LED Encapsulation Market Size 2024-2028

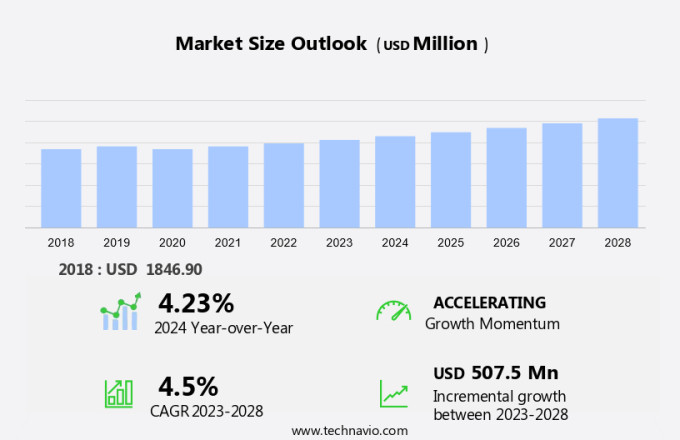

The LED encapsulation market size is estimated to grow by USD 507.5 million at a CAGR of 4.5% between 2023 and 2028. The global market is experiencing significant growth due to the increasing demand for high-power applications across various industries. One of the primary drivers of this trend is the automotive sector, where LED lighting is becoming increasingly popular for headlights, taillights, and interior lighting. Additionally, the industrial sector is also witnessing a surge in demand for LED lights due to their energy efficiency, longevity, and versatility. LED lights are ideal for harsh industrial environments and can be used for a wide range of applications, including signage, hazardous location lighting, and general illumination. The growing adoption of LED lighting in these sectors is expected to continue, fueled by advancements in technology and increasing awareness of the cost savings and environmental benefits of LED lighting.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Dynamic and Customer Landscape

The market is witnessing significant growth due to the increasing demand for LED displays in various applications, including outdoor small pitch displays. The production technology and manufacturing process of LED displays involve the use of packaging technology, such as COB packaging technology and SMD package, to protect the delicate LED chip from physical damage and environmental factors. Encapsulation materials play a crucial role in this process, with epoxy resins, organic silicone resins, and organic-inorganic nanocomposite materials being commonly used. LED chips are vulnerable to oxidation, electrodes, and heat dissipation, which can affect their performance. To mitigate these issues, encapsulation materials are used to provide protection against oxygen, chemicals, and fluids. In the semiconductor lighting field, LED encapsulation materials are used in handheld devices, mobile phones, display backlights, and more. The market for LED encapsulation materials is expected to grow in the consumer electronics and telecommunication industries due to the increasing demand for advanced displays and lighting solutions. Inorganic nanoparticles are also used in LED encapsulation to improve the performance and reliability of LED displays. The market is expected to grow significantly in the coming years due to the increasing demand for high-performance and energy-efficient LED displays. The use of advanced packaging technologies and materials is expected to drive the growth of the market in the semiconductor lighting field. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The growing demand for high power LED applications is notably driving market growth. The LED encapsulation market is experiencing significant growth due to the increasing adoption of energy-efficient lighting sources, particularly high power LEDs, in various applications such as telecommunication, energy conservation, lighting, and TV display. The European Commission and governments of several countries are promoting the use of LED lighting by offering incentives and subsidies, thereby fueling market growth. High-power LEDs offer numerous advantages, including energy efficiency, high brightness, and long operating hours at low maintenance costs. These benefits make them ideal for general lighting and automotive applications. In the automobiles industry, LEDs are increasingly being used for tail lights, headlights, and interior lighting. Encapsulation raw materials, such as silicone encapsulants and organic silicones, play a crucial role in the LED packaging process, ensuring light transmission, refractive index, and protection against environmental factors like moisture and heat. Organic Light-emitting diodes (OLED) and Organic silicones are also gaining popularity in the market due to their superior performance in terms of color gamut, contrast ratio, and viewing angle. Solder joint fatigue is a major concern in LED packaging, and encapsulation materials help mitigate this issue by providing thermal management and mechanical stress relief. LED importers and manufacturers are continually expanding their product offerings to cater to the diverse needs of various industries. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

Silicone encapsulant is expected to witness significant growth is the key trend in the market. The market has witnessed significant growth in recent years, with silicone encapsulation emerging as the preferred material for LED protection. Silicones offer flexibility and temperature resistance, making them suitable for various applications, including telecommunication, energy conservation in lighting, and TV display applications using Organic Light-emitting diodes (OLED) and Organic Silicones. However, reliability concerns in cold weather applications necessitate ongoing research to enhance their performance. Organic silicones have been widely used as encapsulant materials for LEDs for several years. Their transparency and stability at operating temperatures make them an ideal choice for LED packaging. Moreover, they serve as the polymer matrix for phosphors to convert blue LEDs into white LEDs. In the automobiles industry, LED importers rely on the LED Encapsulation Industry for high-quality encapsulation raw materials to ensure optimal light transmission and refractive index. Silicone encapsulation not only shields LED devices but also plays a crucial role in the LED packaging process. By providing excellent protection against environmental factors, it ensures the longevity and reliability of LED products. The European Commission's focus on energy conservation and the increasing adoption of LEDs in various industries are expected to drive the growth of the LED Encapsulation Industry. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

Volatile prices of encapsulant material is the major challenge that affects the growth of the market. The market encompasses various applications, including telecommunication, energy conservation in lighting, and TV display applications. The European Commission has emphasized the importance of energy conservation, leading to the increasing adoption of Organic Light-emitting diode (OLED) and Organic Silicones in LED packaging. Encapsulation raw materials, such as silicone encapsulants, play a crucial role in ensuring the durability and reliability of LED components. However, the continuous volatility in the prices of raw materials, including silicone, epoxy, and polyurethane, poses a challenge to the growth of the LED Encapsulation Industry. For instance, polyurethane, a common encapsulation material, is derived from crude oil. Consequently, the fluctuations in global crude oil prices lead to price instability in polyurethane-based LED encapsulation. In Q2 2020, the global demand for crude oil declined by approximately 2.5 mb/d due to COVID-19-induced lockdowns, resulting in a decrease of around 90,000 barrels a day in oil demand compared to the same period in 2019. This volatility in the raw material market may impact the product offerings of LED importers and manufacturers. Additionally, factors like solder joint fatigue, phosphors, refractive index, and light transmission also influence the performance and quality of LED encapsulation. The automobiles industry is another significant end-user of LED encapsulation, with the increasing demand for energy-efficient lighting and advanced display systems. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ams OSRAM AG - The company offers products such as quantum dots encapsulating LEDs.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Avantor Inc.

- CHT Germany GmbH

- Dow Inc.

- DuPont de Nemours Inc.

- Epic Corp.

- Foshan NationStar Optoelectronics Co. Ltd.

- H.B. Fuller Co.

- Henkel AG and Co. KGaA

- Hitachi Ltd.

- Intertronics Ltd.

- KYOCERA Corp.

- Nitto Denko Corp.

- Panasonic Holdings Corp.

- Shin Etsu Chemical Co. Ltd.

- SolEpoxy Inc.

- Wacker Chemie AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

By Type

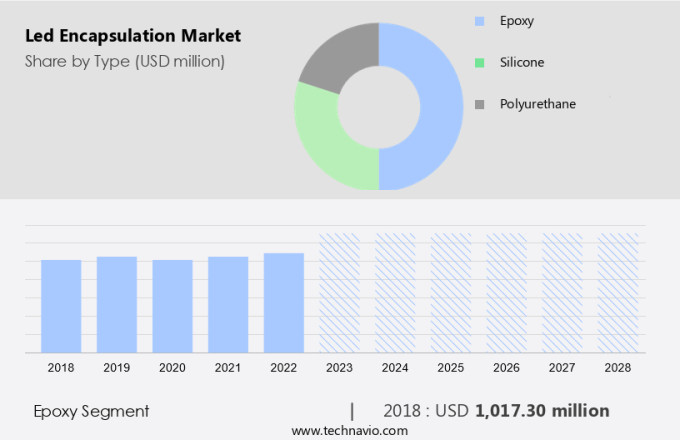

The epoxy segment is estimated to witness significant growth during the forecast period. LED encapsulation plays a crucial role in the semiconductor lighting field, particularly in LED display applications. Outdoor small pitch LED displays require advanced packaging technology to protect the LED chip from environmental factors such as moisture, physical damage, electrodes oxidation, and oxygen intrusion. COB packaging technology and SMD package are common encapsulation methods used in LED display manufacturing.

Get a glance at the market share of various regions Download the PDF Sample

The epoxy segment accounted for USD 1.02 billion in 2018. The manufacturing process involves the application of conductive and insulating adhesives, epoxy resins, organic silicone resins, and organic-inorganic nanocomposite materials. Inorganic nanoparticles are also used for enhanced heat dissipation and protection against fluids and chemicals. Integration technology is essential in the production of finished LED products, ensuring optimal experience for consumers in various applications, including handheld devices, mobile phones, display backlights, electronic signs, and LED packaging market in electronics. Epoxy resins and other encapsulation materials are critical in ensuring the longevity and reliability of semiconductor chips in these applications.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

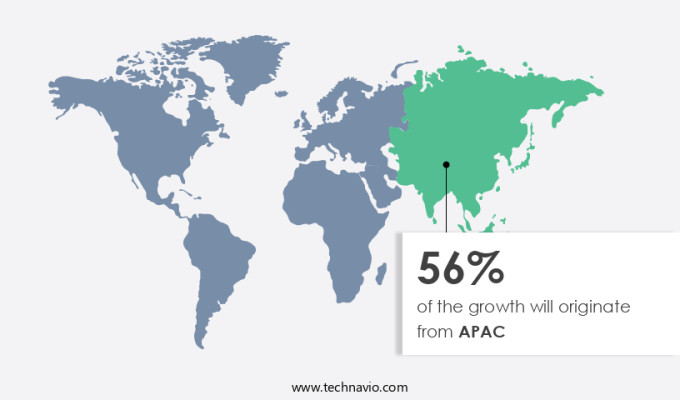

APAC is estimated to contribute 56% to the growth of the global market during the market forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

LED encapsulation plays a crucial role in the semiconductor lighting field, particularly in LED display applications. Outdoor small pitch LED displays require advanced encapsulation technology to protect LED chips from moisture, physical damage, electrodes from oxidation, and oxygen intrusion. Production technology and manufacturing processes employ various encapsulation materials, including epoxy resins, organic silicone resins, and organic-inorganic nanocomposite materials with inorganic nanoparticles. COB packaging technology and SMD package use conductive adhesive and insulating adhesive in the encapsulation process. LED chips are attached to a PCB lamp bead, and the entire assembly is encapsulated using epoxy resin for moisture protection and heat dissipation. Screen factories integrate advanced encapsulation technology to ensure the finished product delivers optimal performance and experience in various applications, such as handheld devices, mobile phones, display backlights, electronic signs, and LED packaging market in electronics and semiconductor chips. Encapsulation materials must withstand harsh environments, including fluids and chemicals, to ensure the longevity and reliability of LED displays.

Segment Overview

The market report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion " for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type Outlook

- Epoxy

- Silicone

- Polyurethane

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Argentina

- Brazil

- Chile

- North America

You may also be interested in:

- Electronic Adhesives Market Analysis APAC, Europe, North America, South America, Middle East and Africa - China, India, US, UK, Japan - Size and Forecast

- Printed Electronics Market Analysis APAC, North America, Europe, Middle East and Africa, South America - South Korea, Japan, China, US, UK - Size and Forecast

- Flat Panel Display (FPD) Equipment Market Analysis APAC, North America, Europe, South America, Middle East and Africa - US, Japan, China, India, Germany - Size and Forecast

Market Analyst Overview

LED (Light Emitting Diodes) encapsulation refers to the process of protecting the delicate LED chip from environmental factors such as moisture, physical damage, oxidation, and heat dissipation. The encapsulation materials used in this process include epoxy resins, organic silicone resins, and organic-inorganic nanocomposite materials. The market is driven by the increasing demand for LED displays in various applications such as outdoor small pitch displays, handheld devices, mobile phones, display backlights, electronic signs, and semiconductor lighting field. The production technology for LED encapsulation involves the use of SMD (Surface Mounted Device) packages, COB (Chip on Board) packaging technology, and integration technology. The manufacturing process for LED encapsulation involves the application of conductive adhesive and insulating adhesive on the PCB (Printed Circuit Board) lamp bead, followed by the placement of the LED chip and the application of encapsulation material. Epoxy resins are commonly used as encapsulation materials due to their excellent thermal and electrical insulation properties. However, the market faces challenges such as the need for high-performance materials that can withstand harsh outdoor conditions, the need for materials that can dissipate heat effectively, and the need for materials that can prevent moisture and oxygen ingress. The market is expected to grow significantly in the electronics industry due to the increasing demand for energy-efficient lighting and displays. The finished product experience of LED displays and semiconductor chips is enhanced by the use of advanced encapsulation materials and technologies.

Also, the market is expected to grow at a significant CAGR during the forecast period, driven by the increasing demand for LED displays and the need for high-performance encapsulation materials. In summary, the LED encapsulation market is a critical component of the LED display and semiconductor lighting industry, and the demand for advanced encapsulation materials and technologies is expected to grow significantly in the coming years. The market is driven by the increasing demand in various applications, and the need for materials that can withstand harsh environmental conditions and provide effective heat dissipation, moisture protection, and electrode protection. The use of advanced materials such as inorganic nanoparticles and organic-inorganic nanocomposite materials is expected to drive the growth of the market in the future.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 507.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 56% |

|

Key countries |

US, China, Japan, Germany, and Taiwan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiLED |

ams OSRAM AG, Avantor Inc., CHT Germany GmbH, Dow Inc., DuPont de Nemours Inc., Epic Corp., Foshan NationStar Optoelectronics Co. Ltd., H.B. Fuller Co., Henkel AG and Co. KGaA, Hitachi Ltd., Intertronics Ltd., KYOCERA Corp., Nitto Denko Corp., Panasonic Holdings Corp., Shin Etsu Chemical Co. Ltd., SolEpoxy Inc., and Wacker Chemie AG |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- DetaiLED information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detaiLED information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies