Lightweight Construction Material Market Size 2025-2029

The lightweight construction material market size is forecast to increase by USD 45.6 billion at a CAGR of 5.4% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for energy-efficient and sustainable building solutions. Innovations in material science have led to the development of advanced lightweight materials, such as aerated concrete, lightweight steel, and engineered wood, which offer superior insulation properties and reduced construction time. However, the high cost of these materials remains a major challenge for market growth. Additionally, the construction industry's ongoing shift towards green and sustainable building practices is driving the adoption of lightweight materials. The market is expected to witness steady growth in the coming years, with key trends including the increasing use of prefabricated and modular construction, growing demand for net-zero energy buildings, and the integration of smart technologies in construction materials. Overall, the market presents significant opportunities for manufacturers and suppliers of lightweight construction materials, particularly in North America and Europe.

What will be the Size of the Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing demand for energy-efficient buildings and infrastructure in various industries. Smart technologies are playing a crucial role in this trend, enabling the optimization of resource utilization and reducing carbon footprint. One such innovation is the use of bio-based composites, derived from renewable energy sources, in vacuum forming and thermoforming processes. In the marine industry, lightweight materials like recycled plastics are gaining popularity for their fuel efficiency and durability. Commercial construction and urbanization are also driving the demand for lightweight materials, particularly in high-rise buildings and energy-efficient homes. Regulations and incentives are further pushing the adoption of these materials, with energy consumption and greenhouse gas emissions being key areas of focus.

- In addition, the wind energy industry is another significant market for lightweight construction materials, with the use of lightweight steel framing and composite materials in wind turbines. Automotive and aerospace industries are also leveraging lightweight materials for fuel efficiency and automation. In the defense industry, lightweight materials are used in the production of defense vehicles and spacecraft. Construction materials such as pultrusion, compression molding, and injection molding are commonly used in the production of lightweight materials. Thermal insulation is another area of focus, with equity investments pouring in to develop advanced insulation materials. The assembly process is also being optimized to reduce the environmental impact and improve efficiency.

How is this market segmented and which is the largest segment?

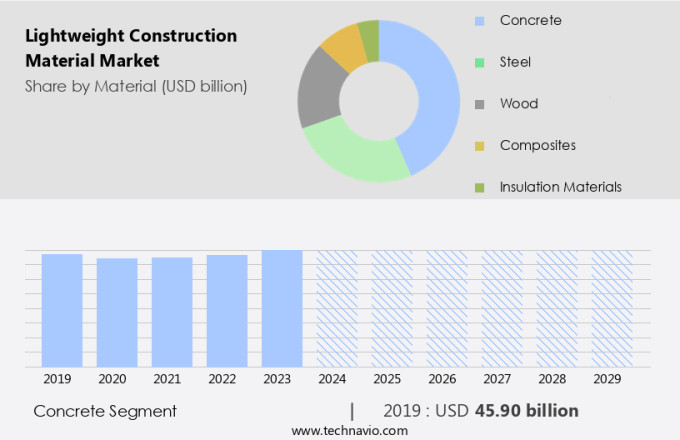

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Material

- Concrete

- Steel

- Wood

- Composites

- Insulation materials

- End-user

- Commercial

- Industrial

- Residential

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- North America

- US

- Middle East and Africa

- South America

- Brazil

- APAC

By Material Insights

- The concrete segment is estimated to witness significant growth during the forecast period.

The market, specifically in the lightweight concrete segment, is experiencing notable progress and increased usage due to its distinct features and advantages. Lightweight concrete, which utilizes aggregates such as expanded clay, shale, or slate, offers a decreased density compared to conventional concrete. This weight reduction is particularly significant for tall structures and other projects where minimizing load is essential. The primary merit of lightweight concrete lies in its capacity to decrease the dead load on structures, resulting in cost savings during foundation and support design and construction. Moreover, its insulation properties make it a preferred option for energy-efficient buildings, enabling the maintenance of consistent indoor temperatures and reducing energy consumption for heating and cooling.

Get a glance at the market report of share of various segments Request Free Sample

The concrete segment was valued at USD 45.90 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

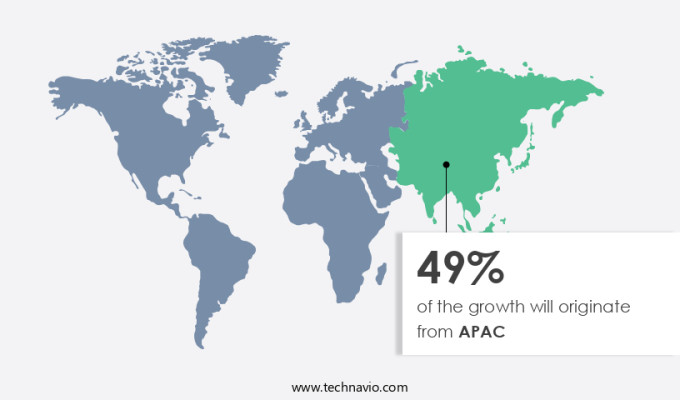

- APAC is estimated to contribute 49% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The urbanization trend in the Asia-Pacific (APAC) region is advancing, with varying rates across countries. By 2023, territories like Macao, Singapore, and Hong Kong reached full urbanization, while Papua New Guinea remains largely rural. Urbanization is projected to continue, particularly in ASEAN countries. By 2025, Malaysia's urbanization rate is expected to reach 80.1%, and Brunei's around 79.7%. This growth is primarily driven by people seeking better job opportunities and living standards in urban areas. Lightweight construction materials play a crucial role in this development, with advanced manufacturing, sustainable materials, recycling technologies, circular economy, and carbon neutrality being key considerations. Building design and manufacturing processes are being optimized using composite materials to promote sustainable development. These trends reflect the importance of reducing waste and carbon emissions in the construction industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Lightweight Construction Material Market?

Construction growth is the key driver of the market.

- The market is experiencing significant growth due to the increasing focus on net-zero buildings and sustainable development in the construction sector. Advanced manufacturing techniques and innovative product design are driving the use of high-performance, lightweight materials in building design, manufacturing processes, and construction. Sustainable materials, such as composite materials and bio-based materials, are gaining popularity due to their carbon neutrality and waste reduction properties. Recycling technologies and circular economy principles are also key factors in the market's growth, as they contribute to the reduction of carbon footprints and resource efficiency. The construction industry's shift towards energy efficiency solutions, climate change mitigation, and environmental sustainability is further fueling the demand for lightweight construction materials.

- In addition, the marine industry, transportation industry, and structural engineering are among the sectors adopting lightweight materials to improve resilient infrastructure and reduce building codes compliance costs. The future of transportation and aviation is also embracing lightweight materials for eco-friendly aircraft and sustainable design principles. Modern building codes and green building standards require energy-efficient design, assembly time optimization, and construction waste management. Building performance simulation and carbon footprint reduction are essential aspects of building design, and smart building technologies, such as building automation systems, are increasingly being integrated to enhance building performance. The market for lightweight construction materials is expected to continue growing, driven by the need for adaptive reuse, earthquake resistance, building envelope optimization, renewable energy integration, and renewable energy sources.

What are the market trends shaping the Lightweight Construction Material Market?

Innovations in material science is the upcoming trend in the market.

- The market is experiencing substantial growth due to advancements in material science and innovation. For instance, Suranaree University of Technology in Thailand introduced a groundbreaking project in June 2024, converting white polystyrene (PS) foam waste into lightweight construction materials. This initiative transforms commonly used packaging waste through a two-step grinding process, first reducing it to marble-sized pieces and then further grinding it into tiny grains of sand. These pellets are subsequently coated with glue and combined with fly ash to prevent clumping. The resulting material, resembling small pebbles, can be molded into various shapes, including bricks, blocks, and lightweight bricks.

- Furthermore, this circular economy approach to manufacturing aligns with the goals of net-zero buildings and carbon neutrality, as it reduces waste and promotes sustainable development in residential construction, marine industry, and structural engineering. Additionally, the use of high-performance materials and energy-efficient design principles contributes to climate change mitigation, environmental sustainability, and urban regeneration. The integration of renewable energy, off-site construction, and smart building technologies further enhances the future of construction and transportation industries.

What challenges does Lightweight Construction Material Market face during the growth?

High cost of lightweight construction materials is a key challenge affecting the market growth.

- Lightweight construction materials, such as advanced composites and high-performance building envelope components, play a crucial role in achieving net-zero buildings and reducing carbon footprints in various industries, including residential construction, marine, and transportation. The production of these materials involves advanced manufacturing processes and sustainable materials, such as recycled plastics and bio-based fibers, contributing to a circular economy. However, the high cost of lightweight construction materials is a significant challenge, with complex manufacturing processes and specialized equipment driving up production costs. Additionally, the limited availability of these materials increases transportation and logistics expenses. To address these challenges, innovation in construction, such as industrial automation and modular construction, is essential for optimizing resource efficiency and reducing waste.

- Furthermore, the integration of renewable energy and green building standards, like passive house design and energy-efficient design, enhances the environmental sustainability of lightweight construction materials. The future of transportation and infrastructure development also relies on the adoption of lightweight materials for climate change mitigation and resilient building design. The importance of lifecycle analysis, carbon footprint reduction, and smart building technologies in achieving net-zero energy buildings and reducing the overall carbon impact of the construction industry cannot be overstated.

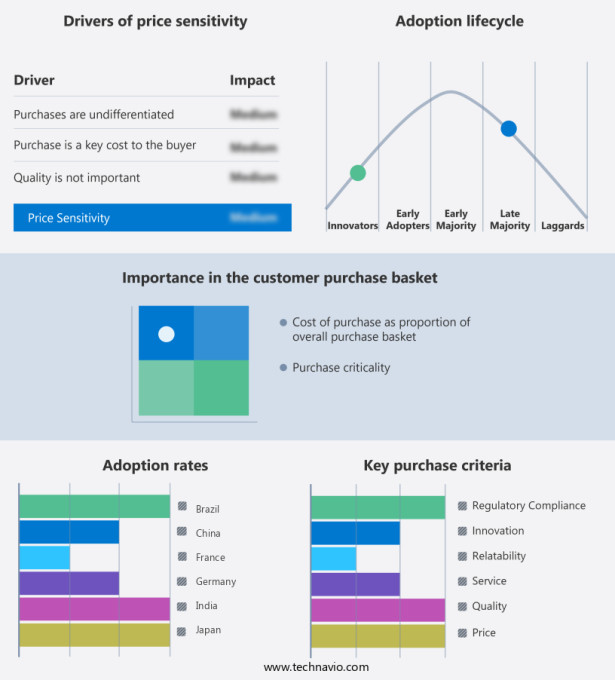

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AERCON AAC - The company offers lightweight construction material such as AERCON AAC Mine Blocks that are used in coal mine for mine stoppings, they are short stacked, noncombustible, solid, and lightweight block.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AeroBlocks

- Aerolite Quarries

- Alfatherm Insulation

- Bauroc AS

- Eco Green

- EcoLite

- Ecorex Buildtech Pvt. Ltd.

- EnviroLite

- Forterra Building Products Ltd.

- GREELITE ACC BLOCKS

- H H UK Ltd.

- Hebel

- LCC Siporex

- SOLBET Sp. z o. o.

- Ytong

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The construction industry is undergoing a significant transformation, with a growing focus on sustainability, circular economy, and carbon neutrality. Lightweight construction materials are at the forefront of this evolution, offering numerous benefits in terms of energy efficiency, resource optimization, and waste reduction. Lightweight materials are essential for achieving net-zero energy buildings, a critical component of sustainable development. These materials enable architects and engineers to design structures with minimal environmental impact, reducing the demand for energy-intensive heating and cooling systems. Moreover, lightweight materials contribute to the optimization of building envelopes, enhancing insulation and thermal performance.

Furthermore, advanced manufacturing processes play a crucial role in the production and application of lightweight construction materials. Industrial automation and composite materials have revolutionized the industry, enabling the creation of high-performance, eco-friendly products. These innovations have led to significant reductions in assembly time, construction costs, and carbon footprint. The circular economy is another driving force behind the adoption of lightweight construction materials. Recycling technologies have made it possible to repurpose waste materials into valuable resources, reducing the need for virgin raw materials. This approach not only minimizes waste but also contributes to the reduction of greenhouse gas emissions. The marine industry, transportation sector, and structural engineering are just a few industries that have embraced lightweight construction materials.

In addition, in the marine industry, lightweight materials help to improve fuel efficiency and reduce emissions, making vessels more sustainable. In transportation, lightweight materials are used to manufacture eco-friendly aircraft and vehicles, contributing to the future of sustainable aviation and transportation. Building codes and green building standards continue to evolve, reflecting the growing importance of sustainability and energy efficiency. Net-zero energy buildings, resilient infrastructure, and smart building technologies are becoming the norm, driving the demand for innovative, lightweight construction materials. The future of construction is about creating structures that are not only functional and cost-effective but also environmentally sustainable. Lightweight construction materials are at the heart of this vision, offering a range of benefits from energy efficiency to resource optimization and waste reduction.

Furthermore, as the industry continues to innovate, we can expect to see even more advanced materials and manufacturing processes that will further drive the adoption of lightweight construction. In conclusion, lightweight construction materials are a critical component of the sustainable built environment. They offer numerous benefits, from energy efficiency and resource optimization to waste reduction and carbon footprint reduction. As the construction industry continues to evolve, we can expect to see more innovative materials, manufacturing processes, and design principles that will drive the adoption of lightweight construction and contribute to a more sustainable future.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market growth 2025-2029 |

USD 45.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.0 |

|

Key countries |

US, China, Japan, India, Germany, UK, South Korea, France, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch