Laser-Assisted In Situ Keratomileusis (LASIK) Surgery Market Size 2025-2029

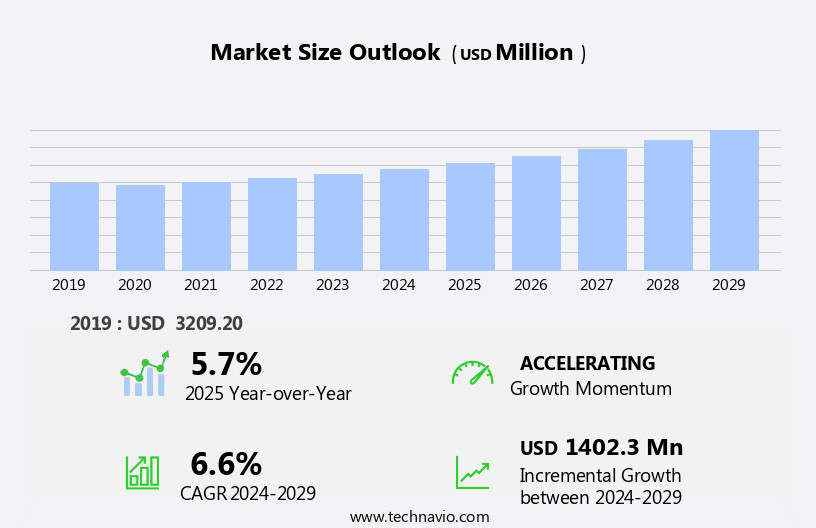

The laser-assisted in situ keratomileusis (LASIK) surgery market size is forecast to increase by USD 1.4 billion, at a CAGR of 6.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by increasing awareness and acceptance of the procedure as a viable vision correction solution. The popularity of LASIK surgery is further boosted by the rising trend of medical tourism, with patients traveling to countries offering affordable and high-quality LASIK procedures. However, the market faces challenges, including minimal insurance coverage for LASIK surgery, which may limit access for some potential patients. As a result, companies in this market must focus on developing innovative financing solutions and expanding their reach in international markets to capitalize on the growing demand for LASIK surgery.

- Additionally, investing in advanced technologies and enhancing patient safety and satisfaction will be crucial for market success. Overall, the LASIK surgery market presents both opportunities and challenges, requiring strategic planning and effective market positioning for companies seeking to capitalize on its potential.

What will be the Size of the Laser-Assisted In Situ Keratomileusis (LASIK) Surgery Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and increasing demand for personalized vision correction. Outpatient clinics remain a popular choice for patients seeking this procedure due to its convenience and shorter recovery time. Precision medicine plays a significant role in LASIK, with customized treatments based on individual corneal refractive index and wavefront aberrometry ensuring optimal clinical outcomes. Surgical equipment, such as excimer lasers and femtosecond lasers, have undergone significant advancements, leading to improved treatment accuracy and safety. Eye tracking technology and virtual consultations facilitate better patient education and informed consent. Regulation and safety remain top priorities, with ongoing clinical trials and regulatory approvals shaping the market's future trends.

Night vision concerns and surgical complications, including dry eye syndrome and the halo effect, are areas of ongoing research and development. Intraocular lens implants and cataract surgery are increasingly being integrated with LASIK, offering comprehensive eye care solutions. Ethical considerations, such as patient selection and preoperative evaluation, are essential components of the LASIK process. LASIK flap diameter and thickness, as well as laser ablation, are critical factors influencing treatment effectiveness and long-term results. Medical devices, such as corneal topography and corneal collagen cross-linking, support the diagnosis and treatment of various eye conditions, expanding LASIK's applications. The ongoing unfolding of market activities reveals a dynamic and innovative landscape, with emerging technologies and clinical advancements continually shaping the future of LASIK surgery.

Patient satisfaction and quality of life remain the ultimate goals, with eye care professionals committed to delivering the best possible care.

How is this Laser-Assisted In Situ Keratomileusis (LASIK) Surgery Industry segmented?

The laser-assisted in situ keratomileusis (LASIK) surgery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- Wavefront-guided

- Wavefront-optimized

- Topography-guided

- End-user

- LASIK centers

- Eyecare clinics

- Hospitals

- Type

- Myopia

- Hyperopia

- Astigmatism

- Presbyopia

- Mixed astigmatism

- Age Group

- Young adults

- Middle-aged adults

- Elderly

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

.

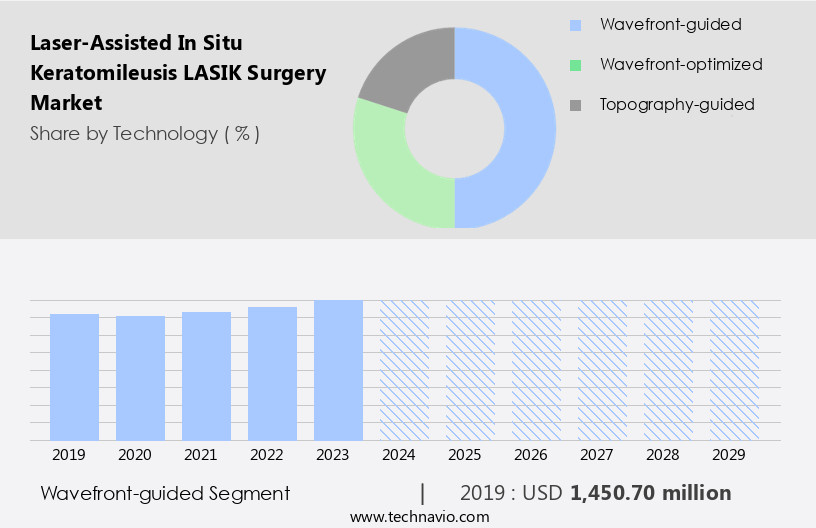

By Technology Insights

The wavefront-guided segment is estimated to witness significant growth during the forecast period.

The LASIK surgery market encompasses refractive procedures that employ advanced technologies to correct vision impairments, primarily at outpatient clinics. One such technique, wavefront-guided LASIK, utilizes AI-powered mapping of the cornea to create personalized treatment plans. This procedure, which accounts for a significant market share, offers enhanced precision and is particularly effective for individuals with higher refractive errors, such as astigmatism or hyperopia. The growing need for personalized vision correction, fueled by increasing screen time, changing lifestyles, and genetic predispositions, has driven the demand for LASIK surgery. Advanced technologies, including femtosecond lasers, corneal collagen cross-linking, and laser ablation, have revolutionized the field, leading to improved clinical outcomes and patient satisfaction.

Surgical complications, such as corneal ectasia and dry eye syndrome, remain concerns, necessitating rigorous regulation and safety measures. Precision medicine and customized approaches, including custom LASIK and wavefront aberrometry, are gaining popularity to minimize these risks. Eye tracking technology and virtual consultations facilitate preoperative evaluation and informed consent, ensuring a more streamlined and patient-centric experience. Long-term results, cost, and insurance coverage are essential factors influencing patient decision-making. LASIK technology advancements continue to evolve, with emerging trends like surface ablation, intraocular lens implants, and night vision correction shaping the future of the market. Eye care professionals play a crucial role in guiding patients through the decision-making process and managing post-LASIK recovery.

In the realm of refractive surgery, LASIK remains a leading option for those seeking to improve their visual acuity and enhance their quality of life. The market is expected to witness continued growth, driven by ongoing research, advancements in surgical equipment, and a commitment to ethical considerations and informed consent.

The Wavefront-guided segment was valued at USD 1.45 billion in 2019 and showed a gradual increase during the forecast period.

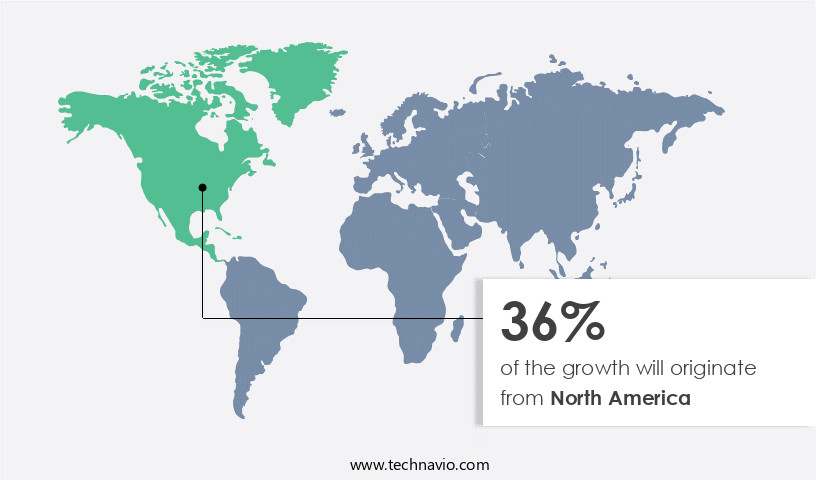

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The LASIK surgery market in North America is experiencing significant growth due to the increasing prevalence of refractive errors, such as myopia, and the rising number of individuals with ocular conditions exacerbated by lifestyle factors, including excessive alcohol consumption, substance use, and smoking. The region's dominance in the global market is anticipated to continue, driven by the increasing adoption of cosmetic surgeries among the young population, technological advancements, and heightened awareness of LASIK's benefits. Advancements in LASIK technology include the integration of AI-powered refractive surgery, custom LASIK, and femtosecond laser-assisted corneal flap creation, which offer greater precision and personalized vision correction.

Surgical equipment innovations, such as eye tracking technology and wavefront aberrometry, enhance the accuracy and safety of LASIK procedures. Long-term results, patient satisfaction, and quality of life are crucial factors influencing the market's growth. Regulation and safety concerns, insurance coverage, and patient education are essential aspects of the market, ensuring informed consent and ethical considerations. Emerging technologies, such as corneal collagen cross-linking and laser ablation, are transforming the landscape of LASIK surgery. Additionally, virtual consultations and clinical trials are shaping the future of the market. Post-LASIK recovery, intraocular lens implants, and surgical complications are areas of ongoing research and development.

Eye care professionals play a vital role in the market, providing expert preoperative evaluation, patient selection, and preoperative care. Cataract surgery and surface ablation are alternative treatments, offering potential opportunities for market expansion. Despite the numerous advantages, LASIK surgery comes with potential risks, including dry eye syndrome and the halo effect. Regulation and safety measures, such as FDA approval and ongoing clinical trials, are essential to mitigate these risks and ensure the highest standards of patient care. In conclusion, the LASIK surgery market in North America is experiencing steady growth, driven by the increasing prevalence of refractive diseases, technological advancements, and growing awareness of the procedure's benefits.

The market's future trends include personalized vision correction, emerging technologies, and ongoing research and development to improve patient outcomes and minimize complications.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Laser-Assisted In Situ Keratomileusis (LASIK) Surgery Industry?

- LASIK surgery's growing recognition and acceptance in the medical community and among the general public serve as the primary catalyst for market expansion.

- LASIK surgery, a laser eye procedure, is gaining popularity due to its numerous benefits and faster recovery time compared to alternative laser eye surgeries. LASIK corrects a wider range of eye prescriptions with superior precision. The procedure involves creating a thin flap in the cornea using a femtosecond laser, followed by laser ablation to reshape the underlying corneal tissue. This results in improved visual acuity and reduced dependence on corrective eyewear. Advancements in LASIK technology include the use of corneal topography for precise measurement of the corneal surface, virtual consultations for pre-operative assessment, and corneal collagen cross-linking for enhancing the stability of the cornea.

- The halo effect, a common side effect of LASIK, is minimized with modern techniques. Eye care professionals emphasize the importance of informed consent and thorough pre-operative assessment to ensure optimal outcomes. Dry eye syndrome, a common condition among LASIK patients, can be managed with appropriate treatments. Emerging technologies, such as wavefront-guided LASIK and customized ablation profiles, further enhance the accuracy and safety of the procedure. Quality of life improvements following LASIK surgery are significant, with patients reporting increased confidence and freedom from the hassle of glasses or contact lenses. Hospital-based surgeries ensure a sterile environment and experienced medical staff, contributing to the overall success of the procedure.

What are the market trends shaping the Laser-Assisted In Situ Keratomileusis (LASIK) Surgery Industry?

- LASIK surgery is currently experiencing a significant increase in demand from medical tourism, representing a notable market trend in the healthcare industry. This trend reflects the growing popularity of affordable and high-quality vision correction procedures among international patients.

- LASIK surgery, a vision correction procedure, involves using a laser to reshape the cornea. The market for this surgical intervention is significant due to the large number of individuals seeking to reduce their dependence on glasses or contact lenses. Ethical considerations are crucial in the LASIK surgery market, ensuring proper patient selection and preoperative evaluation to minimize potential risks. Clinical trials and advanced medical devices, such as wavefront aberrometry and intraocular lens implants, contribute to the procedure's safety and efficacy. The future trends in LASIK surgery include the integration of technology like 3D mapping and customized treatments.

- Post-LASIK recovery time varies, and patients must follow strict guidelines to ensure optimal results. Night vision disturbances are a potential side effect, but improvements in surgical techniques have minimized this issue. Surgical centers worldwide are getting accredited and licensed for LASIK procedures, providing patients with more options. Despite the high costs, which can range from USD2,000 to significantly less in countries like India, the demand for LASIK surgery remains strong. Patients undergoing LASIK surgery must consider various factors, including the potential risks and benefits, the expertise of the surgeon, and the cost. Cataract surgery may be an alternative for some patients, depending on their individual circumstances.

What challenges does the Laser-Assisted In Situ Keratomileusis (LASIK) Surgery Industry face during its growth?

- The insufficient coverage offered by insurance providers poses a significant challenge to the industry's growth trajectory.

- LASIK surgery, a type of refractive surgery, is typically performed as an outpatient procedure at clinics. The technology involves using a laser to reshape the cornea to improve vision, specifically addressing issues such as nearsightedness, farsightedness, and astigmatism. AI-powered refractive surgery technology has advanced LASIK, enabling more precise corneal flap creation and measurement of the corneal refractive index. These advancements contribute to better long-term results and reduced risk of complications like corneal ectasia. Despite the benefits, the high cost of LASIK surgery, averaging around USD2,000 per eye in the US, poses a significant barrier for many individuals.

- Most insurance providers, including UnitedHealthcare and Cigna, do not cover LASIK as it is considered elective. Consequently, the vast majority of the population may forgo this procedure due to financial constraints. However, advancements in LASIK technology, such as surface ablation and customized LASIK flap diameter and thickness, continue to improve the overall patient experience and outcomes.

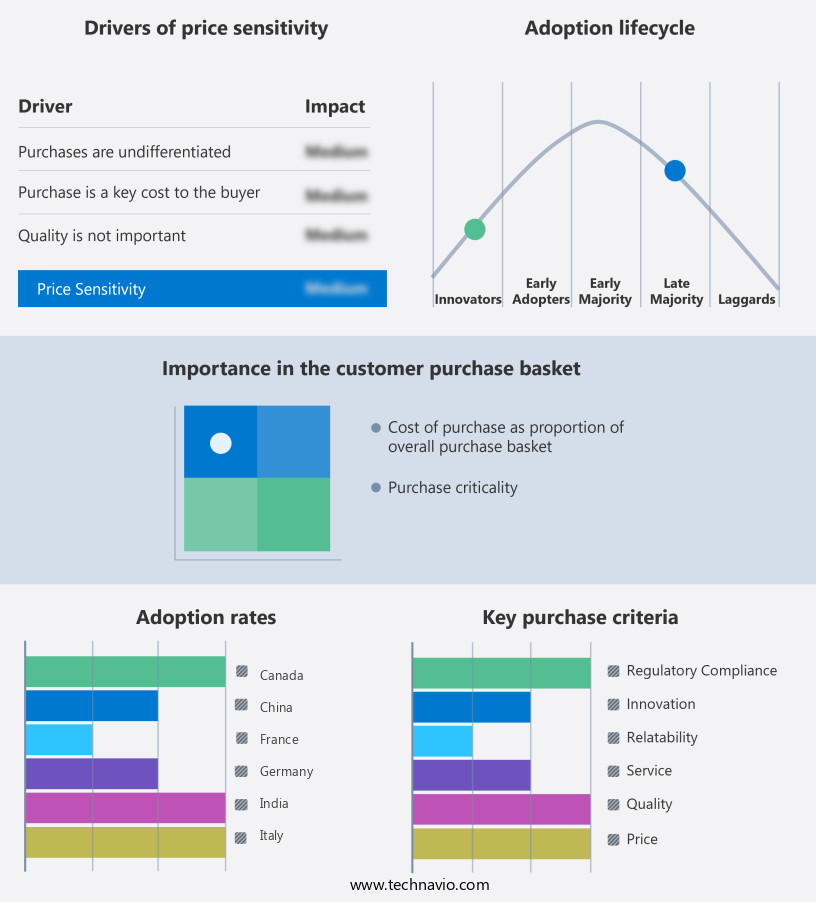

Exclusive Customer Landscape

The laser-assisted in situ keratomileusis (LASIK) surgery market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the laser-assisted in situ keratomileusis (LASIK) surgery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, laser-assisted in situ keratomileusis (LASIK) surgery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - This company specializes in LASIK surgery, a vision correction procedure that alleviates the dependency on corrective lenses for individuals diagnosed with hyperopia or myopia.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Alcon Inc.

- Bausch Lomb Corp.

- Carl Zeiss AG

- Coherent Corp.

- EyeCare Partners LLC

- GHV Advanced Health Pvt Ltd.

- Hoopes Vision Correction Center, P.C.

- Johnson and Johnson

- LasikPlus

- Mayo Foundation for Medical Education and Research

- Medfin.

- NIDEK Co. Ltd.

- Novartis AG

- Restivo Laser Vision

- SCHWIND eye-tech-solutions GmbH

- Smart Vision Eye Specialities Pvt. Ltd.

- TLC Vision Corporation

- Vidal Health Insurance TPA Pvt Ltd

- Ziemer Ophthalmic Systems AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Laser-Assisted In Situ Keratomileusis (LASIK) Surgery Market

- In March 2023, Alcon, a leading ophthalmic pharmaceuticals and surgical equipment company, announced the U.S. Food and Drug Administration (FDA) approval of its new LASIK system, the Catalys Precision Laser System Enhancement. This advanced technology enables surgeons to customize the LASIK procedure for each patient based on their unique eye anatomy, potentially improving safety and accuracy (Alcon press release, 2023).

- In June 2024, Carl Zeiss Meditec AG, a global leader in medical technology, entered into a strategic partnership with the University of California, San Diego (UCSD) to advance research and development in the field of refractive surgery. The collaboration aims to explore new technologies and techniques, including LASIK, to address unmet needs and enhance patient outcomes (UCSD News Center, 2024).

- In October 2024, Johnson & Johnson Vision, a worldwide leader in eye health, completed the acquisition of TearScience, a company specializing in ocular surface disease treatments. This acquisition is expected to expand Johnson & Johnson Vision's product portfolio and strengthen its position in the LASIK market by providing complementary solutions for pre- and post-LASIK care (Johnson & Johnson Vision press release, 2024).

- In February 2025, the European Union (EU) granted marketing authorization for the Wavelight EX500 Excimer Laser, the latest innovation from Wavelight, a leading provider of refractive surgery systems. This laser offers enhanced customization and precision, making it an attractive option for European ophthalmologists and their patients (Wavelight press release, 2025).

Research Analyst Overview

- The Lasik surgery market encompasses various refractive procedures, with a significant focus on Lasik for farsightedness, nearsightedness, hyperopia, astigmatism, and presbyopia. Eye care management companies are integrating advanced technologies like custom wavefront LASIK and corneal topography mapping to enhance refractive surgery outcomes. Cost-effectiveness and insurance coverage are crucial factors influencing market growth, with ongoing efforts to streamline processes and improve patient follow-up. Managing LASIK complications and ensuring proper corneal healing are essential aspects of postoperative care. The aging population and their increasing need for vision correction, coupled with the safety and convenience of LASIK, fuel market expansion.

- Patients can resume driving shortly after the procedure, making it a popular choice for those seeking to improve their visual acuity. Lasik's success rate is high, with minimal complications reported, making it a preferred option for individuals seeking to reduce their dependence on glasses or contact lenses. The market also caters to specific patient groups, such as those with myopia, astigmatism, or presbyopia, ensuring a diverse range of solutions to address various eye conditions. The Lasik flap interface and ongoing research into refractive surgery techniques continue to drive innovation in the field, further solidifying its role as a leading solution for vision correction.

- Patients' active lifestyles and the need for clear vision in sports further boost the demand for LASIK surgery.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Laser-Assisted In Situ Keratomileusis (LASIK) Surgery Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

227 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.6% |

|

Market growth 2025-2029 |

USD 1402.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.7 |

|

Key countries |

US, China, Japan, India, Germany, Canada, UK, France, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Laser-Assisted In Situ Keratomileusis (LASIK) Surgery Market Research and Growth Report?

- CAGR of the Laser-Assisted In Situ Keratomileusis (LASIK) Surgery industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the laser-assisted in situ keratomileusis (lasik) surgery market growth of industry companies

We can help! Our analysts can customize this laser-assisted in situ keratomileusis (lasik) surgery market research report to meet your requirements.