Lactase Enzyme Market Size 2025-2029

The lactase enzyme market size is forecast to increase by USD 221.6 million, at a CAGR of 5.8% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing consumer preference for enzyme-based foods and the rising awareness about lactose-free products. This trend is driven by the growing number of lactose intolerant individuals and those adhering to specific dietary requirements, such as veganism or vegetarianism. The market is also influenced by the varying prices of enzymes, which can impact the profitability of manufacturers. However, challenges persist in the form of stringent regulatory requirements and the high production costs associated with lactase enzymes.

- Manufacturers must navigate these challenges to capitalize on the market's opportunities and maintain a competitive edge. To succeed, companies must focus on innovation, cost-effective production methods, and compliance with regulatory standards. By addressing these factors, they can effectively meet the growing demand for lactose-free products and cater to the evolving needs of health-conscious consumers.

What will be the Size of the Lactase Enzyme Market during the forecast period?

The market continues to evolve, driven by the increasing demand for lactose-free and dairy-free products across various sectors. Microbial strains are utilized for the production of food additives, enabling the lactose intolerant population to enjoy a wider range of foods, including dairy products. The food processing industry leverages lactase enzymes for the production of gluten-free, vegan, organic, and lactose-free products. The distribution channels for these products are expanding, with e-commerce platforms and specialized retailers gaining popularity. Enzyme activity plays a crucial role in the production process, ensuring efficient lactose breakdown and maintaining the desired shelf life.

Functional foods and personalized nutrition are driving innovation in the market, with a focus on gut health and nutritional deficiency. Regulatory approval processes and safety testing are essential components of the supply chain, ensuring the production of high-quality lactase enzymes. Clinical trials and dietary supplements are also utilizing lactase enzymes for the treatment of digestive disorders. The market's competitive advantage lies in its ability to cater to diverse consumer preferences and dietary needs, with ongoing research and development efforts aimed at enhancing enzyme production through microbial fermentation and downstream processing. The environmental impact of lactase enzyme production is a growing concern, with a focus on non-GMO and sustainable production methods.

Pricing strategies are evolving to cater to the varying needs of consumers and industries, with a focus on transparency and ingredient declaration. In the dairy industry, lactase enzymes are used to produce lactose-free and dairy-free ice cream, ensuring consumers with lactose intolerance can enjoy these treats. The market's continuous dynamism reflects the evolving consumer preferences and regulatory landscape, offering opportunities for innovation and growth.

How is this Lactase Enzyme Industry segmented?

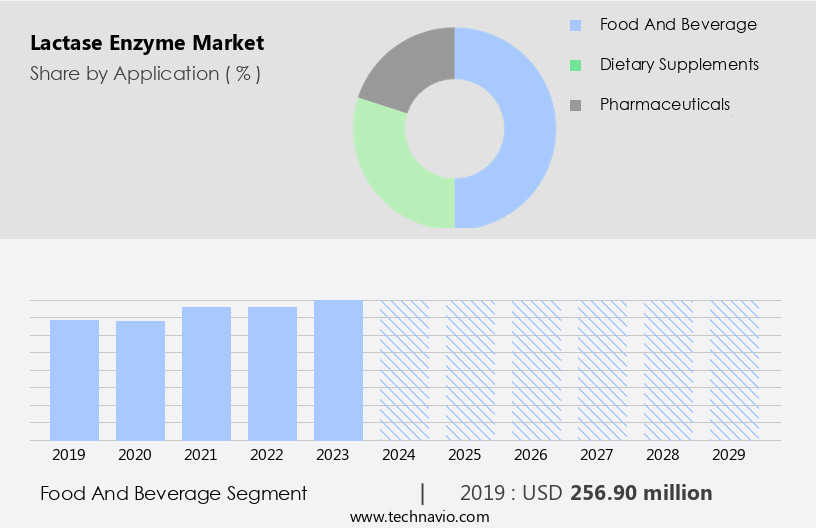

The lactase enzyme industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Food and beverage

- Dietary supplements

- Pharmaceuticals

- Type

- Dry

- Liquid

- Source

- Fungi

- Yeast

- Bacteria

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Middle East and Africa

- UAE

- Rest of World (ROW)

- North America

By Application Insights

The food and beverage segment is estimated to witness significant growth during the forecast period.

The market experiences significant growth due to its application in various sectors, particularly in the food and beverage industry. Lactase enzymes are utilized to produce lactose-free products, with dairy items being the primary focus. These enzymes enable the production of lactose-free milk, which offers several advantages over regular milk. Lactose-digesting enzymes convert lactose into simple sugars, resulting in a sweeter taste for consumers. Moreover, lactose-free milk is easier to digest, allowing individuals with lactose intolerance to maintain their calcium intake and avoid symptoms such as abdominal discomfort, nausea, diarrhea, vomiting, gas, and bloating. Food processing companies employ lactase enzymes to cater to the increasing demand for lactose-free and dairy-free alternatives.

The distribution channels for these products include supermarkets, online retailers, and specialized stores. Additionally, lactase enzymes are used in the production of gluten-free, vegan, organic, and non-GMO products, further expanding the market's reach. Environmental sustainability is a growing concern in the production of lactase enzymes, with microbial fermentation being a popular method due to its lower environmental impact compared to chemical synthesis. Regulatory approval, safety testing, and ingredient declaration are crucial factors in the market, ensuring the production of high-quality, safe, and transparent products. Functional foods, personalized nutrition, and gut health are emerging trends in the food and beverage industry, with lactase enzymes playing a vital role in catering to these consumer preferences.

Clinical trials and dietary supplements are also areas of growth for the market, as research continues to uncover the potential health benefits of lactase enzymes. The competitive advantage of lactase enzyme producers lies in their ability to provide cost-effective and efficient solutions for the production of lactose-free and dairy-free products. Pricing strategies, downstream processing, and supply chain management are essential aspects of the market that require continuous attention to maintain a competitive edge.

The Food and beverage segment was valued at USD 256.90 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is the largest, driven by the significant consumption of dairy products and the high prevalence of lactose intolerance. Approximately 60% of the North American population experiences lactose intolerance, fueling demand for lactase enzymes to improve lactose digestion. The well-established food and beverage industry in the US, Canada, and Mexico, the key contributing countries, provides growth opportunities for major food enzyme manufacturers, such as DuPont de Nemours Inc. Food processing companies incorporate lactase enzymes as food additives to produce lactose-free dairy products, catering to the growing consumer base with lactose intolerance. The distribution channels for these products include supermarkets, online retailers, and specialized stores.

The increasing popularity of gluten-free, vegan, organic, and lactose-free products further boosts market growth. Enzyme production is primarily through microbial fermentation, ensuring the environmental sustainability of the process. Regulatory approval and safety testing are crucial factors in the production and distribution of lactase enzymes. The market also benefits from the increasing health awareness and demand for functional foods, personalized nutrition, and gut health solutions. The market for lactase enzymes extends to various applications, including infant formula, ice cream, clinical trials, dietary supplements, and dairy-free products. Non-GMO products and vegetarian alternatives are also gaining traction, with pricing strategies and competitive advantages playing a significant role in market differentiation. Ingredient declaration and transparency are essential for consumer trust, as the market continues to evolve with the increasing demand for lactase-free and lactose-digestible products.

Market Dynamics

The Lactase Enzyme Market is growing, fueled by demand for lactase enzyme supplements and lactose-free dairy enzymes in lactose-free milk production. The food and beverage lactase market, especially in the North American lactase market and Asia-Pacific lactase market, drives lactose intolerance relief through digestive health solutions. Advanced fermentation technology and enzyme encapsulation technology enhance high-stability lactase enzymes for applications like lactose-free yogurt production with lactase enzymes. Plant-based lactase enzymes and sustainable lactase production align with eco-friendly trends. Exploring best lactase enzyme supplements for lactose intolerance and how to produce lactose-free milk with lactase boosts engagement. Lactase enzyme market trends for 2025 highlight clean-label lactase enzymes for food manufacturing and regulatory-compliant lactase for food safety.

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Lactase Enzyme Industry?

- The increasing consumer preference towards enzyme-based foods serves as the primary market driver.

- Lactose intolerance, a common digestive issue, limits the consumption of dairy products for many individuals. However, the increasing health awareness and focus on wellness have fueled the demand for lactase enzyme-based solutions. Lactase enzyme aids in the digestion of lactose, a sugar found in milk and dairy products. This enzyme's growing popularity is driven by the food industry's response to consumer preferences for healthier alternatives and the increasing demand for dairy-free products. The food and beverage industry's emphasis on safety testing and downstream processing ensures the production of high-quality lactase enzyme-based products. Microbial fermentation is a common method used in the production of lactase enzymes, ensuring non-GMO products align with consumer preferences.

- Pricing strategies play a crucial role in the market's growth, making these products accessible to a wider audience. One application of lactase enzyme is in the production of lactic acid drinks (LADs), which are gaining popularity due to their health benefits. These drinks are made by adding sugar and flavors to fermented milk, followed by pasteurization. LADs contain probiotic bacteria, which improve digestion and build immunity. Companies like Yakult Danone and Asahi Group offer popular LAD products, demonstrating the market's potential. In conclusion, the market is experiencing significant growth due to increasing health awareness, consumer preferences for dairy-free alternatives, and the production of high-quality, safe lactase enzyme-based products. The market's future looks promising, with continued innovation and consumer demand driving its expansion.

What are the market trends shaping the Lactase Enzyme Industry?

- The increasing consciousness regarding lactose-free products signifies a notable market trend. Consumers are increasingly seeking out dairy alternatives due to lactose intolerance or dietary preferences.

- Lactose intolerance, a common digestive disorder, affects an estimated 65 percent of the global population. Despite this, awareness programs are crucial to educate individuals that they do not need to completely avoid dairy products due to misconceptions about the condition. These programs emphasize the importance of lactose-free alternatives, enabling individuals with lactose intolerance to consume essential nutrients from milk, cheese, and yogurt. The demand for lactose-free products is growing, with applications extending to various industries such as infant formula, ice cream, and dietary supplements. The competitive advantage of lactose-free products lies in their ability to cater to the diverse dietary needs of consumers, including those with vegetarian preferences.

- Clinical trials and research continue to explore the potential benefits of lactose-free products for individuals with lactose intolerance, further fueling market growth. The NIH in the US advocates for the consumption of lactose-free dairy products to prevent nutrient insufficiency and potential adverse health effects. In conclusion, the increasing awareness of lactose intolerance and the availability of lactose-free alternatives have led to a significant shift in consumer preferences. This trend is expected to continue, with the market for lactose-free products showing steady growth in the coming years. Ingredient declaration and innovation in lactose-free technologies are key factors driving the market's expansion.

What challenges does the Lactase Enzyme Industry face during its growth?

- The fluctuating prices of enzymes pose a significant challenge to the growth of the industry. Enzymes, essential biocatalysts used in various sectors such as food, pharmaceuticals, and biofuels, experience price volatility due to factors like supply and demand imbalances, raw material costs, and production capacity. This price instability hinders long-term planning and profitability for industry players.

- The market is characterized by a fragmented landscape with numerous small players. These companies face challenges in affording and utilizing advanced technologies to ensure product quality. Major players, such as Kerry Group plc, Koninklijke DSM NV, and Novozymes AS, have the resources to invest in research and development and secure product patents. However, this process comes with a high cost, leading to an increase in the price of lactase for the dairy industry. This, in turn, raises the prices of lactose-free products. Although this factor may not significantly impact markets in regions with high disposable income, it is essential to note.

- The demand for lactase enzymes is driven by the growing preference for food additives in food processing, particularly in the production of gluten-free, vegan, organic, and lactose-free products due to nutritional deficiency concerns. The enzyme's ability to hydrolyze lactose into galactose and glucose makes it a valuable ingredient in the food industry.

Exclusive Customer Landscape

The lactase enzyme market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the lactase enzyme market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, lactase enzyme market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advanced Enzyme Technologies Ltd. - The consumption of whole milk necessitates the presence of lactase, an enzyme that facilitates the complete digestion of lactose, a natural sugar.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Enzyme Technologies Ltd.

- Amano Enzyme Inc.

- Antozyme Biotech Pvt. Ltd.

- Aumgene Biosciences

- Berg Schmidt GmbH and Co. KG

- Biolaxi Corp.

- Calza Clemente s.r.l.

- Chr Hansen AS

- Creative Enzymes

- DSM-Firmenich AG

- DuPont de Nemours Inc.

- Enzyme Bioscience Pvt. Ltd.

- Infinita Biotech Pvt. Ltd.

- Kerry Group Plc

- Merck KGaA

- MITUSHI BIO PHARMA

- Novact Corp.

- Novozymes AS

- Oenon Holdings Inc.

- RAJVI ENTERPRISE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Lactase Enzyme Market

- In February 2023, DuPont Nutrition & Biosciences introduced a new lactase enzyme product, LactoGuard Ultra, designed to deliver enhanced performance in various dairy applications. This innovation is expected to help manufacturers produce lactose-free dairy products with improved taste and texture (DuPont Press Release).

- In May 2024, Danisco, a division of DuPont, and Fonterra, the world's largest dairy cooperative, announced a strategic partnership to co-develop and commercialize lactose-free dairy ingredients. This collaboration aims to address the growing demand for lactose-free dairy products and expand their market reach (Fonterra Press Release).

- In October 2024, Novozymes, a leading enzyme provider, secured a significant investment of â¬200 million to expand its production capacity for industrial lactase enzymes. This investment will enable Novozymes to meet the increasing demand for lactose-free products and strengthen its position in the market (Novozymes Press Release).

- In January 2025, the European Commission approved the use of lactase enzymes in the production of infant formula allowing manufacturers to offer lactose-free options to a wider audience. This regulatory approval is expected to boost the demand for lactase enzymes in the infant formula market (European Commission Press Release).

Research Analyst Overview

- The market is experiencing significant growth due to increasing consumer preferences for lactose-free products and the rising prevalence of lactose deficiency and food allergies. New product development in the sector is driven by advancements in biotechnology, including microbial engineering and recombinant enzymes, which enhance enzyme activity and stability. Quality control is a key focus for manufacturers to ensure accurate enzyme dosing and nutrient absorption, as calcium absorption and intestinal health are crucial for bone health. Industry trends indicate a shift towards enzyme therapy and enzyme replacement therapy for managing lactose maldigestion and its associated symptoms. Consumer behavior and food sensitivities continue to influence market dynamics, with a target audience that prioritizes gut microbiome healthand wellness and protein digestion.

- Enzyme kinetics and immobilization techniques are also areas of ongoing research to improve enzyme efficiency and cost-effectiveness. The future outlook for the market is promising, with continued innovation and product development expected to meet the evolving needs of consumers.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Lactase Enzyme Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 221.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

US, Canada, China, UK, Germany, Japan, India, France, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Lactase Enzyme Market Research and Growth Report?

- CAGR of the Lactase Enzyme industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the lactase enzyme market growth of industry companies

We can help! Our analysts can customize this lactase enzyme market research report to meet your requirements.