North America Invisible Orthodontics Market Size 2024-2028

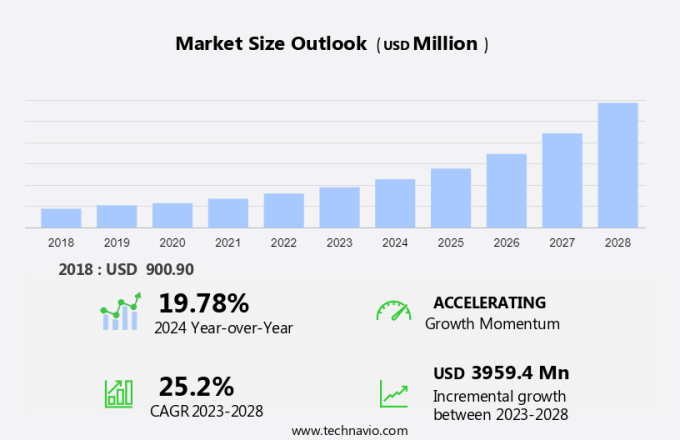

The North America invisible orthodontics market size is forecast to increase by USD 3.96 million at a CAGR of 25.2% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. The increasing number of dental conditions, particularly malocclusions and misaligned teeth, is driving the demand for orthodontic treatments. Additionally, digitization in the orthodontic industry, driven by Computer-Aided Design/Computer-Aided Manufacturing (CAD/CAM) technology, is making treatments more precise and efficient.

- However, high costs associated with orthodontic procedures remain a challenge for many consumers, limiting market growth. Despite this, the market is expected to continue expanding due to advancements in technology and increasing awareness of the importance of oral health.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant growth due to the increasing popularity of aesthetic dental treatments. The market caters to various dental conditions such as diastema, crossbite, overbite, underbite, and malocclusion. Orthodontic devices like clear aligners, including brands have gained popularity due to their aesthetic appeal and convenience. Dental clinics are increasingly adopting intra-oral scanners to provide precise and customized aligners to patients. The geographical landscape of the market is diverse, with the US and Canada being the major contributors. Dental hygiene and medical resources are readily available, ensuring a comprehensive market. The penetration rate of invisible orthodontics is increasing due to the availability of various orthodontic devices, such as ceramic braces and lingual braces.

- Additionally, dental healthcare professionals are embracing these techniques to offer tooth ailment solutions that are less intrusive and more comfortable for patients. The market facets include dental clinics, dental diseases, cosmetic and restorative dental treatments, and dental care. The company landscape is competitive, with key players focusing on product innovation and strategic collaborations to expand their reach. Comprehensive data on the market trends, growth drivers, challenges, and future opportunities is essential for stakeholders in the dental industry.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Dental and orthodontic clinics

- Hospitals

- Product

- Clear aligners

- Ceramic braces

- Lingual braces

- Geography

- North America

- Canada

- Mexico

- US

- North America

By End-user Insights

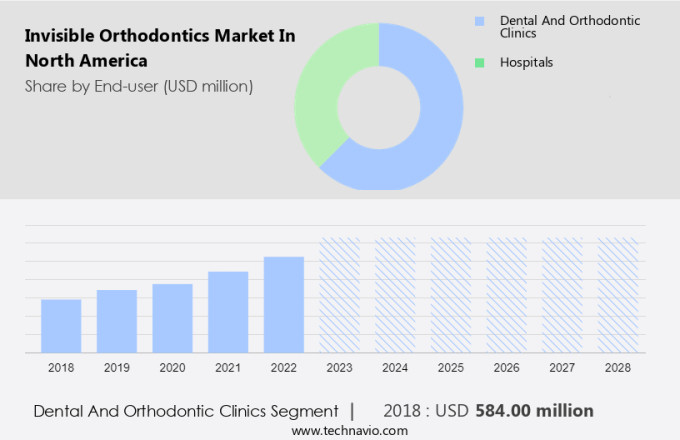

- The dental and orthodontic clinics segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth due to the increasing adoption of aesthetic dental treatments, such as clear aligners, among dental care consumers. Intra-oral scanners are increasingly being used to create precise aligners, ensuring effective treatment for dental crowding and malocclusions. Dental healthcare professionals are embracing these technologies, leading to a comprehensive market landscape. company landscape is also competitive, with companies focusing on collaborations and partnerships to expand their reach. Dental implant clinics and dental healthcare professionals are adopting these orthodontic solutions, fueling market growth.

Private dental insurance providers, such as Aetna Inc. And Sun Life Assurance Company of Canada, offer coverage for orthodontic treatment and care, further boosting demand. Overall, the North American Invisible Orthodontics Market is poised for growth, driven by the increasing preference for discreet orthodontic treatments and the availability of financing options. Market research reports indicate a positive outlook for the future, with key players focusing on innovation and expansion strategies.

