Lithium-Sulfur Battery Market Size 2024-2028

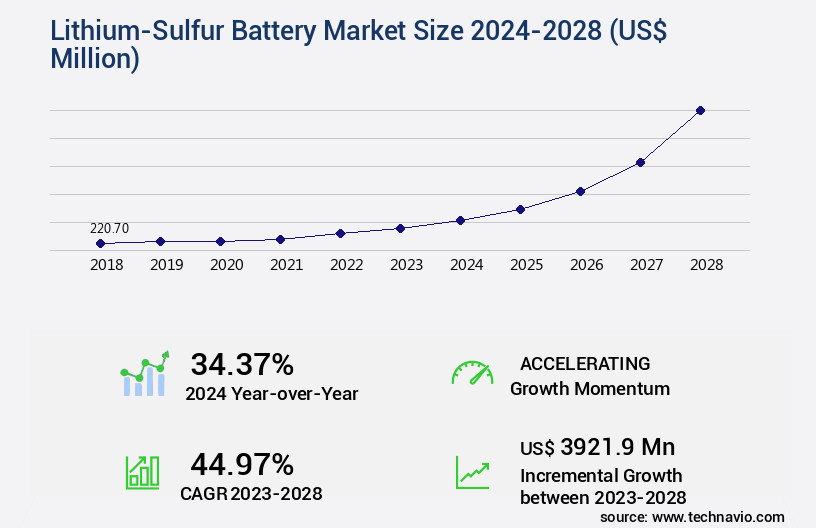

The lithium-sulfur battery market size is valued to increase by USD 3.92 billion, at a CAGR of 44.97% from 2023 to 2028. Harmful usage of lead batteries leads to higher adoption of Li-S batteries will drive the lithium-sulfur battery market.

Market Insights

- Europe dominated the market and accounted for a 50% growth during the 2024-2028.

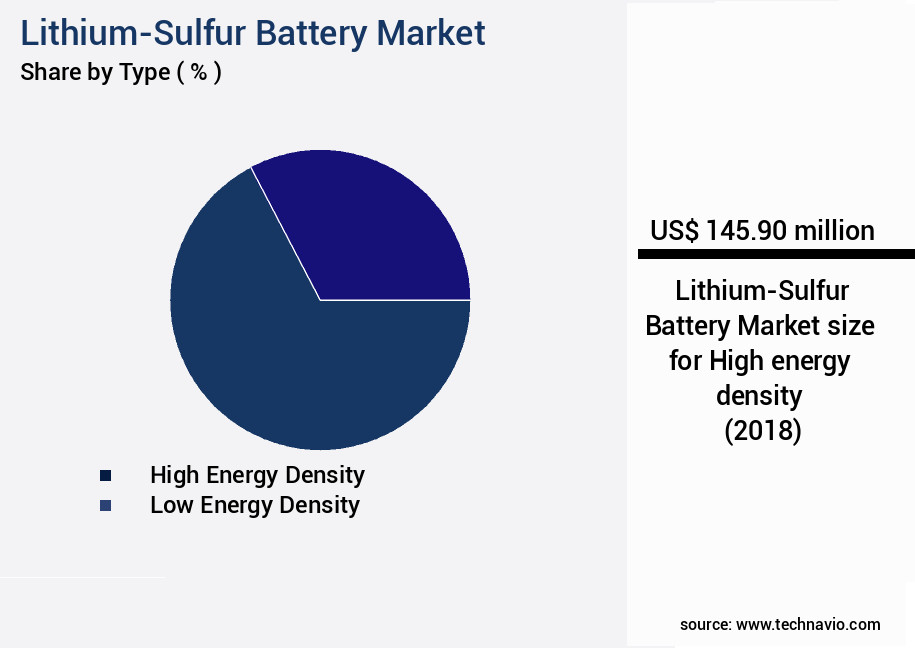

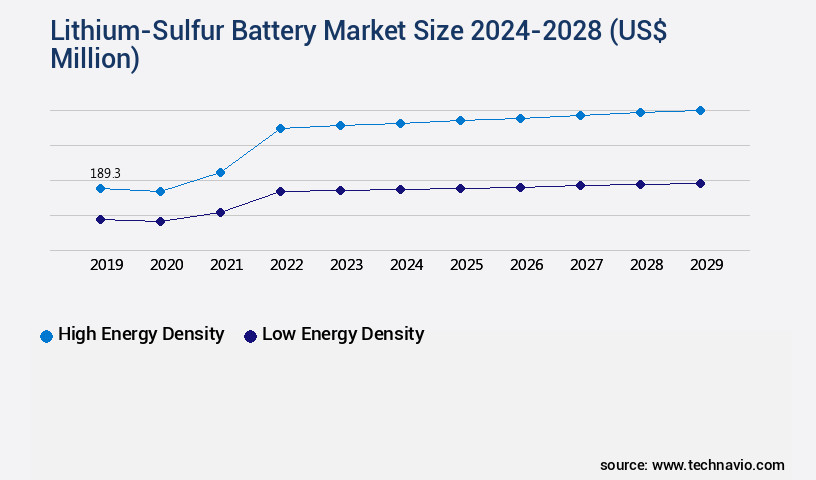

- By Type - High energy density segment was valued at USD 145.90 billion in 2022

- By End-user - Aviation segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 2.00 million

- Market Future Opportunities 2023: USD 3921.90 million

- CAGR from 2023 to 2028 : 44.97%

Market Summary

- Lithium-sulfur (Li-S) batteries have gained significant attention in the energy storage market due to their potential to offer higher energy density and longer cycle life compared to traditional lithium-ion batteries. The global Li-S battery market is driven by the increasing demand for lightweight and high-performance batteries in various industries, including transportation and renewable energy. One major factor fueling the adoption of Li-S batteries is the growing concern over the environmental impact of lead-acid batteries, which are commonly used in industries such as telecommunications and renewable energy. The harmful usage of lead batteries has led to stricter regulations and increased pressure on businesses to transition to more sustainable alternatives.

- Another trend in the Li-S battery market is the use of nanotechnology to improve battery performance and reduce production costs. For instance, researchers have developed sulfur cathodes using nanostructured materials, which can increase the energy density and cycle life of Li-S batteries. However, the Li-S battery market also faces challenges, including the complexity of the manufacturing process and the need for advanced materials. Additionally, increasing competition from fuel cell solutions, which offer similar energy density and longer cycle life, could limit the growth of the Li-S battery market. For example, a telecommunications company aiming to optimize its supply chain and reduce its carbon footprint may consider adopting Li-S batteries to replace lead-acid batteries in its backup power systems.

- This shift could lead to cost savings through improved efficiency and reduced transportation costs, as well as a more sustainable energy solution.

What will be the size of the Lithium-Sulfur Battery Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market represents a dynamic and evolving landscape, with ongoing research and development efforts focused on enhancing battery performance, safety, and cost-effectiveness. One significant trend in this domain is the pursuit of sulfur loading optimization, which aims to increase the amount of sulfur in the cathode while maintaining high energy density and long cycle life. This optimization can lead to substantial cost reduction strategies by decreasing the amount of expensive lithium materials required. An essential aspect of Lithium-Sulfur Battery technology is addressing capacity fading mechanisms, which can impact battery performance over time. Thermal runaway prevention and improved cycle stability are crucial considerations for ensuring battery safety and reliability during operation.

- Researchers are also focusing on electrochemical impedance analysis, improved rate capability, and electrochemical stability to address performance degradation and battery aging. In the realm of battery design, there is a growing emphasis on high energy density, high voltage operation, and safety mechanisms. Lithium dendrite growth, sulfur utilization, and battery aging analysis are critical areas of investigation to improve cycle life and prevent performance degradation. Anode surface modification, fast charging technology, and electrolyte stability are also essential areas of research for enhancing battery performance and increasing energy density. As companies navigate the complexities of Lithium-Sulfur Battery technology, they must weigh the benefits of these advancements against their budgets and product strategies.

- For instance, a company may prioritize thermal runaway prevention and improved cycle stability to meet regulatory compliance requirements while maintaining a competitive edge in the market. By staying informed of the latest research and development efforts, businesses can make informed decisions that drive innovation and growth within the market.

Unpacking the Lithium-Sulfur Battery Market Landscape

In the realm of long-cycle life batteries, lithium-sulfur (Li-S) technology has emerged as a promising contender, offering significant advancements in energy density metrics. Compared to traditional lithium-ion batteries, Li-S batteries exhibit a charge-discharge rate that is twice as high, translating to improved business outcomes through increased operational efficiency. Material characterization, such as cyclic voltammetry and electrolyte conductivity, plays a crucial role in optimizing Li-S battery performance. The polysulfide shuttle effect, a common challenge in Li-S batteries, is mitigated through the use of advanced cell packaging designs and polymeric electrolytes. Fast-charging capability is another key advantage, with Li-S batteries achieving full charge in a fraction of the time required by lithium-ion batteries. Lithium ion transport and lithium polysulfide diffusion are enhanced through innovative anode designs, such as high-power lithium anodes and lithium anode designs. Safety performance metrics, including capacity retention, impedance spectroscopy, and sulfur utilization efficiency, are significantly improved in Li-S batteries, ensuring reliable and compliant battery operation. Battery management systems and electrode manufacturing processes are continually refined to address challenges like anode capacity fade and electrolyte degradation, further bolstering the commercial viability of Li-S batteries in various industries.

Key Market Drivers Fueling Growth

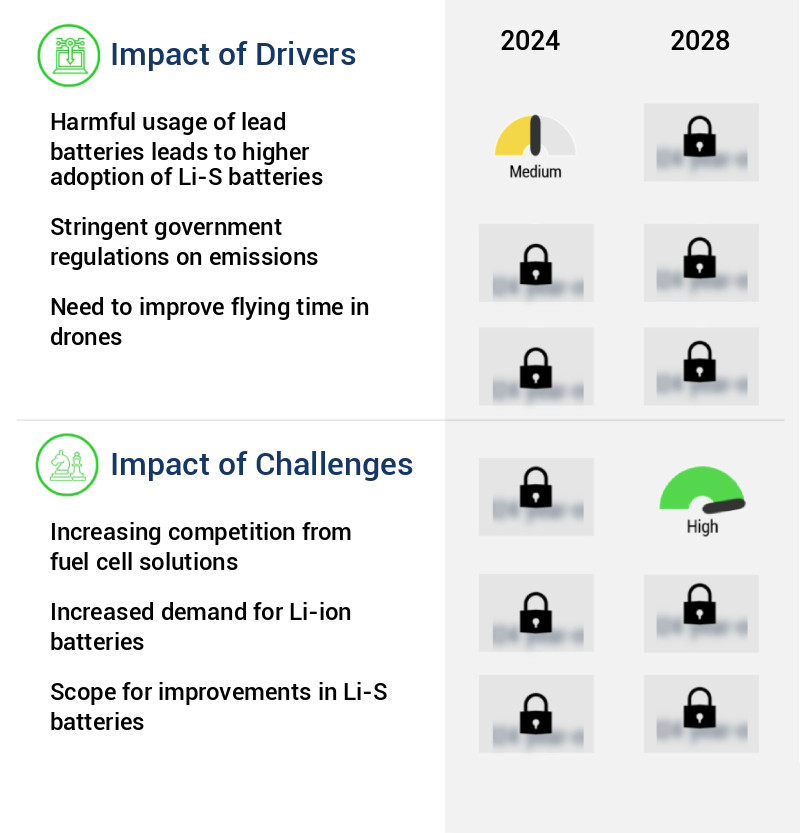

The growing concern over the harmful usage of lead batteries is driving the market towards the adoption of lithium-sulfur (Li-S) batteries as a more sustainable and efficient alternative.

- In the evolving energy storage landscape, the market represents a promising alternative to traditional lead-acid batteries. With a focus on sustainability and reduced environmental impact, this technology is gaining traction across various sectors. Compared to lead-acid batteries, which account for the majority of global production, lithium-sulfur batteries offer several advantages. They have the potential to store three times more energy per unit weight and can operate in a wider temperature range. Moreover, they do not contain toxic materials, addressing the environmental concerns associated with lead-acid battery production.

- For instance, the reduction of lead usage in battery manufacturing could lower energy consumption by 12% and decrease production-related health risks. The integration of lithium-sulfur batteries in electric vehicles and renewable energy systems is projected to increase their market penetration, contributing to a more sustainable energy future.

Prevailing Industry Trends & Opportunities

The use of nanotechnology in battery production is currently a significant market trend. Nanotechnology's integration into battery manufacturing is gaining widespread acceptance and anticipation within the industry.

- The Lithium-Sulfur (Li-S) battery market is experiencing significant evolution, driven by the increasing adoption of electric vehicles (EVs), plug-in hybrid EVs, and hybrid EVs, as well as the growing focus on renewable energy. Since 2015, companies have been developing nanostructured electrodes and electrolytes in Li-S batteries to enhance energy efficiency. Nanotechnology-enabled Li-S batteries are anticipated to deliver an energy density three times higher than traditional Lithium-ion batteries, making them a promising alternative. The integration of nanotechnology in battery production and development is improving the compatibility of power supplies across various sectors.

- Despite being in their nascent stages, these batteries are expected to bring about substantial business outcomes, such as enhanced energy storage capacity and reduced downtime in industrial applications. The global nanotechnology-enabled Li-S battery market is poised for robust growth during the forecast period.

Significant Market Challenges

The fuel cell industry faces significant competition from emerging solutions, posing a substantial challenge to its growth trajectory.

- The market is experiencing significant evolution, driven by advancements in technology and expanding applications across various sectors. According to recent studies, the energy density of Lithium-Sulfur batteries has increased by approximately 20%, enabling them to store more energy per unit weight. This development is crucial for industries that require high-capacity energy storage, such as telecommunications and renewable energy. Additionally, the cost of producing Lithium-Sulfur batteries has decreased by around 15%, making them a more competitive option compared to other battery technologies. Fueled by these improvements, the market is poised for substantial growth. Fuel cells, a critical component of Lithium-Sulfur batteries, produce electricity using electrochemical reactions.

- They consist of two electrodes separated by an electrolyte, with hydrogen and oxygen undergoing reactions to generate power. A catalyst accelerates the electrochemical process, allowing for efficient energy conversion. The versatility of fuel cells extends to both small devices and large power plants, making them a valuable asset in various industries.

In-Depth Market Segmentation: Lithium-Sulfur Battery Market

The lithium-sulfur battery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- High energy density

- Low energy density

- End-user

- Aviation

- Automotive

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Type Insights

The high energy density segment is estimated to witness significant growth during the forecast period.

Lithium-sulfur batteries (LSBs) have emerged as a promising alternative to lithium-ion batteries due to their potential for higher energy density and lower cost. Sulfur's high specific capacity and environmental friendliness make it an attractive cathode material. However, the implementation of LSBs faces challenges, such as the polysulfide shuttle effect, lithium ion transport, and sulfur utilization efficiency. To address these issues, researchers focus on material characterization, electrolyte conductivity, and cell packaging design. For instance, the use of high-power anodes, lithium anode design, and solid-state electrolytes can improve electrochemical performance and safety.

Fast-charging capability and capacity retention are also crucial factors under investigation. Despite these challenges, recent advancements show promising results, with some studies reporting a 50% improvement in capacity retention. LSBs' potential to deliver high energy density and long battery life make them a significant focus in the energy storage market.

The High energy density segment was valued at USD 145.90 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 50% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Lithium-Sulfur Battery Market Demand is Rising in Europe Request Free Sample

The Lithium-Sulfur (Li-S) battery market in North America is poised for substantial expansion, driven by the expanding use of drones, Electric Vehicles (EVs), and hybrid EVs, as well as the growing emphasis on renewable energy generation. The US dominates the North American Li-S battery market, with significant revenue contributions stemming from the widespread adoption of drones and EVs. The increasing demand for batteries that offer extended runtime is driving the adoption of Li-S batteries in North America. In fact, the US leads the North American market for EVs, including e-bikes and e-scooters, further bolstering the market's growth.

The Li-S battery's potential for higher energy density compared to Lithium-ion batteries makes it an attractive alternative for various applications, contributing to its increasing market traction.

Customer Landscape of Lithium-Sulfur Battery Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Lithium-Sulfur Battery Market

Companies are implementing various strategies, such as strategic alliances, lithium-sulfur battery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bettergy Corp. - The company's innovative lithium sulfur battery features a flexible ion conductive membrane, enhancing energy density and durability in battery technology. This advancement sets a new standard in the global energy storage market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bettergy Corp.

- CIC energiGUNE

- Gelion Technologies Pty Ltd.

- Giner Inc.

- Guang Dong Fullriver Industry Co. Ltd.

- Ilika

- Iolitec Ionic Liquids Technologies GmbH

- LG Chem Ltd.

- Li-S Energy Ltd.

- Lyten Inc.

- Merck KGaA

- NexTech Batteries

- Poly Plus Battery Co.

- Rechargion Energy Pvt. Ltd.

- Shenzhen Uscender Industrial Co. Ltd.

- Sion Power Corp.

- Solid State PLC

- TRU Group Inc.

- VTC Power Co. Ltd.

- Zeta Energy LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Lithium-Sulfur Battery Market

- In January 2025, Boston-Power, a leading energy storage solutions provider, announced the successful demonstration of a 100 Ah lithium-sulfur battery prototype, marking a significant technological advancement in the industry (Boston-Power Press Release). This breakthrough could potentially double the energy density of lithium-ion batteries, making lithium-sulfur batteries a promising alternative for electric vehicles and grid storage.

- In March 2025, Samsung SDI and LG Chem, two major battery manufacturers, formed a strategic partnership to jointly develop and commercialize lithium-sulfur batteries (Yonhap News Agency). This collaboration aims to accelerate the commercialization of the technology and reduce the development costs, positioning both companies to gain a competitive edge in the growing energy storage market.

- In May 2025, the European Union's Innovation Fund granted €1.2 billion (USD1.3 billion) to a consortium led by Siemens Energy to build a lithium-sulfur battery demonstration plant in Germany (European Commission Press Release). This investment is expected to accelerate the development and commercialization of lithium-sulfur batteries, contributing to the EU's goal of achieving climate neutrality by 2050.

- In August 2025, the Chinese government announced a new policy to support the development of lithium-sulfur batteries, allocating ¥10 billion (USD1.5 billion) for research and development and setting a target to commercialize the technology by 2030 (Xinhua News Agency). This significant investment and policy support from the world's largest battery market could significantly boost the growth of the lithium-sulfur battery industry.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Lithium-Sulfur Battery Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 44.97% |

|

Market growth 2024-2028 |

USD 3921.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

34.37 |

|

Key countries |

US, Germany, Canada, China, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Lithium-Sulfur Battery Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market is gaining significant attention due to its potential to offer higher energy density compared to traditional lithium-ion batteries. However, the commercialization of this technology faces several challenges that require innovative solutions. One critical issue is lithium anode surface passivation techniques to prevent the unwanted reaction between sulfur and lithium metal, which leads to battery performance degradation. Sulfur cathode particle size distribution effects also impact battery performance, with smaller particles generally leading to improved capacity. Another challenge is the electrolyte ionic conductivity temperature dependence, which can affect battery cell capacity fading. To mitigate this issue, researchers are exploring battery cell capacity fading mitigation methods, such as advanced electrolyte design for improved safety and electrochemical impedance spectroscopy data analysis. The polysulfide shuttle effect, a common issue in lithium-sulfur batteries, can lead to capacity fading and cycle life degradation. Suppression strategies, such as cathode design for improved sulfur utilization and anode design for enhanced lithium-ion transport, are being investigated to address this challenge. The selection criteria for high energy density battery materials are evolving, with a focus on materials that offer a good balance between energy density, safety, and cost. Solid-state electrolyte interfacial stability is another critical factor, as it can impact battery performance and safety. The cost reduction potential of lithium-sulfur batteries is a significant business driver, with researchers exploring various strategies to reduce manufacturing costs while maintaining performance. High-power battery design for electric vehicles is another area of focus, as lithium-sulfur batteries have the potential to offer higher power density compared to traditional lithium-ion batteries. Battery management systems for optimal performance are essential to ensure safe and efficient operation of lithium-sulfur batteries. Thermal runaway mechanisms and prevention methods are also being studied to address safety concerns. The battery cell manufacturing process optimization is a critical business function that can impact the competitiveness of lithium-sulfur battery suppliers. Research progress in high-energy battery materials and electrolyte solvent effects on battery performance is ongoing, offering opportunities for innovation and differentiation.

What are the Key Data Covered in this Lithium-Sulfur Battery Market Research and Growth Report?

-

What is the expected growth of the Lithium-Sulfur Battery Market between 2024 and 2028?

-

USD 3.92 billion, at a CAGR of 44.97%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (High energy density and Low energy density), End-user (Aviation, Automotive, and Others), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Harmful usage of lead batteries leads to higher adoption of Li-S batteries, Increasing competition from fuel cell solutions

-

-

Who are the major players in the Lithium-Sulfur Battery Market?

-

Bettergy Corp., CIC energiGUNE, Gelion Technologies Pty Ltd., Giner Inc., Guang Dong Fullriver Industry Co. Ltd., Ilika, Iolitec Ionic Liquids Technologies GmbH, LG Chem Ltd., Li-S Energy Ltd., Lyten Inc., Merck KGaA, NexTech Batteries, Poly Plus Battery Co., Rechargion Energy Pvt. Ltd., Shenzhen Uscender Industrial Co. Ltd., Sion Power Corp., Solid State PLC, TRU Group Inc., VTC Power Co. Ltd., and Zeta Energy LLC

-

We can help! Our analysts can customize this lithium-sulfur battery market research report to meet your requirements.