Low And Medium Capacity Gas Generator Market Size 2025-2029

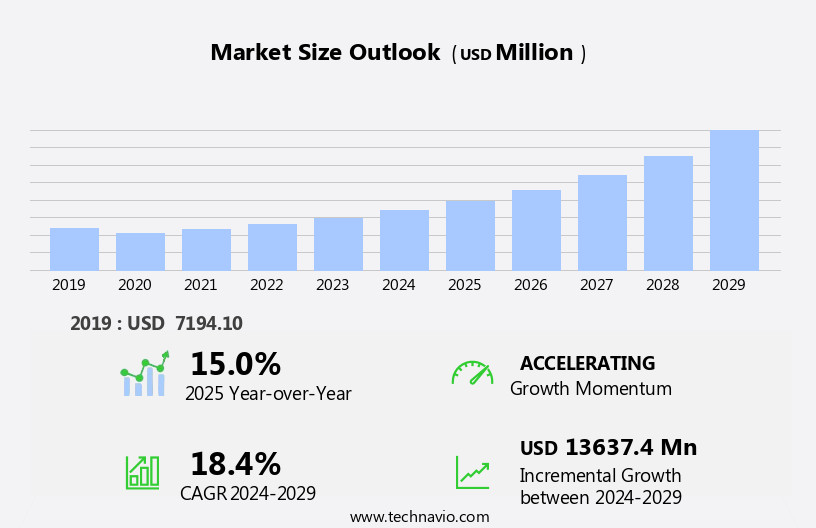

The low and medium capacity gas generator market size is forecast to increase by USD 13.64 billion at a CAGR of 18.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the rising preference for gas generators due to their environmental friendliness and cost-effectiveness compared to traditional diesel generators. Another key trend in the market is the introduction of bi-fuel technology in generators, allowing them to operate on both natural gas and liquid fuels, thereby increasing their versatility and reducing operational costs. However, the market faces challenges due to the volatility in natural gas prices, which can impact the profitability of gas generator operators. As such, companies in the market need to closely monitor price trends and adopt strategies to mitigate the impact of price fluctuations.

- Additionally, investments in research and development to improve the efficiency and reliability of gas generators can help companies gain a competitive edge in the market. Overall, the market presents significant opportunities for growth, particularly for those companies able to effectively manage the challenges posed by natural gas price volatility.

What will be the Size of the Low And Medium Capacity Gas Generator Market during the forecast period?

- The market continues to evolve, driven by the diverse needs of various sectors. Fuel efficiency remains a key focus, with propane generators and natural gas generators gaining popularity due to their lower carbon emissions and improved fuel economy. Standby power applications, such as data centers and hybrid power systems, require reliable and consistent power output, leading to advancements in generator control systems and load sharing capabilities. Power quality and power factor are crucial considerations for maintaining optimal performance, with remote monitoring and automatic transfer switches enabling real-time analysis and proactive maintenance. Operating hours and generator repair are essential for ensuring longevity and reliability, with distributed generation and commercial applications increasingly adopting parallel operation for enhanced grid stability.

- Generator commissioning and installation are critical phases, with generator protection systems and emission standards ensuring safe and efficient operation. Frequency regulation and voltage regulation are also essential for maintaining grid stability, while noise levels and fuel consumption remain key concerns for residential applications. Emergency power needs continue to drive demand, with backup power solutions essential for critical infrastructure and renewable energy integration. Data logging and generator troubleshooting enable predictive maintenance, reducing downtime and improving overall performance. The ongoing dynamism of the market ensures a continuous unfolding of market activities and evolving patterns.

How is this Low And Medium Capacity Gas Generator Industry segmented?

The low and medium capacity gas generator industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Residential

- Commercial

- Industrial

- Application

- Stationary

- Portable

- Capacity

- Less than 10 KW

- 10.1-15 KW

- Less than 60 KW

- 61 to 500 KW

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The residential segment is estimated to witness significant growth during the forecast period.

Natural gas generators, fueled by a widely used residential fuel source, dominate the market for low and medium capacity power generation. These generators provide standby power during outages, supplying the entire house with electricity through the power distribution panel. Manufacturers offer a range of generators, from air-cooled to liquid-cooled, catering to various power requirements. The residential sector, particularly the portable generator segment, is a significant end-user. In addition to residential applications, these generators are also employed in commercial settings for emergency power and distributed generation. Medium capacity generators play a crucial role in grid stability and frequency regulation, while low capacity generators are ideal for energy storage and renewable energy integration.

Generator maintenance, including troubleshooting and repair, is essential for optimal performance. Generator control systems, load sharing, and parallel operation further enhance efficiency and reliability. Data centers and hybrid power systems rely on these generators for power factor correction, power quality, and remote monitoring. Operating hours, engine speed, voltage regulation, and harmonic distortion are essential factors influencing generator selection. Fuel consumption, noise levels, and emission standards are also critical considerations. Generator commissioning and installation are essential steps in ensuring seamless integration into power systems.

