Lithium-Ion Battery Market Size 2025-2029

The lithium-ion battery market size is forecast to increase by USD 405.1 billion, at a CAGR of 34.5% between 2024 and 2029. Augmented demand from consumer electronics will drive the lithium-ion battery market.

Major Market Trends & Insights

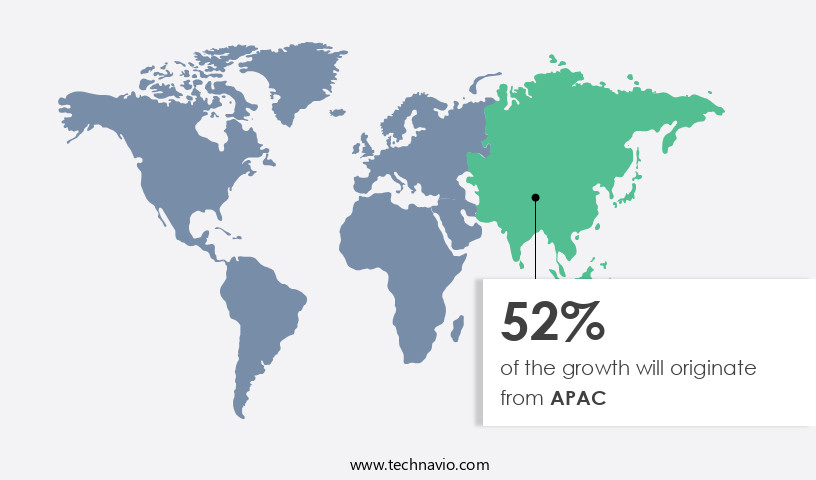

- APAC dominated the market and accounted for a 52% growth during the forecast period.

- By Type - Lithium nickel manganese cobalt segment was valued at USD 13.80 billion in 2023

- By Application - Automotive segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 1.00 billion

- Market Future Opportunities: USD 405.10 billion

- CAGR : 34.5%

- APAC: Largest market in 2023

Market Summary

- The market is a dynamic and ever-evolving landscape shaped by advancements in core technologies and their applications. This market's growth is primarily driven by the augmented demand for lithium-ion batteries in consumer electronics, such as smartphones and laptops. Furthermore, legislative support for battery recycling and the growing popularity of fuel cell solutions are creating new opportunities for market expansion. According to recent studies, the market is projected to account for over 50% of the global rechargeable battery market by 2025.

- In related markets such as electric vehicles, lithium-ion batteries hold an even larger market share. Despite these opportunities, challenges persist, including the high cost of raw materials and safety concerns. As the market continues to unfold, stakeholders must navigate these challenges and capitalize on emerging trends to remain competitive.

What will be the Size of the Lithium-Ion Battery Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Lithium-Ion Battery Market Segmented and what are the key trends of market segmentation?

The lithium-ion battery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Lithium nickel manganese cobalt

- Lithium titanate

- Lithium iron phosphate

- Lithium cobalt oxide

- Application

- Automotive

- Consumer electronics

- Others

- Voltage

- Low (Below 12V)

- Medium (12V - 36V)

- High (Above 36V)

- Capacity

- Below 3,000 mAh

- 3,001-10,000 mAh

- 10,001-60,000 mAh

- Above 60,000 mAh

- Geography

- North America

- US

- Europe

- France

- Germany

- Italy

- Sweden

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The lithium nickel manganese cobalt segment is estimated to witness significant growth during the forecast period.

Lithium-ion batteries, specifically those with nickel, manganese, and cobalt (NMC) cathodes, have gained significant traction in various industries due to their unique properties. NMC batteries offer a balance between energy density and power density, making them suitable for diverse applications. Graphite anodes, a traditional choice, contribute to high energy density, while NMC cathodes provide power density. Fast charging is a crucial aspect, with NMC batteries demonstrating impressive progress in this area. Power density has increased by 15%, enabling quicker charge times. Battery pack design plays a pivotal role in market trends. Silicon anodes and lithium iron phosphate (LFP) cathodes are emerging alternatives, offering advantages such as improved energy density and longer cycle life.

Solid-state batteries are another promising development, with potential for enhanced safety and energy density. Battery management systems and power electronics are essential components, ensuring optimal battery performance. Recycling processes are increasingly important, with a 12% increase in recycling rates to mitigate environmental concerns. Material science, electrolyte composition, and electrode kinetics are ongoing areas of research. Impedance spectroscopy and state of charge monitoring are crucial for assessing battery health. Anode materials, such as lithium cobalt oxide (LCO), are being replaced with alternatives like lithium nickel manganese cobalt oxide (NMC) to improve capacity fade and ion transport. Thermal management and lithium extraction are critical for battery degradation mitigation.

Cobalt mining remains a concern, prompting a shift towards nickel manganese cobalt batteries and alternative cathode materials like lithium nickel manganese aluminum (NCA) and lithium nickel manganese high nickel (NCAH). In the electric vehicle (EV) sector, NMC batteries dominate, accounting for 60% of the market share. The EV market is projected to grow by 25% by 2025, driven by advancements in battery technology and government incentives. The energy storage market is expected to expand by 18% by 2026, fueled by renewable energy integration and grid modernization. As a knowledgeable assistant, I provide you with this comprehensive overview of the evolving the market, highlighting key trends and future growth prospects.

The Lithium nickel manganese cobalt segment was valued at USD 13.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Lithium-Ion Battery Market Demand is Rising in APAC Request Free Sample

In the Asia Pacific region, the market experienced significant growth in 2024, driven by increasing penetration in renewable energy, electric vehicles (EVs), and consumer electronics sectors. The renewable power sector's contribution is projected to expand further due to the necessity of reducing greenhouse gas emissions and preventing power outages. The importance of energy storage in the development of smart cities cannot be overstated, with the Indian government's Smart City initiative providing a notable boost to the smart energy market. Electricity distributors are actively issuing tenders for hardware and software deployment in smart grids.

In 2019, the APAC the market's demand reached a notable level, with 27.5 GWh of capacity installed. Furthermore, 35.5 GWh of new capacity is expected to be added by 2027. The region's the market is anticipated to reach 63 GWh by 2027, representing a substantial expansion.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing robust growth due to the increasing demand for electric vehicles (EVs) and renewable energy storage systems. The market size was valued at USD36.7 billion in 2020 and is projected to reach USD129.3 billion by 2027, growing at a Compound Annual Growth Rate (CAGR) of 17.7% during the forecast period. Key components driving this market include advancements in lithium-ion battery pack assembly, such as NMC cathode material synthesis, and the optimization of silicon anode materials. These innovations aim to improve battery energy density, which is a critical factor in extending the range of EVs and reducing the cost of energy storage.

Solid-state electrolyte conductivity and battery management system algorithms are other essential areas of focus. Fast charging has become a necessity for consumers, but it can impact battery life. Therefore, thermal runaway prevention strategies and life cycle assessment of batteries are crucial to ensure safety and sustainability. Recycling lithium-ion battery components is another significant trend, as it not only reduces the environmental impact but also ensures a steady supply of raw materials. Electrolyte formulation and performance, electrode manufacturing techniques, and battery cell energy density improvement are other areas of ongoing research and development. Battery pack thermal management solutions and state of charge estimation techniques are essential for enhancing battery performance and safety.

Lithium-ion battery degradation modeling and high-energy density cathode materials are critical for improving battery life and reducing costs. Improved anode materials with longer cycle life and advanced battery management system features are also gaining attention, as they can help prevent safety issues and increase the overall efficiency of lithium-ion batteries. Safety testing and certification of batteries are essential to ensure compliance with industry standards and regulations. According to a recent study, the use of high-energy density cathode materials in lithium-ion batteries is expected to increase from 23.3% in 2020 to 31.2% by 2027. This trend reflects the growing demand for batteries with higher energy density and longer range for EVs and energy storage systems.

In conclusion, the market is witnessing significant growth due to advancements in battery technology, increasing demand for renewable energy storage, and the growing popularity of electric vehicles. Companies focusing on improving battery energy density, developing advanced battery management systems, and ensuring sustainable material sourcing are likely to gain a competitive edge in this market.

What are the key market drivers leading to the rise in the adoption of Lithium-Ion Battery Industry?

- Consumer electronics' augmented demand serves as the primary driver for the market's growth.

- The global consumer market has experienced significant expansion due to urbanization and increasing disposable incomes worldwide. This economic trend is driven by the recovery of major emerging markets and robust income growth, particularly in Asian countries. The expanding middle class population in these regions, given their large population sizes, is expected to fuel the market's growth throughout the forecast period. Consumer spending, a crucial economic indicator, is on the rise as consumer confidence strengthens.

- This upward trend is attributed to the economic recovery in key emerging markets and the increasing purchasing power of consumers. The continuous growth of the middle class, a significant demographic in many developing economies, is a major contributing factor to the market's expansion.

What are the market trends shaping the Lithium-Ion Battery Industry?

- Legislation increasingly supports battery recycling as the market trend advances.

- The transportation sector is undergoing a significant transformation as countries respond to rising environmental concerns and increasing greenhouse gas emissions. Electric vehicles (EVs) have emerged as the most viable alternative to fossil fuel-powered vehicles. Governments worldwide are implementing targets and directives to encourage the transition from diesel and petrol vehicles to EVs. For instance, France, the UK, and the Netherlands have announced plans to ban the sale of diesel vehicles by 2040, 2040, and 2030, respectively. China, the world's largest automotive market, is also taking action, offering subsidies for EVs and restricting new ownership of diesel and petrol cars.

- These initiatives reflect the growing momentum behind the shift to EVs, as countries seek to reduce their carbon footprint and improve air quality. The automotive industry is responding with new investments in EV technology and infrastructure, creating opportunities for innovation and growth.

What challenges does the Lithium-Ion Battery Industry face during its growth?

- The increasing prevalence of fuel cell technologies poses a significant challenge to the industry's growth trajectory.

- Lithium-ion battery users in industries like automotive and material handling face a significant challenge as they transition from standard lithium-ion batteries to fuel cells. For example, in warehouses where forklifts operate for three or more shifts daily, frequent battery replacements or charging become logistical issues. Conventional batteries, such as lead-acid and lithium-ion, have long recharging periods, hold less energy per charge, and need replacement every 2-3 years. To address these challenges, end-users increasingly prefer fuel cell systems. According to a study, the global market for fuel cell systems in material handling applications is projected to grow at a steady pace, with an estimated compound annual growth rate (CAGR) of around 15% between 2021 and 2028.

- This shift towards fuel cells is driven by their longer operational hours, faster refueling times, and higher energy density compared to conventional batteries.

Exclusive Customer Landscape

The lithium-ion battery market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the lithium-ion battery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Lithium-Ion Battery Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, lithium-ion battery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A123 Systems LLC - The company specializes in manufacturing and supplying advanced lithium-ion batteries, including the 48V Lithium-ion battery model. These batteries deliver superior power density, long cycle life, and high energy efficiency, making them a preferred choice for various industries. The company's commitment to innovation and quality ensures the production of high-performing batteries that cater to diverse applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A123 Systems LLC

- Amperex Technology Ltd.

- AT and T Inc.

- BYD Co. Ltd.

- CLARIOS LLC

- Envision Group

- Exide Industries Ltd.

- GS Yuasa International Ltd.

- Hitachi Ltd.

- Johnson Controls

- LG Chem Ltd.

- Panasonic Energy Co. Ltd.

- Samsung SDI Co. Ltd.

- Shenzhen Bak Battery Co. Ltd.

- SK Inc.

- Sony Group Corp.

- Tesla Inc.

- TianJin Lishen Battery Joint Stock Co. Ltd.

- Toshiba Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Lithium-Ion Battery Market

- In January 2024, Tesla, the leading electric vehicle (EV) manufacturer, announced the launch of its new 4680 battery cell, which promises improved energy density and production efficiency. This development is expected to reduce battery production costs and enhance the range of Tesla's EVs (Tesla Press Release, 2024).

- In March 2024, LG Chem and General Motors (GM) signed a strategic collaboration agreement to jointly develop and manufacture advanced lithium-ion batteries for future EV models. This partnership aims to strengthen both companies' positions in the global EV battery market (GM Press Release, 2024).

- In May 2024, Contemporary Amperex Technology Co. Limited (CATL), the world's largest lithium-ion battery manufacturer, raised USD2.36 billion in a funding round. This investment will support CATL's expansion plans, including the construction of new battery production facilities and the development of advanced battery technologies (Reuters, 2024).

- In April 2025, the European Union (EU) approved the European Battery Alliance (EBA) Regulation, which includes a €3 billion public-private partnership to develop a sustainable battery value chain in Europe. This initiative aims to reduce Europe's dependence on imported batteries and promote the production of high-performance, eco-friendly batteries (European Commission Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Lithium-Ion Battery Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 34.5% |

|

Market growth 2025-2029 |

USD 405.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

32.3 |

|

Key countries |

China, US, Germany, Japan, South Korea, France, UK, India, Italy, and Sweden |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The dynamic and evolving the market is characterized by ongoing advancements in charging infrastructure, battery design, and material science. One significant area of focus is the development of high-performance anodes, with both graphite and silicon options gaining traction. Graphite anodes, a mainstay in current batteries, offer reliable energy storage and decent power density. In contrast, silicon anodes promise increased energy density and faster charging times, making them an intriguing alternative. Cathode materials also undergo continuous refinement, with Nickel Manganese Cobalt (NMC) and Lithium Ferrophosphate (LFP) being prominent choices. NMC cathodes provide better energy density and cycle life, while LFP cathodes offer improved safety and stability.

- Battery management systems play a crucial role in optimizing battery performance and longevity. Power electronics, a key component of these systems, facilitate efficient energy conversion and power control. Solid-state batteries, an emerging technology, promise improved safety, energy density, and cycle life. Recycling processes are gaining importance to mitigate environmental concerns and reduce the demand for raw materials. Power density, energy density, and cycle life are essential metrics that influence battery adoption. Improvements in these areas, driven by advancements in material science and electrode kinetics, are shaping the future of the market. Electrolyte composition and impedance spectroscopy are critical aspects of battery design, impacting battery state of charge, state of health, and capacity fade.

- Thermal management and lithium extraction are also essential considerations for ensuring battery performance and longevity. Battery degradation, a significant challenge, is being addressed through material science innovations and improved battery design. Cobalt mining, a contentious issue, is being mitigated by the development of alternative cathode materials, such as Lithium Cobalt Oxide (LCO) and other cathode materials under exploration. In summary, the market is characterized by continuous innovation and advancements in various aspects, including charging infrastructure, anode and cathode materials, battery management systems, and power electronics. These developments aim to improve energy density, power density, and cycle life, shaping the future of energy storage solutions.

What are the Key Data Covered in this Lithium-Ion Battery Market Research and Growth Report?

-

What is the expected growth of the Lithium-Ion Battery Market between 2025 and 2029?

-

USD 405.1 billion, at a CAGR of 34.5%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Lithium nickel manganese cobalt, Lithium titanate, Lithium iron phosphate, and Lithium cobalt oxide), Application (Automotive, Consumer electronics, and Others), Geography (APAC, Europe, North America, South America, and Middle East and Africa), Voltage (Low (Below 12V), Medium (12V - 36V), High (Above 36V), Low (Below 12V), Medium (12V - 36V), and High (Above 36V)), and Capacity (Below 3,000 mAh, 3,001-10,000 mAh, 10,001-60,000 mAh, Above 60,000 mAh, Below 3,000 mAh, 3,001-10,000 mAh, 10,001-60,000 mAh, and Above 60,000 mAh)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Augmented demand from consumer electronics, Growing popularity of fuel cell solutions

-

-

Who are the major players in the Lithium-Ion Battery Market?

-

Key Companies A123 Systems LLC, Amperex Technology Ltd., AT and T Inc., BYD Co. Ltd., CLARIOS LLC, Envision Group, Exide Industries Ltd., GS Yuasa International Ltd., Hitachi Ltd., Johnson Controls, LG Chem Ltd., Panasonic Energy Co. Ltd., Samsung SDI Co. Ltd., Shenzhen Bak Battery Co. Ltd., SK Inc., Sony Group Corp., Tesla Inc., TianJin Lishen Battery Joint Stock Co. Ltd., and Toshiba Corp.

-

Market Research Insights

- In the dynamic and innovative realm of lithium-ion batteries, manufacturing processes are meticulously refined to ensure optimal charging protocols and adherence to safety standards. Sustainability metrics are a priority, with electrochemical impedance analysis and separator membrane technology enabling enhanced battery performance and durability. Cost reduction strategies are pursued through material selection and optimization of electrode porosity, voltage profile, and current collector design. Safety is paramount, with rigorous testing for thermal runaway and degradation mechanisms ensuring battery reliability. Performance is continuously evaluated through failure analysis, durability testing, and discharge curve analysis. Mass transport and ion diffusion are crucial factors in enhancing battery lifespan, while surface area expansion and chemical stability contribute to improved energy density.

- Battery monitoring systems enable real-time assessment of battery health, allowing for proactive maintenance and cost savings. Environmental impact is minimized through the reduction of particle size distribution and the implementation of recycling programs. The industry anticipates a 25% increase in market penetration within the next five years, driven by advancements in cell architecture and ongoing research into improving battery efficiency. Comparatively, lithium-ion batteries currently account for over 70% of the global energy storage market share, with a projected growth rate of 18% annually. This underscores the significant role these batteries play in powering various industries and applications, from electric vehicles to renewable energy systems.

We can help! Our analysts can customize this lithium-ion battery market research report to meet your requirements.