Livestock Feeding Systems Market Size 2024-2028

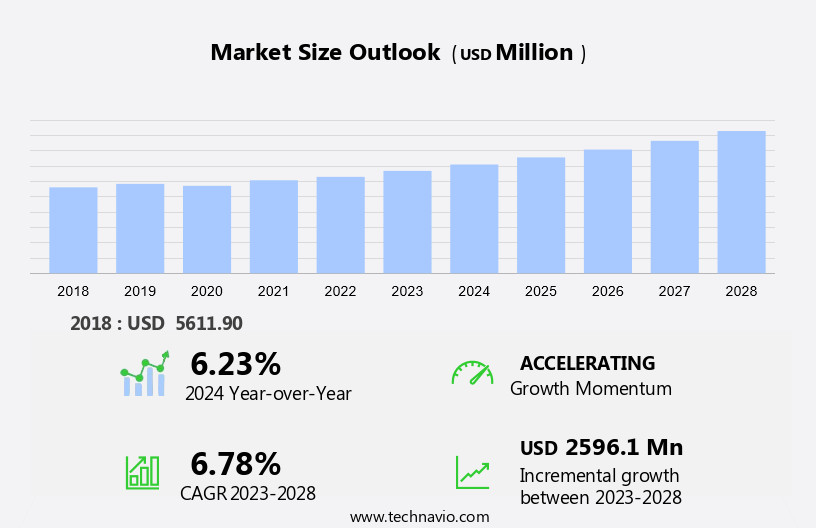

The livestock feeding systems market size is forecast to increase by USD 2.6 billion at a CAGR of 6.78% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing population of cattle in farms and the rising demand for modular and flexible systems. The global livestock industry is expanding, leading to an increased focus on efficient and cost-effective feeding systems. This trend is particularly prominent in developed markets, where intensive farming practices are prevalent. Moreover, the need for significant initial investments in advanced feeding systems, such as automated and computerized systems, presents both opportunities and challenges for market participants. On one hand, these systems offer improved productivity, reduced labor costs, and enhanced animal welfare. On the other hand, they require substantial capital expenditures and ongoing maintenance costs. Key trends In the market include the integration of IoT and data analytics to optimize feeding operations, the increasing popularity of alternative protein sources, and the growing adoption of sustainable and eco-friendly feeding systems. Companies seeking to capitalize on these opportunities must stay abreast of the latest technological advancements and regulatory requirements, while also addressing the challenges posed by rising input costs and increasing competition. Effective strategic planning, operational efficiency, and a strong focus on innovation will be essential for success in this dynamic and evolving market.

What will be the Size of the Market during the forecast period?

- The market encompasses a range of technologies and practices designed to efficiently and effectively deliver feed to cattle, dairy farms, poultry, swine, equine, and other livestock producers. This market is driven by the need to optimize farm profitability, enhance animal health, and improve labor efficiency. Automated feeding systems, including feed mixes, feeding tables, and cameras with artificial intelligence, are increasingly popular solutions.

- Feed management systems, incorporating heat detection and health monitoring technologies, enable farmers to optimize feeding schedules and prevent potential health issues. Novel feeding solutions, such as acoustic feeding technology and shrimp farming systems, also contribute to the market's growth. Overall, the market is expected to continue expanding as technology advances and farmers seek to maximize productivity and profitability.

How is this Livestock Feeding Systems Industry segmented?

The livestock feeding systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Poultry

- Ruminants

- Swine

- Others

- Technology

- Manual

- Automated

- Robotic

- Others

- Geography

- Europe

- Germany

- The Netherlands

- UK

- North America

- US

- APAC

- Australia

- South America

- Middle East and Africa

- Europe

By Application Insights

The poultry segment is estimated to witness significant growth during the forecast period. The global livestock industry is witnessing significant growth, particularly In the poultry, pig, equine, ruminant, and aquaculture segments. According to the Organization for Economic Co-operation and Development (OECD), the global consumption of poultry meat is projected to reach 150 million tons by 2029, driving the demand for advanced livestock feeding systems. Labor intensive activities, such as feeding, are a significant challenge for livestock producers, especially in dairy farming with dairy cattle. Automated feeding systems, including feed pushers, feeding robots, and automated feeding tables, are gaining popularity to improve farm profitability and animal health. Feed components, such as soybean meal, feed additives, and feed mixes, are essential for optimal livestock growth and production efficiency.

Get a glance at the market report of share of various segments Request Free Sample

The poultry segment was valued at USD 1.88 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

In Europe, the market is witnessing significant growth due to the increasing demand for meat products both domestically and internationally. The European Union (EU) is a major contributor to the global meat industry, accounting for a substantial portion of livestock production. To cater to the rising demand, livestock producers are adopting advanced feeding systems, such as automated feeding systems and feed additives, to improve production efficiency, animal health, and farm profitability. Companies like Roxell BV are introducing innovative products, such as MiniMax feeder pans, to meet the specific requirements of various livestock categories, including poultry, cattle, and equine. Additionally, agriculture technology, such as GIS, GPS systems, and satellite devices, is being integrated into livestock monitoring services to optimize feed management, heat detection, health monitoring, and real-time updates on air temperatures, CO2 levels, and humidity levels.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Livestock Feeding Systems Industry?

- Rising population of cattle in farms is the key driver of the market. The global livestock farming industry has witnessed a significant expansion due to the increasing demand for meat and dairy products. According to the United States Department of Agriculture (USDA), the number of dairy cows In the US reached 9.4 million in January 2020, marking a substantial increase from a decade ago. This trend is driving the demand for cattle feed, as farmers aim to optimize their resources and enhance profitability. Advanced livestock feeding systems are essential to minimize wastage and ensure efficient nutrient utilization.

- Consequently, The market is experiencing steady growth during the forecast period. Farmers' focus on maximizing productivity and reducing operational costs is fueling the adoption of advanced technologies and automated feeding systems. These systems offer features such as real-time monitoring, automated feeding, and precision feeding, enabling farmers to optimize their feeding practices and improve animal health and performance.

What are the market trends shaping the Livestock Feeding Systems Industry?

- Growing demand for modular and flexible systems is the upcoming market trend. Livestock farming operations require efficient and effective feeding systems to optimize animal health and productivity. This need is driving the adoption of advanced livestock feeding systems. companies are responding to this demand by introducing new products with enhanced features. This integration of technology further improves operational efficiency, reduces labor costs, and enables data-driven decision-making. Additionally, modular and flexible feeding systems contribute to improved animal welfare and productivity by providing greater control over feeding schedules, portion sizes, and feed formulations.

- This results in better feed conversion rates, healthier animals, and ultimately, higher yields for farmers. For instance, in late 2020, a leading company launched a new feed grabber system for its automated feeding solution. This system streamlines the feeding process, reducing wastage during distribution, and extending the lifespan of the feed grabber bucket. Such innovations will significantly impact the market, contributing to cost savings and improved functionality for farmers during the forecast period.

What challenges does the Livestock Feeding Systems Industry face during its growth?

- Need for significant initial investments is a key challenge affecting the industry growth. Livestock feeding systems have gained significance In the agricultural industry due to their ability to enhance livestock health and reduce operational expenses for farmers. These systems continuously monitor feed consumption, ensuring optimal nutrition and preventing wastage.

- However, the high cost of acquisition and installation, particularly for small and medium-sized livestock farmers, poses a significant barrier to adoption. Large-scale farmers, on the other hand, require multiple systems due to the larger number of animals they manage, leading to substantial investments. Despite these challenges, companies continue to innovate and upgrade their offerings to cater to the evolving needs of the farming community.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGCO Corp.

- Big Dutchman AG Holding

- Cargill Inc.

- CTB Inc.

- Dairymaster

- Daviesway Pty Ltd.

- DeLaval International AB

- Fullwood Ltd.

- GEA Group AG

- Hetwin Automation Systems Gmbh

- JH Agro AS

- Lely International NV

- Madison One Holdings LLC

- Maskinfabrikken Cormall AS

- Pellon Group Oy

- Rovibec Agrisolutions

- Scale Aquaculture AS

- Trevaskis Engineering Pty Ltd.

- Trioliet BV

- VDL Agrotech BV

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Livestock feeding systems have been a crucial aspect of agricultural production for centuries. These systems play a significant role in ensuring the health and well-being of cattle, poultry, pigs, equines, and other livestock species. The livestock feeding industry has seen significant advancements in technology, automation, and innovation in recent years, aimed at improving production efficiency, reducing labor intensity, and enhancing animal health. Livestock producers have traditionally relied on labor-intensive activities such as manually preparing feed mixes and distributing them to feeding tables. However, the increasing labor shortage and the need for more precise and efficient feeding methods have led to the adoption of automated feeding systems.

Moreover, these systems utilize various components, including feed additives, feeding pushers, and feeding robots, to ensure accurate and consistent feeding. The integration of agriculture technology into livestock feeding systems has revolutionized the industry. Automated feeding systems use control devices, GIS, GPS systems, and satellite devices to optimize feed distribution and monitor livestock populations. Livestock monitoring services provide real-time updates on various parameters such as air temperatures, ventilation, CO2 levels, humidity levels, power failures, and equipment failures, enabling farmers to respond promptly to any issues. Facial recognition technology and communication interfaces have been integrated into feeding systems to improve animal health and management.

Furthermore, heat detection and health monitoring cameras enable farmers to identify sick animals early and provide timely treatment. Artificial intelligence and optifeeding systems optimize feeding based on animal behavior and digestion, improving production efficiency and feed conversion. The livestock feeding industry caters to various livestock categories, including ruminant species such as cows and buffaloes, and monogastric species such as poultry, pigs, and equines. The industry also serves the aquaculture segment, with novel feeding solutions for shrimp farming. The adoption of technology-enabled systems has led to significant improvements in farm profitability, animal health, and agricultural output. The livestock feeding industry is not limited to dairy farms and dairy cattle.

In addition, it also serves the poultry, swine, and equine management sectors, producing meat products such as chicken meat, beef, and pork. The industry's focus on innovation and automation has led to the development of acoustic feeding technology, which uses sound to attract animals to the feeding area, reducing labor requirements and improving efficiency. The integration of agriculture technology, automation, and innovation has led to significant advancements In the industry, benefiting farmers, livestock producers, and consumers alike. The future of the industry lies in continued innovation and the adoption of technology-enabled systems to optimize livestock feeding and management.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 2.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.23 |

|

Key countries |

US, Germany, The Netherlands, Australia, and UK |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Livestock Feeding Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.