LNG Carriers Market Size 2024-2028

The lng carriers market size is forecast to increase by USD 3600 billion, at a CAGR of 4.62% between 2023 and 2028.

- The LNG carrier market is experiencing significant growth, driven primarily by the increasing demand for natural gas as a cleaner alternative fuel. This shift towards cleaner energy sources is a global trend, with numerous countries and industries seeking to reduce their carbon footprint. Additionally, fluctuations in oil and gas prices continue to influence the market dynamics. While the volatility in oil prices presents both opportunities and challenges, the long-term trend of declining oil prices is expected to boost the demand for LNG as a cost-effective alternative. However, the market faces several challenges. First, the high capital costs associated with building and operating LNG carriers can be a barrier to entry for new players.

- Second, the complex nature of LNG value chains, including production, transportation, and regasification, requires extensive expertise and coordination among various stakeholders. Lastly, the lack of infrastructure for LNG storage and distribution in some regions limits the market's growth potential. Companies seeking to capitalize on the opportunities presented by the LNG carrier market must navigate these challenges effectively by building strategic partnerships, investing in infrastructure, and leveraging their expertise to deliver cost-effective and efficient solutions.

What will be the Size of the LNG Carriers Market during the forecast period?

The liquefied natural gas (LNG) carrier market continues to evolve, shaped by various market dynamics that impact different sectors of the industry. Emissions reduction is a key driver, with the adoption of dual-fuel engines and cryogenic technology in LNG carriers reducing greenhouse gas emissions. Weather routing and route optimization help improve fuel efficiency and reduce fuel costs in the LNG price-sensitive market. Gas infrastructure development, including liquefaction plants and LNG terminals, influences the supply and demand dynamics of the global LNG trade. Independent tanker operators and fleet management companies play a crucial role in optimizing vessel operations, ensuring safety systems, and maintaining fuel efficiency.

Ballast water management and crew training are essential components of LNG vessel operations, ensuring compliance with environmental regulations. The ongoing evolution of smart shipping and methane slip technologies contributes to the continuous optimization of LNG fueling and cargo handling processes. Freight rates, natural gas exports, and cargo hold capacity are influenced by the interplay of gas demand, LNG supply chain efficiency, and market volatility. The spot market and time charter contracts offer flexibility in the LNG transportation sector, while long-term contracts provide stability. LNG projects and fleet renewal are critical to meeting the growing demand for LNG fuel and maintaining a modern and efficient LNG carrier fleet.

The ongoing energy transition towards cleaner fuels and the increasing importance of data analytics and remote monitoring further shape the LNG carrier market's future trajectory. Pressure relief systems and hull design innovations contribute to the ongoing optimization of LNG transportation, ensuring safe and efficient gas transportation across diverse trade routes. The LNG infrastructure and tank capacity expansion continue to support the growth of the global LNG trade, making it a dynamic and evolving market.

How is this LNG Carriers Industry segmented?

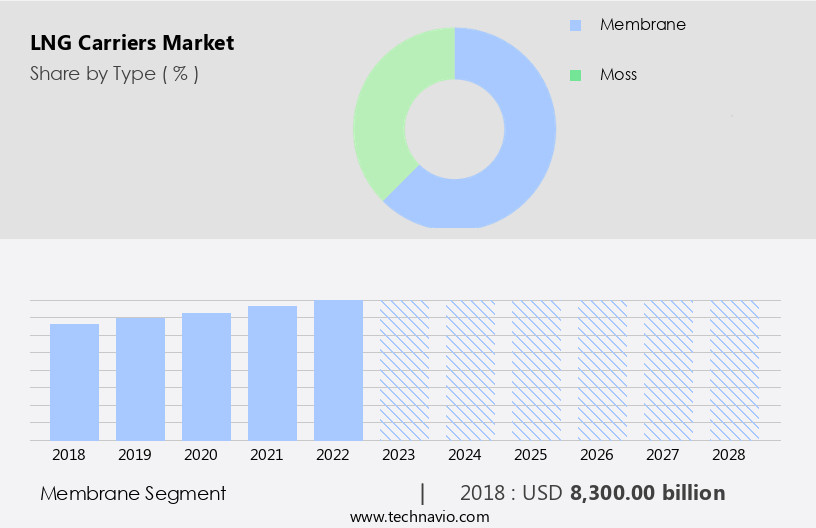

The lng carriers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Membrane

- Moss

- Geography

- Europe

- Greece

- UK

- Middle East and Africa

- Qatar

- APAC

- Japan

- Malaysia

- Rest of World (ROW)

- Europe

By Type Insights

The membrane segment is estimated to witness significant growth during the forecast period.

Liquefied Natural Gas (LNG) carriers play a crucial role in the global energy transition by transporting this cleaner fuel from production sites to consumers. Membrane containment systems, a key component of these carriers, consist of insulated cargo tanks enclosed within an inner hull and protected by an outer hull. The spaces between the hulls serve as ballast and provide additional safety during emergencies. Membrane containment systems offer enhanced visibility compared to moss-type containments, which have protruding structures that can obstruct sightlines. Furthermore, membrane tanks have a higher carrying capacity, with a 10.27% increase in loading capacity under identical ship dimensions.

Cryogenic technology is integral to LNG carriers, enabling the liquefaction of natural gas at extremely low temperatures. Dual-fuel engines, which can run on both LNG and traditional fuels, are increasingly adopted to reduce emissions. Weather routing, optimizing routes based on meteorological conditions, and route optimization help improve fuel efficiency and reduce emissions. LNG prices and demand growth are significant factors influencing the market. Gas infrastructure, including liquefaction plants and terminals, plays a vital role in the LNG supply chain. Voyage charters, gas carriers, independent tanker operators, and fleet management companies contribute to the transportation of LNG. Environmental compliance is a priority, with ballast water management systems and safety systems essential for ensuring safe and sustainable operations.

Fleet renewal, engine optimization, propeller efficiency, and hull design are crucial aspects of fleet management. Data analytics and smart shipping technologies, such as route optimization and remote monitoring, enhance operational efficiency and reduce emissions. LNG bunkering and cargo handling are essential services in the LNG supply chain. Pressure relief systems and safety systems ensure safe vessel operations. Long-term contracts and spot market prices influence the LNG market dynamics. Market volatility and methane slip, a minor emission during LNG transportation, are challenges the industry must address. The energy transition and increasing demand for cleaner fuels are driving the growth of the LNG market. Boil-off gas, a byproduct of LNG transportation, can be utilized as fuel, further increasing the market's potential. LNG fueling infrastructure development and trade routes expansion are key areas of focus for the industry.

The Membrane segment was valued at USD 8,300.00 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 27% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is driven by the significant production of natural gas in countries like the US and Canada. This production surge has led to a high demand for LNG carriers to transport the gas across the world. Bermuda, with its large fleet of LNG carriers owned by major shipowners such as Teekay LNG Partners, plays a crucial role in this global trade. Teekay LNG Partners' fleet includes vessels like Arwa Spirit and Cubal, with capacities of 165,500 m3 and 160,400 m3, respectively. The use of dual-fuel engines and weather routing in LNG carriers contributes to emissions reduction, enhancing their environmental compliance.

Cryogenic technology, a crucial aspect of LNG carriers, ensures the safe and efficient transportation of LNG. The global LNG trade relies on the optimization of routes and cargo handling, with data analytics playing a significant role in this process. The spot market and time charter are the primary contractual arrangements in the market. The increasing adoption of smart shipping practices, such as remote monitoring and fleet management, improves fuel efficiency and safety systems. The energy transition towards natural gas from traditional fossil fuels has led to an increase in LNG demand and the expansion of LNG infrastructure, including liquefaction plants and terminals.

The LNG supply chain faces challenges such as market volatility, methane slip, and ballast water management. To address these challenges, fleet renewal, engine optimization, hull design, and long-term contracts are essential strategies. The LNG bunkering industry is growing, providing LNG as a fuel alternative to traditional marine fuels. Crew training and safety systems are crucial for the safe operation of LNG carriers. The LNG projects underway, including new liquefaction plants and expansions, will further boost the market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of LNG Carriers Industry?

- The primary factor fueling the market is the rising demand for natural gas. The International Energy Agency (IEA) projects that global natural gas demand will expand from 3,740 billion cubic meters (bcm) in 2017 to 4,100 bcm in 2023, representing a yearly growth rate of 1.6%. This expansion is largely driven by emerging economies, with China anticipated to become the world's leading natural gas importer by 2019. The IEA forecasts that China's natural gas demand will surge by 60% between 2017 and 2023, primarily due to government initiatives aimed at reducing air pollution by replacing coal with gas. In response to this growing demand, the LNG carrier market is poised for significant development.

- LNG fuel's lower emissions compared to coal and oil make it an attractive alternative for reducing greenhouse gas emissions. To capitalize on this trend, gas carriers are increasingly adopting dual-fuel engines and implementing route optimization and weather routing to improve efficiency. Furthermore, the expansion of gas infrastructure, including liquefaction plants and LNG terminals, is expected to boost the voyage charter market for gas carriers. Independent tanker operators are also investing in cryogenic technology to enhance their fleets' competitiveness. Overall, the LNG carrier market is witnessing robust growth, driven by the increasing demand for natural gas and the need for cleaner energy sources.

What are the market trends shaping the LNG Carriers Industry?

- The trend in the market is shifting towards an increased demand for cleaner fuels. This growing preference reflects a commitment to reducing environmental impact and promoting sustainability.

- The market is experiencing significant growth due to the increasing demand for natural gas as a cleaner alternative to traditional energy sources such as oil and coal. According to the International Energy Agency (IEA), the global energy demand is projected to rise by 30% by 2040, driven by population growth and industrialization in emerging economies. This increasing demand for energy has led to a surge in natural gas exports and seaborne trade. LNG carriers play a crucial role in the global LNG trade by transporting the chilled fuel from production sites to importing countries. The market is driven by several factors, including the need for ballast water management to comply with international regulations, the adoption of smart shipping technologies to improve fuel efficiency and reduce methane slip, and the growing demand for LNG bunkering to support the expansion of the LNG fuel market.

- Freight rates in the LNG carrier market are influenced by various factors, including the supply and demand balance, cargo hold size, and the type of charter agreement (spot market or time charter). The market is also impacted by the development of new LNG projects and the overall health of the global economy. Crew training and safety regulations are essential considerations in the LNG carrier market, as the transportation of LNG requires specialized skills and knowledge. The market is expected to continue growing as natural gas becomes an increasingly important part of the global energy mix.

What challenges does the LNG Carriers Industry face during its growth?

- The volatile nature of oil and gas prices poses a significant challenge to the industry's growth trajectory. The LNG carrier market has experienced notable shifts due to the volatility in crude oil prices since the second quarter of 2016. The average crude oil import price dropped from USD 96.23/bbl in 2014 to USD 51.4/bbl in 2017, as per the International Energy Agency. This decline affected companies in the upstream oil and gas sector, leading to reduced profit margins and stalled investments. Consequently, several oil and gas projects were halted or canceled. Despite the challenges, the LNG infrastructure sector has continued to evolve, with a focus on fleet management, engine optimization, propeller efficiency, and environmental compliance.

- Vessel operations have become more data-driven, with the integration of safety systems, fuel efficiency monitoring, and real-time cargo handling. Pressure relief systems have also gained importance to ensure safe and efficient LNG transportation. As the global gas demand continues to rise, the LNG supply chain is adapting to meet the growing needs. Companies are investing in advanced technologies to enhance fleet management, optimize engine performance, and improve propeller efficiency. Data analytics is playing a crucial role in optimizing vessel operations, ensuring regulatory compliance, and maintaining safety standards. The LNG carrier market is undergoing significant transformations to adapt to the changing market dynamics.

- Companies are focusing on enhancing operational efficiency, ensuring safety, and complying with environmental regulations to remain competitive in the market.

Exclusive Customer Landscape

The LNG carriers market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the LNG carriers market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, lng carriers market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

BW Group - The company specializes in providing a diverse range of LNG carrier solutions, encompassing floating LNG infrastructure such as BW LNG, BW LPG, BW Epic, BW Offshore, BW Energy, and BW Dry Cargo.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BW Group

- Dynagas Ltd.

- Flex LNG Ltd.

- GasLog Ltd.

- Gaztransport and Technigaz SA

- Golar LNG Ltd.

- Hanwha Corp.

- Japan Marine United Corp.

- K Shipbuilding

- Kawasaki Heavy Industries Ltd.

- Maran Gas Maritime Inc.

- Mitsubishi Heavy Industries Ltd.

- Mitsui and Co. Ltd.

- Nakilat

- PETRONAS Chemicals Group Berhad

- Samsung Heavy Industries Co. Ltd.

- Shell plc

- Teekay LNG Partners L.P

- Wartsila Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in LNG Carriers Market

- In February 2023, Shell and TotalEnergies announced a strategic partnership to jointly develop and construct a new LNG carrier fleet, aiming to reduce emissions and enhance their market presence in the LNG sector (Shell press release, 2023). This collaboration is expected to result in the construction of up to 12 new LNG carriers, each with a capacity of around 220,000 cubic meters, by 2028 (Shell press release, 2023).

- In October 2024, Qatar Petroleum and ExxonMobil signed a memorandum of understanding to collaborate on the development of a new LNG production facility and associated infrastructure in Mozambique. This strategic partnership is anticipated to significantly expand the market presence of both companies in the LNG sector and contribute to the growing demand for LNG in Asia (ExxonMobil press release, 2024).

- In January 2025, Mitsui O.S.K. Lines, Ltd. (MOL) and NYK Line, two major Japanese shipping companies, completed the merger of their LNG shipping businesses. This merger, valued at approximately USD 1.7 billion, is expected to create the world's largest LNG carrier fleet, enabling the combined entity to better compete in the global LNG shipping market and optimize their operations (MOL press release, 2025).

- In March 2025, China's CNOOC Limited successfully deployed the world's first Type-C Flex LNG carrier, which features a unique design enabling it to load and unload LNG at a wider range of temperatures and pressures. This technological advancement is expected to significantly enhance the flexibility and efficiency of LNG trading and transportation, particularly in the rapidly growing Asian LNG market (CNOOC press release, 2025).

Research Analyst Overview

- In the dynamic LNG carrier market, various carrier types cater to diverse customer needs, each with unique emissions profiles. Size matters in LNG shipping, with larger vessels offering economies of scale but also higher emissions. Regulation plays a significant role, driving innovation in carrier technology to enhance efficiency and sustainability. The future of LNG carriers lies in advanced designs, focusing on safety, performance, and financing. LNG carrier operations must balance efficiency with regulatory compliance and technological advancements.

- Emissions reduction is a key trend, with carriers investing in innovative solutions to meet stringent regulations. Safety remains a top priority, with continuous improvements in carrier design and technology. Overall, the LNG carrier sector is undergoing transformative changes, shaping the future of the global energy landscape.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled LNG Carriers Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

145 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.62% |

|

Market growth 2024-2028 |

USD 3600 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

UK, Japan, Qatar, Greece, and Malaysia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this LNG Carriers Market Research and Growth Report?

- CAGR of the LNG Carriers industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Middle East and Africa, Europe, APAC, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the lng carriers market growth of industry companies

We can help! Our analysts can customize this lng carriers market research report to meet your requirements.