Kayaking Equipment Market Size 2025-2029

The kayaking equipment market size is forecast to increase by USD 230.2 million at a CAGR of 4.3% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing popularity of outdoor recreational activities. With more people seeking new experiences and a desire to connect with nature, the demand for kayaking equipment is on the rise. This trend is further fueled by the continuous introduction of innovative products, such as inflatable kayaks and advanced paddling technologies, which cater to a wider audience and diverse usage scenarios. Seasonal demand, particularly during the summer months, presents both opportunities and challenges for market participants. The market exhibits growth, driven by the increasing popularity of water sports and adventure tourism.

- On the one hand, the peak season generates substantial sales revenue. On the other hand, it also results in increased competition and inventory management complexities. To capitalize on market opportunities and navigate challenges effectively, companies should focus on expanding their product offerings, improving operational efficiency, and enhancing customer engagement strategies. Additionally, exploring emerging markets and partnerships with local distributors can help businesses tap into new customer bases and gain a competitive edge.

What will be the Size of the Kayaking Equipment Market during the forecast period?

- Outdoor enthusiasts and casual participants alike are drawn to the mental and physical benefits of kayaking, leading to repeat demand and expanding the customer base. New customers are attracted through engaging content, digital marketing strategies, and community engagement efforts. Sustainable production and the use of eco-friendly materials are key trends, resonating with consumers' values and preferences. Adventure tour operators and rental services cater to experienced paddlers seeking thrilling white-water experiences, while recreational paddlers opt for fishing kayaks or portable equipment for leisurely outings.

- Safety gear and protective equipment remain essential, ensuring customer satisfaction and trust. Retailers employ marketing tactics to attract potential customers, including dealer visits, sports equipment clubs, and brand stores. The market's rapid change is evident in the emergence of smart equipment, which enhances the user experience and caters to diverse customer needs. Sales channels continue to evolve, with online platforms becoming increasingly popular for convenience and accessibility. Overall, the market shows no signs of slowing down, offering ample opportunities for growth and innovation.

How is the Kayaking Equipment Industry segmented?

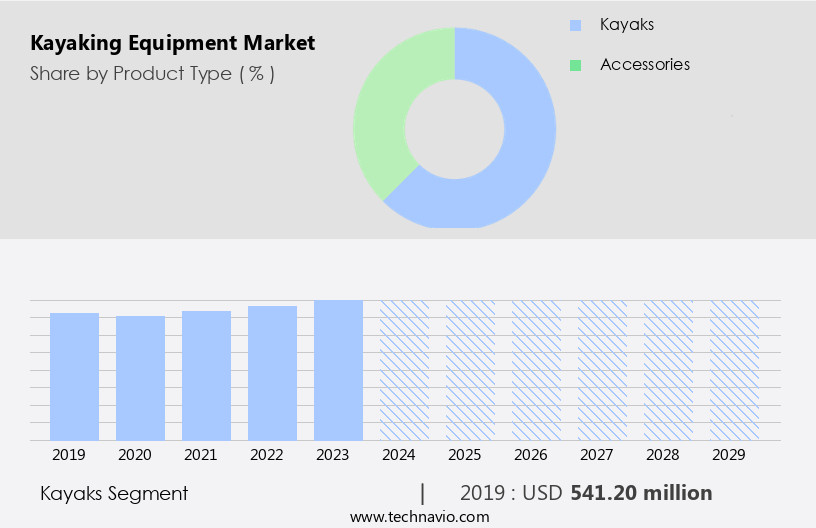

The kayaking equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product Type

- Kayaks

- Accessories

- Distribution Channel

- Offline

- Online

- End-user

- Recreational

- Tourism

- Sports

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- Australia

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

By Product Type Insights

The kayaks segment is estimated to witness significant growth during the forecast period. The market encompasses a range of products designed for adventure enthusiasts seeking to explore waterways. With increasing environmental consciousness, eco-friendly kayaking options are gaining popularity. Kayaking and innovation continue to shape the market, with sports marketing strategies targeting the kayaking lifestyle. Personal flotation devices (PFDs) are essential safety equipment for all paddlers. Sports retailers, including outdoor gear stores and sports equipment stores, offer canoe rentals and kayaking lessons for beginner paddlers. Artificial waterbodies, such as lakes and reservoirs, provide convenient access to kayaking and canoeing trips for those unable to travel to natural waterways. Fishing kayak accessories and specialized products cater to the needs of water sports enthusiasts.

