Laptop Carry Case Market Size 2025-2029

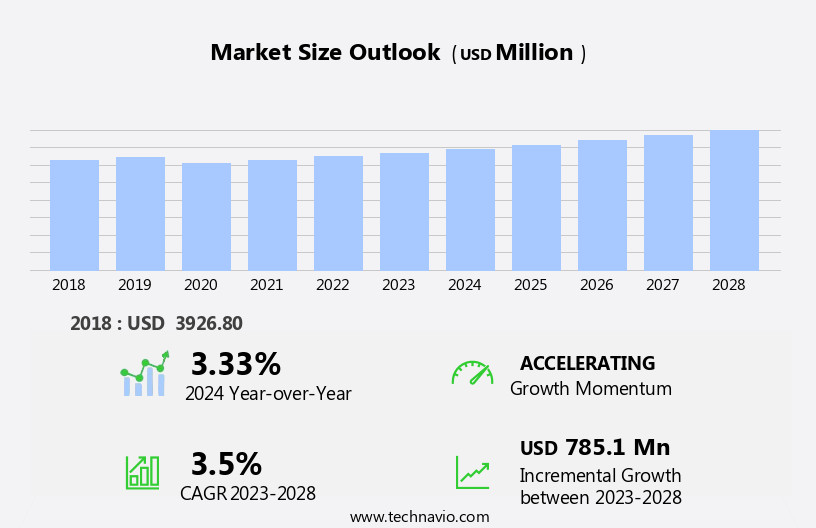

The laptop carry case market size is forecast to increase by USD 638.1 million at a CAGR of 5.9% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for portable and protective solutions for laptops, particularly during the academic year. This trend is expected to continue as remote work and learning become more prevalent. A key market trend is the growing adoption of sustainable materials, such as recycled polyester and vegan leather, in laptop bags, aligning with consumer preferences for eco-friendly products. However, the market is not without challenges. The presence of counterfeit laptop carry cases poses a significant threat, with these products often underpriced and lacking the quality and durability of authentic brands. Consumers seek stylish and functional carry solutions to protect their valuable electronics during commuting, travel, and outdoor leisure activities.

- Companies seeking to capitalize on market opportunities should focus on offering high-quality, sustainable, and secure laptop carry cases, while also implementing anti-counterfeit measures. Effective supply chain management and strategic partnerships can help mitigate the risks associated with counterfeit products and ensure the long-term success of businesses in this market. The market is driven by the increasing purchase decisions for technological gadgets and computers, which require protective cases for safe transportation.

What will be the Size of the Laptop Carry Case Market during the forecast period?

- In today's business landscape, the market is experiencing significant growth and innovation. Companies are integrating advanced technologies such as RFID blocking and biometric authentication to ensure data security. Wearable technology and limited edition designs add a personal touch, while water-resistant coatings and upcycled materials promote sustainability. TSA checkpoint friendly designs and expandable features cater to the needs of frequent travelers. Moreover, companies are incorporating ergonomic straps, external battery pockets, and shock-absorbing materials for added comfort and functionality. Businesses value minimalist designs, modern aesthetics, and personalized options, leading to collaborations with brands. Social media campaigns and influencer marketing have become essential tools for promoting laptop carry cases.

- Smart fabrics, ventilation panels, and hidden compartments cater to the demands of high-performance laptops and gaming systems. Fair trade practices and sustainable manufacturing are increasingly important, with durable fabrics and laptop cooling features becoming standard. Hybrid laptops and casual laptops also have their place in the market, appealing to various user preferences. In summary, the market is evolving to meet the needs of businesses, with a focus on advanced technologies, sustainability, and functionality.

How is this Laptop Carry Case Industry segmented?

The laptop carry case industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Backpack

- Messenger bag

- Others

- Material

- Fabric

- Leather

- Plastic

- Others

- Geography

- APAC

- Australia

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Distribution Channel Insights

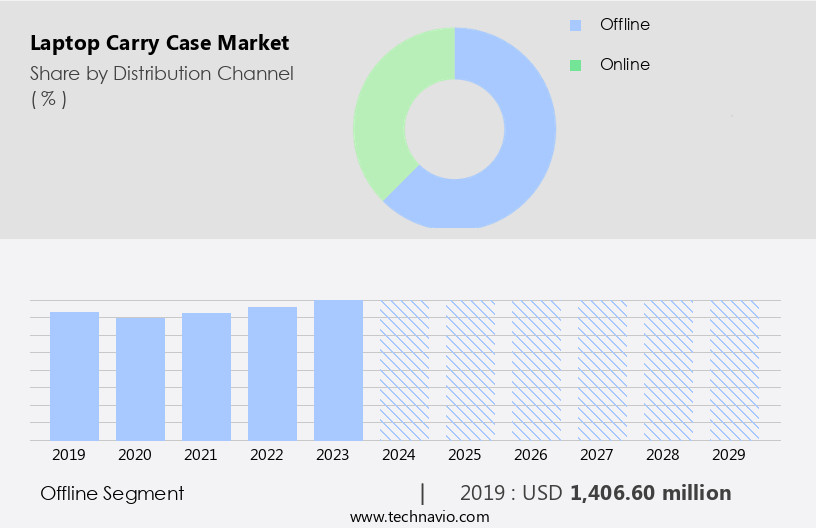

The offline segment is estimated to witness significant growth during the forecast period. The market encompasses various distribution channels, with offline sales accounting for a significant portion. Revenue in this sector stems from the sale of carry cases through specialty stores, hypermarkets, supermarkets, and department stores. However, consumer preferences have been shifting towards online shopping, leading to a gradual decline in offline sales. To counteract this trend, manufacturers are expanding their retail presence in local and regional markets. Carry cases, available in various sizes and designs, cater to diverse user needs. Business professionals prefer durable and functional cases with carry handles, adjustable straps, and ergonomic designs. Casual users, on the other hand, may opt for lightweight and customizable options with zippered pockets and accessory storage. Tech-savvy consumers demand more than just protection; they want accessories that offer added convenience, such as USB charging ports, smartphone functions, and seamless integration with tablets and desktops.

Smart features, such as wireless charging and RFID blocking, add value for money and enhance user experience. Material technology plays a crucial role in the market, with premium materials and durable constructions ensuring long-lasting protection. E-commerce platforms facilitate online sales, allowing customers to read reviews, compare prices, and make informed decisions. Brand recognition and loyalty influence purchasing decisions, making it essential for manufacturers to differentiate their products through innovative designs and features. The market also caters to multi-device compatibility, tablet storage, and anti-theft protection, ensuring that carry cases meet the evolving needs of tech-savvy consumers. As the market continues to grow, manufacturers focus on product differentiation, competitive pricing, and personalized designs to capture market share.

Get a glance at the market report of share of various segments Request Free Sample

The Offline segment was valued at USD 1.41 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

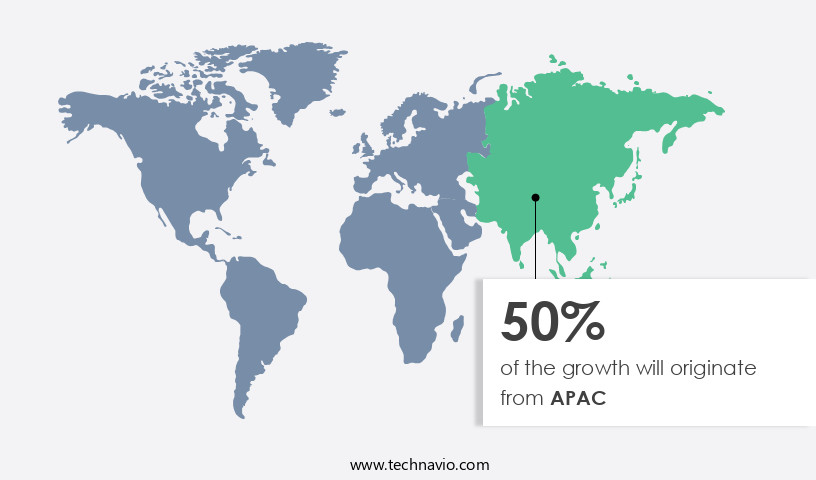

APAC is estimated to contribute 50% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in the Asia Pacific region is experiencing significant growth, driven primarily by the high demand for personal accessories among millennials in countries like China, Japan, and India. With China being the most prominent market for personal accessories, including laptop carry cases, due to the country's large population and consumer preference for premium and high-quality items, the region's growth is expected to continue. The Asia Pacific region, home to over 60% of the world's population, offers a vast consumer base for laptop carry cases, making it an attractive market for manufacturers. Key features driving the market include material technology, smart features, and functional design.

Wireless charging and RFID blocking are becoming increasingly popular features, while customizable options, adjustable straps, and multi-device compatibility cater to the diverse needs of consumers. Carry cases with ergonomic designs, durable construction, and value for money are also in high demand among business professionals. E-commerce platforms and retail distribution channels have made laptop carry cases easily accessible to consumers, allowing for competitive pricing and personalized design options. Brands are differentiating themselves through the use of premium materials, brand loyalty programs, and anti-theft features, such as tracking devices and protective cases. As the market evolves, laptop carry cases are becoming more than just protective covers. Messenger bags, luggage bags, rollers, and laptop sleeves are popular choices among business professionals and younger consumers alike.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Laptop Carry Case Industry?

- High demand for laptop carry cases during academic years is the key driver of the market. The demand for laptop carry cases experiences significant growth during specific periods, such as the festive season and the start of the academic year. This demand is driven by the increased requirement for laptops and accompanying carry cases, which is amplified by enticing offers from manufacturers and retailers. For instance, leading laptop manufacturer Hewlett Packard Enterprise Co. (HP) introduces back-to-school promotions in various regions, targeting students starting new courses or academic years. These promotions incentivize customers to purchase new laptops, subsequently increasing the demand for laptop carry cases. Overall, market dynamics, including seasonal trends and promotional strategies, contribute to the increased sales of laptop carry cases.

What are the market trends shaping the Laptop Carry Case Industry?

- Growing adoption of recycled polyester and vegan leather laptop bags is the upcoming market trend. The market is experiencing a notable transition towards sustainability. This shift is primarily driven by the increasing usage of recycled materials, such as polyester derived from post-consumer plastic bottles, in the production of laptop carry cases. Brands like Targus and I WAS PLASTIC are spearheading this trend with their eco-friendly collections. Targus' EcoSmart range includes backpacks and briefcases made from recycled PET polyester, offering durability, water resistance, and environmental benefits. They are now being designed with user experience in mind, incorporating features like zipper closure, lightweight materials, and messenger bag styles. The integration of accessory storage, tablet storage, and screen size compatibility further enhances the functionality of these cases, catering to both casual and professional users. In summary, the market in the Asia Pacific region is experiencing rapid growth, driven by consumer demand for premium and functional designs, as well as the increasing availability of these products through various distribution channels. Brands are differentiating themselves through innovative features, materials, and user experience, making it an exciting and competitive market to watch.

What challenges does the Laptop Carry Case Industry face during its growth?

- Presence of counterfeit products is a key challenge affecting the industry growth. The market experiences significant challenges due to the proliferation of counterfeit products in the market. The increasing demand for fashionable laptop cases and their affordability parallelly fuels the demand for counterfeit luxury handbags, particularly in developing regions. E-commerce platforms expand the reach of these counterfeit products, making it difficult for consumers to distinguish between authentic and imitation items. The low pricing of counterfeit products further fuels their demand, negatively impacting the sales and reputation of genuine companies. In response, global players are compelled to lower their prices to remain competitive, which erodes their profit margins. This situation underscores the need for anti-counterfeiting measures and consumer education to protect the integrity of the market.

Exclusive Customer Landscape

The laptop carry case market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the laptop carry case market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, laptop carry case market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ACCO Brands Corp. - The company provides a selection of laptop carry cases, including the Kensington LM340 grey model, ensuring secure and stylish transportation for devices.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACCO Brands Corp.

- ASUSTeK Computer Inc.

- C.C. Filson Co. Inc.

- Crumpler Ltd.

- Da Milano Leathers Pvt. Ltd.

- Elecom Co. Ltd.

- Fabrique Ltd.

- HP Inc.

- Lenovo Group Ltd.

- Pioneer Square Brands Inc.

- Safari Industries India Ltd.

- Samsonite International SA

- Sanwa Supply Inc.

- Targus Inc.

- Thule Group

- United States Luggage Co. LLC

- Victorinox AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to experience significant growth as businesses and individuals seek reliable and functional solutions for transporting their devices. This market encompasses a wide range of products, including laptop sleeves, tote bags, messenger bags, and more. One notable trend in this market is the incorporation of smart features, such as RFID blocking and wireless charging, which offer added convenience and security. Online sales have become a dominant channel for laptop carry cases, with e-commerce platforms providing easy access to a vast selection of options. Customer reviews play a crucial role in the purchasing decision-making process, with many consumers relying on the experiences of others to inform their choices.

Brand recognition is another essential factor in the market, with many consumers preferring to purchase from established brands. Material technology also plays a significant role, with premium materials such as leather and ballistic nylon offering both durability and style. Design innovation is a key driver of differentiation in the market, with many manufacturers focusing on customizable options, adjustable straps, and personalized design to appeal to a wide range of consumers. Competitive pricing is also a significant consideration, with many brands offering value for money without compromising on functionality or durability. The size and screen size of laptops continue to evolve, requiring carry cases that offer multi-device compatibility and tablet storage.

Casual users and business professionals alike value functional features such as carry handles, durable construction, and ergonomic design. Accessory storage, zippered pockets, and customizable options are also important considerations for many consumers. Durable materials, such as recycled materials and anti-theft features, are becoming increasingly popular as consumers prioritize sustainability and security. The market is highly competitive, with many brands vying for market share. Brand loyalty plays a significant role in consumer decision-making, with many consumers preferring to stick with brands they trust. Ergonomic design and user experience are becoming increasingly important considerations, with many consumers seeking carry cases that offer a comfortable and convenient carrying experience. Lightweight materials, such as ripstop nylon and neoprene, are also popular choices for those who prioritize portability. The market is a dynamic and evolving industry, with a focus on functional features, smart technology, and user experience. Brands that can offer durable and customizable options at competitive prices are likely to succeed in this competitive market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

224 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2025-2029 |

USD 638.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.7 |

|

Key countries |

US, China, Japan, South Korea, Germany, UK, India, France, Canada, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Laptop Carry Case Market Research and Growth Report?

- CAGR of the Laptop Carry Case industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the laptop carry case market growth of industry companies

We can help! Our analysts can customize this laptop carry case market research report to meet your requirements.