Language Services Market Size 2025-2029

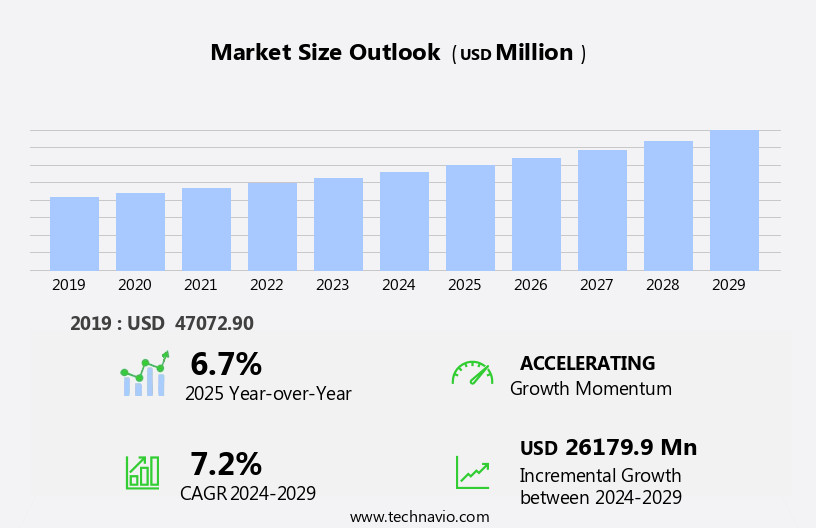

The language services market size is forecast to increase by USD 26.18 billion at a CAGR of 7.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of technology to enhance the translation process and improve efficiency. Companies are recognizing the value of transcreation, which goes beyond simple translation to ensure cultural appropriateness and localization of content. However, the market faces challenges that require careful navigation. Regulatory hurdles impact adoption, particularly in industries with stringent compliance requirements. Supply chain inconsistencies also temper growth potential, as companies seek to maintain quality and meet tight deadlines. To capitalize on market opportunities and navigate these challenges effectively, companies must invest in building a team of skilled professionals with expertise in language services and cultural nuances. One key factor driving this growth is the increasing use of machine learning and AI-driven tools, which allow for faster processing and more reliable translations. Social networking sites have become essential platforms for businesses to engage with diverse audiences, necessitating translation services.

- Strategic partnerships and technology integration can also help streamline operations and improve overall competitiveness. In summary, the market is poised for growth, with technology adoption and transcreation driving demand. However, regulatory hurdles and supply chain inconsistencies present challenges that require a strategic approach to talent acquisition and operational efficiency. Companies that invest in building a strong team and leveraging technology will be best positioned to capitalize on market opportunities and maintain a competitive edge.

What will be the Size of the Language Services Market during the forecast period?

- In the dynamic global marketing landscape, effective language services have become essential for businesses aiming to expand their reach. The market encompasses various offerings, including language analysis, cultural analysis, language engineering, and linguistic analysis, among others. These services enable businesses to navigate language and cultural nuances, ensuring accurate language data and user interface localization. Language automation and integration have gained significant traction, streamlining translation workflows and language testing processes. Language certification and audiovisual translation are also crucial components, ensuring language and technology alignment for global customer support and multilingual marketing initiatives. Language analytics and localization APIs play a pivotal role in managing language data and optimizing localization workflows. Localization services cater to IT and telecommunications, BFSI, and artificial intelligence (AI) driven approaches in the global marketplace.

- Content localization, game localization, and multilingual customer support are essential for businesses seeking to engage with diverse audiences. Language management systems and translation management platforms facilitate efficient language and culture adaptation, while language acquisition and global communication are ongoing priorities for businesses aiming to expand their market presence. Language segmentation and translation workflows are continuously evolving, with a focus on improving user experience and fostering effective business interactions across borders. Ultimately, language and technology convergence is driving innovation and growth in the market. AI, machine learning, and an AI-driven approach enhance translation and interpretation services for e-commerce companies, product descriptions, user interfaces, customer engagement, and industries like automotive and collaborative platforms.

How is this Language Services Industry segmented?

The language services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service

- Translation

- Interpretation

- Others

- End-user

- Healthcare

- ICT

- BFSI

- Government

- Others

- Learning Method

- Online

- Offline

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Service Insights

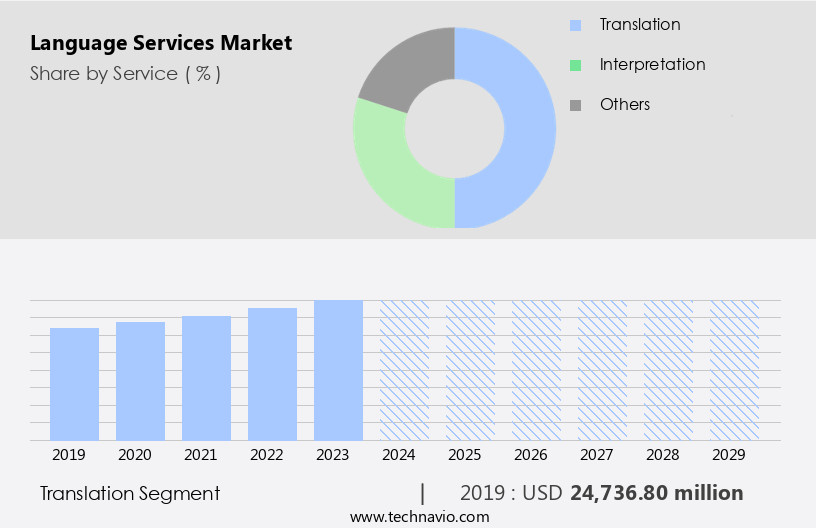

The translation segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth due to the increasing globalization of businesses and the prevalence of digital communication. This trend is driven by the need for companies to connect with diverse audiences in multiple languages, leading to an increased demand for document translation, cross-cultural communication, mobile app localization, financial translation, and website localization services. In the healthcare industry, the accurate translation of medical records and reports is essential for effective patient care, highlighting the importance of medical translation. Language services providers offer expertise in various language pairs, cultural adaptation, and technical translation to cater to the unique requirements of different industries. Machine translation, speech recognition, and natural language processing are just a few examples of how technology is transforming the way language services are delivered.

The Translation segment was valued at USD 24.74 billion in 2019 and showed a gradual increase during the forecast period. Translation agencies and freelance translators play a crucial role in ensuring linguistic quality and cultural sensitivity in target languages. Neural machine translation and language technology, including translation memory, terminology management, and natural language processing, are revolutionizing the translation process, enhancing efficiency and accuracy. Moreover, the global workforce's growing linguistic diversity necessitates language training and assessment to foster effective communication and promote diversity and inclusion. Legal translation and quality assurance are also essential components of the market, ensuring the accuracy and reliability of translated documents. The integration of artificial intelligence, cloud computing, and language service bureaus further streamlines the translation process and enables businesses to expand their reach to new markets. Overall, the market is evolving to cater to the diverse needs of businesses and industries, ensuring seamless communication and effective cross-cultural interaction.

Regional Analysis

North America is estimated to contribute 32% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European the market is experiencing significant growth, driven by the region's linguistic diversity and increasing business expansion. Western Europe, particularly the UK and Germany, are major contributors to market revenue due to their economic strength and high demand for document translation, cross-cultural communication, and mobile app localization. The Nordic region also presents a substantial opportunity for language services providers (LSPs), with a significant demand for multilingual content, financial translation, and software localization. Government investment in language services and the rise of local companies are propelling market growth in Western Europe. In the Nordic region, cultural sensitivity and target language proficiency are essential for effective communication and business success.

The European market is witnessing a shift towards advanced language technology, including neural machine translation, translation memory, and terminology management, to enhance linguistic quality and efficiency. Moreover, the increasing global workforce and the need for marketing translation, legal translation, and website localization are creating new opportunities for LSPs. Cultural adaptation and natural language processing are becoming crucial aspects of language services, as businesses expand their reach to diverse markets. The integration of artificial intelligence, cloud computing, and language training into language services is transforming the industry, enabling faster turnaround times and more accurate translations. The market is also embracing diversity and inclusion, recognizing the importance of accurate and sensitive translations for all language pairs.

Quality assurance and linguistic quality are paramount in ensuring the success of language services, as businesses seek to overcome language barriers and communicate effectively with their global audience.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Language Services market drivers leading to the rise in the adoption of Industry?

- The efficiency of the language translation process is significantly enhanced through the adoption of advanced technologies, serving as the primary catalyst for market growth. The market is experiencing significant growth due to the increasing need for document translation, mobile app localization, financial translation, and cross-cultural communication in today's globalized business environment. A major market driver is the adoption of computer-aided translation (CAT) software, which uses a computerized program to translate from one language to another using translation memory. Translation memory is a database that saves previously translated words and their associated translations, enabling more efficient and consistent translations. CAT software offers a more streamlined and interactive editing platform, allowing professional translators to work more efficiently and quickly. Furthermore, cultural adaptation is crucial in ensuring effective communication between businesses and their international clients.

- Language services providers offer expertise in various language pairs and industries, including technical translation, ensuring accurate and precise translations. Overall, the market is essential for businesses seeking to expand globally and communicate effectively with clients and partners in different languages and cultures.

What are the Language Services market trends shaping the Industry?

- Transcreation, or the process of adapting marketing content from one language to another while maintaining its intended tone and meaning, is gaining significant importance in today's global market. As a professional virtual assistant, I can assist you in creating accurately translated and culturally appropriate content for your business, ensuring effective communication with your international audience. Transcreation, a process that goes beyond literal translation to adapt and customize content for specific cultural and linguistic nuances, is gaining traction in today's global business landscape. This approach, which combines translation and copywriting, enables marketers to effectively connect with their target audience. Transcreation services are increasingly in demand, with companies such as Ampere Nordic Translations and Zeitgeist leading the way. Website localization and software localization are two common applications of transcreation. In the healthcare sector, medical translation services are crucial for accurate communication and patient care. Multilingual content and marketing translation are also essential for businesses seeking to expand their reach and engage customers in their native languages.

- Effective content management and a global workforce with high language proficiency are essential for successful transcreation projects. Freelance translators and translation agencies offer flexibility and expertise in various languages and industries. The use of transcreation tools and approaches can keep a chord with the target audience and the brand's message. The increasing importance of transcreation in the global marketplace highlights the need for professional transcreation services. Companies can leverage these services to localize their websites, software, and marketing materials, ensuring effective communication and engagement with their diverse customer base.

How does Language Services market faces challenges face during its growth?

- The shortage of skilled professionals poses a significant challenge to the industry's growth trajectory, as the lack of adequate human capital hampers productivity and innovation. The market demands a workforce of proficient linguists, translators, and interpreters to deliver precise and trustworthy translations. However, the scarcity of these skilled professionals poses a substantial hurdle to the market's expansion. This shortage may lead to project delays, compromising client satisfaction. As a result, the market may witness an increase in the number of inexperienced professionals, potentially affecting the quality of language services. In response, language service providers might elevate their service fees to offset the scarcity of skilled labor. Cultural sensitivity is crucial in language services, and the target language must be translated with accuracy and nuance.

- Neural machine translation, language technology, translation memory, and artificial intelligence are essential tools to enhance the efficiency and consistency of language services. Diversity and inclusion are essential aspects of language services, requiring a deep understanding of various cultures and languages. Cloud computing enables seamless access to language services and facilitates collaboration among teams. Language training is vital to maintain a skilled workforce and keep up with the evolving demands of the market.

Exclusive Customer Landscape

The language services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the language services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, language services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acolad Group - This company specializes in language solutions, providing translation, interpreting, transcription, website localization, and outsourcing services.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acolad Group

- APPEN Ltd.

- Centific Global Solutions Inc.

- Cyracom International Inc.

- Dubbing Brothers SAS

- Honyaku Center Inc.

- IMAGICA GROUP Inc.

- Iyuno

- Keywords Studios Plc

- Lionbridge Technologies LLC

- President Translation Service Group International

- Questel

- RWS Holdings PLC

- STAR AG

- Teleperformance SE

- thebigword Group Ltd.

- TransPerfect Global Inc.

- United Language Group

- Voice and Script International Ltd.

- Welocalize Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Language Services Market

- In February 2024, leading language services provider, TransPerfect, announced the launch of their AI-powered neural machine translation technology, Revolution Translation Engine (RTE), aimed at enhancing translation quality and efficiency (TransPerfect Press Release, 2024). In October 2025, language technology company, Google, entered into a strategic partnership with Microsoft to integrate Google's Translate API into Microsoft Teams, expanding multilingual communication capabilities for businesses (Microsoft Press Release, 2025). In the same year, SDL, a language technology company, completed the acquisition of Language Weaver, a machine learning-based translation technology provider, to strengthen its AI capabilities and expand its market presence (SDL Press Release, 2025). In April 2025, the European Union passed the new EU Regulation on Transparency and Understanding (EU TAU), mandating the use of clear and unambiguous language in consumer contracts, increasing demand for language services in the region (EU Commission Press Release, 2025).

Research Analyst Overview

The market continues to evolve, driven by the increasing need for cross-cultural communication and business expansion in a globalized world. Entities requiring localization of website content, document translation, and software localization seek to bridge language barriers and ensure cultural adaptation for their source language materials. Translation agencies, language service providers, and freelance translators play pivotal roles in delivering high-quality translations in various sectors, including medical, financial, and marketing. Multilingual content and cultural sensitivity are paramount in today's diverse and inclusive business landscape. Neural machine translation and language technology have revolutionized the translation process, while translation memory and terminology management ensure consistency and accuracy.

Quality assurance and linguistic quality are essential to meet the demands of global workforces and clients. Language proficiency in the target language is crucial for effective communication, and language learning and training are ongoing processes for professionals. Cloud computing and artificial intelligence have streamlined the translation process, enabling real-time collaboration and efficient workflows. Legal translation and cross-cultural communication require a deep understanding of legal terminology and cultural nuances. Continuous innovation in language services and technology ensures that businesses can effectively navigate the complexities of global expansion and maintain a competitive edge.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Language Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.2% |

|

Market growth 2025-2029 |

USD 26179.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.7 |

|

Key countries |

US, UK, India, Germany, China, France, Italy, Canada, South Korea, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Language Services Market Research and Growth Report?

- CAGR of the Language Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the language services market growth of industry companies

We can help! Our analysts can customize this language services market research report to meet your requirements.