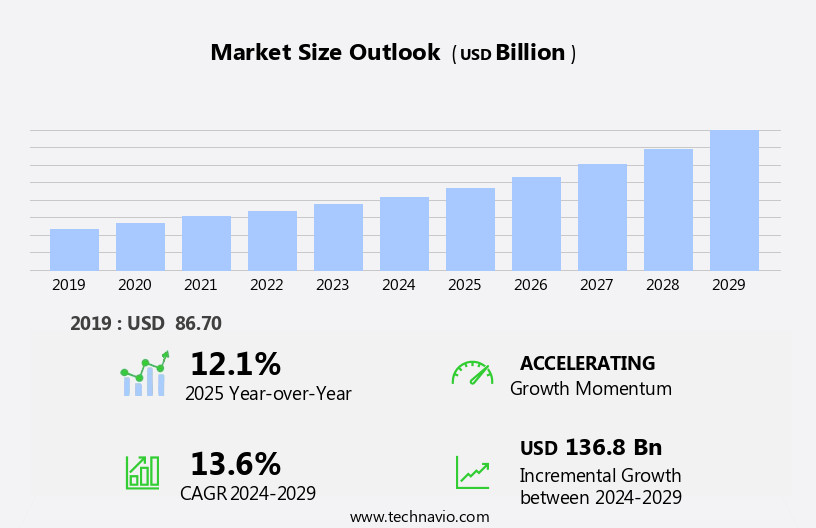

K-12 Online Tutoring Market Size 2025-2029

The k-12 online tutoring market size is forecast to increase by USD 136.8 billion, at a CAGR of 13.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing importance of Science, Technology, Engineering, and Mathematics (STEM) education. The emergence of learning via mobile devices further fuels this market's expansion, as students and parents seek flexible, accessible educational solutions. However, the market faces challenges, including the threat from open tutoring resources and private tutors. These competitors offer free or low-cost alternatives, putting pressure on market players to differentiate their offerings through personalized instruction, advanced technology, and additional resources.

- To capitalize on opportunities and navigate challenges effectively, companies must focus on delivering high-quality, interactive, and engaging online tutoring experiences that cater to the unique needs of individual students.

What will be the Size of the K-12 Online Tutoring Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic applications across various sectors. Standardized testing, social studies, college admissions counseling, and subscription models are seamlessly integrated into personalized learning programs. Accessibility features, such as closed captioning and text-to-speech, ensure inclusivity. Educational content creation and assessment tools cater to STEM education and adaptive learning. Progress tracking and small group instruction enable teachers to monitor student progress and provide personalized feedback. Teacher dashboards offer insights into student performance and allow for data-driven instruction. Freemium models provide access to basic services, while subscription models offer premium features. Special education and recorded lessons cater to diverse learning needs, while virtual classroom technology and mobile learning facilitate flexibility and convenience.

Teacher training and student engagement tools ensure effective implementation of online tutoring platforms. Curriculum development and test preparation services cater to specific academic requirements. Blended learning and interactive learning tools enhance student engagement and understanding. Security and privacy measures protect student data. Compliance regulations ensure adherence to industry standards. Math, science, writing, and reading tutoring cater to various subjects. Homework help and one-on-one tutoring offer personalized assistance. Parent communication tools keep families informed. Live online tutoring and group tutoring provide opportunities for real-time interaction and collaboration. Asynchronous learning resources offer flexibility for students with varying schedules. Administrative tools streamline platform management.

Interactive learning tools and gamification in education keep students engaged and motivated. Middle school students benefit from these services, as they prepare for high school and beyond. Overall, the market is a continuously unfolding landscape of innovation and growth.

How is this K-12 Online Tutoring Industry segmented?

The k-12 online tutoring industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Structured tutoring

- On-demand tutoring

- Courses

- Assessments

- Subjects

- Application

- High schools

- Primary schools

- Junior high schools

- Kindergarten

- Pre-kindergarten

- Geography

- North America

- US

- Europe

- France

- Germany

- Spain

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

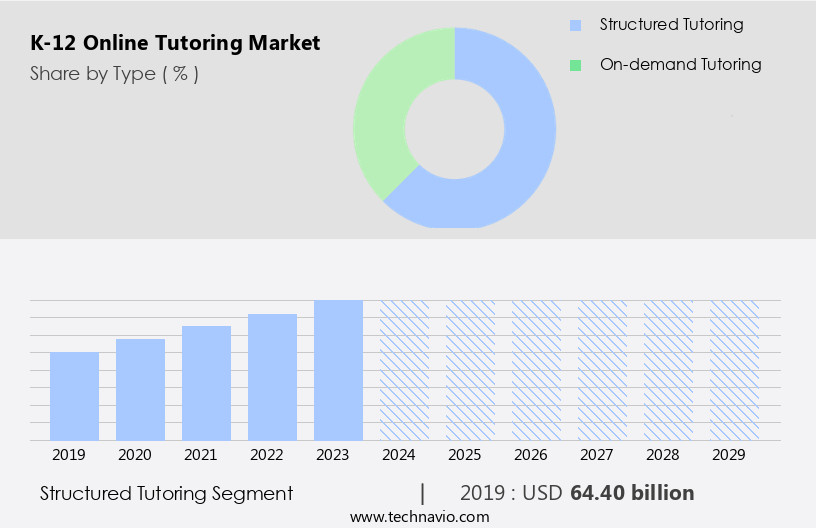

By Type Insights

The structured tutoring segment is estimated to witness significant growth during the forecast period.

The markets offer various solutions to enhance educational experiences, with accessibility features ensuring access to personalized learning programs for students. Companies provide educational content creation and assessment tools, catering to STEM education, progress tracking, and small group instruction. Teacher dashboards enable real-time monitoring, while freemium models offer flexibility for various budgets. Math tutoring, SAT prep, student support services, and homework help are popular offerings. High schools and middle schools utilize live online tutoring for AP courses and test preparation. Elementary schools focus on adaptive learning and writing tutoring. Compliance regulations and standardized testing requirements are met through security and privacy measures.

Virtual classroom technology, mobile learning, and teacher training foster student engagement. Curriculum development and test preparation cater to various subjects, including science tutoring and social studies. College admissions counseling, subscription models, and special education services are also available. Recorded lessons and interactive learning tools facilitate asynchronous learning. Blended learning and gamification in education add to the immersive and harmonious learning environment.

The Structured tutoring segment was valued at USD 64.40 billion in 2019 and showed a gradual increase during the forecast period.

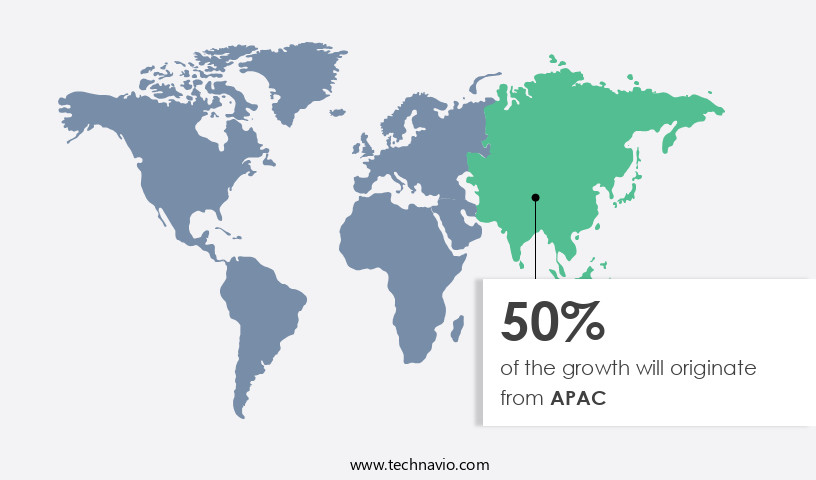

Regional Analysis

APAC is estimated to contribute 50% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia Pacific region is experiencing significant growth, with major contributions from South Korea, China, India, Singapore, and Australia. Advanced educational technologies, including personalized learning programs, assessment tools, and interactive learning resources, are driving this evolution. Government initiatives to promote digital learning in schools and universities are a key factor, as are the increasing acceptance of mobile app learning and the emergence of numerous courses on these platforms. Companies such as Ambow Education Holding Ltd., TAL Education Group, Think and Learn Pvt. Ltd., and Vedantu Innovations Pvt. Ltd. Are leading the charge in the region. These firms offer a range of services, from one-on-one tutoring and small group instruction to adaptive learning and progress tracking.

Freemium models and parent communication tools are also popular, ensuring accessibility for a wide range of students. Science, math, and test preparation subjects, including SAT and ACT, are popular areas for online tutoring. Compliance regulations and data security are also crucial considerations, with companies investing in robust security measures to protect student information. Special education and student engagement are other areas of focus, with personalized feedback and gamification techniques used to enhance the learning experience. The market for K-12 online tutoring is diverse, catering to elementary, middle, and high school students. It also includes offerings for AP courses, writing tutoring, reading tutoring, and college admissions counseling.

Virtual classroom technology, curriculum development, and teacher training are essential components, ensuring a high-quality educational experience. Blended learning and asynchronous learning are also gaining traction, offering flexibility and convenience for students. Overall, the market in the Asia Pacific region is dynamic and innovative, responding to the evolving needs of students and educators.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the rapidly evolving educational landscape, the market continues to gain momentum. This sector offers personalized learning solutions for students, enabling them to overcome academic challenges from the comfort of their homes. K-12 online tutors leverage advanced technology, such as virtual whiteboards and real-time collaboration tools, to deliver effective instruction. Live, interactive sessions provide immediate feedback, fostering improved understanding and academic growth. Parents value the flexibility and affordability of online tutoring, making it an increasingly popular alternative to traditional in-person tutoring. Subjects covered span the curriculum, including math, science, English, and social studies. Adaptive learning technologies ensure instruction is tailored to each student's unique learning style and pace. The market caters to diverse student needs, offering a convenient, accessible, and effective educational experience.

What are the key market drivers leading to the rise in the adoption of K-12 Online Tutoring Industry?

- The significance of STEM (Science, Technology, Engineering, and Mathematics) education continues to escalate, serving as the primary catalyst for market growth.

- The market is experiencing significant growth due to the increasing demand for student support services, particularly in the areas of homework help and one-on-one tutoring. Parents and students seek personalized instruction to enhance learning and improve academic performance, leading to increased adoption of live online tutoring. Adaptive learning technologies are also gaining popularity, providing customized instruction based on individual student needs. Moreover, the market is witnessing increasing demand for parent communication tools, ensuring transparency and enabling real-time interaction between parents and tutors. Security and privacy are critical concerns, with compliance regulations ensuring data protection and confidentiality.

- Beyond STEM subjects, writing tutoring, reading tutoring, AP courses, and ACT prep are also popular areas of demand. The flexibility and convenience of online tutoring cater to the diverse needs of students, making it an immersive and harmonious learning experience. The market's growth is driven by the emphasis on providing comprehensive support services, addressing the unique requirements of students in various educational contexts.

What are the market trends shaping the K-12 Online Tutoring Industry?

- The emergence of mobile learning is a significant market trend, with an increasing number of professionals and students utilizing mobile devices for education and skill development. This shift towards mobile education offers flexibility, accessibility, and convenience, making it an essential aspect of modern learning solutions.

- The market is experiencing significant growth due to the increasing adoption of mobile devices in education. With the widespread use of smartphones and tablets, students can now access educational content and attend virtual classes from anywhere, making learning more flexible and personalized. This trend is particularly important for subjects like standardized testing, college admissions counseling, social studies, and special education, where students require additional support and resources. Subscription models have become increasingly popular in this market, providing students with access to recorded lessons and virtual classroom technology. Teacher training and curriculum development are also crucial aspects of the market, ensuring student engagement and academic success.

- Mobile learning, test preparation, and virtual classroom technology are key drivers of this market, as they offer students the flexibility to learn at their own pace and in their preferred environment. The use of technology in education is no longer a luxury but a necessity, and the market is at the forefront of this trend. By leveraging the power of virtual classroom technology, recorded lessons, and mobile learning, students can receive personalized instruction and support, enhancing their overall educational experience.

What challenges does the K-12 Online Tutoring Industry face during its growth?

- The growth of the education industry is facing significant challenges from open tutoring resources and private tutors, making it essential for organizations to adapt and provide value-added services to differentiate themselves.

- The market is experiencing significant competition from free open-source tutors, posing a threat to commercial online tutoring providers. While companies like Ambow Education, China Distance Education, and iTutorGroup offer personalized instruction and interactive learning resources for a fee, the availability of free services from open-source tutors attracts consumers. Additionally, private tutoring remains a popular choice due to the belief that it caters to each student's unique learning pace. Despite the high cost, the preference for private tutoring is evident. Asynchronous learning, digital resources, and administrative tools are essential components of K-12 online tutoring, enhancing the learning experience.

- Science tutoring, group sessions, and blended learning models are also gaining traction. Data security is a critical concern in the digital learning landscape, with providers implementing robust measures to ensure student information remains protected. Gamification in education further engages students, making learning an immersive and harmonious experience.

Exclusive Customer Landscape

The k-12 online tutoring market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the k-12 online tutoring market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, k-12 online tutoring market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ambow Education Holding Ltd. - The company's Ambow Learning Engine (ALE) provides K-12 online tutoring services. This advanced technology monitors, navigates, optimizes, and manages learning and training activities through its self-adapting feedback mechanism of human-computer interaction. ALE's innovative approach enhances educational experiences by tailoring instruction to each student's unique learning style and pace. By leveraging the latest advancements in artificial intelligence and machine learning, ALE delivers personalized instruction and real-time progress reports, ensuring optimal academic growth.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ambow Education Holding Ltd.

- ArborBridge

- Chegg Inc.

- China Distance Education Holdings Ltd.

- Club Z Inc.

- D2L Corp.

- Fleet Education Services Ltd.

- Franchise Group Inc.

- Growing Stars Inc.

- Instructure Holdings Inc.

- iTutorGroup Inc.

- John Wiley and Sons Inc.

- New Oriental Education and Technology Group Inc.

- Nuevo Agora Centro De Estudios SL

- Pearson Plc

- Stride Inc.

- TAL Education Group

- Toppr Technologies Pvt. Ltd.

- Vedantu Innovations Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in K-12 Online Tutoring Market

- In January 2024, Brainfuse, a leading K-12 online tutoring provider, announced the launch of its new adaptive learning platform, incorporating AI technology to personalize tutoring sessions for students. (Source: Brainfuse Press Release)

- In March 2024, Chegg, an education technology company, entered into a strategic partnership with Carnegie Learning, a leading K-12 math education provider, to offer integrated tutoring services and improve student learning outcomes. (Source: Chegg Press Release)

- In May 2024, Aventa Education, a K-12 online tutoring company, secured a USD20 million Series C funding round led by Insight Partners to expand its tutoring services and enhance its technology platform. (Source: Crunchbase News)

- In February 2025, the U.S. Department of Education launched a new initiative, "Digital Learning Now," providing grants to schools and districts to expand access to online tutoring services, aiming to close the education gap and improve student performance. (Source: U.S. Department of Education Press Release)

Research Analyst Overview

- In the market, differentiated instruction takes center stage with educational apps employing predictive modeling to deliver personalized learning paths. File sharing and assignment submission streamline communication between students, teachers, and parents. Standards-based education is ensured through accessibility standards and curriculum alignment. Digital textbooks, screen sharing, and customer support facilitate effective instruction. Learning analytics and progress reports enable real-time student performance analysis. Third-party integrations, including educational games, video conferencing, and professional development tools, expand the offerings.

- Communication platforms, feedback mechanisms, and interactive simulations foster collaborative learning. Skill-based learning is enhanced through API integrations and online libraries. Teacher collaboration tools and parent portals strengthen the educational ecosystem. Platform integration ensures seamless user experience and efficiency.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled K-12 Online Tutoring Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.6% |

|

Market growth 2025-2029 |

USD 136.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.1 |

|

Key countries |

China, US, India, Japan, UK, South Korea, Germany, France, Spain, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this K-12 Online Tutoring Market Research and Growth Report?

- CAGR of the K-12 Online Tutoring industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the k-12 online tutoring market growth of industry companies

We can help! Our analysts can customize this k-12 online tutoring market research report to meet your requirements.