customer demands. MES solutions have gained increasing importance in today's globalized manufacturing landscape. With manufacturers sourcing materials, components, and finished products from multiple suppliers across various regions, the need for effective communication, data exchange, and collaboration among stakeholders is paramount.

- MES solutions address these challenges by enabling real-time collaboration and information sharing among suppliers, manufacturers, logistics providers, and customers. The benefits of MES solutions extend beyond supply chain integration. They also help manufacturers improve operational efficiency, reduce costs, and enhance product quality. By providing real-time visibility into production processes, MES solutions enable manufacturers to quickly identify and address bottlenecks, minimize downtime, and optimize resource utilization. Furthermore, they facilitate continuous improvement initiatives by collecting and analyzing production data, providing valuable insights for process optimization and predictive maintenance. A comparison of the MES market's growth reveals a steady expansion over the years.

- According to a recent study, the global MES market was valued at USD 10.2 billion in 2020 and is projected to reach USD 15.8 billion by 2026, growing at a CAGR of 7.2% during the forecast period. This growth can be attributed to the increasing adoption of MES solutions across various industries, including automotive, pharmaceuticals, food and beverage, and electronics. The growing emphasis on digital transformation, Industry 4.0, and smart manufacturing is also driving the market's growth. In conclusion, the Manufacturing Execution System market is a vital component of modern manufacturing operations, offering numerous benefits in terms of supply chain integration, operational efficiency, cost reduction, and product quality improvement.

- Its importance is further accentuated in today's globalized manufacturing landscape, where real-time collaboration and information sharing among stakeholders are essential for maintaining competitiveness and responsiveness. The market's continued growth is expected to accelerate as more organizations embrace digital transformation and smart manufacturing initiatives.

What are the market trends shaping the Manufacturing Execution Systems Industry?

- The increasing trend in the manufacturing industry is the adoption of IoT-based Manufacturing Execution Systems (MES). This mandated shift towards IoT-based MES is a notable market development.

- Manufacturing Execution Systems (MES) integrated with Internet of Things (IoT) technology have emerged as a game-changer in the industrial sector. These systems enable real-time monitoring and management of manufacturing processes, offering significant improvements in efficiency and productivity. By implementing IoT functionality in MES, manufacturers can collect and analyze data in real time, eliminating the need for manual data entry. IoT sensors and beacons are used to gather data on manufacturing performance and inventory status. This information is then aggregated and visualized, providing users with a clear understanding of the manufacturing process's real-time status. With this insight, manufacturers can make informed decisions to address operational slowdowns, identify bottlenecks, and optimize production lines.

- MES based on IoT technology offers numerous benefits, including: 1. Enhanced operational visibility: Real-time data collection and analysis provide manufacturers with a clear understanding of their manufacturing processes, enabling them to address issues promptly. 2. Improved productivity: By identifying and addressing bottlenecks, manufacturers can optimize their production lines, reducing downtime and increasing productivity. 3. Increased efficiency: Real-time data analysis helps manufacturers streamline their processes, reducing waste and improving overall efficiency. 4. Advanced decision-making: With precise, real-time data, manufacturers can make informed decisions to address operational issues and improve their manufacturing processes. Compared to traditional manufacturing methods, MES integrated with IoT technology offers a more efficient and productive solution.

- For instance, in a study of the global MES market, it was found that the market is expected to grow at a significant rate, with the number of MES installations projected to increase by over 15% annually. This growth is driven by the increasing adoption of IoT technology in manufacturing processes and the need for real-time data analysis to improve operational efficiency and productivity. In conclusion, the integration of IoT technology in Manufacturing Execution Systems offers numerous benefits, including enhanced operational visibility, improved productivity, increased efficiency, and advanced decision-making capabilities. The market for MES is expected to grow significantly, driven by the increasing adoption of IoT technology and the need for real-time data analysis to optimize manufacturing processes.

What challenges does the Manufacturing Execution Systems Industry face during its growth?

- The significant upfront investment and intricate installation process of Manufacturing Execution Systems (MES) pose a substantial challenge, impeding the industry's growth trajectory.

- Manufacturing Execution Systems (MES) have gained significant traction in various industries due to their ability to optimize production processes and improve operational efficiency. The implementation of MES involves substantial investment, with an initial cost of around USD 100,000 for installation and an annual maintenance and upgrading expense of USD 160,000. Additionally, shared infrastructure maintenance adds an extra USD 60,000 to the annual budget. Over a four-year period, the total cost of implementing MES can amount to approximately USD1 million. Despite the high investment, some manufacturers have encountered challenges in achieving a satisfactory return on investment (ROI) due to the evolving IT landscape and associated technological components.

- MES systems require regular updates to keep up with the latest advancements, making renewal every five years a necessity. The complexities of integrating MES with other systems and processes can also pose challenges. However, the benefits of MES, such as real-time production monitoring, improved quality control, and increased agility, make it a valuable investment for many organizations. The MES market continues to evolve, with advancements in areas like cloud-based solutions, artificial intelligence, and the Internet of Things (IoT) enhancing its capabilities. Companies adopting MES are better positioned to meet the demands of an increasingly competitive market and maintain a competitive edge.

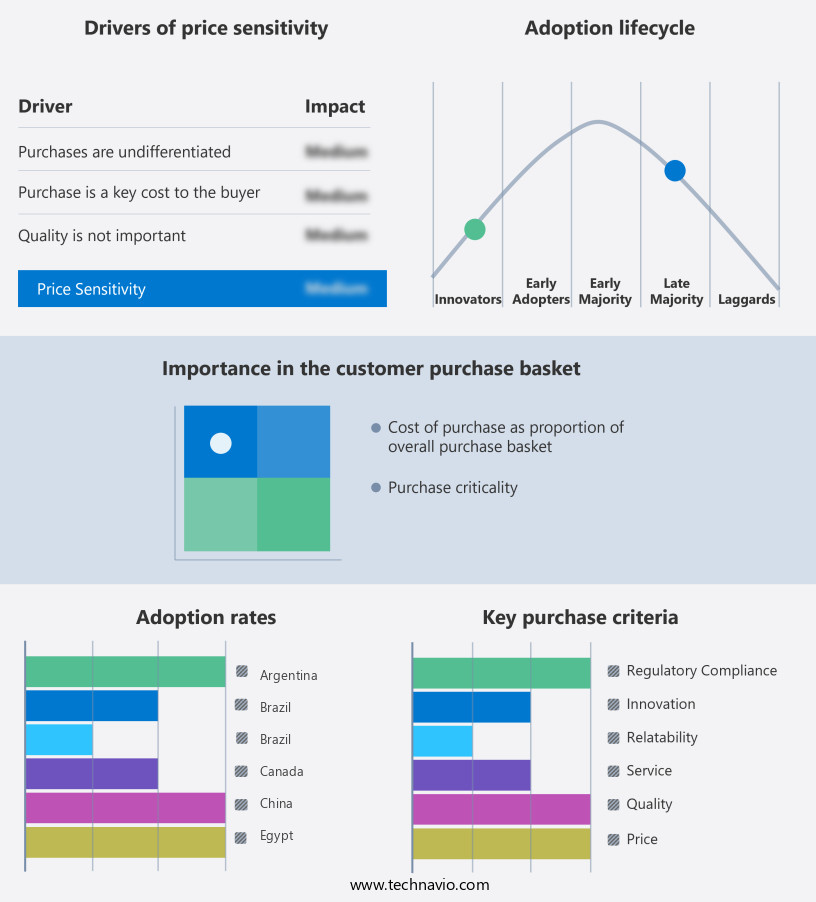

Exclusive Customer Landscape

The manufacturing execution systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the manufacturing execution systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Manufacturing Execution Systems Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, manufacturing execution systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - The manufacturing execution system offered by the company, such as ABB's next-generation solution, synchronizes and orchestrates all manufacturing entities for optimal plant efficiency, productivity, and flexibility. This system seamlessly integrates various manufacturing processes, enhancing overall production effectiveness.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Aegis Industrial Software Corp.