Get a glance at the market share of various segments Request Free Sample

The dental and orthodontic clinics segment was valued at USD 584.00 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of North America Invisible Orthodontics Market?

Increasing number of dental conditions is the key driver of the market.

- The market is witnessing significant growth due to the rising prevalence of malocclusions and the increasing need for aesthetic dental treatments. Periodontal diseases, such as periodontitis, which result in gum infections and inflammation of the gums and bones supporting the teeth, are major contributors to the demand for orthodontic devices. In such conditions, the gums may pull away from the teeth, leading to bone loss and tooth misalignment. This necessitates orthodontic treatment, thereby fueling the demand for invisible orthodontic solutions, including clear aligners from brands. The geographical landscape of the market is characterized by the presence of key dental healthcare professionals and dental implant clinics, which are increasingly adopting advanced dental technologies, such as intra-oral scanners, to offer more precise and effective treatments.

- Additionally, key market players, such as Straumann, Dental Wings, and Henry Schein Orthodontics, are focusing on expanding their product portfolios and enhancing their distribution networks to cater to the growing demand for orthodontic devices. Furthermore, companies like Envista Holdings Corporation, Curaeos Clinics, and Dental Wings are investing in research and development to introduce innovative solutions, such as ceramic braces and lingual braces, to cater to the diverse needs of consumers. Market research reports suggest that the market is expected to grow steadily over the next few years, driven by these factors and the increasing awareness of the importance of dental care and dental technologies.

What are the market trends shaping the North America Invisible Orthodontics Market?

Digitization driven by CAD/CAM technology is the upcoming trend in the market.

- The market is witnessing significant growth due to the increasing popularity of aesthetic dental treatments, such as clear aligners, among dental healthcare professionals and patients.

- The integration of intra-oral scanners and CAD/CAM technology in dentistry has enabled the production of custom-made, transparent aligners and brackets. These advanced orthodontic solutions cater to various dental issues, including dental crowding and malocclusions. Key dental implant clinics and dental healthcare professionals are adopting these technologies to offer their patients more comfortable and discreet orthodontic treatment options.

What challenges does North America Invisible Orthodontics Market face during the growth?

High costs associated with orthodontic procedures are key challenges affecting the market growth.

- In the realm of dentistry, the market for invisible orthodontics in North America is witnessing significant growth due to the increasing preference for aesthetic dental treatments. These companies offer solutions such as clear aligners, like Invisalign, which are gaining popularity for their discreet design.

- However, the high cost of these orthodontic solutions, including invisible aligners, may act as a restraint for some individuals. Malocclusions, dental crowding, and other dental issues may necessitate more invasive procedures, such as ceramic braces, lingual braces, or even orthognathic surgery. The latter involves realigning the jaw to correct severe malocclusions and carries an average cost of USD 22,000 to USD 45,000 in the US. Dental healthcare professionals in dental implant clinics and dental care centers use various dental technologies, such as Henry Schein Orthodontics and Envista Holdings Corporation, to provide effective solutions for their patients. Curaeos Clinics also offer comprehensive data on these treatments to help dental care consumers make informed decisions.

Exclusive North America Invisible Orthodontics Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Align Technology Inc.

- AlignerCo

- American Orthodontics

- Aso International Co. Ltd.

- Candid Care Co.

- DENTAURUM GmbH and Co. KG

- Dentsply Sirona Inc.

- DynaFlex

- Envista Holdings Corp.

- G and H Orthodontics

- Great Lakes Dental Technologies Ltd.

- Henry Schein Inc.

- Institut Straumann AG

- King Orthodontics

- Retainer Club Inc.

- Risas Dental and Braces

- SmileDirectClub Inc.

- TP Orthodontics Inc.

- Ultradent Products Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing preference for aesthetic dental treatments. The geographical landscape of the market is diverse, with key players catering to dental healthcare professionals in dental clinics and dental implant clinics. The market is characterized by the adoption of advanced dental technologies, such as intra-oral scanners, to enhance the accuracy and efficiency of orthodontic treatments.

In summary, orthodontic issues like dental crowding and malocclusions continue to drive the demand for orthodontic braces, including ceramic braces and lingual braces. The comprehensive market research reports provide data on the market size, trends, and competitive landscape. Key companies in the market include Henry Schein Orthodontics, Envista Holdings Corporation, Curaeos Clinics, and others. The market is expected to grow steadily due to the increasing awareness of dental care and the availability of advanced dental technologies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

149 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 25.2% |

|

Market growth 2024-2028 |

USD 3.96 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

19.78 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch