Lactose-Free Butter Market Size 2024-2028

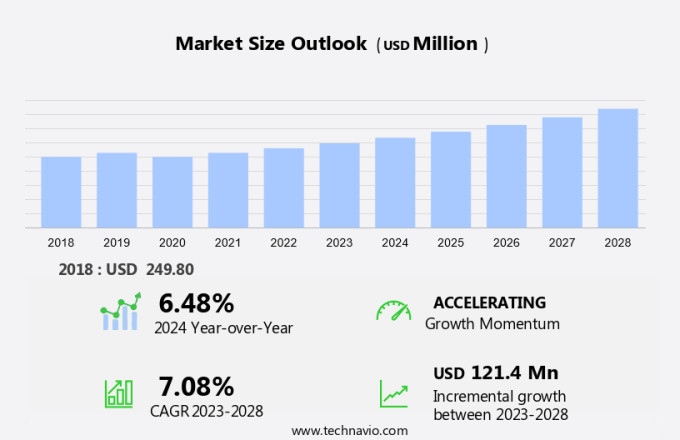

The lactose-free butter market size is forecast to increase by USD 121.4 million at a CAGR of 7.08% between 2023 and 2028.

- The dairy foods market, particularly the lactose-free butter segment, is experiencing significant growth due to the rising nutritional needs of consumers with lactose intolerances and allergies. These conditions can cause uncomfortable symptoms such as gas, bloating, and abdominal pain. To address this, many manufacturers are incorporating the use of lactase enzymes in their products to make them more accessible to this consumer base. Food service operators and retailers have also recognized the potential of lactose-free butter.

- Moreover, the increasing number of organized retail outlets worldwide is also contributing to the market's expansion. However, limited awareness and high prices remain challenges for the growth of the market in the US. As consumers become more health-conscious and seek out alternatives to traditional dairy products, the demand for lactose-free options is expected to continue rising.

What will be the Size of the Market During the Forecast Period?

- The dairy foods sector, including butter, has seen a significant shift in consumer preferences towards lactose-free options. This trend is driven by the growing number of individuals with lactose intolerance and those following vegan or low-fat diets. Lactose intolerance is a common condition affecting an estimated 65% of the global population. Symptoms such as gas, bloating, and abdominal pain occur when the body is unable to digest lactose, a sugar found in milk and dairy products.

- For these consumers, lactose-free butter offers a healthier alternative. The processed food industry has responded to this demand by introducing lactose-free butter into the market. This product is made using a lactase enzyme that breaks down the lactose during the manufacturing process, resulting in a butter that is free from lactose. Food service operators cater to the increasing number of consumers with dietary restrictions and intolerances by offering a variety of lactose-free dairy foods. This not only helps them meet the nutritional needs of their customers but also expands their customer base.

- In conclusion, the aging population and the rise in chronic conditions such as diabetes further fuel the demand for lactose-free butter. Older adults and individuals with diabetes are more likely to be lactose intolerant, making lactose-free butter an essential offering in their diets. In conclusion, the market is poised for growth due to the increasing prevalence of lactose intolerance and the growing awareness of healthier food options. Food service operators and retailers can capitalize on this trend by offering a range of lactose-free dairy foods, including butter, to cater to the diverse needs and preferences of their customers.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Household

- Commercial

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- India

- South America

- Middle East and Africa

- North America

By Application Insights

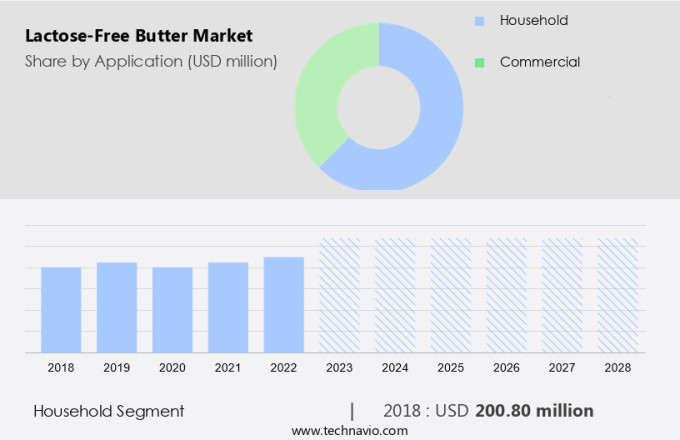

- The household segment is estimated to witness significant growth during the forecast period.

The household segment dominated The market in 2023, accounting for the largest market share. The increasing preference for lactose-free dairy products, including butter, for household applications is driving the growth of this segment. Lactose-free butter caters to the nutritional needs of individuals with lactose intolerances and dairy allergies. It provides the same essential nutrients as regular dairy butter, such as calcium and vitamins.

Moreover, lactose-free butter offers additional health benefits, like reducing symptoms of lactose intolerance, such as gas, bloating, and abdominal pain, due to the addition of the lactase enzyme. The prevalence of lactose intolerance in the US population is on the rise, leading to a significant increase in demand for lactose-free butter from households. This trend is expected to continue during the forecast period.

Get a glance at the market report of share of various segments Request Free Sample

The household segment was valued at USD 200.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

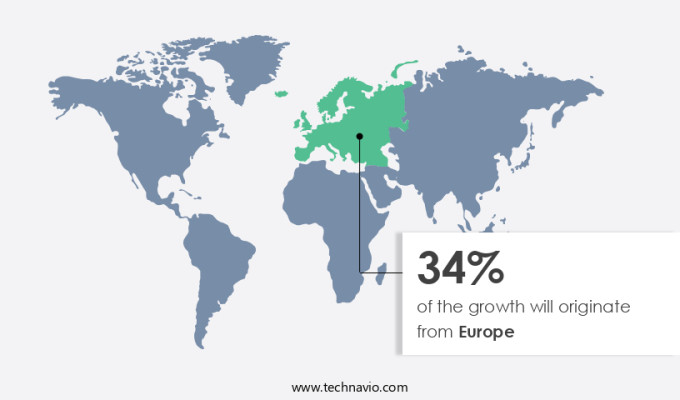

- Europe is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is experiencing significant growth due to the increasing number of individuals with lactose intolerance. This segment is expected to dominate the global market throughout the forecast period. The expanding network of specialty stores, commercial outlets, and online retail channels is further fueling the market's growth in North America. For instance, Walmart Canada's recent announcement of opening a new Walmart Supercentre in British Columbia is a testament to this trend. Quality food and nutritional needs are driving the demand for Lactose-Free Butter in households and commercial establishments alike.

As a result, Dairy Foods manufacturers are focusing on producing high-quality, lactose-free alternatives to cater to this growing consumer base. Furthermore, the availability of various flavored lactose-free butter options is adding to the market's appeal. In conclusion, the market in North America is poised for continued growth due to the increasing prevalence of lactose intolerance and the expanding retail landscape. This trend is expected to persist throughout the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Lactose-Free Butter Market?

Growing awareness of lactose-intolerant conditions is the key driver of the market.

- The increasing recognition of lactose intolerance among consumers in various parts of the world has led to a significant rise in demand for lactose-free butter options. Companies are responding to this consumer preference by introducing lactose-free butter made with the aid of the lactase enzyme, allowing individuals with lactose intolerance to enjoy dairy products without experiencing uncomfortable symptoms. This trend is particularly relevant to an aging population and those with dietary restrictions, such as those following gluten-free or sugar-free diets.

- Moreover, the natural and organic food markets have also seen a growth in demand for lactose-free alternatives, as health-conscious consumers seek out products that align with their values and dietary needs. By offering these options, businesses are not only catering to the specific needs of their customers but also positioning themselves as providers of healthier choices in the market.

What are the market trends shaping the Lactose-Free Butter Market?

An increasing number of organized retail outlets worldwide is the upcoming trend in the market.

- Lactose-free butter has gained significant traction in the market due to the increasing prevalence of lactose intolerance and the rise of veganism. This dairy-free alternative to traditional butter is becoming increasingly popular among consumers who cannot consume dairy products or prefer plant-based options. In response, companies are introducing various flavors and low-fat versions of lactose-free butter to cater to diverse consumer preferences. Organized retailing plays a crucial role in the distribution and marketing of lactose-free butter.

- Similarly, supermarkets, hypermarkets, and convenience stores are the primary channels for selling these products. Retailers, including Walmart and Meijer, Inc., have recognized the growing demand for lactose-free butter and have included it in their product offerings. Food service operators, such as restaurants and cafeterias, are also adopting lactose-free butter to cater to the needs of their customers. The availability of lactose-free butter in organized retailing outlets has made it easier for new entrants to enter the market and increase the market visibility of their products. Overall, the market is expected to continue growing, driven by increasing consumer awareness and demand for dairy-free alternatives.

What challenges does Lactose-Free Butter Market face during the growth?

Limited awareness and high prices are key challenges affecting the market growth.

- Lactose-free butter is a niche product with limited consumption in various regions due to its higher price point compared to regular butter. This price disparity is a significant barrier for the middle-income population in both developing and developed countries. The cost of lactose-free butter can range from 50% to 100% more than conventionally processed butter, depending on the brand. For example, in India, lactose-free butter costs approximately USD 3.5 per pound, while the price for conventional butter is only USD 2. This price difference can be attributed to the production process and the demand for specialty products. Lactose-free butter is produced using chemical-free methods to ensure nutritional quality, making it a preferred choice for individuals with lactose intolerance or those seeking healthier alternatives. These consumers often have higher disposable incomes and living standards, enabling them to invest in such products.

- Moreover, the availability of lactose-free butter is expanding beyond traditional retail channels, with online retail becoming an increasingly popular option. Specialty stores and online platforms cater to the growing demand for lactose-free products, offering convenience and accessibility to consumers. Additionally, the focus on weight management and overall health expenditure has fueled the growth of the market. In conclusion, the higher price of lactose-free butter remains a challenge for its wider adoption, particularly among the middle-income population. However, the increasing awareness of health and wellness, coupled with the convenience of online retail, is expected to drive the growth of this niche market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arla Foods amba

- California Dairies Inc.

- Cargill Inc.

- Chr Hansen Holding AS

- Conagra Brands Inc.

- Corbion nv

- General Mills Inc.

- Ingredion Inc.

- International Flavors and Fragrances Inc.

- Johnson and Johnson Services Inc.

- Kellogg Co.

- Kerry Group Plc

- Miyokos Creamery

- Redwood Hill Farm and Creamery Inc.

- The Hain Celestial Group Inc.

- Uelzena eG

- Upfield B.V

- Valio Ltd

- Wm Morrison Supermarkets Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Lactose-free butter is a dairy product that caters to the nutritional needs of individuals with lactose intolerance and those following veganism. This type of butter is free from lactose, a sugar found in milk, making it an ideal alternative for those experiencing symptoms such as gas, bloating, and abdominal pain after consuming regular dairy products. The processed food industry has seen a growth in demand for lactose-free butter due to increasing health consciousness and consumer preference for natural and organic food. Food service operators and retailers are recognizing the potential of lactose-free butter in their offerings. Households, commercial establishments, specialty stores, and online retailers are stocking up on this healthier option.

Moreover, the aging population, individuals with diabetes, obesity, and weight management concerns, and those with allergies or intolerances are key consumers of lactose-free butter. The market is witnessing growth due to the increasing disposable income, living standards, and health expenditure. Consumers are becoming more health-conscious and are opting for chemical-free, nutritional, and quality food. Flavored lactose-free butter is also gaining popularity, offering a wider range of choices for consumers. The market is expected to continue growing as more individuals seek healthier options for their dietary needs.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.08% |

|

Market growth 2024-2028 |

USD 121.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.48 |

|

Key countries |

US, UK, Germany, Canada, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch