K-12 Instruction Material Market Size 2025-2029

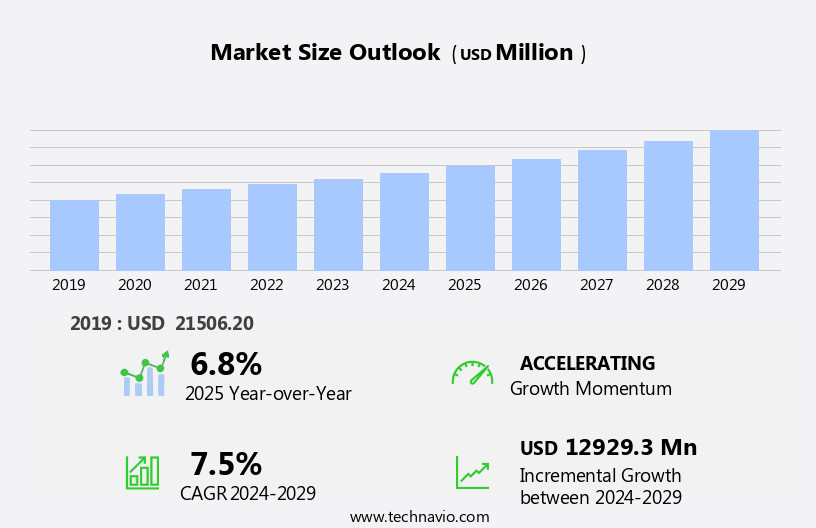

The k-12 instruction material market size is forecast to increase by USD 12.93 billion at a CAGR of 7.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for adaptive learning solutions that cater to the unique needs of individual students. This trend is particularly prominent in the US and other developed markets, where educational institutions are investing in technology to enhance teaching and learning experiences. Another key driver is the emergence of virtual classroom training, which enables remote learning and provides flexibility for students and educators. However, this market also faces challenges, such as low digital literacy levels among some students and educators, which can hinder the adoption of advanced instructional materials. Companies seeking to capitalize on this market opportunity must focus on developing user-friendly solutions that address these challenges and provide value to educators and students alike.

- By staying abreast of the latest trends and adapting to the evolving educational landscape, these companies can effectively navigate the market's dynamics and position themselves for long-term success.

What will be the Size of the K-12 Instruction Material Market during the forecast period?

- The market encompasses a diverse range of educational resources designed to support academic achievement in primary and secondary education. Traditional instruction materials, such as textbooks and teacher-created resources, continue to play a significant role. However, the market is experiencing a shift towards digital instruction materials, including adaptive learning platforms, learning management systems, and virtual classroom training. Digital content, including supplementary materials and educational resources, offers personalized learning experiences and improved access to education. Technology integration is a key trend, with digital education systems enabling active learning through visual learning, learning analytics, and content authoring.

- Online learning and blended learning models are gaining popularity, offering flexibility and convenience. Curriculum development and adherence to educational standards remain crucial, ensuring academic rigor and preparing students for future success. Overall, the market is dynamic, with continued growth and innovation in traditional and digital resources.

How is this K-12 Instruction Material Industry segmented?

The k-12 instruction material industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Courses

- Curriculum

- Assessment

- Product

- Traditional instruction material

- Digital instruction material

- Material

- Language arts

- Mathematics

- Science

- Social studies

- Others

- Geography

- North America

- US

- Canada

- APAC

- Australia

- China

- India

- Japan

- Europe

- France

- Germany

- Italy

- UK

- South America

- Middle East and Africa

- North America

By Courses Insights

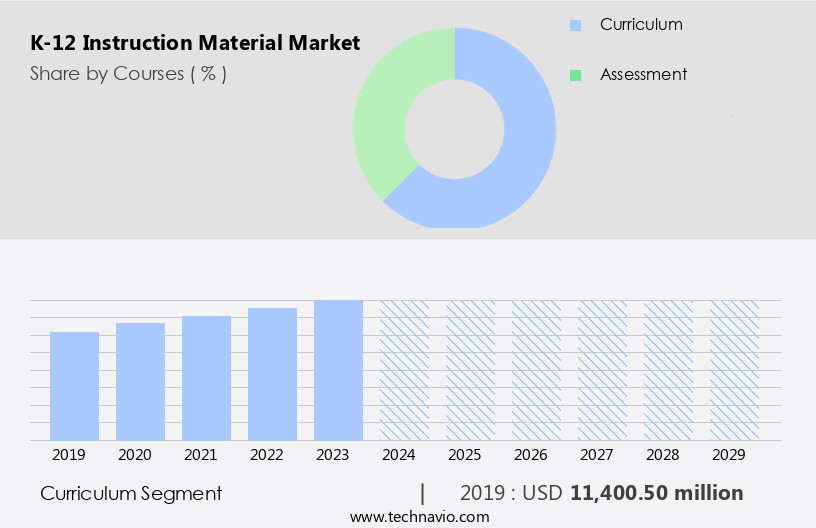

The curriculum segment is estimated to witness significant growth during the forecast period.

The K-12 instruction materials market is experiencing significant growth due to the increasing emphasis on STEM education and language learning, particularly in schools from emerging countries like India and China. STEM subjects have gained prominence in recent years, leading to the development of more effective curricula and instruction methods. Digital instruction materials are increasingly being adopted for STEM education to facilitate interactive and inquiry-based learning, enhancing content absorption and conceptual . Companies in the market are focusing on refining STEM-centric curriculum materials to cater to this demand. The integration of technology in education through digital content, virtual classrooms, learning management systems, and educational software is transforming traditional learning methods.

Personalized learning and adaptive learning are becoming essential components of modern instruction tools, enabling students to learn at their own pace. Learning analytics and assessment resources are also crucial in measuring academic achievement and identifying areas for improvement. The market for K-12 instruction materials encompasses a wide range of educational resources, including traditional print and online delivery methods, teacher-created resources, and e-learning solutions. The adoption of blended learning models, curriculum development, and educational standards further underscores the importance of this market in the digital age.

Get a glance at the market report of share of various segments Request Free Sample

The Curriculum segment was valued at USD 11.4 billion in 2019 and showed a gradual increase during the forecast period.

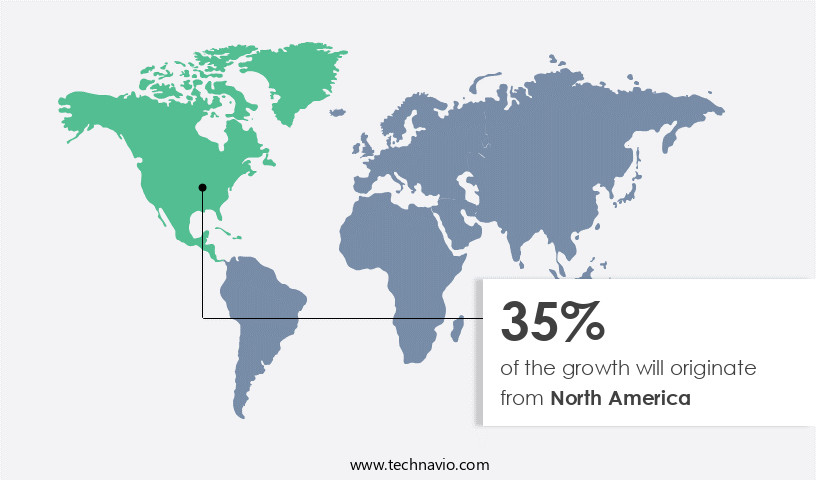

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is currently leading the global industry due to increased investments in educational resources. Factors driving this growth include expanding student enrollment, integration of technology devices in classrooms, and the implementation of new educational standards and assessments. This shift towards digital content has enhanced the learning experience, with schools adopting comprehensive digital packages for various subjects, offering additional assignments and multimedia resources. Digital instruction materials have been shown to improve student engagement and retention. The use of adaptive learning technologies, learning management systems, educational software, and virtual classrooms further personalizes instruction and facilitates assessment.

The integration of technology in K-12 education continues to evolve, with trends such as blended learning models, curriculum development, and social-emotional learning gaining popularity. The digital divide remains a challenge, but the ongoing advancements in digital education systems, online learning, and e-learning solutions are addressing this issue.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of K-12 Instruction Material Industry?

Increasing demand for adaptive learning is the key driver of the market.

- Adaptive learning software is increasingly integrated into instructional materials, enhancing the educational experience. This shift towards personalized and flexible learning models is driven by the demand for more effective feedback mechanisms, mastery-based evaluation, and concept mapping. Publishing houses recognize this trend and are either developing their own adaptive learning programs or collaborating with partners to remain competitive. For instance, in May 2024, Coursera introduced new entry-level certificates from Microsoft, emphasizing the significance of adaptive learning tools in equipping learners with necessary skills for in-demand jobs.

- This market dynamic underscores the importance of adaptive learning software in education.

What are the market trends shaping the K-12 Instruction Material Industry?

Emergence of virtual classroom training is the upcoming market trend.

- The market is undergoing a transformation as virtual classrooms gain popularity. Virtual classrooms offer a flexible learning environment where students can collaborate and learn online through video conferencing. This shift from traditional classroom settings is driven by several advantages, including the convenience of attending classes from anywhere, cost savings, and increased accessibility to education. Virtual classrooms can cater to small teams or individual learners, a capability not possible in physical classrooms.

- The market growth is attributed to the non-restrictive nature of virtual learning and its cost-efficiency, making it an attractive alternative to traditional instruction methods.

What challenges does the K-12 Instruction Material Industry face during its growth?

Low digital literacy is a key challenge affecting the industry growth.

- The integration of digital classrooms in developed countries' education systems, including the US and the UK, has significantly enhanced the learning experience. This transformation is attributed to the widespread availability of essential hardware and technologies, as well as the faculty's proficiency in utilizing these tools optimally. This shift towards digital learning has reduced the time and resources required to transition from traditional methods. However, in developing regions, challenges persist. The lack of adequate digital infrastructure and low digital literacy among educators, who often have limited experience operating digital hardware and software, hinder the adoption of technology in education.

- Despite these obstacles, the potential benefits of digital learning are substantial, making it a priority for countries to invest in digital infrastructure and educate their teachers to effectively leverage technology in the classroom.

Exclusive Customer Landscape

The k-12 instruction material market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the k-12 instruction material market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, k-12 instruction material market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Blackboard Inc. - The company provides K-12 educators with efficient instructional solutions through online teaching software, enabling them to streamline their instructional duties and maximize productivity from any location. This approach eliminates hindrances to teaching and ensures a seamless educational experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Blackboard Inc.

- Carnegie Learning Inc.

- Cengage Learning Inc.

- Chegg Inc.

- D2L Inc.

- Discovery Education Inc.

- Follett Corp.

- Gakken Holdings Co. Ltd.

- Hachette Book Group Inc.

- Houghton Mifflin Harcourt Co.

- Mastery Education

- McGraw Hill LLC

- Oracle Corp.

- Pearson Plc

- Sanoma Corp.

- Savvas Learning Co. LLC

- Scholastic Corp.

- Springer Verlag GmbH

- Stride Inc.

- Vista Higher Learning

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a vast array of resources designed to facilitate learning in primary and secondary education. Traditional instruction material, such as textbooks and printed worksheets, have long been the cornerstone of classroom instruction. However, the advent of digital instruction material has disrupted this landscape, offering new opportunities and challenges. Digital instruction material, including e-books, interactive educational software, and multimedia resources, is increasingly popular due to its accessibility and flexibility. Virtual classrooms and online learning platforms enable students to access educational content from anywhere, at any time. This is particularly beneficial for students in remote areas or those with limited access to traditional resources.

Moreover, technology integration in K-12 education has led to the emergence of blended learning models, which combine traditional and digital instruction methods. These models allow teachers to use a variety of instruction tools, such as learning management systems, to deliver content and assess student progress. Personalized learning is another trend gaining traction in the market. Adaptive learning technologies enable instruction to be tailored to individual students' learning styles and abilities, leading to improved academic achievement. Learning analytics and assessment resources help teachers monitor student progress and adjust instruction accordingly. The use of ICT devices, such as laptops and tablets, has become ubiquitous in K-12 education.

These devices enable students to engage in active learning, collaborate with their peers, and access a wealth of educational resources. However, the digital divide, which refers to the unequal access to technology and digital content, remains a significant challenge. STEM education is a key focus area in the market. Digital learning platforms and e-learning solutions offer engaging, interactive resources that help students develop essential skills in science, technology, engineering, and mathematics. Curriculum development and educational standards continue to play a crucial role in the market. Content providers offer a range of curriculum materials, from traditional resources to digital content and teacher-created resources.

Instructional design and lesson planning are essential components of effective instruction material development. In , the market is undergoing significant transformation, driven by technology integration and the shift towards digital instruction methods. Adaptive learning, personalized learning, and STEM education are key trends shaping the market. The use of ICT devices and the digital divide remain significant challenges, while learning analytics and assessment resources offer opportunities for improving academic achievement.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.5% |

|

Market growth 2025-2029 |

USD 12929.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.8 |

|

Key countries |

US, China, Germany, India, Canada, UK, France, Japan, Italy, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this K-12 Instruction Material Market Research and Growth Report?

- CAGR of the K-12 Instruction Material industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the k-12 instruction material market growth of industry companies

We can help! Our analysts can customize this k-12 instruction material market research report to meet your requirements.