The Residential segment was valued at USD 3.1 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

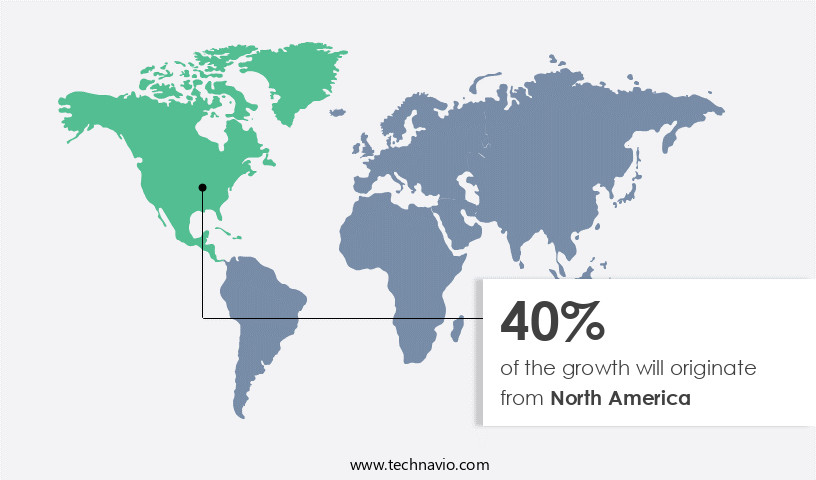

North America is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The US market for low and medium capacity gas generators has experienced significant growth due to the easy availability and affordability of natural gas, driven by discoveries of shale gas. This has led to a decrease in initial investments for gas supply infrastructure, making gas generators an attractive option for both residential and commercial consumers. The declining gas prices since 2008 have further fueled the market's growth. Gas generators offer advantages such as fuel efficiency, standby power, and frequency regulation, making them ideal for power generation applications. Generator maintenance, automatic transfer switches, and generator commissioning are crucial aspects of the market, ensuring reliable power output.

Medium capacity generators are increasingly being adopted for data centers and commercial applications, while low capacity generators find popularity in residential applications. Energy storage, noise levels, and generator protection systems are other key considerations. Renewable energy integration, load sharing, and parallel operation are emerging trends. Fuel consumption, generator troubleshooting, and generator repair are ongoing concerns. The market's evolution also includes the development of hybrid power systems, distributed generation, and grid stability. Power factor, power quality, and remote monitoring are essential for optimizing generator performance. Engine speed, voltage regulation, and harmonic distortion are critical control system considerations. Emission standards and generator installation are regulatory concerns.

Overall, the US market for low and medium capacity gas generators is expected to continue growing due to the affordability and versatility of natural gas.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Low And Medium Capacity Gas Generator Industry?

- The increasing demand for gas-powered generators serves as the primary market driver.

- Gas generators, specifically those fueled by propane and natural gas, have seen increasing demand over the past five years. These generators offer several advantages over diesel generators, including improved fuel efficiency and the elimination of the need for storage and maintenance. In developed countries like the US, where natural gas pipeline infrastructure is well-established, these generators have become a popular choice for standby power and frequency regulation in larger spaces. Although natural gas generators have only been commercially available for about a decade, they have gained traction due to their clean fuel source and cost-effectiveness in the long run.

- While they initially came with higher upfront costs, advancements in technology have made them more affordable. Additionally, the integration of automatic transfer switches and energy storage systems further enhances their reliability and efficiency. Overall, the shift towards gas generators is a significant trend in the power generation market.

What are the market trends shaping the Low And Medium Capacity Gas Generator Industry?

- The introduction of bi-fuel technology in generators is an emerging market trend. This technology enables generators to run on two different fuel sources, providing increased flexibility and efficiency.

- The market is gaining traction due to the increasing demand for reliable power sources with reduced noise levels. These generator sets are commonly used in residential applications and offer fuel efficiency, making them a cost-effective solution for consumers. However, fuel consumption is a significant factor in the operating costs of these generators. The volatility of fuel prices, particularly for oil and gas, poses a challenge for consumers. To mitigate the impact of fuel price fluctuations, some generators incorporate the use of both gas and diesel fuel. This hybrid approach offers the benefits of both fuels, providing power stability and reducing overall fuel consumption.

- Generator commissioning and load sharing are essential features of these systems, ensuring grid stability and efficient power distribution. Moreover, the integration of generator control systems and renewable energy sources, such as solar and wind, is a growing trend in the market. These systems enable the seamless integration of renewable energy into the power grid, reducing the reliance on traditional fuel sources and lowering overall carbon emissions. Generator troubleshooting and maintenance are crucial aspects of ensuring the longevity and efficiency of these systems. Regular maintenance and timely repairs can help prevent costly downtime and ensure the generator is operating at optimal performance levels.

- In conclusion, the market is driven by the need for reliable and cost-effective power sources. The integration of fuel efficiency, hybrid fuel systems, renewable energy sources, and advanced control systems is shaping the future of this market.

What challenges does the Low And Medium Capacity Gas Generator Industry face during its growth?

- The volatility in natural gas prices poses a significant challenge to the industry's growth trajectory.

- The market is influenced by various factors, including maintenance intervals, power quality, and power factor in data centers and commercial applications. Hybrid power systems and distributed generation are increasingly popular due to their ability to provide reliable power and improve overall system efficiency. Remote monitoring and parallel operation enable better generator performance and reduce operating hours, thereby minimizing the need for generator repair. Power quality and maintaining optimal operating hours are crucial for ensuring the longevity and efficiency of gas generators. As these generators are used extensively in various industries, their maintenance schedules must be carefully planned to minimize downtime and ensure uninterrupted power supply.

- The adoption of gas generators in commercial applications, such as data centers and telecommunications, is on the rise due to their ability to provide reliable power and improve power quality. Parallel operation of multiple generators allows for increased capacity and improved system redundancy, ensuring uninterrupted power supply during power outages or peak demand periods. In conclusion, the market is driven by the need for reliable power and improved power quality in various industries. The increasing adoption of hybrid power systems and distributed generation, along with the importance of maintenance intervals and remote monitoring, are key factors influencing market growth.

- Despite the volatility in natural gas prices, the market is expected to continue growing due to the increasing demand for reliable and efficient power solutions.

Exclusive Customer Landscape

The low and medium capacity gas generator market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the low and medium capacity gas generator market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, low and medium capacity gas generator market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Atlas Copco AB - The company specializes in two distinct lines of gas generators: IP and P series. IP generators encompass a broader fuel range capability, making them suitable for various applications. Meanwhile, P series generators boast enhanced power output and efficiency. Both product lines cater to diverse energy requirements, ensuring a comprehensive solution for businesses and industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Atlas Copco AB

- AVK-SEG (UK) Ltd.

- Briggs & Stratton Corp.

- Caterpillar Inc.

- Champion Power Equipment Inc.

- Cummins Inc.

- DuroMax Power Equipment

- Generac Power Systems Inc.

- Genesal Energy

- Honda Motor Co. Ltd.

- J C Bamford Excavators Ltd.

- Kohler Co.

- PERIN GENERATORS GROUP

- Pulsar Products Inc.

- Rolls Royce Holdings Plc

- WEN Products

- Westinghouse Electric Corporation

- Yamaha Motor Co. Ltd.

- Yanmar Holdings Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Low And Medium Capacity Gas Generator Market

- In February 2024, Caterpillar Inc., a leading manufacturer of industrial and power generation equipment, introduced its new 3520E gas generator set, designed to deliver enhanced fuel efficiency and lower emissions for low to medium capacity power generation applications (Caterpillar Inc. Press release, 2024). This new offering is expected to strengthen Caterpillar's position in the gas generator market.

- In May 2025, Siemens Energy and Mitsubishi Heavy Industries (MHI) announced a strategic collaboration to develop and commercialize advanced gas turbine technologies, focusing on the low and medium capacity segment. This partnership combines Siemens Energy's expertise in gas turbines and MHI's experience in industrial gas turbines, aiming to provide more efficient and cost-effective solutions for customers (Siemens Energy press release, 2025).

- In October 2024, GE Power, a leading provider of power generation technologies, secured a significant order from the Nigerian National Petroleum Corporation (NNPC) to supply six Jenbacher J320 gas engines for a 22 MW power plant project in Nigeria. This marks GE Power's entry into the Nigerian power market and reinforces its commitment to expanding its presence in Africa (GE Power press release, 2024).

- In January 2025, Siemens Gamesa Renewable Energy and MAN Energy Solutions announced the successful demonstration of a world-first gas engine-wind turbine hybrid system, which integrates a 4.4 MW Siemens Gamesa wind turbine with a 1.5 MW MAN gas engine. This technological advancement is expected to improve the flexibility and efficiency of renewable energy systems, particularly in low-wind regions (Siemens Gamesa Renewable Energy press release, 2025).

Research Analyst Overview

The market encompasses various applications, from prime power to portable use. Generator service and parts play a crucial role in ensuring generator reliability and performance throughout the generator life cycle. Regulations governing generator emissions continue to evolve, driving the need for compliance and optimization. Generator rental and leasing offer flexible solutions for businesses requiring continuous power. Financing options, such as generator ROI and warranty, facilitate cost-effective investments. Silent generators and generator efficiency are essential considerations for businesses seeking to minimize noise and energy consumption.

Generator testing, automation, and standards ensure optimal generator performance and longevity. Accessories like fuel tanks and transfer switches expand generator capabilities. Overall, the market for gas generators remains dynamic, with a focus on cost, compliance, and efficiency.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Low And Medium Capacity Gas Generator Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.4% |

|

Market growth 2025-2029 |

USD 13637.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

15.0 |

|

Key countries |

US, Canada, Germany, UK, China, France, Japan, Italy, South Korea, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Low And Medium Capacity Gas Generator Market Research and Growth Report?

- CAGR of the Low And Medium Capacity Gas Generator industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the low and medium capacity gas generator market growth of industry companies

We can help! Our analysts can customize this low and medium capacity gas generator market research report to meet your requirements.