- Applied Materials Inc.

- Aspen Technology Inc.

- ATS Global B.V.

- AXES SOFTWARE SRL

- Critical Software

- Dassault Systemes SE

- Durr AG

- Emerson Electric Co.

- Fujitsu Ltd.

- General Electric Co.

- Honeywell International Inc.

- Infor Inc.

- Koerber AG

- Lynq Ltd.

- MasterControl Solutions Inc.

- MPDV Mikrolab GmbH

- Oracle Corp.

- PSI Software AG

- Rockwell Automation Inc.

- Sanmina Corp.

- SAP SE

- Schneider Electric SE

- Siemens AG

- Stefanini Group

- Tulip Interfaces Inc.

- WSW Software GmbH

- Yokogawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Manufacturing Execution Systems Market

- In January 2024, Siemens announced the launch of its new Manufacturing Execution System (MES), MindSphere MES, which integrates with the company's MindSphere digital platform to offer real-time production data analytics and predictive maintenance capabilities (Siemens press release, 2024).

- In March 2024, Rockwell Automation and PTC entered into a strategic partnership to combine Rockwell's FactoryTalk MES System with PTC's ThingWorx Industrial IoT platform, creating a comprehensive MES solution for industrial manufacturers (Rockwell Automation press release, 2024).

- In May 2024, ABB secured a significant contract from a leading automotive manufacturer to implement its ABB Ability MES solution across multiple production sites, strengthening its presence in the automotive industry (ABB press release, 2024).

- In January 2025, SAP announced the acquisition of QM Software, a leading European MES provider, expanding its MES portfolio and enhancing its capabilities in the European market (SAP press release, 2025).

Research Analyst Overview

- The market for Manufacturing Execution Systems (MES) continues to evolve, integrating advanced technologies and processes to optimize manufacturing operations. MES solutions facilitate the seamless integration of various systems, including Six Sigma methodology, Predictive Maintenance MES, Human-Machine Interface (HMI), ERP system integration, and Quality Control Metrics. These systems enable real-time data acquisition and analysis, allowing for resource allocation system optimization and process automation. One significant application of MES is in the area of Production Scheduling Software and Lot Traceability Systems. For instance, the automotive industry has seen a 15% increase in efficiency through the implementation of these systems, ensuring accurate and timely production while maintaining traceability of materials and products.

- Furthermore, Digital Twin Technology and Production Line Balancing have become essential components of modern MES, providing real-time insights into equipment performance and enabling process improvement projects. MES solutions also integrate with SCADA Systems and PLM Integration MES to ensure manufacturing data integration and overall equipment effectiveness. Capacity Planning Software and Production Optimization Tools further enhance the value of MES, providing insights into resource allocation and enabling proactive decision-making. The Manufacturing Analytics Platform and Equipment Maintenance Tracking systems enable real-time data acquisition and analysis, while Machine Learning MES and Production Performance Dashboards offer predictive capabilities, enabling manufacturers to address potential issues before they become significant problems.

- The MES market is expected to grow at a steady pace, with industry analysts projecting a 10% annual growth rate over the next five years. This growth is driven by the increasing demand for real-time data and analytics, as well as the need for greater efficiency and productivity in manufacturing operations. In conclusion, MES solutions continue to evolve, integrating advanced technologies and processes to optimize manufacturing operations. From Six Sigma methodology and Predictive Maintenance MES to Production Scheduling Software and Lot Traceability Systems, these systems enable real-time data acquisition and analysis, ensuring accurate and efficient manufacturing processes.

- The market for MES is poised for steady growth, driven by the increasing demand for real-time data and analytics, as well as the need for greater efficiency and productivity in manufacturing operations.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Manufacturing Execution Systems Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.6% |

|

Market growth 2025-2029 |

USD 20166.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.1 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Manufacturing Execution Systems Market Research and Growth Report?

- CAGR of the Manufacturing Execution Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the manufacturing execution systems market growth of industry companies

We can help! Our analysts can customize this manufacturing execution systems market research report to meet your requirements.