The kayaking community fosters a sense of camaraderie and shared experiences, with mobile equipment options allowing for easy transportation and access to various kayaking destinations. Safety tips and eco-friendly materials are crucial considerations for both recreational and whitewater kayaking gear. Sports equipment brands invest in consumer interest by offering adventure experiences, water sports events, and kayaking tours. Kayaking and nature experiences, as well as kayaking for families and travel, continue to drive sales in the sports equipment market. Product categories include paddle sports, canoeing equipment, and soft adventure gear. Kayaking safety, techniques, and fitness are essential aspects of the market, with a focus on customer service training and sustainable practices.

Kayaking and technology intersect, providing innovative solutions for enhancing the kayaking experience. In summary, the market caters to a diverse range of users, from beginner paddlers to experienced whitewater kayakers. The market is driven by consumer demand for adventure, environmental consciousness, and innovative equipment, with a focus on safety, sustainability, and customer service.

Get a glance at the market report of share of various segments Request Free Sample

The Kayaks segment was valued at USD 541.20 million in 2019 and showed a gradual increase during the forecast period.

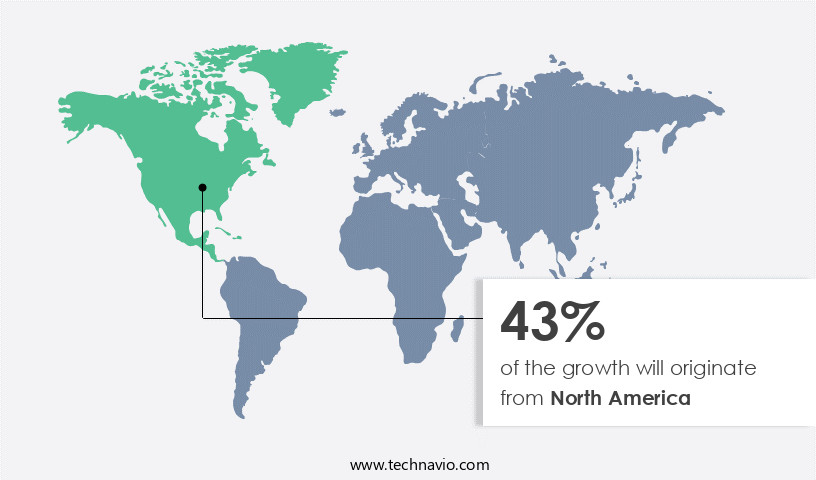

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market experiences significant growth due to the increasing popularity of adventure experiences and the kayaking lifestyle. With environmental consciousness at the forefront, eco-friendly kayaking and canoeing trips are on the rise. Outdoor gear stores and sports equipment retailers cater to this demand, offering a wide range of Personal Flotation Devices (PFDs), specialized kayaking equipment, and canoe camping accessories. Sports marketing initiatives, water sports events, and kayaking tours attract water sports enthusiasts, driving sales of sports equipment brands. Innovative products, such as portable kayaks and mobile equipment, cater to beginner paddlers and families. Kayaking safety tips and eco-friendly materials are essential considerations for both recreational and competitive kayaking.

The market includes product categories like paddle sports, canoeing equipment, and soft adventure gear. Kayaking and technology intertwine, with accessories like fishing kayak accessories and kayaking techniques enhancing the overall experience. Kayaking lessons and safety training are crucial for both beginners and advanced paddlers. The kayaking community thrives on sharing resources and experiences, with numerous online platforms and water sports retailers catering to consumer interest. Kayaking destinations, such as the Colorado River, the Great Lakes, and coastal regions, offer diverse experiences for adventure tourism and outdoor recreation. The American Canoe Association (ACA) and the Gorge Downwind Championships (GDC) collaborate to host the USA Canoe Ocean Racing (COR) National Championships, further promoting the growth of the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Kayaking Equipment Industry?

- Rising interest in outdoor recreation is the key driver of the market. The market experienced significant growth due to the increasing consumer interest in adventure sports and outdoor recreation. According to the latest economic data from the Bureau of Economic Analysis (BEA), the US outdoor recreation economy reached approximately USD 1.2 trillion in 2024, with around 175.8 million Americans engaging in outdoor activities each year. This trend is driven by various factors, including the growing awareness of health and wellness benefits associated with physical activities. Kayaking and canoeing offer unique adventure experiences, providing opportunities for exercise, stress relief, and social interaction. Water sports retailers reported a rise in sales of specialized products, such as fishing kayak accessories, whitewater kayaking gear, and portable kayaks.

- Kayaking techniques, safety, and eco-friendly materials have become essential considerations for water sports enthusiasts. Adventure tourism, including kayaking tours, kayaking lessons, and kayaking rentals, has gained popularity among consumers seeking unique experiences. Outdoor gear stores and sports equipment online platforms have responded by expanding their offerings and improving customer service training. The kayaking community continues to grow, fostering a lifestyle centered around adventure, nature, and innovation. Water sports events, such as kayaking competitions and races, have attracted a large following, with competitive kayaking emerging as an endurance sport. Sports marketing efforts have focused on promoting the health benefits and adventure experiences associated with kayaking and canoeing.

What are the market trends shaping the Kayaking Equipment Industry?

- The introduction of new products is the upcoming market trend. The market is witnessing innovation with the introduction of new products, catering to the diverse needs of water sports enthusiasts. For instance, Pelican International, a leading player In the outdoor gear industry, recently launched the iEscape110, an inflatable tandem kayak. This product, available from May 5, 2024, offers features such as Durazone polyester material for durability, three Safetech air chambers for safety, a rigid I-beam floor for improved tracking, and Boston air valves with pressure relief for proper inflation. Additional features include carry handles for transport, bungee deck lacing for gear storage, and an open cockpit design for easy entry.

- This marks Pelican International's entry into the inflatable kayak segment following its acquisition of Advanced Elements. The iEscape110 is a testament to the company's commitment to providing specialized products for adventure experiences, including canoeing trips, kayaking tours, and whitewater rafting trips. The market for kayaking equipment continues to grow, driven by consumer interest in adventure sports, outdoor recreation, and eco-friendly kayaking. Kayaking equipment, including paddles, personal flotation devices, and accessories, is available at water sports retailers, outdoor gear stores, and sports equipment online. Safety is a priority, with kayaking safety tips and resources readily available for beginner paddlers. Kayaking techniques, such as those for fitness, endurance sports, and competitive kayaking, are also popular.

What challenges does the Kayaking Equipment Industry face during its growth?

- Seasonal demand is a key challenge affecting the industry's growth. The market experiences seasonal fluctuations due to the nature of kayaking as an outdoor activity. Peak demand for kayaking equipment occurs during spring and summer, driven by consumers seeking adventure experiences and water sports participation. This period sees increased sales of kayaks, paddles, safety gear, and accessories. To meet this heightened demand, manufacturers and retailers must carefully plan and forecast inventory levels. Seasonality poses a challenge for sales consistency and inventory management, requiring specialized attention. Kayaking equipment is not just limited to recreational use; it also caters to fishing enthusiasts, competitive paddlers, and those seeking adventure travel. The kayaking equipment market is a significant segment of the larger water recreation equipment industry, with specialized equipment catering to various types of kayaking, including whitewater kayaks, being in high demand. These kayaks are designed for rough waters and feature additional protective gear and storage compartments for safety and convenience.

- The market encompasses various product categories, including canoe accessories, whitewater kayaking gear, and portable kayaks. Outdoor gear stores, water sports retailers, and sports equipment online platforms are key sales channels. Consumer interest in eco-friendly materials and sustainability is also driving innovation in the market. Kayaking safety, techniques, and lessons are essential considerations for beginners and families. Kayaking tours, rentals, and community events offer opportunities for adventure seekers to engage with the kayaking lifestyle. The market continues to grow, driven by the increasing popularity of paddle sports and the desire for outdoor recreation.

Exclusive Customer Landscape

The kayaking equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the kayaking equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, kayaking equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AIRE Inc. - The company offers kayaking equipment such as Outfitter I inflatable kayak which is known for its stability and durability in whitewater conditions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AIRE Inc.

- Airhead

- Aqua Marina

- Decathlon SA

- Gumotex Group

- Hobie Cat Co. II LLC

- Johnson Outdoors Inc.

- Kirton Kayaks LTD.

- Lifetime Products Inc.

- Mission Kayaking

- Northshore Kayaks

- NRS Inc.

- Pelican International Inc.

- Pyranha Mouldings Ltd.

- Rockpool Kayaks Ltd.

- Southern Boats Pvt. Ltd.

- Tahe Outdoors France SASU

- Valley sea kayaks

- Yolo Kayaks and Boats

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of products designed for individuals seeking adventure and connection with nature. This market caters to those with a passion for the outdoors, environmental consciousness, and an active lifestyle. Kayaking equipment includes personal flotation devices, paddles, boats, and various accessories. This trend is driven by the increasing awareness of health and wellness, as well as the desire for unique experiences. Also, the market experiences strong growth, driven by the increasing popularity of water sports and adventure tourism worldwide. The kayaking lifestyle continues to gain popularity, fueled by sports marketing efforts and the growing interest in soft adventure. Canoe rentals and kayaking tours offer accessible experiences for beginners, while specialized products cater to advanced paddlers and whitewater enthusiasts. Outdoor gear stores and sports equipment retailers play a significant role in providing customers with the necessary equipment for their kayaking adventures.

Canoe camping and eco-friendly kayaking have emerged as trends in the market, reflecting consumers' increasing focus on sustainability. Innovations in materials and technology have led to the development of portable and lightweight equipment, making it easier for individuals to explore various water bodies. Eco-friendly materials, such as recycled plastics and biodegradable materials, are increasingly being used to reduce the environmental impact of kayaking. The sports equipment industry has seen a wave in customer interest, driven by the growing popularity of endurance sports and outdoor recreation. Kayaking and canoeing equipment sales have been particularly strong, as more people seek adventure experiences and opportunities to connect with nature. Sports equipment brands have responded to this demand by investing in research and development, creating specialized products, and offering customer service training to ensure optimal performance and safety.

The market for kayaking equipment is driven by the growing popularity of water sports and adventure tourism, with sales and marketing efforts targeting field events, adventure tourism operators, water sports clubs, and retailers. Consumption expenditure on recreational paddling and endurance training is also on the rise, leading to new launches of innovative and high-performance kayaking equipment. Specialty stores and retailers are key players in the market, offering a wide range of kayaking equipment, from basic recreational kayaks to advanced whitewater models. Protective gear, such as helmets, spray skirts, and paddle leashes, are essential accessories for kayakers, ensuring safety and comfort during their adventures. The market for kayaking equipment is expected to continue its growth trajectory, with ongoing innovation and technological advancements in materials and design, making kayaking an even more enjoyable and accessible water sport for enthusiasts.

Kayaking and nature have become synonymous, with many individuals incorporating the activity into their health and wellness routines. Water sports events, such as races and tours, have gained significant attention, attracting both competitive and recreational paddlers. The market for kayaking accessories, including fishing gear and camping equipment, has also seen substantial growth. The kayaking community is a diverse and passionate group, with various resources available to help individuals improve their skills and connect with like-minded individuals. Kayaking techniques, safety tips, and eco-friendly materials are just a few of the topics covered in online resources and forums. The market is a dynamic and growing industry, driven by consumer interest in adventure, environmental consciousness, and a desire to connect with nature. The market offers a wide range of products and services, catering to both beginners and advanced paddlers, and continues to evolve with innovations in technology and materials.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.3% |

|

Market growth 2025-2029 |

USD 230.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.3 |

|

Key countries |

US, Germany, Australia, Canada, UK, Japan, France, Brazil, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Kayaking Equipment Market Research and Growth Report?

- CAGR of the Kayaking Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the kayaking equipment market growth and forecasting

We can help! Our analysts can customize this kayaking equipment market research report to meet your requirements.